2026 Is the Year of Balance Sheet Engineering in the Battery Storage Market

- The energy storage market has pivoted to a focus on financial stability and manufacturing yield, leading to the collapse of several undercapitalized, next-generation battery startups.

- A "Great Bifurcation" has emerged between the Western strategy of betting on premium, Solid-State technologies and China's strategy of aggressively scaling "good enough" Sodium-Ion (Na-ion) and LFP batteries for geopolitical control.

- For US companies, the business model is now driven primarily by harvesting Section 45X tax credits from the Inflation Reduction Act, creating desperate demand for supply chains compliant with Foreign Entity of Concern (FEOC) rules.

In the first quarter of 2026, the global energy storage market is no longer a playground for visionaries... it is a graveyard for the undercapitalized.

The data is rough. As of March 2025, QuantumScape (NYSE: QS) sat on $860 million in cash against a trailing twelve-month burn rate of $331 million. This 2.6-year window is the "valley of death" made manifest in a ledger.

While the early 2020s were fueled by the speculative highs of SPAC mergers and theoretical energy density, the 2026 market has pivoted to "Balance Sheet Engineering."

Success is now measured by manufacturing yield and the ability to exploit the U.S. Inflation Reduction Act (IRA) Section 45X.

The gap between a patent and a production line has become a chasm that physics and finance are struggling to bridge.

Lessons from the Liquidation Slow-Burn

The history of next-generation batteries is written in the records of bankruptcy courts. We see the "polysulfide shuttle" not as a chemical reaction, but as a financial sinkhole.

OXIS Energy, once the titan of Lithium-Sulfur (Li-S), entered administration in 2021 and spent four years in a liquidation slow-burn. Creditors were still waiting for "intended dividends" in September 2025. They received pennies for a dream that promised 550 Wh/kg but delivered fewer than 100 cycles before the chemistry ate itself.

Physics is indifferent to venture capital timelines... and physics usually wins.

Pellion Technologies attempted to harness the divalent power of Magnesium-Ion, offering theoretical density that dwarfed lithium. But magnesium ions move through solid hosts like sludge. When Khosla Ventures realized the drone market couldn't fund the R&D required for automotive scale, they pulled the plug. Pellion is now "deadpooled."

Not every failure ends in an auction of lab equipment. Ambri, the MIT-born liquid metal battery firm, utilized a Section 363 sale in 2024 to wipe its slate clean. By selling assets to a consortium led by Bill Gates’s Frontier fund, Ambri shed its legacy debt while keeping its calcium-antimony tech alive.

In energy finance, "failure" is a terminal event for the middle class... but it is merely a recapitalization event for the ultra-high-net-worth.

How Sodium Neutralized Lithium’s Edge

While Western startups navigate insolvency, China has executed a violent pivot to Sodium-Ion (Na-ion). This is the "Great Bifurcation" of 2026.

The Western strategy is a high-stakes bet on premium "leapfrog" technologies like Solid-State. The Chinese strategy is a brutal scale-up of the "good enough."

In 2025, Lithium-Iron-Phosphate (LFP) prices in China crashed to $44/kWh due to massive overcapacity. Sodium-Ion, despite lacking the same scale, is hovering at $59/kWh.

- LFP Cost (2025): $44–$52/kWh

- Na-ion Cost (2025): ~$59/kWh

- The Friction: Sodium is currently more expensive than the lithium incumbent it was meant to replace.

But cost is only half the story. Sodium-Ion represents a geopolitical hedge. By deploying Na-ion via brands like CATL’s "Naxtra," China has effectively destroyed the pricing power of lithium miners. If lithium prices spike, the world’s largest manufacturer simply flips a switch to sodium.

The West is playing for performance... China is playing for control.

Subsidy Lifelines

For the survivors in the U.S., the business model is no longer about selling batteries—it is about harvesting tax credits.

Section 45X of the IRA has become the primary revenue driver for firms like Peak Energy and Lyten. The credit provides 10% of the production cost for "electrode active materials." Because the legal definition is chemistry-neutral, it doesn't matter if the cathode is made of expensive lithium or dirt-cheap Prussian Blue.

