Renewable Energy And EV Growth Have Far Exceeded 2015 Forecasts

- The COP30 summit in Brazil ended with little progress, as nations again failed to agree on phasing out fossil fuels despite renewed warnings of missed climate goals.

- Renewable and EV growth has far outpaced earlier forecasts: global solar capacity is now four times higher than the IEA’s 2015 projection, and EVs make up over 20% of new car sales.

- China’s dominance in clean energy manufacturing has driven costs down worldwide.

The latest edition of the annual UN climate summit ended with little fanfare on Friday, marking a decade since the famous Paris Climate Agreement of 2015. Dubbed COP30, the summit held in Brazil followed the usual pattern of the experts warning of how far off track the world is from meeting its climate goals, but failed to discuss a shift away from fossil fuels for the second year running. However, here’s a little ‘trivia’ the experts rarely talk about: the world has by far exceeded the most ambitious climate forecasts from just a decade ago, with renewable energy and electric vehicle adoption growing much faster than expected.

To wit, 553 gigawatts of solar power--enough to power 100 million U.S. homes--was installed across the globe last year, 15 times more than the International Energy Agency (IEA) projected in 2015. The world’s total installed solar capacity is now four times what the IEA projected 10 years ago. Meanwhile, more than 20% of new vehicles sold worldwide today are EVs, a dramatic increase from less than 1% in 2015. The world is now on track to hit 100 million EVs in 2028, even if growth flatlines from here.

But here’s the kicker: the planet is on course to record a 2.6 degrees increase in global temperatures by 2100, avoiding the catastrophic 4 degrees projected just a decade ago.

So, why did the navel gazers get it so wrong this time around? A big part of it is that modelers grossly underestimated the scale of clean energy manufacturing in China which has helped drive down renewable energy costs. China's immense scale of clean energy manufacturing has fundamentally driven down global costs of renewable technologies through economies of scale and innovation, making clean energy the most affordable option in most markets worldwide.

As of 2024, China accounted for over 80% of global solar panel production across all key stages and produced around 60% of the world's wind turbines and battery cell manufacturing. China's current manufacturing capacity for solar panels and batteries is greater than the global demand, leading to a supply glut and intense price competition that further reduces costs globally.

Since 2010, the costs of solar PV, wind, and batteries have fallen by between 60% and 90%, a trend largely attributed to China's rapid increase in production volume. Not surprisingly, more than 90% of newly commissioned wind and solar facilities globally in 2024 were cheaper than the cheapest available form of fossil fuel generation.

While China’s clean energy manufacturing boom has been blamed for distorting the global markets, it’s proving to be good for the environment. The affordability of these technologies enables faster adoption, particularly in emerging markets in Africa, Asia, and Latin America, many of which are now leapfrogging traditional fossil fuel infrastructure. Clean energy goods exported from China in 2024 alone are estimated to cut importing countries' carbon emissions by 1% annually, with the cumulative lifetime emissions savings from these products reaching an estimated 4.0 GtCO2. Indeed, the IEA has forecast that global emissions will level off at 38 metric gigatons per year in 2040, significantly lower than the 46 metric gigatons it had projected in 2015. And, that’s if countries continue doing business as usual: the IEA says the figure could drop to just 33 metric gigatons per year if countries follow through on their pledges.

That said, a second Trump presidency is expected to significantly set back global climate goals, primarily by weakening U.S. domestic climate policy and disengaging from international climate efforts. President Trump has already re-submitted the US withdrawal from the Paris Agreement, which will formally take effect in 2026. This action removes the U.S., the world's second-largest emitter, from the primary global climate cooperation framework and could reduce global trust in U.S. commitments, potentially encouraging other climate-laggard nations to stymie their own efforts.

The administration has targeted key provisions of the Inflation Reduction Act (IRA), halting billions in clean energy tax credits and loans for wind and solar projects, and has also revoked an order setting a 50% electric vehicle target for 2030. Meanwhile, the U.S. is expected to cease or significantly reduce its contributions to international climate funds, such as the Climate Loss and Damage Fund, resulting in less financing available for developing economies to address climate change and adopt cleaner energy measures.

Overall, analysts predict that Trump's policies, which focus on maximizing oil and gas production and rolling back environmental regulations, could result in the U.S. emitting an additional 4 billion metric tons of carbon dioxide by 2030 compared to previous projections.

By Alex Kimani for Oilprice.com

Value of EV battery nickel second highest on record, cobalt at 30-month high

In 2016, Elon Musk famously said:

“Although [they’re] called lithium-ion, the actual percentage of lithium in a lithium-ion cell is approximately 2%. Technically, our cells should be called nickel-graphite, because the primary constituent in the cell as a whole is nickel. There’s a little bit of lithium in there, but it’s like the salt on the salad.”

In 2016, nickel cobalt manganese (NCM) and nickel cobalt aluminum or NCA, favoured by Tesla and its cell provider Panasonic dominated the market. Tesla’s Model S and Nissan’s Leaf were the bestselling EVs in the world at the time.

Lithium iron phosphate batteries (LFP) did have a place in the market then, but the chemistry’s inherent disadvantages – low energy density and therefore limited range – saw it confined to low-end urban runabouts and delivery vans.

On a battery capacity deployed basis – a better indicator of battery metal demand than unit sales alone – LFP’s share of the EV market actually fell from more than 20% in 2016 to less than 5% three years later. And that in a market, in GWh terms, which was larger by a factor of five.

LFP adoption only kicked into high gear in early 2020. The catalysts were BYD’s introduction of the so-called Blade prismatic battery pack and conversion of its entire model line-up to LFP, and Tesla starting shipments of entry level LFP models from its Shanghai factory (and now German plant).

Today, LFP is on its way to capture half the global total even though the market for the chemistry still skews to smaller and budget models. In China, which deploys more battery capacity than the rest of the world combined, LFP’s market share now sits at 70%, data from Toronto-based research consultants Adamas Intelligence shows.

Nickeliferous Europe and Americas

For suppliers to the industry, nickel and cobalt are enjoying a late charge, however. In North America and Europe, NCM – more specifically high-nickel packs with roughly 70% up to over 90% nickel content – predominate and LFP as a proportion of the market only recently broke through 10%.

High-nickel NCMA batteries, manufactured by Ultium Cells, a joint venture between General Motors and LG Energy Solution, are also beginning to impact the market. While only 6% of global EV battery nickel deployed so far in 2025 at 15kt, that’s up 120% year on year.

