Trump shocked by China’s move on rare earths, threatens more 100% tariffs

US President Donald Trump has announced plans to impose an additional 100% tariff on imports from China from next month, escalating economic tensions between the world’s two largest economies. The move follows Beijing’s decision to tighten export controls on rare earth elements, a vital group of materials used in electric vehicles, smartphones, and other advanced technologies.

"Some very strange things are happening in China!" Trump wrote in a post on his Truth Social account on October 10, adding "They are becoming very hostile."

The US president later added that China had "taken an extraordinarily aggressive position on Trade in sending an extremely hostile letter to the World, stating that they were going to, effective November 1st, 2025, impose large scale Export Controls on virtually every product they make, and some not even made by them."

Washington is also preparing to introduce export restrictions on certain critical software, marking a further deterioration in the fragile trade truce reached earlier this year. Financial markets reacted sharply to the prospect of renewed confrontation, with the S&P 500 closing 2.7% lower, its steepest single-day decline since April, multiple US sources have reported.

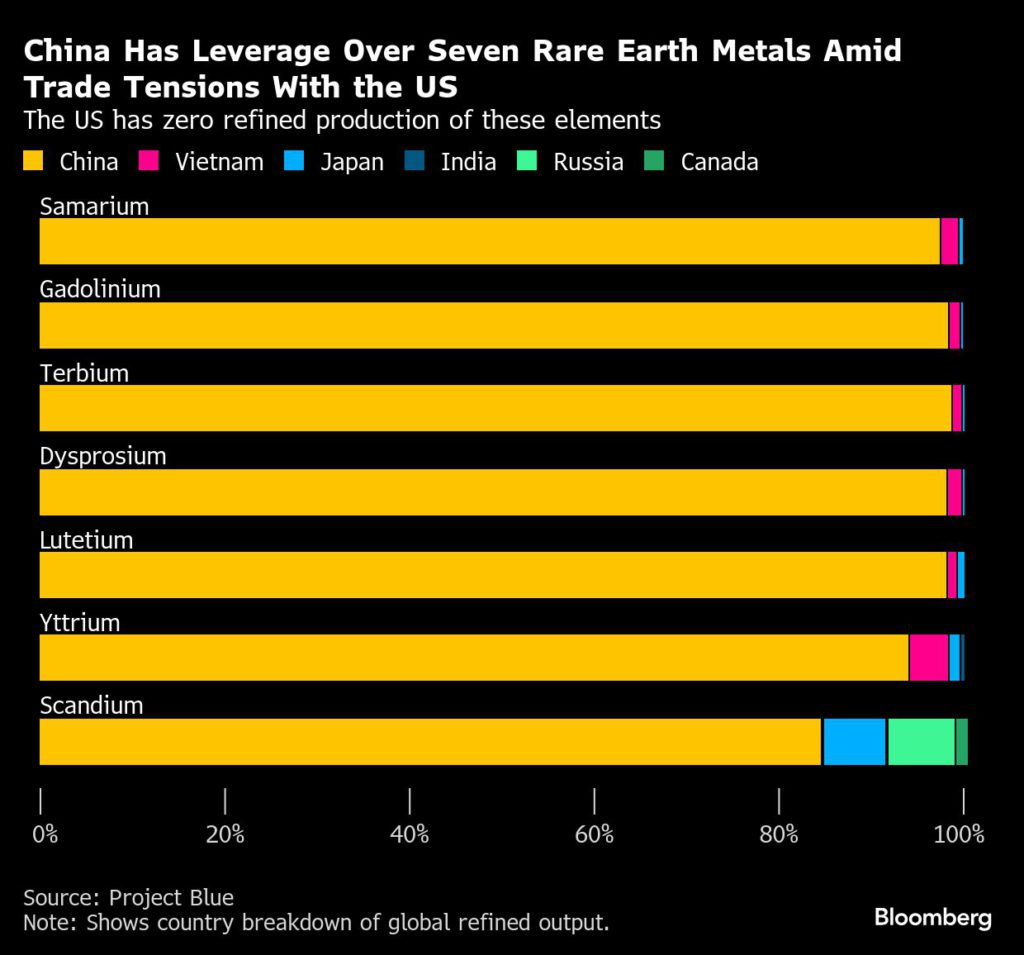

China remains the dominant global producer of rare earths and other key minerals essential to manufacturing and defence industries. Previous curbs on such exports, introduced after earlier US tariff hikes, prompted widespread disruption for American firms reliant on Chinese materials.