The Foreign Entity of Concern (FEOC) rules have created a "supply chain wall." Because China controls 80% of the lithium refining capacity, standard Li-ion batteries are increasingly ineligible for U.S. consumer tax credits.

This has created a desperate demand for "FEOC-compliant" alternatives.

- Sion Power: Secured $75M in Series A funding led by LG Energy Solution.

- The Logic: LG isn't buying a chemistry; they are buying a 50 Amp-hour large-format cell production line in Arizona that doesn't rely on Chinese precursors.

- The Shift: Hiring former GM executive Pamela Fletcher as CEO signals that the "science experiment" phase is over.

You don't hire an automotive veteran to run a lab... you hire them to manage a supply chain.

A Solid-State Stalemate

If Sodium-Ion is the hammer, Solid-State is the ghost. Toyota, the undisputed leader in solid-state patents, has moved the goalposts again. Mass production, once promised for 2025, has been pushed to 2027 and beyond.

The technical friction remains the "yield" bottleneck.

Ceramic separators are brittle. In a laboratory, a 90% yield is a triumph. In a gigafactory, a 10% scrap rate is a financial death sentence. This is why companies like Solid Power (NASDAQ: SLDP) have pivoted to a capital-light licensing model. They are letting BMW and SK Innovation take the hit on the CAPEX-heavy manufacturing while they collect royalties on the sulfide electrolytes.

The market has bifurcated into two distinct spheres:

- The China-Sphere: Focused on LFP and Na-ion, driven by TWh-scale manufacturing and low-cost exports.

- The Western-Sphere: Focused on High-Nickel and Solid-State, propped up by Section 45X subsidies and trade barriers.

The "PowerPoint Engineering" era is dead. The "Balance Sheet Engineering" era is here.

The winners of 2026 are not the companies with the highest theoretical energy density... they are the ones with the smartest tax lawyers and the highest manufacturing yields.

By Michael Kern for Oilprice.com

Energy Transition Strategies: Advancing Emerging Battery Technologies

Advancing battery technologies stand out as next-generation solutions to help reduce carbon emissions for marine and offshore applications. Yet, rapid expansion and implementation require technical oversight and validation through an objective classification process that reinforces safety above all.

