U.S. REVANCHIST

Energy Shift Bolsters China's Offshore Wind Dominance

- The US strategy to decouple from Chinese supply chains by focusing on domestic oil and gas has created economic challenges for its offshore wind industry, leading to decreased investments and project halts.

- Despite US setbacks, global offshore wind capacity is projected to reach 16 gigawatts by 2025, with China developing two-thirds of these projects and forecasted to hold 45% of the world's cumulative capacity by 2030.

- The shift in US energy policy is deterring European wind developers from US investment, and Western original equipment manufacturers are returning to China's favorable business environment, making it difficult for the US to compete in the long term

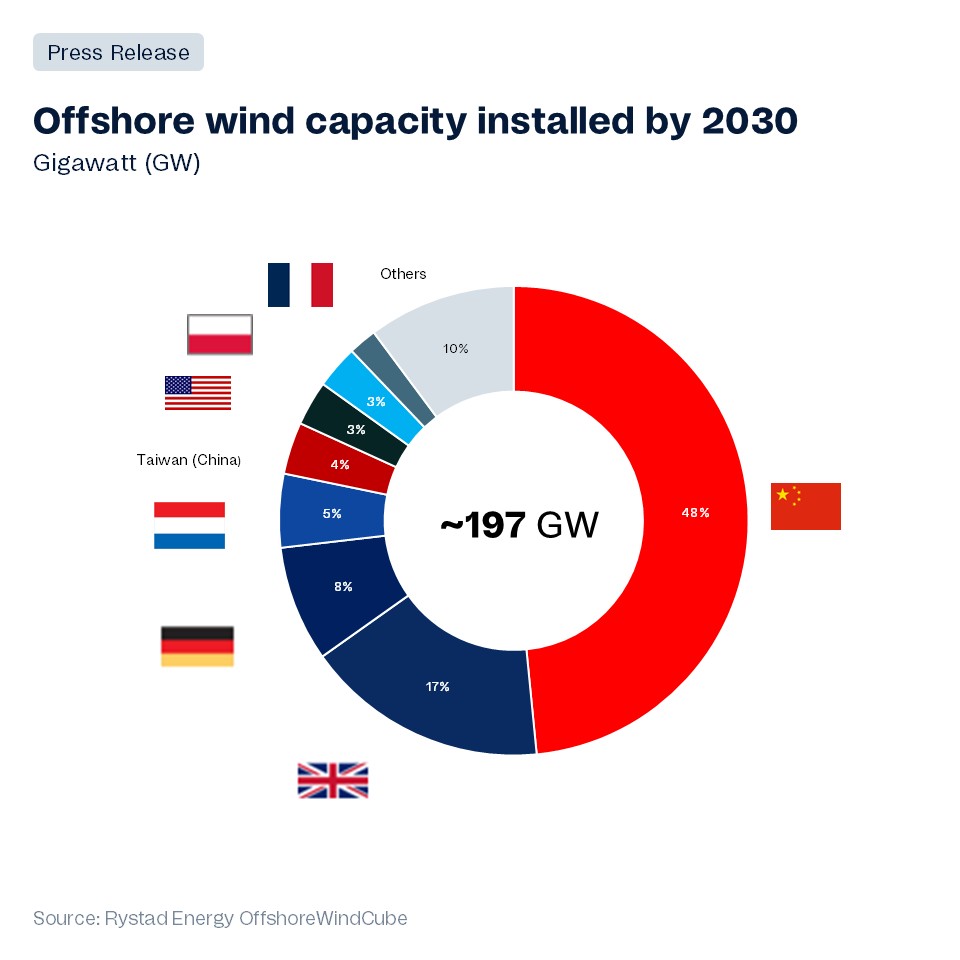

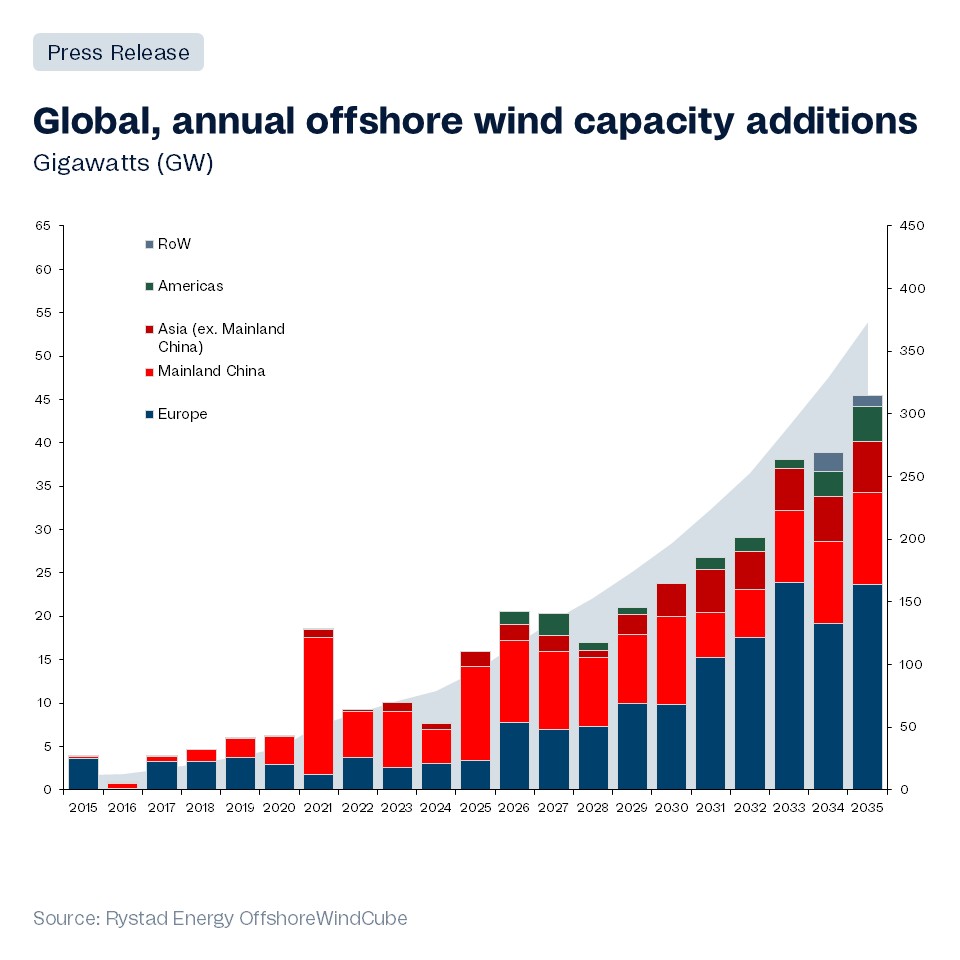

As the US aims to decouple from Chinese supply chains by doubling down on its domestic oil and gas resources, industries such as offshore wind have faced a barrage of economic challenges, from stop-work orders, to tax break rollbacks and rising inflationary costs. Despite unfavorable conditions in the US, Rystad Energy research shows new global offshore wind capacity will reach 16 gigawatts (GW) by the end of 2025 due to projects already underway, with two thirds of them being developed in China. By 2030, Rystad Energy forecasts China’s offshore wind projects will claim 45% of the world’s cumulative capacity, making it difficult for the US market to compete in the long term, regardless of policy reversals.

It is now clear that the energy policy shift in the US not only halts or slows progress on offshore wind projects that were previously greenlit but pushes European wind developers away from US investment. The US-China supply chain may be decoupled, but China’s position as a global renewables leader may have only been strengthened because of it.

Alexander Fløtre, senior vice president and head of offshore wind research, Rystad Energy

Learn more with Rystad Energy’s Offshore Wind Solution.

Some clear effects are already emerging. US renewable energy investments have plunged 36% year-on-year?so far in 2025, whereas European investments are rising as companies redirect capital away from the US. Stop work orders were issued for both Orsted’s Rhode Island offshore wind development and Equinor’s New York project, with the latter reaching a deal that lifted the administration’s ban. A federal judge has reversed the order on Orsted’s Revolution project, with the question of a continued legal battle waiting to be answered. To remain attractive to investors, Orsted and companies like it must evaluate all options for offshore wind developments and their overall US presence.

On the flipside, China-based CNOOC stated that it is staging its offshore wind portfolio expansion, with a key project in the 1.5 GW Hainan CZ7 aimed to be commissioned before 2030. The project is approved and is to be the first utility-scale project for CNOOC.?For European energy companies with less US exposure, their reliance on China and other nations will only be enhanced.

The chances of creating an alternate, renewables-driven supply chain to compete with China are low, with Western original equipment manufacturers (OEMs) flocking back to the country’s favorable business environment after fleeing in 2020. The challenge is formidable: an analysis of turbine platforms with IEC-type certification commonly used across Europe, for example, reveals that approximately 25% of the manufacturing sites producing key components for Western OEMs are in China.

Europe’s wind industry has taken notice, and policymakers are mobilizing to help reduce the reliance on Chinese imports and beef up the domestic wind energy supply chain. Officials hope such measures will encourage manufacturing buildouts while keeping costs in check.

Andrea Scassola, vice president of supply chain research at Rystad Energy

- The US strategy to decouple from Chinese supply chains by focusing on domestic oil and gas has created economic challenges for its offshore wind industry, leading to decreased investments and project halts.

- Despite US setbacks, global offshore wind capacity is projected to reach 16 gigawatts by 2025, with China developing two-thirds of these projects and forecasted to hold 45% of the world's cumulative capacity by 2030.

- The shift in US energy policy is deterring European wind developers from US investment, and Western original equipment manufacturers are returning to China's favorable business environment, making it difficult for the US to compete in the long term

As the US aims to decouple from Chinese supply chains by doubling down on its domestic oil and gas resources, industries such as offshore wind have faced a barrage of economic challenges, from stop-work orders, to tax break rollbacks and rising inflationary costs. Despite unfavorable conditions in the US, Rystad Energy research shows new global offshore wind capacity will reach 16 gigawatts (GW) by the end of 2025 due to projects already underway, with two thirds of them being developed in China. By 2030, Rystad Energy forecasts China’s offshore wind projects will claim 45% of the world’s cumulative capacity, making it difficult for the US market to compete in the long term, regardless of policy reversals.

It is now clear that the energy policy shift in the US not only halts or slows progress on offshore wind projects that were previously greenlit but pushes European wind developers away from US investment. The US-China supply chain may be decoupled, but China’s position as a global renewables leader may have only been strengthened because of it.

Alexander Fløtre, senior vice president and head of offshore wind research, Rystad Energy

Learn more with Rystad Energy’s Offshore Wind Solution.

Some clear effects are already emerging. US renewable energy investments have plunged 36% year-on-year?so far in 2025, whereas European investments are rising as companies redirect capital away from the US. Stop work orders were issued for both Orsted’s Rhode Island offshore wind development and Equinor’s New York project, with the latter reaching a deal that lifted the administration’s ban. A federal judge has reversed the order on Orsted’s Revolution project, with the question of a continued legal battle waiting to be answered. To remain attractive to investors, Orsted and companies like it must evaluate all options for offshore wind developments and their overall US presence.

On the flipside, China-based CNOOC stated that it is staging its offshore wind portfolio expansion, with a key project in the 1.5 GW Hainan CZ7 aimed to be commissioned before 2030. The project is approved and is to be the first utility-scale project for CNOOC.?For European energy companies with less US exposure, their reliance on China and other nations will only be enhanced.

The chances of creating an alternate, renewables-driven supply chain to compete with China are low, with Western original equipment manufacturers (OEMs) flocking back to the country’s favorable business environment after fleeing in 2020. The challenge is formidable: an analysis of turbine platforms with IEC-type certification commonly used across Europe, for example, reveals that approximately 25% of the manufacturing sites producing key components for Western OEMs are in China.

Europe’s wind industry has taken notice, and policymakers are mobilizing to help reduce the reliance on Chinese imports and beef up the domestic wind energy supply chain. Officials hope such measures will encourage manufacturing buildouts while keeping costs in check.

Andrea Scassola, vice president of supply chain research at Rystad Energy

SouthCoast Wind Challenges DOJ’s Delaying and Political Agenda

The developers of the proposed SouthCoast offshore wind project filed their response to the Department of Justice’s efforts to derail the approved project, calling the filing “yet another example of the president’s ongoing coordinated attack on this renewable energy industry.”

The response came as the Department of Justice filed on September 18 with the U.S. District Court in the District of Columbia seeking to voluntarily remand and stay a suit by the Town of Nantucket against the Department of the Interior, the Bureau of Ocean Energy Management, and SouthCoast Wind. DOJ is asking the court to defer indefinitely the case and to remand the December 2024 Record of Decision for the project so that BOEM can reconsider the approval of the Construction and Operations Plan.