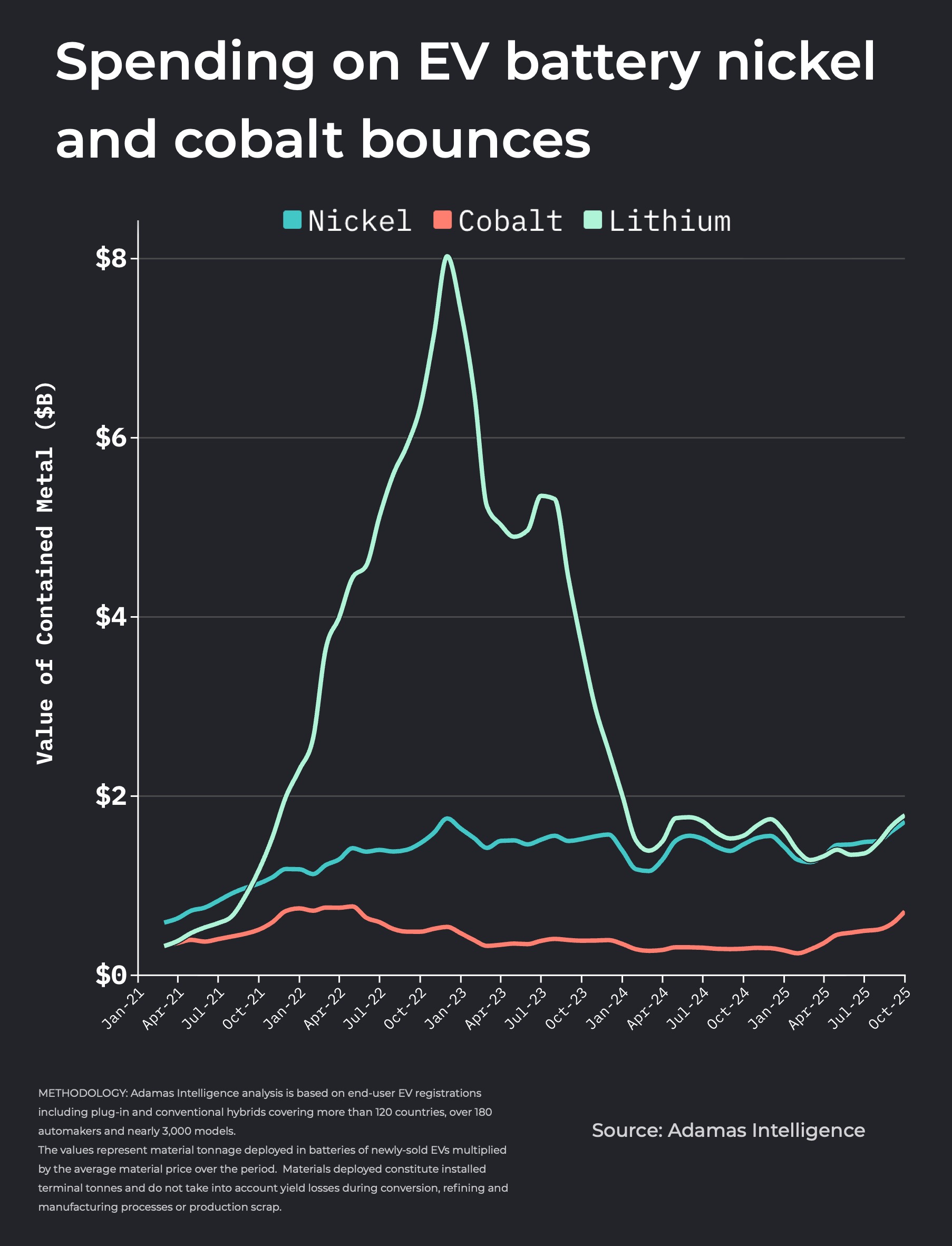

On a rolling 3-month basis spending on nickel to end-October was the second highest on record at $1.71 billion. The value of the contained nickel in the batteries of EVs sold during a three month period was only ever topped in the fourth quarter of 2022.

The EV battery nickel market’s much improved performance also comes at a time when nickel sulphate prices have been far from buoyant.

Nickel sulphate entering the Chinese EV supply chain averaged more than $18,000 a tonne in October (100% basis), the highest level since June 2024, but before the recent slump the metal spent more than three years north of $20,000 and closer to $30,000 over the course of 2022. Spending on nickel also outstripped that of lithium during a good portion of the second and third quarters.

Cobalt’s 2025 power surge

Compared to nickel, cobalt’s turnaround in fortune has almost everything to do with price.

In October, Congo, which is responsible for upwards of three-quarters of global output, began implementing a quota system to replace a ban announced in February. Allowed base volumes of 87,000 tonnes per year is around half total exports registered in 2024.

Cobalt consumption in EV batteries overtook other sources of demand like aerospace alloys several years ago and the downstream impact of the DRC’s supply strategy has been swift.

The price of cobalt sulphate entering the EV battery supply chain in China is now trading 335% higher than at the start of the year, averaging $11,932 tonne in October – which translates to a price of $58,200 on a 100% cobalt content basis. That remains far off the March 2022 peak of more than $90,000 per tonne, however.

Automakers continue to lighten their cobalt loadings with the metal being hit from both LFP’s rise and the ongoing trend towards high-nickel cathodes with less than 10% contained cobalt (and sometimes much less).

However, on a rolling 3-month basis spending on cobalt jumped to $712.6 million by end-October – the highest since the three months to end-May 2022. The value of the contained cobalt in EV batteries for the first ten months of the year is up to $4.4 billion, already well beyond that of the 2024 calendar year.

Cobalt prices would likely remain elevated and could rise further under the quota scheme put in place for 2026 and 2027 and will be further supported if the US government does begin to stockpile cobalt for the first time since 1990.

Late charge

The boom in value of both the nickel and cobalt battery market heading into 2025 is also thanks to a late surge in the US after EV buyers pulled ahead purchases before the expiry of retail incentives at the end of September.

Adding to the bounce is a European market in rude health.

The continent has now pulled ahead of Asia Pacific as the fastest growing EV market of 2025. Over the first three quarters of this year, Asia Pacific’s rate of expansion (+30% to 473.3 GWh) has now fallen behind that of Europe, the Middle East and Africa (+33% to 169.4 GWh).

In the Americas growth has slowed to 16% year on year hitting 116.3 GWh despite the third quarter sprint.

For a fuller analysis of the EV battery metals market check out the latest issue of The Northern Miner print and digital editions.

* Frik Els is Editor at Large for MINING.COM and Head of Adamas Inside, providing news and analysis based on Adamas Intelligence data.

No comments:

Post a Comment