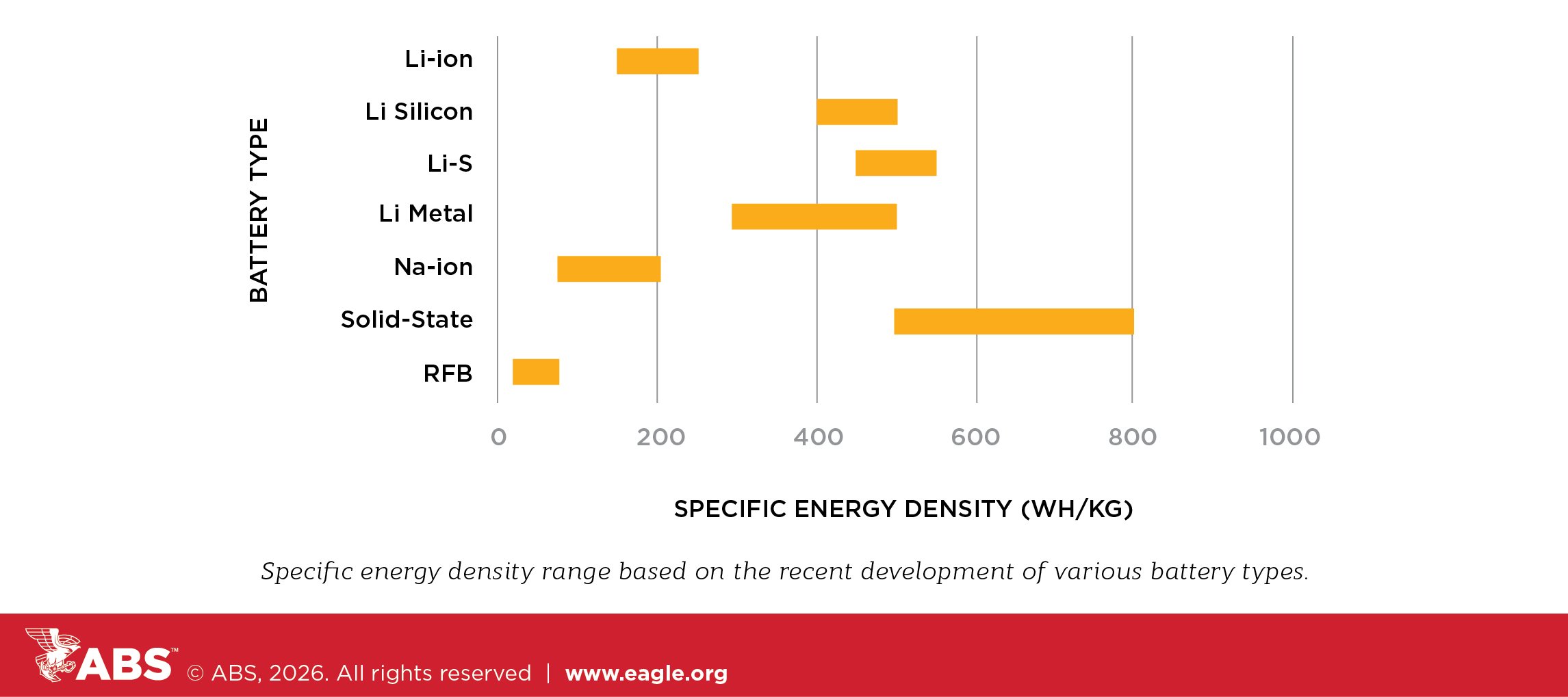

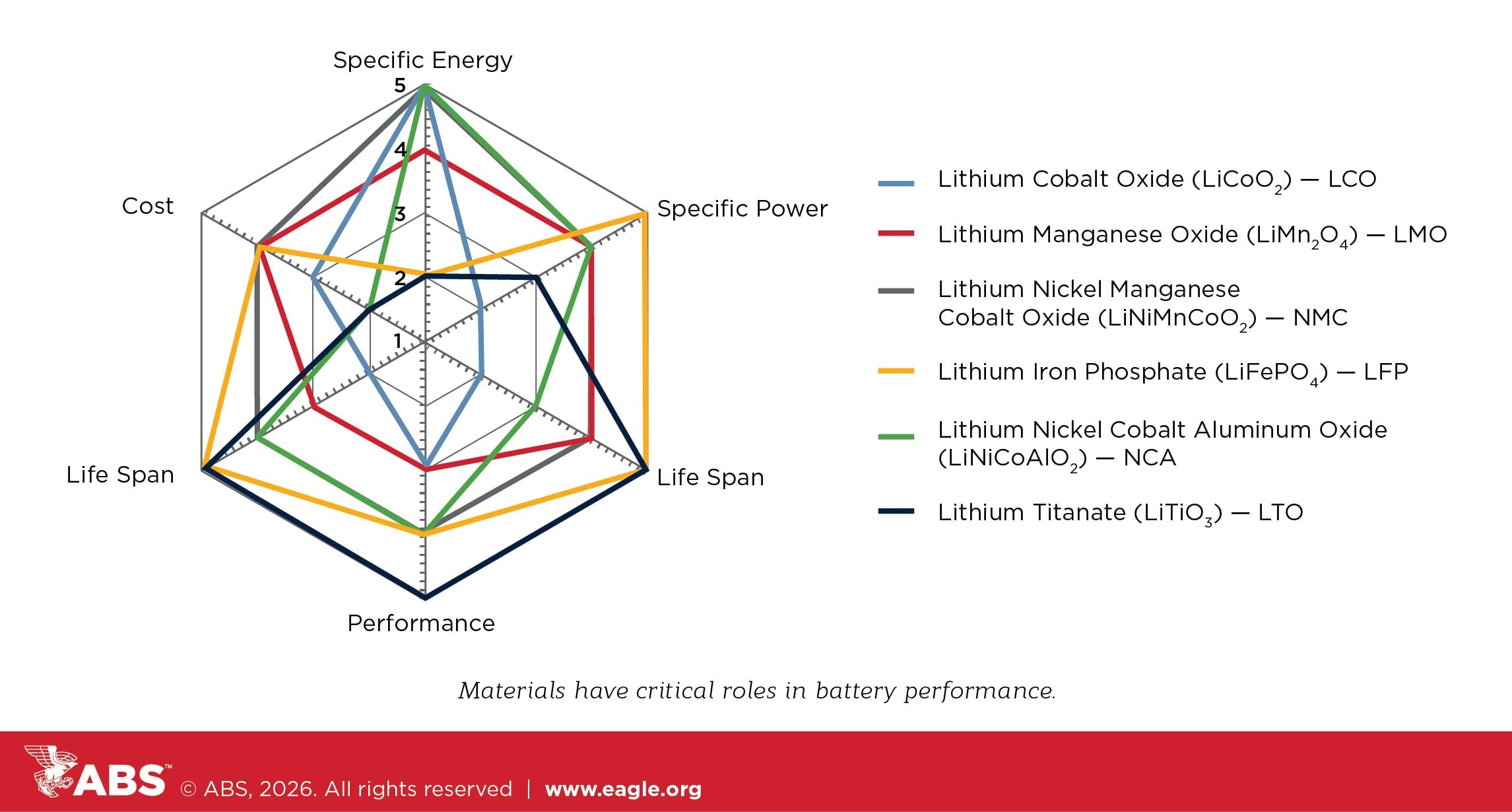

The ABS 2025 study, Emerging Battery Technologies in the Maritime Industry, Vol. 2, examines advancements in lithium-ion (Li-ion) and six of the latest battery technologies to map the safety implications for the marine and offshore industries. Key technical insights from the evaluation address their chemistries and energy density, while also indicating that the industry needs effective strategies to support safe operations.

Looking Beyond Lithium-ion

Li-ion batteries have demonstrated their effectiveness and reliability in powering all-electric and hybrid vessels, from small harbor crafts like tugboats and electric ferries as well as larger applications such as energy storage systems (ESS) for offshore platforms. The technology readiness level (TRL) of Li-ion battery technology for hybrid and all-electric vessels is high, indicating that the technology is sufficiently mature for regular commercial use.

However, today's Li-ion batteries also face significant challenges that limit broader maritime adoption, opening the door to other alternative chemistries in development. ABS is working closely with technology suppliers to advance emerging battery technologies by maintaining comprehensive safety requirements through extensive testing and verification.

Recognizing that different battery types require tailored safety approaches, ABS continues to update specific guidelines for each chemistry. As foundational publications, the ABS Requirements for Use of Lithium-Ion Batteries in the Marine and Offshore Industries (2025) and ABS Requirements for Hybrid and All-Electric Power Systems for Marine and Offshore Applications (2024) provide the industry with a framework for safe deployment, while the “All-Electric Vessel” notation designates that vessels can operate in all-electric modes with confidence.