In a parallel move, according to the BBC, Beijing has launched an antitrust investigation into the US technology company Qualcomm, potentially jeopardising its planned acquisition of another chipmaker. China has also indicated it will begin levying new port fees on vessels with links to US ownership or operations.

The latest escalation threatens to derail planned trade discussions between Trump and Chinese President Xi Jinping, who had been expected to meet later this month at a summit in South Korea. Recent negotiations between the two sides have focused on semiconductor exports, agricultural trade, and the future of platforms such as TikTok.

Despite earlier progress towards easing tariffs, under which US goods entering China currently face a 10% levy and Chinese exports to the US a 30% surcharge, the prospect of further duties and export controls underscores the fragility of US-China relations.

The world’s chip supply chain is bracing for fallout from China’s rare earth curbs

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation.

China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the AI boom. They prompted US President Donald Trump to announce on Friday that he would impose an additional 100% tariff on China and export controls on “any and all critical software.”

The rare earth curbs may lead to weekslong delays in shipments for ASML Holding NV, the only manufacturer in the world of machines that make the most advanced semiconductors, a person familiar with the company said.

A senior manager at a major US chip company said the firm is still assessing potential impacts. But the clearest risk the company is facing now is an increase in the prices of rare earth-dependent magnets that are critical to the chip supply chain, this person said, asking not to be identified discussing operations.

An official at another US chip company said the business is rushing to identify which of its products contain rare earths from China and is worried that the country’s requirement for licenses will grind its supply chain to a halt.

It’s not clear what software products from the US might be hit by Trump’s latest proposed export ban. In July, the administration lifted export license requirements for chip-design software sales, rules that had been imposed in May as part of a raft of measures responding to Beijing’s earlier limits on shipments of essential rare earths.

China’s new rules require overseas firms to seek approval for shipping any material containing even trace amounts of Chinese rare earths — and explicitly call out parts used to make certain computer chips and advance AI research with military applications.

“These are the strictest export controls that China has utilized,” said Gracelin Baskaran, a critical minerals-focused director at the Center for Strategic and International Studies. “It’s quite clear that they have the sticks and the leverage to make, not just US firms, but firms worldwide comply.”

Chipmaking machines, like those sold by ASML and Applied Materials Inc., are especially dependent on rare earths because they contain extremely precise lasers, magnets and other equipment that use these elements.

ASML is preparing for disruptions, particularly due to a clause that requires foreign firms to seek China’s approval for reexports of products containing its rare earths, said the person familiar with ASML, who asked not to be identified discussing private matters and noted that ASML is lobbying Dutch and US allies for alternatives. The company declined to comment.

“Within the semiconductor value chain, China’s new export controls will likely most impact chipmakers that use rare earth-based chemicals during the chip fabrication process and toolmakers that integrate rare earth magnets into their equipment,” said Jacob Feldgoise, senior data research analyst at Georgetown University’s Center for Security and Emerging Technology.

Some have questioned how long the restrictions will last, viewing them as potential posturing ahead of a trip to Asia Trump had planned that was expected to include a meeting with Chinese President Xi Jinping later this month. It’s unclear how China would even track rare earths at such discrete levels to enforce the rules.

But China’s move has instead escalated tensions with the US. Trump’s announced tariffs would raise import taxes on many Chinese goods to 130% starting next month. That would be just below the 145% level imposed earlier this year, before both countries ratcheted down the levies in a truce to advance trade talks. On Friday, Trump also threatened to call off his meeting with Xi altogether, describing the new rare earth controls as a “hostile” action.

“I have always felt that they’ve been lying in wait, and now, as usual, I have been proven right! There is no way that China should be allowed to hold the World ‘captive,’” Trump said in a post on Truth Social.

This isn’t the first time that rare earths have landed in the center of US-China trade wars. After Trump hiked tariffs on Chinese imports earlier this year, China’s government responded by cutting off mineral exports to US companies. Officials from both sides had agreed to a truce in the spring, under which Trump lowered duties and Xi’s officials agreed to resume the flow of the minerals.

The world’s biggest chipmakers, including Intel Corp., Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co., rely on ASML to produce semiconductors. Samsung and Intel declined to comment. TSMC didn’t respond to a request for comment.

A White House official said the government and relevant agencies are assessing any impact from the new rules, which were announced without notice and imposed in an apparent effort to exert control over the entire world’s technology supply chains.

The US House Select Committee on China panned the Asian nation for the move, describing the restrictions as “an economic declaration of war against the US.” Committee Chairman John Moolenaar, a Republican, said in a statement on Thursday that China has “fired a loaded gun at the American economy.”

