Colombia to buy gold from small miners to curb illegal trade

Colombia’s government plans to start purchasing gold directly from small-scale producers in a bid to curb illegal activity and formalize an unregulated mining boom fueled by surging prices.

Government agencies including the tax and mining authorities will coordinate the effort starting in November, following an order from President Gustavo Petro, Mines and Energy Minister Edwin Palma wrote in an X post.

Illegal gold mining and trafficking in South America is surging along with bullion prices, which are up about 50% this year largely due to central bank purchases. In Colombia and Peru — top growers of the plants used to make cocaine — illegal gold is estimated to generate more money for organized crime than the drug trade itself. About 80% of all gold sold in Colombia comes from informal or illegal operations, Palma wrote. The impact on forests, rivers and local communities can be devastating.

Colombia’s central bank already buys physical gold, but its strict requirements exclude most informal miners. The new plan would allow other state entities to make purchases, potentially cutting small producers out of criminal supply chains.

Gold acquired under the program will be held by the SAE, which oversees property confiscated from illicit activities. It remains unclear what the SAE will do with the newly acquired gold.

Ecuador and Bolivia’s central banks already buy gold from local miners. In Peru, lawmakers have proposed similar legislation to empower either the central bank or the state-owned Banco de la Nación to make such purchases. Central bank chief Julio Velarde has opposed the idea, warning it could enable money laundering through illegal gold.

(By Andrea Jaramillo and Oscar Medina)

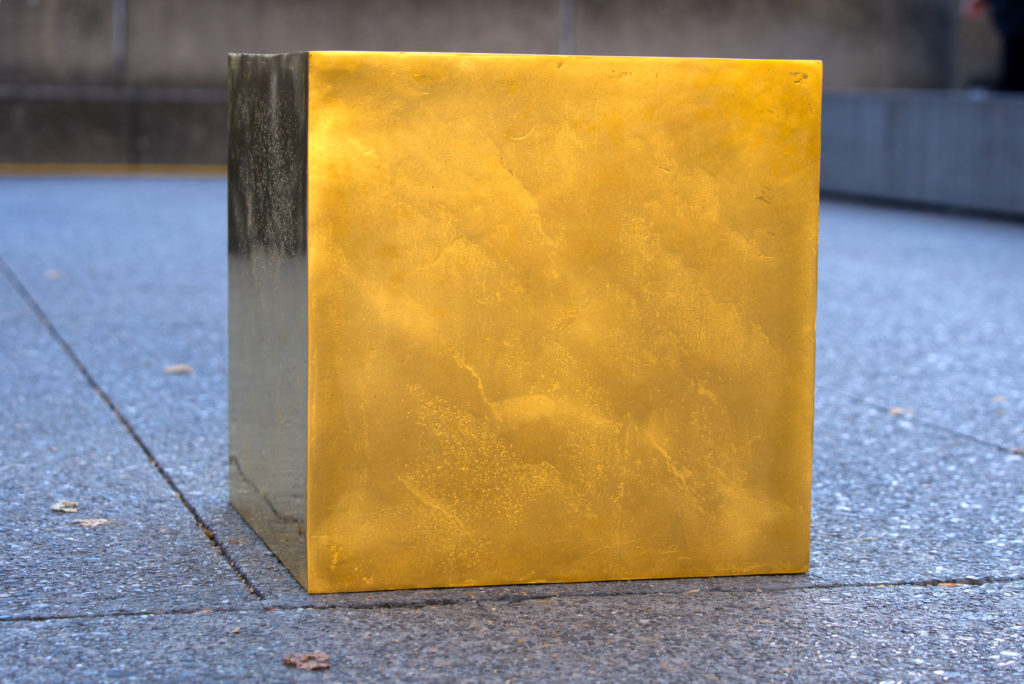

Stake in 186-kg gold cube may be sold in Austrian insolvency

A stake in a 186-kilogram (410 pound) gold cube is being prepared to be sold by the administrators of insolvent Austrian investor Klemens Hallmann.

The businessman owns a 32% stake in the Castello Cube, created by German artist Niclas Castello, according to Creditreform, a creditors’ protection association. Hallmann’s share of the hollowed out, 24-carat conceptual artwork will be transferred to the restructuring administrator to sell to maximize compensation for his creditors, they said.

Using the current market price of $4,010 an ounce, the value of the gold in the entire cube would be around $23 million. Creditor associations didn’t specify how a sales process would work, or how the stake sale would be impacted by its ownership structure.

The Castello Cube stirred public attention in 2022 when it was placed mysteriously in New York’s Central Park for a day. The artwork, which was not intended to be sold according to its website, has been used to garner attention for an accompanying crypto token launched by Castello.

Hallmann, whose insolvency proceedings as an entrepreneur opened in August, has invested in sectors such as film and real estate. He has also seen the collapse of his real estate developer SÜBA AG into insolvency earlier this year. The company is now in liquidation after it failed to make a payment as part of its restructuring plan.

Creditors of Hallmann could receive an additional payment as part of a “super-quota” dependent on the sales process for his stake in the artwork, according to creditor association KSV1870. The restructuring plan approved by investors as part of the self-administration process otherwise envisages a payment of 35% of their original claim.

A spokesperson for Castello didn’t respond to a request for comment. Hallmann said in a statement that he will “continue to work with full transparency, reliability and consistency on implementing the approved restructuring plan” and his representative declined further comment on the potential sale.

(By Libby Cherry and Mark Burton)

Gold industry sees price rising to near $5,000/oz over 12 months

The price of gold is expected to hit $4,980 an ounce over the next 12 months, up some 27% from current levels, delegates to the London Bullion Market Association’s (LBMA) annual gathering in Kyoto predicted on Tuesday.

On track for its biggest yearly rise since 1979, gold’s 52% growth so far this year has seen it break through $3,000 per ounce in March and then $4,000 in October – both seen as psychological resistance levels by market players.

Results of the LBMA poll were gathered in the organization’s annual poll and shown to delegates at the conference.

Fear of missing out

Political tensions, US tariff uncertainty and, more recently, a wave of fear of missing out on the advance saw gold rallying to a record of $4,381 an ounce on October 20.

The LBMA prediction compares with Reuters‘ latest poll of expectations, which delivered a 2026 average gold price forecast of $4,275 on Monday as economic and geopolitical turmoil keep the metal’s safe-haven allure intact.

A poll of delegates from around the world at the LBMA conference also predicted that silver prices would jump to $59 per ounce in a year’s time from around $46 on Tuesday.

Silver rise is most since 2010

Silver prices are up 62% so far this year, the most since 2010, after hitting a record high of $54.5 on October 17 due to strong investment demand, tight supply in the London spot market and elevated purchases in India.

They also forecast that platinum prices would climb to $1,816 an ounce from the current $1,544 and palladium would gain to $1,709 from around $1,364.

Platinum and palladium are up 76% and 54%, respectively, so far this year amid tight mine supply and concerns about the US tariffs, prompting outflows to US stocks.

(By Polina Devitt; Editing by David Holmes)

No comments:

Post a Comment