Transformative Benefits

Battery technology delivers compelling advantages. The most immediate benefit is gaining operational efficiency through multiple applications that optimize vessel performance and reduce fuel consumption.

At a glance, the technology’s promising benefits to support the energy transition include:

- Significant greenhouse gas (GHG) emissions reduction: Full or partial battery-electric propulsion during sea-going and port operations substantially lower emissions for improved air quality. Cold ironing applications allow ships to connect to shore power while docked, eliminating GHG emissions during port stays.

- Hybrid system optimization: Peak-shaving capabilities allow batteries to offset the need to start additional engines during high-demand periods, while load leveling enables engines to operate at optimal efficiency points. This strategic loading can reduce fuel consumption by 10-20% in typical operations, delivering immediate economic returns alongside environmental benefits.

- Enhanced operational flexibility: Dynamic power applications provide immediate backup power and enable seamless transitions between power sources. Energy harvesting capabilities allow vessels to store power from renewable sources or recover energy from onboard systems, for example, in Power Take-In (PTI)[1] and Power Take-Off (PTO)[2] systems, creating new operational efficiencies.

- Potential future economic advantages: While lithium-ion batteries currently cost approximately $115 per kWh at the module level, their lower operating costs—requiring no fuel, fewer moving parts and reduced maintenance—create favorable lifecycle economics.

Confronting Current Challenges

Despite proven benefits, battery technology faces significant obstacles that limit broader maritime adoption.

