Does foreign aid end up in the pockets of elites instead of contributing to inclusive economic development? A recently published journal article offers new evidence of elite capture of World Bank loans by analysing data on bank accounts and shell companies in offshore financial centers.

The effectiveness of foreign aid remains controversial. Some scholars assert that aid plays a pivotal role in promoting economic development in the poorest countries. Others are sceptical. Many studies emphasize that aid effectiveness depends crucially on the quality of institutions and policies in the receiving countries.

A specific concern often voiced by sceptics is that aid may be captured by economic and political elites. In our journal article, recently published in the Journal of Political Economy we study aid capture by combining data on aid disbursements from the World Bank (WB) and foreign deposits from the Bank for International Settlements (BIS). The former covers all disbursements made by the WB to finance development projects and provide general budget support. The latter covers foreign-owned deposits in all major financial centres — including havens such as Switzerland, Cayman Islands, and Singapore, all known for financial secrecy.

Some aid money gets diverted straight to offshore accounts

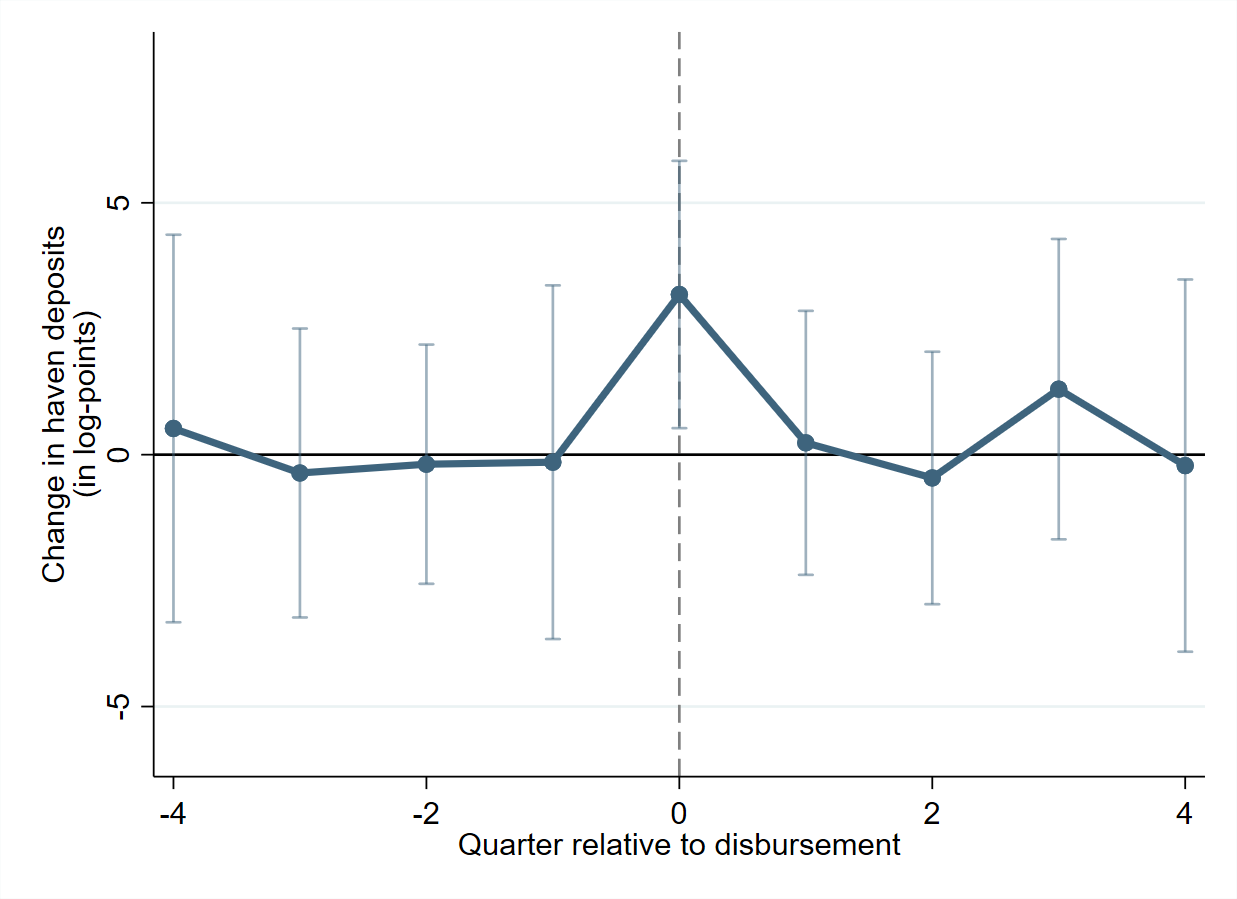

We study whether aid disbursements trigger money flows to bank accounts in havens focusing on the 22 most WB aid-dependent countries in the world. Our main finding that aid disbursements induce outflows to havens is illustrated in Figure 1. A country’s deposits in havens increase sharply in the same quarters that it receives an aid disbursement. The outflows are both statistically and economically significant: aid disbursements equivalent to 1% of GDP are associated with an increase in haven deposits of around 3.4%. The implied leakage rate is 7.5%. In other words, for each dollar of aid disbursed, haven deposits increase by 7.5 cents.

Figure 1. The relation between aid disbursements and outflows to tax havens (Source: Deposit data from the BIS locational banking statistics, disbursement data from World Bank).

While our analysis documents that aid disbursements are associated with wealth accumulation on offshore accounts, the macro nature of the deposit data represents an important limitation. We do not observe who stores wealth in havens and therefore cannot directly infer the economic mechanism. In any case, it is almost certain that the beneficiaries of the money flowing to havens at the time of aid disbursements belong to economic elites, as offshore bank accounts are overwhelmingly concentrated at the very top of the wealth distribution.

While our analysis documents that aid disbursements are associated with wealth accumulation on offshore accounts, the macro nature of the deposit data represents an important limitation. We do not observe who stores wealth in havens and therefore cannot directly infer the economic mechanism. In any case, it is almost certain that the beneficiaries of the money flowing to havens at the time of aid disbursements belong to economic elites, as offshore bank accounts are overwhelmingly concentrated at the very top of the wealth distribution.

Several reasons to suspect elite capture in the most aid-dependent countries

A number of additional results suggest that the increase in haven deposits around aid disbursements reflect capture by ruling elites.

First, we find no similar increase in deposits in non-havens. While aid disbursements trigger money flows to places like Zurich, the global centre for banking secrecy and private wealth management, there are no analogous flows to other international banking centres such as New York, London, and Frankfurt. If the money derives from corruption and embezzlement, it is natural that it flows to banking centres with institutionalized financial secrecy.

Second, the estimated effect varies across countries and projects in ways that are consistent with elite capture. We find that aid disbursements cause more money flows to havens when countries are more corrupt and have less democratic checks and balances (according to standard measures) and when projects have unsatisfactory outcomes (according to the World Bank's ex post evaluation).

Third, analysing leaked data from corporate service providers and corporate registries in havens such as the British Virgin Islands, Panama, and the Bahamas, we find that aid disbursements cause an increase in the number of offshore corporations with links to the receiving country. These corporations typically have no substantial activities and are known to play a key role in facilitating illicit financial flows.

The estimated leakage rate of 7.5% most likely represents a lower bound since it only includes money diverted to foreign accounts and not money spent on real estate, luxury goods, and pet projects. It also does not include money diverted to the accounts of offshore corporations. In principle, it may also overstate true diversion to the extent that some of the funds appearing on haven accounts around aid disbursements reflect other mechanisms; e.g., local contractors receiving payments under WB-sponsored projects and funnelling the payment to haven accounts to evade taxes.

Finally, we find strong evidence that the leakage rate varies positively with aid-dependence. When we include a wider range of countries in the analysis, including countries that are less dependent on WB aid, the estimated leakage rate drops and becomes statistically insignificant.

A corruption conundrum

When we zoom in on a smaller set of countries that depend the most on WB aid, the estimated leakage rate surges. This pattern suggests that the average leakage rate across all aid-receiving countries is much smaller than in the main sample. Donors are therefore confronted with a corruption conundrum — aid is most likely to be diverted in countries that need it most.

Jørgen Juel Andersen is a Professor at the Norwegian Business School (BI).

Niels Johannesen is a Professor at the University of Copenhagen.

Bob Rijkers is Senior Economist at the World Bank.

The views expressed in this piece are those of the authors, and do not necessarily reflect the views of the Institute or the United Nations University, nor the programme/project donors.

No comments:

Post a Comment