Column: China deal buys US time to build critical minerals supply chain

China has a stronghold on the supply of critical minerals that are essential for the renewable energy industry, making the sector vulnerable to price volatility, geopolitical tensions and supply shocks.

Cobalt, lithium, manganese, graphite and nickel are used in energy storage systems while copper is found in solar panels as well as electrical connections, and silicon is the main material in PV panels. Arsenic, gallium and tellurium are used in solar cells, and rare earths such as neodymium and praseodymium feature in permanent magnets, an essential component of wind turbines.

Critical minerals are also needed for defense systems and electric vehicles, as well as microchips and semiconductors for data center infrastructure. China has an average market share of 70% for 19 of the 20 most strategic critical minerals and 94% for rare earth containing permanent magnets, according to the International Energy Agency (IEA).

CHART: Critical minerals – share of top three producer countries

The Trump administration has enacted policies to ramp up the supply of critical minerals in the US and from allied countries, while engaging in a high-stakes trade and tariff battle with China.

On October 30, the White House announced a deal with China that it later said would “effectively eliminate” all current and proposed export controls on rare earths and other critical minerals. This followed China’s decision in April to virtually halt exports of rare earths and its announcement in October of further restrictions that were expected to chokehold exports of critical minerals to the United States.

“China will issue general licenses valid for exports of rare earths, gallium, germanium, antimony, and graphite for the benefit of US end users and their suppliers around the world,” the White House said on November 1.

“The general license means the de facto removal of controls China imposed since 2023,” the White House said, although industry insiders are awaiting clarity on the scope and impact of the new licenses.

The agreement “is clearly a good move for the global economy because it will take time to build up the strength of the supply chain outside China,” said Barbara Humpton, the CEO of USA Rare Earth, which owns the mining rights to the Round Top deposit of heavy rare earths in Texas and is building a 5,000-ton magnet production facility in Oklahoma.

When it comes to rare earths, US political leaders are doing the right thing “by first moderating the conversation with China and then accelerating investments in the space,” Humpton told Reuters Events.

New supply routes

The Trump administration has sought to diversify the critical minerals supply chain with a multi-pronged strategy.

The government issued two executive orders in March and April to facilitate the extraction of critical minerals from federal land and seabed resources, and has approved the Ambler Road project that could boost output of copper, zinc and cobalt from mineral deposits in Alaska.

The government has also signed public-private partnerships, including a deal with MP Materials to build an end-to-end US rare earth magnet supply chain, and the $1.8 billion Orion Critical Mineral Consortium, which will invest in existing or near-term producing assets to build a portfolio of critical mineral projects.

Orion Resource Partners, the metals and mining private investment firm leading the consortium, is looking at projects across both OECD countries and select emerging markets, “for assets that combine geological quality, scalability, and meaningful economic returns,” said Oskar Lewnowski, Founder and Group CEO. In terms of minerals, Orion is considering investments in lithium, rare earths, cobalt, copper and uranium.

“The goal is not simply to own resources, but to ensure they’re developed and processed through a secure, transparent, and allied framework that strengthens long-term supply resilience,” Lewnowski told Reuters Events.

These moves will help de-risk critical minerals supply chains but more price support is required “because projects outside of China simply have higher operating costs,” said Tom Moerenhout, who leads the Critical Materials Initiative at Columbia’s Center on Global Energy Policy.

“So we will need to see different types of public support, such as price floors or contracts-for-difference,” as well as more funding to find high-grade mineral deposits, Moerenhout added.

Humpton agreed that price floors — a government-imposed minimum price — would help de-risk investments but also called for faster permitting from federal and regional authorities to accelerate US mining projects.

The government also signed the US-Australia Critical Minerals Framework which will initially inject $2 billion in funding for mining projects in the US and Australia that will supply both countries. In late October, the US signed a similar deal with Japan.

“We believe it’s possible for the US to have a very robust supply chain ourselves but we also think it makes sense to be collaborating with allies and this deal announced with Australia is a really good example,” Humpton said.

In addition to controlling the mining of critical minerals, China has a stronghold on mid-stream processing and refining, as well as the equipment needed to process and refine these resources, Moerenhout noted.

“We need to work together with Japan, South Korea, Germany, and other notable equipment manufacturers to make sure that our indigenous equipment is up to global standards,” he told Reuters Events.

Private investments

With demand for critical minerals expected to boom, several companies have recently announced investments in the sector.

As part of efforts to build a mine-to-magnet supply chain, USA Rare Earth in September acquired Less Common Metals (LCM), a UK manufacturer of light and heavy rare earth metals. The acquisition will provide USA Rare Earth with a supply of rare earth metal alloys and strip cast for the magnet making facility it is building in Oklahoma.

USA Rare Earth plans to expand LCM’s metal making capabilities and support its efforts to expand in France, Humpton said.