An immediate practical challenge is space and weight constraints. Current lithium-ion systems providing the energy capacity needed for ocean-going vessels can significantly impact vessel stability and cargo capacity, particularly as energy requirements scale for larger vessels and longer voyages.

Safety risks demand constant vigilance and sophisticated management systems. Thermal runaway remains the primary concern, where internal or external factors trigger self-sustaining chemical reactions that can lead to fires or explosions. During thermal runaway, batteries emit flammable and toxic gases including hydrogen fluoride, carbon monoxide and flammable hydrocarbons, requiring a dedicated safety system and emergency response protocols.

Adding to both cost and complexity, battery management systems are necessary to maintain safe operations. These systems must continuously monitor voltage, current, temperature, state of charge and state of health, with any failure potentially compromising safety or performance.

Meanwhile, infrastructure limitations are constraining deployment opportunities. Offshore charging infrastructure remains in preliminary development stages, meaning vessels may need necessary returns to shore for charging, limiting operational range and flexibility. The planning and investment required for adequate shore-side charging infrastructure represents a significant barrier to widespread adoption.

Furthermore, manufacturing and disposal of lithium-ion batteries generates indirect GHG emissions that should be considered to understand their full environmental impact. End-of-life disposal and recycling present additional environmental challenges, though these processes also offer opportunities for material recovery and secondary use applications.

Finally, high upfront costs create financial challenges for vessel owners, particularly in retrofit applications where existing vessels must be modified. For fleets with 30-year operational lifespans, the challenge of retrofitting or replacing conventional systems with battery technology requires substantial capital investment and careful financial planning.

Technologies for a New Era of Energy Efficiency

Emerging battery technologies offer potential solutions to current limitations while introducing new capabilities that could transform marine and offshore operations.

- Silicon anode batteries are among the most promising candidates for commercial use in the next generation of batteries, with a theoretical specific capacity of approximately 3,600 milliampere-hours per gram (mAh/g), almost 10 times higher than a commercial Li-ion battery with graphite anodes (~350 mAh/g). Silicon’s abundant availability and environmentally friendly nature make it a potential material for large-scale manufacturing of high-energy-density silicon anode cells. However, manufacturing complexity and cost remain barriers to widespread adoption.

- Lithium-sulfur systems present even greater potential with theoretical energy densities of 2,600 Wh/kg, potentially revolutionizing long-duration maritime operations. However, challenges including the "shuttling effect" of dissolving compounds and complex phase transitions during operation require resolution before commercial viability.

- Solid-state batteries represent perhaps the most transformative opportunity, offering energy densities of 500-800 Wh/kg while addressing many current safety concerns. The non-flammable solid electrolytes significantly reduce fire risks, while broader temperature operating ranges enhance operational flexibility. Mass production is anticipated after 2030, driven by advances in materials science and manufacturing processes.

- Sodium-based batteries such as sodium-ion or sodium metal chloride address potential advantages in cost, resource availability and safety. Recent ABS certification of sodium metal chloride batteries demonstrates the commercial viability of these alternatives for specific maritime applications.

- Flow batteries sacrifice energy density for exceptional cycle life (>6,000 cycles) and operational flexibility, making them suitable for applications where space constraints are less critical but long-duration energy storage is essential.

A Goal-Based Approach for Implementation

Safely deploying emerging technologies requires both systematic and goal-based approaches to overcome current limitations. Regulatory frameworks must evolve to keep pace with industry innovation while maintaining strict safety standards. To support advancing novel technologies, ABS has developed a goal-based approach that focuses on intended outcomes rather than prescriptive requirements, while also maintaining rigorous safety validation.

Goals to overcome implementation challenges include the following:

- Safety management strategies should address technology-specific risks. Each battery chemistry presents unique challenges and requires customized solutions for a reliable system design, including the BMS architecture, effective thermal management, gas emission control, and comprehensive emergency response strategies. Water mist-based fire suppression systems have proven to be the most effective solution for cooling and containing battery fires, but safety systems must be carefully integrated in space-constrained marine environments.

- Infrastructure development must proceed in coordination with technology deployment. Shore-side charging capabilities, maintenance facilities and crew training programs require coordinated investment to support widespread adoption. Comprehensive recycling and end-of-life management strategies are needed for environmental sustainability.

