There were some radical choices in Rachel Reeves’ Budget, but some will leave low and middle-income workers paying the price for reducing the national debt

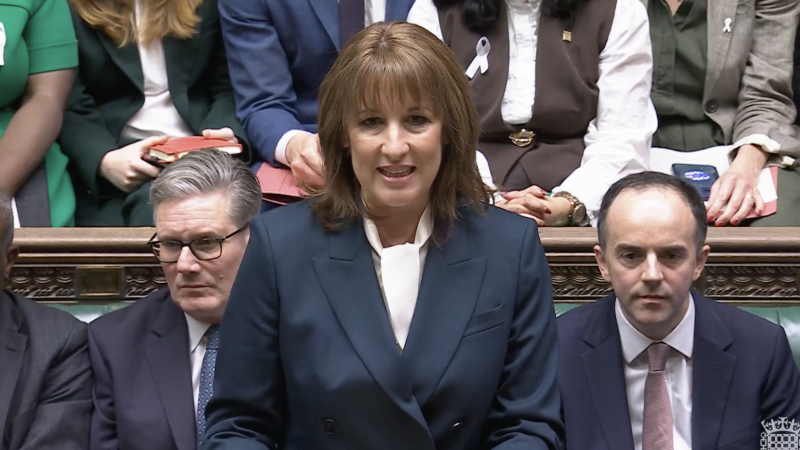

The chancellor Rachel Reeves has now delivered her second, much trailed, Autumn Budget. It started off with the Office for Budget Responsibility leaking the Budget document before Reeves delivered her statement. The government was also admonished by the deputy speaker Nusrat Ghani for giving pre-Budget briefings to the press, which she said had been increasing over several years but have reached “an unprecedented high”.

In today’s Budget, Reeves set out her “Labour choices”, which she said were “Not austerity. Not reckless borrowing. Not turning a blind eye to unfairness”, but “cutting the debt, waiting lists and the cost of living.”

Some of her choices, including scrapping the two-child limit, hiking taxes on gambling firms and mansion tax charges will help those who need it most while targeting the wealthy. However, other policy choices will leave low and middle-income workers paying the price for reducing the national debt.

Here are five key takeaways from Reeves’ budget:

1. Income tax thresholds remain frozen

Before 2022, income tax thresholds were increased every year in line with inflation. Rishi Sunak froze income tax thresholds from April 2022 until 2026. The Tories extended that freeze until 2028, and now Reeves has announced she will freeze them until April 2031. At the last Budget, she said she wouldn’t freeze the thresholds beyond 2028, as that would “hurt working people”.

The key thresholds will now remain unchanged for the rest of the decade:The personal allowance will stay at £12,570.

The higher-rate threshold will remain at £50,270, after which earnings will be taxed at 40%.

Earnings above £125,140 will continue to be taxed at 45%.

This is being called a ‘stealth tax rise’ because, as wages increase, people will pay more tax even though rates aren’t rising, breaking Labour’s manifesto promise not to raise taxes. The policy will raise an extra £8.3bn a year by 2030.

Unison general secretary Christina McAnea said: “The chancellor could and should have asked the wealthiest to pay more. Putting money in the pockets of working people boosts local economies. Freezing tax thresholds does the opposite.”

The government will also slash the tax-free allowance on Cash ISAs from £20,000 to £12,000, while reserving an £8,000 allowance to put into Stocks and Shares ISAs. Sara Hall, co-executive director at Positive Money, said “This will not boost investment in the things we need, it will just push up the price of stocks and shares, mostly benefiting the City of London”.

2. Higher taxation on mansions and landlords

Reeves will enact council tax reforms from April 2028 on high value properties, called the High Value Council Tax Surcharge. Properties worth more than £2 million will pay a yearly surcharge of £2,500, while properties worth £5 million will pay a £7,500 year surcharge on top of council tax. Reeves said this would affect less than the top 1% of properties, and will generate £400 million in 2028-29. Some will say that the council tax system needs more far-reaching reform than this, including by revaluing properties and re-assessing how much council tax they should pay.

Landlords, who do not currently pay national insurance contributions, will pay an additional 2% on property income from April 2027. The government says this is an attempt to make the tax system fairer and narrow the tax gap between landlords and tenants.

3. Closing the tax gap

Reeves also vowed that the government will raise £10 billion in revenue in 2029/30 by collecting more unpaid taxes and targeting those who try to “bend or break” the tax rules. The government will also give HMRC new powers to pursue promoters of tax avoidance schemes.

4. Gambling firm taxes doubled

Gambling firms will pay 40% tax on online gambling activities from April 2026. This marks a significant hike from the 21% they previously paid and will go towards paying for scrapping the two-child limit (which will cost around £3 billion by 2029/30). Reeves said she was increasing tax on gambling companies because “remote gambling is associated with the highest levels of harm”. This will raise £1 billion a year by 2031. Gambling firms have lobbied hard against a tax rise, with chair of the treasury committee Meg Hillier MP, saying their “scaremongering has failed”.

5. Two-child limit scrapped

The two-child limit on Universal Credit, which restricts households from receiving child benefit payments for a third or subsequent child born after April 2017, will be scrapped from April 2026. According to the Child Poverty Action Group, every day the two-child limit remains in place, it pushes 109 more children into poverty.

According to UK Government estimates, the measure will take 450,000 children out of poverty by 2029-30. Reeves criticised the Tories’ rationale for introducing the policy in 2017, and said that “kids have paid the price” for it. Reeves said she will also remove the “vile” rape clause in the policy, which requires “women to prove if their children have been conceived non-consensually to receive support”.

Olivia Barber is a reporter at Left Foot Forward

The removal of the cap will benefit 560,000 families by an average of £5,310 per year and reduce child poverty by 450,000, according to the OBR.

The Labour government has confirmed that it will be lifting the two-child benefit cap which pushed hundreds of thousands of children into poverty.

During the budget speech, Chancellor Rachel Reeves told the Commons: “I can announce today fully costed and fully funded the removal of the two-child limit in full from April.”

The removal of the cap will benefit 560,000 families by an average of £5,310 per year and reduce child poverty by 450,000, according to the OBR.

The two-child benefit cap was introduced by Osborne as Conservative chancellor. It bars families from claiming the £292.81-a-month child element of universal credit for third and subsequent children born after April 6, 2017.

According to the Child Poverty Action Group, every day it remains in place, 109 more children are pulled into poverty by the policy.

Reeves’ announcement was met with much applause in the Commons and will make a major difference to families up and down the country.

This is the difference a Labour government.

Basit Mahmood is editor of Left Foot Forward

The Tory MP thinks lifting children out of poverty is the 'wrong' choice...

The shadow chancellor Mel Stride has said in an interview that he disagreed with Labour lifting the two-child limit on Universal Credit at the Budget yesterday.

Introduced in 2017 by the Tories, the policy affects 1.6 million children and has pushed hundreds of thousands of children into poverty through no fault of their own.

The limit prevents households from claiming the child benefit element of Universal Credit for a third child or any subsequent children.

The chancellor Rachel Reeves’ decision to scrap the limit in April 2026 is being widely welcomed by MPs, think tanks and children’s charities, as it will lift 450,000 children out of poverty by 2029, but Stride said it was the “wrong” choice.

Asked today if he agreed with the government’s decision to scrap the two-child limit, Stride told the BBC’s Naga Munchetty: “No I don’t, I think those are the wrong choices.”

The Tory shadow chancellor added: “When it comes to the size of the family that you decide you’re going to have, and if you want a large family, then those who are working hard, paying taxes and so on are having to take those really hard decisions as to whether they can afford a large family or not.

“I think it’s only fair that those who are on benefits face the same kind of decisions as those who are working hard, paying taxes and paying for those benefits.”

What Stride failed to acknowledge is that as of May 2025, 34% of people on Universal Credit were also in employment, and therefore “working hard and paying taxes”.