Nantucket challenged the approvals repeatedly for the project, which would provide 2.4 GW of electricity to Massachusetts and Rhode Island. The project, which would be located over 20 miles south of Nantucket and 30 miles south of Martha’s Vineyard, gained its final approvals in the last days of the Biden administration. Nantucket’s latest challenge alleges violations of the National Environmental Policy Act and the National Historic Preservation Act, largely related to the alleged visual impacts of the project on historic resources.

The Trump administration has alleged various issues and claimed the Biden administration rushed the approvals. In the response, the lawyers cite that vital energy infrastructure, of which they said SouthCoast Wind is, was covered under the FAST-41 (Fixing America’s Surface Transportation) Act adopted in 2015, which entitled it to a “streamlined and predictable review and permitting process.” They note the lease dates to 2018 and that they underwent years of rigorous review. They assert that the COP approval was valid and lawfully granted.

The response asserts that the “Federal Defendants have no genuine legal basis to reconsider the COP,” and that it is part of the administration’s “obvious disdain for offshore wind.”

They call the DOJ filing “a verbatim, copy-and-paste request,” from similar filings made in other cases challenging offshore wind. They assert the litigation tactic is made “in bad faith without legal authority.” DOJ’s assertions that the project lacks permits, they contend, is because the pending permits “have been unlawfully withheld” by the administration.

Further, they call it a delaying tactic, noting that DOJ is aware SouthCoast Wind has until December 31 to execute its Power Purchase Agreement with the states. The reconsideration, they note, is an open-ended delay. They highlight that the DOJ already filed for and received a 90-day extension before making its filing in September.

Based on the fact that the Federal Defendant has failed to “demonstrate any genuine or good-faith basis to support their remand request,” calling it instead a “pretext,” SouthCoast Wind asks the court to reject the remand request.

If the court grants the remand, SouthCoast says judicial intervention would be required. They ask the court to limit the time of the review, to require the Federal Defendants to file biweekly status reports, and to require a monthly status conference until BOEM renders its final decision. They ask the court to require a final decision within 60 days if the court grants a remand.

It is one of several cases that the DOJ is seeking to have the courts remand. Last week, a Maryland district court rejected a filing by the DOJ to stay its case against the US Wind offshore project while the government is in shutdown. The company argued that the government could continue to undermine its project outside the court, and the judge agreed, ordering the case to proceed.

Orsted Raises $9.4 Billion in Heavily-Discounted Rights Issue

Danish offshore wind giant Orsted has raised $9.4 billion by selling new shares to existing stockholders at a steeply discounted price. With 99 percent of the new shares sold immediately and the remaining one percent swiftly sold to the public, the firm is now on firmer financial ground as it faces market headwinds and political risk in its core markets.

Orsted sold the shares at a price of 66 Danish kroner each ($10.30), a fraction of the stock's publicly-traded price of about 120 kroner and a third of the most recent peak, 180 kroner, reached in early August. Just five years ago, when Orsted's prospects seemed brighter and it was expanding into new markets, its stock briefly traded above 600 kroner.

The extra cash on hand will help Orsted weather a difficult period. Since the pandemic-era inflation bubble began, Orsted has been forced to write down or cancel multiple offshore wind ventures in the United States, suffering billions in losses on its balance sheet. The Trump administration has added more difficulty by pulling the plug on all future leasing and attempting to cancel development of multiple fully-permitted projects, including Orsted's nearly-complete Revolution Wind. The administration ordered the firm to halt work on the project in August, but a federal judge overturned that order and allowed construction to continue.

The firm is adapting its structure in response to regulatory pressure in the U.S. and the deteriorating business case for offshore wind in many overseas markets. In addition to raising fresh capital from shareholders, Orsted is said to be in talks with Apollo to sell half of its giant Hornsea 3 project for more than $11 billion, bringing in more liquidity. Its management has also announced plans to retrench, reduce headcount and refocus on its core European operations.

"The rights issue strengthens Orsted’s financial foundation, allowing us to focus on delivering our six offshore wind farms under construction, continue to handle the regulatory uncertainty in the U.S., and strengthen our position," said CEO Rasmus Errboe.

No comments:

Post a Comment