EU Council Agrees on Plan and Date to End Russian Gas Imports

The European Union (EU) is advancing plans to exert more pressure on Russia’s economy with a commitment to continue reducing gas imports and impose a total ban in 2028. Following Russia’s invasion of Ukraine, the bloc now accepts that stopping gas imports is critical in denying Moscow the resources needed to sustain the aggression.

European Union energy ministers approved a plan at the European Council on October 20 to gradually reduce both pipeline gas and liquefied natural gas (LNG) imports from Russia, with a full ban expected to apply from January 1, 2028. The proposal by the European Council is in line with the REPowerEU Plan, which was adopted in 2022 and sets a roadmap for the bloc to end Europe’s dependency on Russian energy.

The Council presidency reports that negotiations will begin with the European Parliament. The goal is to agree on the final text of the regulation, once the Parliament adopts it position. It comes as the efforts are underway to also finalize the broader 19th sanction package on Russia, which will include the oil and gas ban as well as the listing of additional tankers.

In the approved plan, EU countries agree to stop importing Russia’s gas in January next year, with another two years of transition period for existing contracts. A leeway has been given for short-term contracts that will run until June next year, with long-term contracts ending come 2028.

“An energy independent Europe is a stronger and more secure Europe. Although we have worked hard and pushed to get Russian gas and oil out of Europe in recent years, we are not there yet. Therefore, it is crucial that the Danish Presidency has secured an overwhelming support from Europe’s energy ministers for the legislation that will definitively ban Russian gas from coming into the EU,” said Lars Aagaard, Danish Minister for Climate, Energy and Utilities.

With no end in sight for the Russia-Ukraine war, the EU hopes that stopping the imports will further cripple Russia’s economy and deny the Kremlin resources to sustain the war. Despite efforts to reduce dependence on Russia for energy needs, the bloc remains a major importer of Moscow’s gas, which accounts for an estimated 13 percent of imports in 2025 worth over €15 billion ($17.4 billion) annually.

EU data show that in 2024, the bloc imported 52 billion cubic meters (bcm) of Russian gas, which was around 19 percent of total EU gas imports. It also imported 3 million tonnes of crude oil and more than 2,800 tonnes of uranium in enriched or fuel form. At least 10 member states imported Russian gas in 2024, with three importing oil and seven enriched uranium or uranium services.

The EU has imposed a range of sanctions on the Kremlin as part of efforts to cut imports. Some of the sanctions have banned Russian coal and oil imports to the EU and prohibited the reloading of cargoes in the bloc’s ports carrying LNG from Russia. Particular attention has now shifted to the issue of circumventing the EU oil sanctions by using shadow fleets. On this, the bloc is working on a new plan to further increase the inspections of the shadow tanker fleet that supports the Russian energy industry.

The efforts have seen the EU gas imports from Russia decrease from 45 percent in 2021 to 19 percent in 2024 and 13 percent this year. The share of Russian oil imports has also shrunk from 27 percent at the beginning of 2022 to three percent currently. Notably, around two-thirds of Russian gas imports are supplied based on long-term contracts while around one third is provided on spot (short-term) basis.

In the proposed regulation, countries will be required to submit national diversification plans outlining measures and potential challenges to diversifying their gas supplies. The bloc has also introduced additional monitoring and notification mechanisms to prevent Russian gas from entering the EU under transit procedures.

China Plots Expansion of Shipping on “Polar Silk Road” aka Russia’s NSR

Chinese officials are continuing to promote the benefits of Russia’s Northern Sea Route, which they have taken to calling the “Polar Silk Road.” This comes as their containership Istanbul Bridge is completing its first round of port calls in Northern Europe ahead of the launch of full service in 2026.

China’s Global Times newspaper announced on Monday, October 20, that the shipping company operating the Istanbul Bridge, Sea Legend Shipping, plans to operate regular summer voyages along the route by 2026. It made history last week, completing the fastest transit between China and the UK in just over 20 days using a non-polar containership. The ship is also larger than the vessels that are making the transit from another Chinese shipping company, NewNew Shipping.

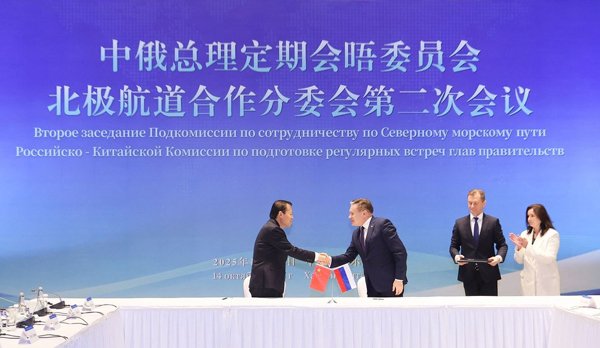

Plans for the service come as China and Russia reported they signed a new agreement to jointly develop and commercialize the Northern Sea Route. China’s Minister of Transport, Liu Wei, met with Russian officials, including the Director General of Rosatom, Alexey Likhachev, in the second session of the Subcommittee of Cooperation on the Northern Sea Route in Harbin, China. Rosatom reports that an action plan was approved and along with a roadmap aimed at creating a sustainable transport corridor.

The Chinese Ministry of Transport says the two sides are promoting cooperation, including Arctic shipping, safety, and polar shipbuilding and technology. They said the goal of the subcommittee is to promote cooperative development of Arctic waterways. China reports that it plans to develop regular Arctic connections, including long-term European port contracts. This, they said, will facilitate deeper integration of high-end manufacturing and new energy industries from China’s Yangtze River Delta with the European market.

Signing of the cooperation agreement in China on October 14 (Rosatom)

The Istanbul Bridge reached Gdansk, Poland, on Sunday, October 19, with officials highlighting the importance of the port call for the transshipment of goods to Central Europe. They say it will permit them to deliver Chinese goods at a lower cost and quicker to the Czech Republic and Hungary. The ship then departed and is making its way to Rotterdam.

The reports are calling the opening of the service a “significant shift” that will improve the flow of goods between Asia and Europe. China highlights that in the first six months of 2025, it exported over $465 billion worth of goods to Europe, with the trade up nearly four percent over 2024. They said the European Union now accounts for 13 percent of China’s foreign trade.

The Global Times says the relatively mild sea conditions along the Northern Sea Route make it well-suited to temperature-sensitive and time-critical cargoes. They say the route could help China to boost exports of lithium electronics, photovoltaic products, and new-energy vehicles.

Sea Legend, which lists a fleet of 18 vessels on its website, said the new services took three years to plan. It had to overcome challenges, including upgrading the ship’s equipment, personnel training, and certification, as well as developing accurate weather and navigation forecasts.

The company says it plans for a weekly or biweekly summer service and will use the information from these first runs to improve the specifications and design of new ice-reinforced ships. Ultimately, it hopes to have year-round navigation on the China-Europe Arctic route. For now, during the non-navigation periods, they will offer an express service requiring 25 days to Europe by combining the Suez Canal route and rail links.

No comments:

Post a Comment