Germany, Europe’s biggest economy, has already introduced measures to diversify its supply of raw materials, and its economic ministry called China’s curbs a “great concern” on Friday. The government said it’s in close contact with affected companies and the European Commission to respond.

Taiwan relies mainly on Europe, the US and Japan for rare earth supplies. “We still need further assessment before deciding on the impact” on the chip industry, the nation’s economic affairs ministry said in a statement. “We will continue to monitor indirect impact from fluctuations in the pricing of raw materials and supply chain adjustments.”

(By Dasha Afanasieva, Debby Wu and Maggie Eastland)

China expands rare earth restrictions, targets defence, semiconductor users

China dramatically expanded its rare earths export controls on Thursday, adding five new elements and extra scrutiny for semiconductor users as Beijing tightens control over the sector ahead of talks between Presidents Donald Trump and Xi Jinping.

The world’s largest rare earths producer also added dozens of pieces of refining technology to its control list and announced rules that will require compliance from foreign rare earth producers who use Chinese materials.

The Ministry of Commerce’s announcements follow US lawmakers’ call on Tuesday for broader bans on the export of chipmaking equipment to China.

They expand controls Beijing announced in April that caused shortages around the world, before a series of deals with Europe and the US eased the supply crunch.

“The White House and relevant agencies are closely assessing any impact from the new rules, which were announced without any notice and imposed in an apparent effort to exert control over the entire world’s technology supply chains,” a White House official told Reuters on Thursday.

The new curbs come ahead of a scheduled face-to-face meeting between Trump and Xi in South Korea at the end of October.

“This helps with increasing leverage for Beijing ahead of the anticipated Trump-Xi summit in (South) Korea later this month,” said Tim Zhang, founder of Singapore-based Edge Research.

China produces over 90% of the world’s processed rare earths and rare earth magnets. The 17 rare earth elements are vital materials in products ranging from electric vehicles to aircraft engines and military radars.

Exports of 12 of them are now restricted after the ministry added five – holmium, erbium, thulium, europium and ytterbium – along with related materials.

Foreign companies producing some of the rare earths and related magnets on the list will now also need a Chinese export licence if the final product contains or is made with Chinese equipment or material. This applies even if the transaction includes no Chinese companies.

The regulations mimic rules the US has implemented to restrict other countries’ exports of semiconductor-related products to China.

It was not immediately clear how Beijing intends to enforce its new regime, especially as the US, the European Union and others race to build alternatives to the Chinese rare earth supply chain.

“We’re likely entering a period of structural bifurcation — with China localizing its value chain and the US and allies accelerating their own,” said Neha Mukherjee, a rare earths analyst with Benchmark Mineral Intelligence.

In a nod to concerns about supply shortages, the ministry said the scope of items in its latest restrictions was limited and “a variety of licensing facilitation measures will be adopted”.

China’s latest restrictions on the five additional elements and processing equipment will take effect on November 8, just before a 90-day trade truce with Washington expires.

The rules on foreign companies that make products using Chinese rare earths equipment or material are to take effect on December 1. Shares in China Northern Rare Earth Group, China Rare Earth Resources and Technology and Shenghe Resources surged by 10%, 9.97% and 9.4%, respectively, on Thursday.

Shares in US-based rare earths companies jumped as well after New York markets opened, with Critical Metals Corp gaining 17%, Energy Fuels adding 11%, and MP Materials and USA Rare Earth each up 6%.

Chips and defense

The ministry also said overseas defence users will not be granted licences, while applications related to advanced semiconductors will be approved on a case-by-case basis.

The new rules apply to 14-nanometer chips or more advanced chips, memory chips with 256 layers or more, and equipment used in production of such chips, as well as to related research and development. These advanced chips are used in products from smartphones to AI chipsets that require powerful computing performance.

The rules will also apply to research and development of artificial intelligence with potential military applications.

South Korea, home to major memory chipmakers Samsung Electronics and SK Hynix, is assessing the details of the new restrictions and will continue discussions with China to minimize their impact, its industry ministry said in a statement to Reuters.

Samsung declined to comment. SK Hynix and Taiwan’s TSMC did not immediately respond to questions.

Shares in TSMC rose 1.8% on Thursday, as the company reported forecast-beating third-quarter revenue. South Korea’s financial markets were closed on Thursday for a public holiday.

(Reporting by Beijing bureau; Additional reporting by Heekyong Yang, Ernest Scheyder, Erin Onstad and Jarrett Renshaw; Editing by Christian Schmollinger, Kate Mayberry, Tom Hogue, Mark Heinrich, Jason Neely and Marguerita Choy)

No comments:

Post a Comment