Noveon Magnetics, a US manufacturer of permanent magnets, on November 12 announced a deal to secure supplies of light and heavy rare earth materials from Solvay, a Belgian company that runs a rare earths processing facility in France.

In October, Redwood Materials closed a $350 million Series E funding round. The Nevada-based company recovers critical elements including lithium, cobalt, nickel and copper by recycling batteries, and builds large scale energy storage systems.

The funds raised by Redwood Materials will go toward “fueling the energy storage deployments and continuing to expand our capacity across our critical materials businesses” with the overall focus of helping the US build a domestic supply chain, Alexis Georgeson, the company’s VP government relations and communications, said.

Redwood Materials’ Nevada campus produced 60,000 metric tons of critical materials in 2024 and the company increased its capacity by 20,000 metric tons when it opened its second campus in South Carolina earlier this month.

In October, the federal government took a 5% stake in Lithium Americas and a separate 5% stake in the company’s Thacker Pass lithium mine in Nevada, a joint venture between Lithium Americas and General Motors that is expected to become the Western Hemisphere’s largest source of lithium when it opens in 2028.

Georgeson praised the speed at which the Trump administration has moved to support the critical minerals industry, adding that more public-private partnerships could further accelerate deployment.

“There is not a ton I can say but we’re definitely having conversations with the administration,” Georgeson told Reuters Events.

Deals with private companies help create “excitement,” but rather than investing in “a few government-selected winners,” the federal government should seek to incentivize midstream operations by introducing more tax credits that would benefit all companies, Moerenhout said.

All these efforts will help diversify mineral supply but won’t be enough to eliminate fears of supply shocks in the short term.

“With minerals the problem is that lead times including exploration, feasibility studies, permitting, litigation and final ramp up to production easily last 15 years, and often more,” said Moerenhout.

“So the timeframe of our dependence on China is not something that can be resolved in two to three years’ time,” he added.

(Opinions expressed are those of the author, Eduardo Garcia, an energy editor for Reuters Events.)

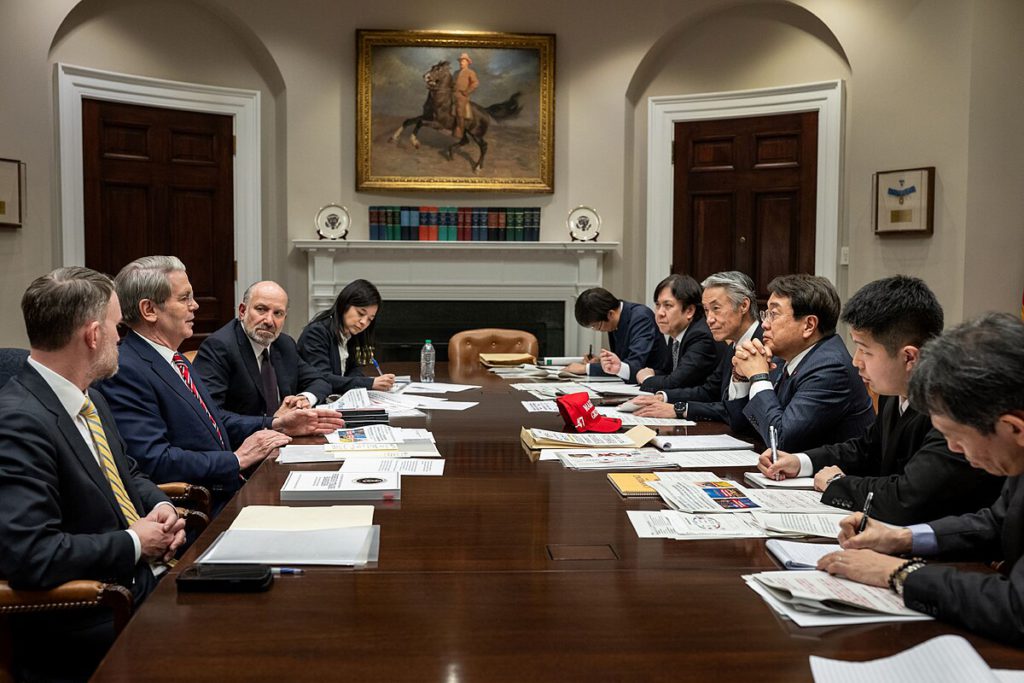

Japan trade minister says no particular change in China rare earth export controls

Japan’s Trade Minister Ryosei Akazawa said on Tuesday there are currently no particular changes in China’s export control measures on rare earths and other materials.

Akazawa’s remarks come as Japan seeks to ease tensions with China amid an escalating dispute over Taiwan.

(By Ritsuko Shimizu and Kaori Kaneko; Editing by Jacqueline Wong)

No comments:

Post a Comment