- Technology qualification processes enable safe adoption of emerging systems. ABS's systematic evaluation approach, following established industry standards, while developing additional criteria for new technologies, provides industry confidence in innovative solutions.

Future Potential and Industry Outlook

The convergence of improving technology performance, declining costs and strengthening regulatory drivers could further propel battery adoption in maritime and offshore applications.

Near-term opportunities focus on hybrid systems that optimize conventional propulsion while gradually increasing battery capabilities and operational experience.

Medium-term prospects center on emerging technologies such as sodium-ion, solid-state and advanced lithium-ion technologies that could enable all-electric operations for coastal and short-sea shipping, potentially transforming vessel design and operational patterns. As anticipated after 2030, commercializing sodium-ion and solid-state batteries represents a future milestone for maritime electrification.

Long-term potential encompasses innovative changes in how vessels are designed, operated and maintained. Advanced battery systems could enable distributed propulsion architectures, autonomous operations and integration with renewable energy systems that fundamentally transform marine and offshore operations.

The industry must balance optimism about technological potential with realistic assessments of current limitations and implementation challenges. Success requires continued investment in research and development, systematic safety validation, infrastructure development and regulatory adaptation that keeps pace with technological advancement.

Battery Breakthroughs on the Horizon

Exploration of next-generation batteries for marine applications reveals a promising future characterized by technological advancements, improved performance and enhanced safety. As the latest ABS 2025 Sustainability Outlook reveals, challenges remain, and adopting these energy solutions requires a careful balance between embracing innovation and managing risks.

From a safety perspective, new battery applications should address the inherent risks associated with energy storage systems. Advanced monitoring and control systems, along with comprehensive testing and compliance with international standards, are essential steps that will enable the safe operation of these batteries in marine and offshore applications.

By overcoming current technological limitations and bringing forward emerging solutions validated by an objective and goal-based classification approach, the marine and offshore industries can achieve greater efficiency for a more sustainable, reliable and increasingly safer energy future.

Michael Kei is Vice President of Technology at ABS.

[1] ABS Requirements for Hybrid and All-Electric Power Systems for Marine and Offshore

Applications (2024): In Power Take-In (PTI) Mode, the shaft generator functions as an auxiliary motor working concurrently with the main diesel engine or independently for electric propulsion, also known as shaft motor mode. This mode provides propulsion power to the shaft which boosts the main engine with extra power or as an electric propulsion motor with the main engine clutched out or secured.

[2] ABS Hybrid Guide: Power Take-Off (PTO) Mode is an operating mode takes the energy generated in the main engine as taken off by the shaft generator to produce electricity as an additional power source.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

Sigma Lithium rebounds on additional sales, denies report on Brazil ops

Sigma Lithium (TSXV, NASDAQ: SGML) rebounded sharply on Friday after announcing additional sales of its product and shutting down media reports of an “operational injunction” on its flagship mine in Brazil.

Earlier this month, several news outlets in Brazil claimed that authorities had ordered a shutdown of waste piles at Sigma’s Grota do Cirilo operations in Minas Gerais due to environmental and safety risks.

The company, however, calls this “fake news” created by online media, using information published on falsified government websites. It claims that these are part of a “defamatory campaign” created to benefit short sellers.

Sigma has yet to respond to MINING.COM’s request for comment.

Sigma Lithium jumped as much as 17% following this update, sending its share price back to levels seen last week and taking the stock back into the green on the year. The company is trading near $14.50 in New York with a market capitalization of $1.6 billion.

Operation updates

In a further boost to investor sentiment, Sigma said on Friday it made an additional sale of 100,000 tonnes in high-purity lithium fines at market price, which has risen since its last sale.

Additionally, the Canada-based lithium miner said remobilization activities at its Brazilian mine site are proceeding as planned and expected to conclude this month.

The Grota do Cirilo operation currently has a nameplate capacity to produce 270,000 tonnes of lithium oxide concentrate on an annualized basis (or approximately 38,000-40,000 tonnes of lithium carbonate equivalent). The company is in the process of constructing a second plant to double its capacity.

No comments:

Post a Comment