Top CEOs outearn average Canadians by January 2nd.

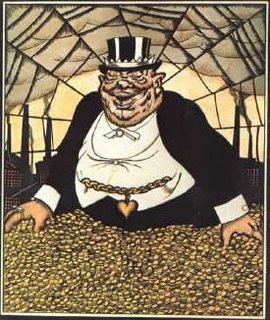

Top CEOs outearn average Canadians by January 2nd.Hey that's today. It took less than 24 hours for Canada's fat cats to earn what you and I make in a year.

And the average worker has not made ANY real gain in wages for the past decade, which just adds insult to injury.

While the corporate elite got a 262% wage and bonus increase between 2005 and the end of 2006.

Perhaps we should declare January 2 the official Canadian Piggie Day for how much the boss class makes off our backs, while barely blinking an eye, or lifting a pen, or doing anything really productive besides lining their own pockets and those of their shareholders, who are all major pension funds, our pension funds in fact.

That's not comforting news to the many Canadians whose primary motivation for heading back to work after the holidays is being able to start paying off their Christmas credit card bills.

"When you say that the average CEO made $9 million in 2005 and the average Canadian made ($38,000), the comparison between those things is so far into the stratosphere that I think people have trouble just coming to terms with what the comparison means," said Hugh Mackenzie, an economist with the independent research institute that focuses on issues of social and economic justice.

"Converting it into time sort of puts it into a frame that people can get their heads around."

Mackenzie crunched the numbers based on 2005 salary figures from Statistics Canada and Report on Business magazine's most recent listing of the 100 best-paid CEOs of Canadian publicly traded companies.

According to his figures, by the time Canadians flick on the 6 p.m. news Tuesday, the average CEO will have pocketed a staggering $70,000.

"I was kind of hoping it would get into the second week of January. As it turns out, it was not even close," Mackenzie quipped. "Once people get over how stunning the differentials are, I think it really raises a lot of questions in people's minds."

"How can somebody possibly be worth that amount in income and ... if those people are taking that much money out of the company or out of the economy, what does that mean for what's left for the rest of us?"

And don't forget these fat cats are a minority in Canada.

Wealth survey highlights include:

- The concentration of wealth at the high end continued to grow from

1999 to 2005.

- The wealthiest 20% families held 69.2% of the total net wealth in

Canada, up from 68.5% in 1999. That increase in share was entirely at

the expense of the middle 20%, whose share dropped from 8.8% to 8.4%.

- The net worth of the 20% of families at the bottom of the wealth

scale was negative again in 2005.

- Debt increased at a faster rate than net worth. More than 6.5% of

families literally operate under water -- with negative net worth.

- Between 1999 and 2005, the median debt load for families rose 38%,

from $32,300 in 1999 to $44,500 in 2005.

While the Fraser Institute declares Tax Freedom Day in June to show

how much government taxes us, the fact is that their prescription for tax cuts

have NOT benefited working class Canadians.

Canada is falling behind a number of OECD nations in a wide range of social and economic areas, and a study released today by the Canadian Centre for Policy Alternatives points to tax cuts as the culprit.

The study, by Neil Brooks and Thaddeus Hwong, compares high-tax Nordic countries and low-tax Anglo-American countries on 50 social and economic measures and finds the high-tax Nordic countries score better in 42 categories.

According to the study, tax cuts are disastrous for the well-being of a nation’s citizens. For example, the high-tax Nordic countries have: