Chile’s copper industry eyes double-digit growth after reforms

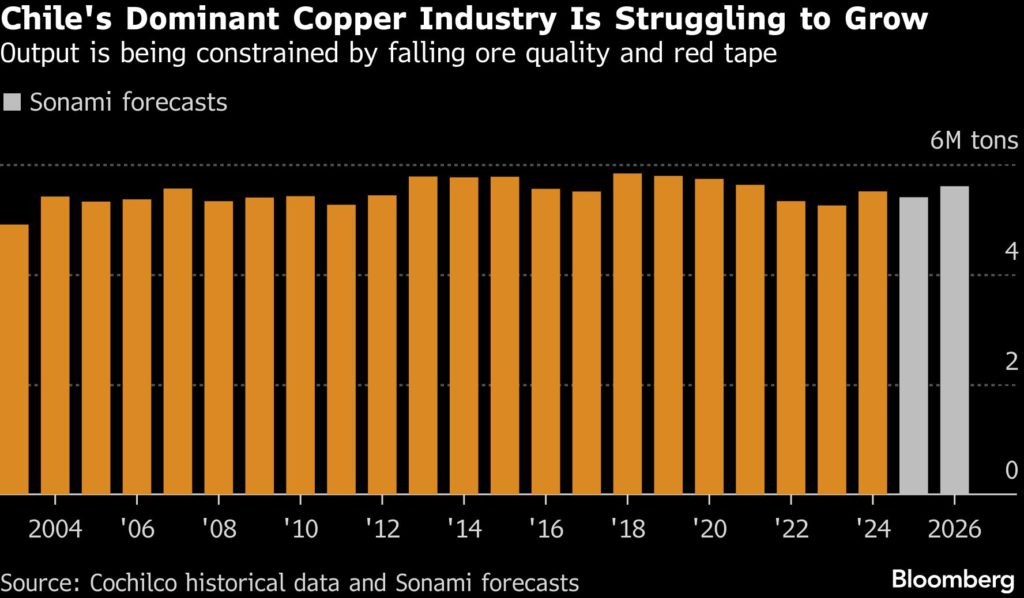

Chile, the world’s top copper producer, could break out of two decades of stagnant output by cutting red tape and easing regulation under the incoming government, according to the country’s mining industry group.

Sonami president Jorge Riesco said Tuesday he agrees with recent comments from President-elect José Antonio Kast’s team that mining output could rise by 10% to 20% over the next year or two. Kast’s projections followed consultations with Sonami, Riesco said.

Removing restraints on investments as part of a pro-growth agenda could unlock billions of dollars in mine expansions that together would have a sizable impact on output, Riesco told reporters in Santiago on Tuesday. Annual production that slipped to 5.4 million metric tons last year is set to reach 5.5 million to 5.7 million this year, according to Sonami. High prices may also flush out more supply, the association said.

Getting Chilean production closer to 6 million tons a year would be welcomed by a tightening global market, where copper prices have surged to a record above $6 a pound. Analysts have warned of a looming supply squeeze as producers struggle to expand output just as demand rises from artificial intelligence and higher defense spending.

Chile’s experience mirrors challenges facing the global mining industry. The development of giant deposits such as Escondida cemented the country’s position as the world’s dominant producer. But output is now broadly in line with levels seen two decades ago as ore grades decline and projects become more complex and expensive.

Still, Sonami forecasts copper prices will average about $4.50 a pound this year — well down from current levels — as some of the disruptions that helped fuel the rally ease. Mining investment in Chile is projected to total $26.8 billion between 2025 and 2029, even as spending this year is expected to fall by about 20%.

(By James Attwood)

Codelco submits $1.3B plan to prolong Radomiro Tomic mine life to 2058

Chile’s state-run miner Codelco, the world’s largest copper producer, on Tuesday submitted a $1.3 billion continuity project to Chile’s environmental authority to request an extension of its leaching operations at its Radomiro Tomic mine until 2058.

The proposal aims to boost the mine’s capacity to an average of 725,000 tonnes per day, up from its current level of 675,000 daily tonnes, requiring pit expansion and new waste dumps and ore stockpile areas.

The plan seeks to extend the operation of the mine’s chlorinated leaching process at an average annual rate of 154,000 tons per day.

Leaching is a method of extracting metals and minerals from rock using liquid chemicals instead of melting or crushing.

The project also seeks to provide operational continuity to its waste treatment and dumping line, which uses chemical solutions to extract copper from ore rather than smelting.

Plans include expanding support facilities and installing a hydraulic barrier system with four wells to control water infiltration in the industrial area.

The project includes truck transport of 20,000 daily tons of ore or waste per year to Codelco’s Chuquicamata facility over the next 10 years.

Codelco’s Radomiro Tomic mine is one of the company’s three most prominent mines in Chile.

(By Fabian Cambero; Editing by Natalia Siniawski)

No comments:

Post a Comment