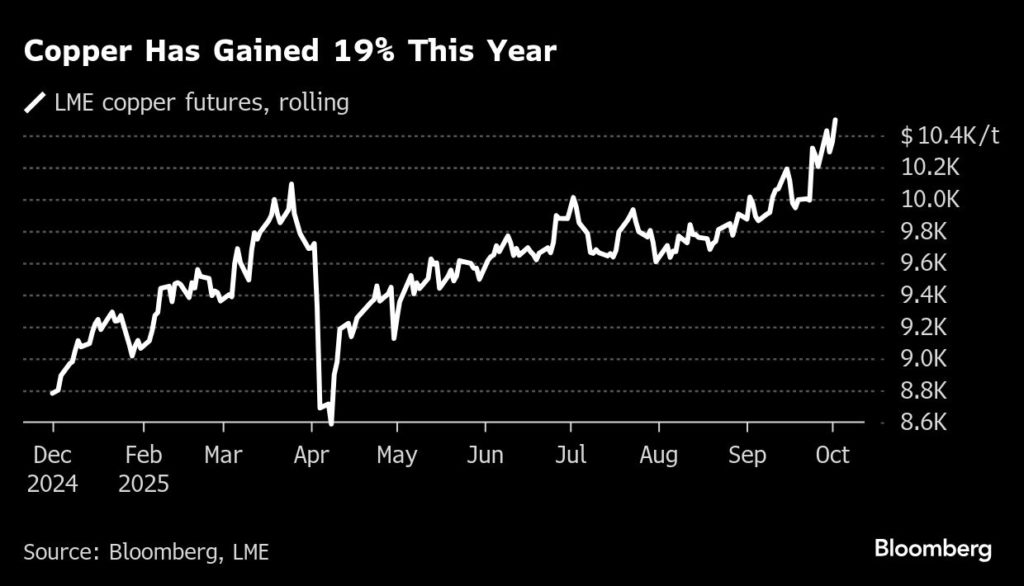

Copper price highest in over a year on Grasberg disruption, Fed outlook

Copper prices climbed to their highest level in more than a year on Thursday, fueled by mounting global supply disruptions and growing expectations that US interest rate cuts will support demand for the industrial metal.

Benchmark futures on the London Metal Exchange (LME) briefly rose above $10,500 a tonne for the first time since May 2024, before trading at $10,497.50, up 1.1% as of 11:50 a.m. in London. Three-month futures traded above $10,976 per ton ($4.989 per lb.) on the CME, up 2.2% for the day.

The rally has been bolstered by news that Freeport-McMoRan (NYSE: FCX) declared force majeure at its giant Grasberg mine in Indonesia. The setback adds to a series of supply challenges across South America and Africa, tightening global availability.

“The scale of this disruption is very big,” said Albert Mackenzie, copper analyst at Benchmark Mineral Intelligence.

Benchmark estimates that supply losses will reach 591,000 tonnes between September 2025 and the end of 2026, equivalent to about 2.6% of 2024’s global mine production, which analysts put at roughly 23 million tonnes.

The disruptions mean the copper market will swing into a deficit of around 400,000 tonnes in 2025, Benchmark said.

The impact has also led Goldman Sachs to revise its market balance forecast. The bank now projects a 55,500-tonne deficit for 2025, compared with its earlier expectation of a 105,000-tonne surplus. A small surplus is still expected in 2026.

Adding momentum to copper’s rally, US economic data reinforced expectations of interest rate cuts. An ADP private payrolls report showed an unexpected decline in September jobs, at a time when official data releases may be delayed by the ongoing US government shutdown.

Lower interest rates typically support commodities by boosting consumption and weakening the US dollar, which in turn makes dollar-priced metals cheaper for buyers using other currencies. A Bloomberg dollar index slipped for a fifth consecutive day on Thursday.

(With files from Reuters and Bloomberg)

Sanctioned Russian copper firm in talks to acquire state-seized gold miner

Russian copper producer UMMC is in talks with the government to acquire a majority stake in the gold mining company UGC which was seized by the state in July, two industry sources told Reuters on Wednesday.

The sources confirmed an earlier report by the Izvestia newspaper, which said that a firm called Atlas Mining that holds some UMMC assets, is negotiating with the Finance Ministry regarding the acquisition.

Neither UMMC nor the Finance Ministry responded to requests for comment from Reuters.

In July, Russia’s general prosecutor’s office won a lawsuit to transfer ownership of the majority stake in UGC, Russia’s fourth-largest gold producer, to the state, alleging it was obtained “through corruption.”

The stake now held by the Finance Ministry was previously owned by Russian billionaire Konstantin Strukov, who acquired gold-producing assets at a bargain price in 1997 from a bankrupt Soviet-era enterprise.

Since the start of the military action in Ukraine, the state has seized over $50 billion worth of assets from Western firms and Russian owners, marking the largest redistribution of property in Russia since privatization in the 1990s.

The government and courts have cited reasons for these seizures ranging from national security to illegal acquisitions. The government has promised to sell some of the assets.

One source noted that there had been other bidders for UGC assets, but they were no longer interested. The source added that there will be a formal bidding process, but its outcome is “predetermined.”

Both UGC and UMMC are under Western sanctions.

Shares in UGC, which in 2023 had one of the largest public offerings since the start of the conflict in Ukraine, fell by about 8% on Wednesday due to what a third source described as fears of a possible delisting of its shares.

According to Izvestia, which cited unnamed sources, the government is seeking 100 billion roubles ($1.23 billion) for the stake in UGC, while UMMC is offering half that amount.

UMMC said in 2022 that its previous owners, billionaires Iskander Makhmudov and Alexei Bokarev, no longer held shares in the company. The company hasn’t disclosed its current ownership.

The Finance Ministry said in September that it plans to sell its 67% stake in UGC before the end of October, following a valuation.

Lender Gazprombank, previously considered a potential buyer of UGC, holds 22%, and minority shareholders own the remaining 11%, according to UMMC’s website.

(By Anastasia Lyrchikova, Darya Korsunskaya, Elena Fabrichnaya and Gleb Bryanski; Editing by Elaine Hardcastle)

No comments:

Post a Comment