CU

Glencore said to consider shutting Canada’s largest copper plant

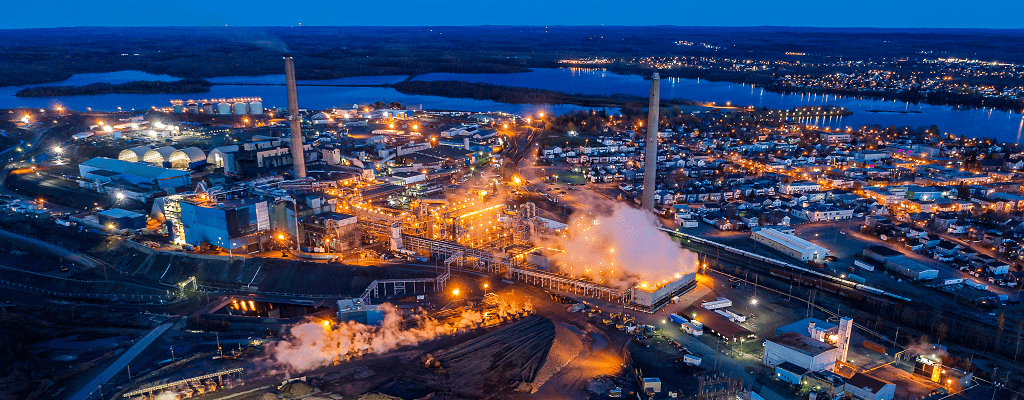

Glencore is planning to wind down its Horne Smelter — Canada’s largest copper-metal producing plant — citing steep environmental upgrades and operational costs, Reuters reported on Monday.

The Swiss commodities giant currently operates the Horne and the Canadian Copper Refinery (CCR), both located in the province of Quebec. The Horne smelter processes concentrates to make copper anode, which is then turned into cathode by CCR.

While no production figures have been published for these assets, industry sources cited by Reuters have pegged their annual output at more than 300,000 tonnes. Much of the copper metal production goes to the US, a net importer.

A closure, according to these sources, would impact as many as 1,000 workers employed on the two sites, which they estimate would require more than $200 million to modernize.

However, a Glencore spokesperson, in response to Reuters‘ requests for comments, denied that the group is considering closing down the Horne and CCR.

The spokesperson acknowledged that smelters globally are facing significant “financial, regulatory and operational pressure” — and Glencore’s smelters in Canada are not exempt from this. Still, “they play an important role in the supply of critical raw materials for the North American market and abroad.”

The potential shutdown of Glencore’s Canadian operations would reinforce forecasts of global shortages, partly due to supply disruptions at major mines in Chile and Indonesia. Canada is currently a major exporter of copper and supplier to the US, accounting for approximately 17% of US imports, ranking it second behind Chile.

According to Reuters, Glencore’s decision to close Horne and CCR stems from the high costs of making the operations environmentally safe, and is not related to a class-action lawsuit recently authorized by Quebec’s Supreme Court related to the smelter’s arsenic emissions dating back to 2020.

Founded nearly 100 years ago, the Horne smelter is said to have pioneered the recycling of electronic scrap in 1980. Glencore currently processes around 100,000 tonnes of discarded electronics annually to produce copper, nickel, cobalt, gold and silver, the company said on its website.

Earlier this year, Glencore sold its Pasar copper refinery in the Philippines, a custom smelter.

Teck’s QB turnaround lifts hopes for $53B Anglo merger

Teck Resources (TSX: TECK.A, TECK.B)(NYSE: TECK) said on Monday its Quebrada Blanca (QB) mine in Chile is showing signs of recovery, following months of underperformance that raised questions about the mine’s viability and future role in the company’s $53 billion merger with Anglo American (LON: AAL).

The Canadian miner noted that mill throughput and copper recoveries at QB are now tracking in line with expectations, thanks to an action plan launched in August. The improvement follows a broader operational review that begun in September, aimed at stabilizing the ramp-up of its flagship copper expansion project.

The “QB Action Plan” included upgrades to tailings infrastructure, with 59% of the mine’s cyclones now replaced. Full replacement is expected by the end of 2025. The company also completed construction of three new rock benches, with two more scheduled for mid-2026.

Teck expects to finalize a key component of its tailings system, known as the sand wedge, in the first half of 2026 and transition QB to steady-state operations later that year.

The company said the current mine plan taps just 15% of QB’s resource base, calling it a platform for “multiple pathways” to long-term growth.

Collahuasi integration gains

The QB turnaround comes as Teck and Anglo American push ahead with a transformative merger that could create the world’s largest copper mine by the early 2030s, potentially overtaking BHP’s (ASX: BHP) Escondida in Chile.

“Completion of the merger will create a leading growth-oriented copper investment vehicle with resilience and capacity to realize significant value across the combined portfolio,” Teck President and CEO Jonathan Price said in a presentation to investors in Chile.

A central feature of the deal is the integration of QB with Anglo’s Collahuasi mine, located just 15 km away.

According to industry analysts, the combined QB-Collahuasi complex could yield around one million tonnes of copper annually. A proposed conveyor system linking Collahuasi’s high-grade ore to QB’s processing plant is projected to add 175,000 tonnes of copper output per year between 2030 and 2049, delivered at lower cost and faster than building a new mine.

The executive added the integration presents one of the most compelling industrial synergy opportunities in the copper sector today. The combined operations are expected to generate up to $1.4 billion in additional annual EBITDA and $800 million in pretax synergies through streamlined procurement and operations.

Top five copper producers

Wood Mackenzie values Teck at $10.8 billion on a post-tax, sum-of-the-parts basis, including $13.8 billion from copper assets. The analysis excludes synergy gains from the merger but includes risks tied to QB’s operational history.

If and when completed, the merger would vault Anglo-Teck into the top five global copper producers, with output reaching 1.35 million tonnes annually, eclipsing Escondida’s 2024 output of 1.28 million tonnes.

It would also mark the largest mining deal of the decade.

No comments:

Post a Comment