Olivia Barber is a reporter at Left Foot Forward

‘Ending the two-child limit: A victory for decency—and a turning point for Labour’

Voters have been crying out for change for years. They have been increasingly frustrated with the slow pace of change almost since Labour were elected. It’s why the party’s approval ratings are reaching ‘friends and family’ levels of bad. But the positive reaction from voters to this Budget suggests a new pathway; that when the government is bold, and argues with clarity and conviction, it can win a hearing. That’s according to research commissioned by my organisation, 38 Degrees in the moments after Rachel Reeves concluded her Budget speech.

38 Degrees is a community of a million people across the country, united in the belief that when ordinary people speak up, decision-makers listen. This week, alongside charities and grassroots groups, we are celebrating a monumental victory for people power – the Chancellor’s decision to scrap the cruel Two-Child Benefit Limit.

READ MORE: ‘The Tories chose child poverty. Labour is choosing to end it’

To truly understand the impact of this decision, you have to listen to the families who lived through it. Immediately after the Budget, we held a focus group made up of people who were directly impacted by the policy. Their raw testimonies cut through the statistics. As a disabled father of three in our group laid bare the difficulty of life under the cap:

“You have to think about what you’re not gonna pay for that week. What are you not gonna pay for? You’re not gonna pay for the gas bill. You’re gonna forego the gas bill so you can feed the kids.”

Abolishing this policy is the single best way to tackle child poverty. Estimates suggest 450,000 children will be lifted out of poverty. This is not just a statistic; it is a life changing shift for families. As another parent of four children (including twins born after the cap was introduced) shared with us regarding how much easier life will become:

“My kids can finally eat maybe two or three times a day.”

A grandparent who has three adult children whose families are directly affected also told us:

“I’m over the moon, absolutely over the moon. It’s gonna make such a difference to three of my adult children. … all round, it’s gonna be a huge relief for those three families.”

The political choice is stark. The previous Conservative Government introduced this policy and has committed to reintroducing it – risking plunging kids back into poverty. The Reform Party offers a poor alternative, rolling back this decision and pushing more children back into poverty. The difference in approach is striking, especially when you consider the moral weight of the issue. As another voter told us:

“I look at the cap and I know from just seeing so many people that struggle, even if they have two children. Just affording the basics and getting them the clothes to make sure they have enough nutritious food, not the stuff where you could buy that’s overly processed….And so for me, I found [the cap] too frightening.”

Meanwhile, the public mandate for removing the cap is massive. Our polling, carried out by Survation, found that nearly two-thirds (64%) of the public support taxing online gambling companies if the money was used to lift kids out of poverty. This support is broad, with a majority in 623 out of 632 constituencies in Britain supporting a tax on gambling companies.

An online panel of voters of all parties conducted for us by JL Partners on the afternoon of the Budget shows that it’s not just those impacted who welcome the Chancellor’s decision. A 33-year old Ops Manager, who currently votes Conservative said:

“I feel encouraged by the announcement. Abolishing the two-child benefit cap—especially if it truly lifts hundreds of thousands of children out of poverty—seems like a meaningful step toward reducing hardship for families.” This is representative of the voters we heard from in the panel.

Scrapping the Two-Child Benefit Limit is a victory for decency and a tangible change for struggling families. No child should go without. Writing off kids’ potential is a moral failure and an economic dead end. We praise the Government for taking 450,000 children out of poverty.

There is a lesson here. The polls have in the past shown that scrapping the two child limit isn’t especially popular with voters. But children living in poverty isn’t popular either. In public, support for this announcement is vocal but in private anxiety amongst Labour MPs is palpable. But if Labour MPs won’t put their necks on the line to take 450,000 kids out of poverty what are they even in Westminster for?

The results of our voter research yesterday, and in recent months shows that when we fight with clarity, conviction and campaigning we can win voters over. When we fight, we won’t always win. But if we don’t fight we will most certainly lose. And losing means more kids growing up in poverty. No progressive should have a moment’s hesitation in choosing to get out there to defend and promote this important policy.

No comments:

Post a Comment