Alberta has 1.6 billion barrels of remaining conventional oil reserves with 2004 production declining five per cent from 2003 levels to 224 million barrels per day. The EUB report also found an increase in marketable natural gas reserves with current levels at 40 trillion cubic feet or roughly an eight year supply. Alberta produced 4.9 trillion cubic feet in 2004.

Note well that Alberta's NON-RENEWABLE stocks of Oil and Gas are declining. This is where the Alberta bumper surplus comes from, however we still have the lowest royalty and tax rate on oil profits in the World. While our conventional supplies are in a serious decline. The reliance on the Oil Sands currently is one of an long term investment, oil factories are being built, which is creating a temporary job boom, and extraction processing is underway but it is not producing royalties or taxes yet. And probably won't for a decade.

The same can be said about the new kid on the block; Coal Bed Methane production of gas. It's being pushed due to our declining gas stocks, and it too is a gamble that can only pay off in the far future.

Coalbed gas production set to take off

AEUB predicts 25-fold increase by 2014

Gordon Jaremko

The Edmonton Journal

September 16, 2005

Canadian energy firms have extra motivation, on top of strong gas prices, to accelerate coalbed methane development, the board observed. Conventional gas reserves are poised to run down after almost 50 years of almost continuous production growth, due to depletion of aging wells.

The board forecasts Alberta's conventional gas production will remain flat at its recent annual level of about five trillion cubic feet in 2005 then decline at a rate of 2.5 per cent per year.

"CBM production is forecast to supplement the supply of conventional gas in the province," the AEUB said.

But with coal gas development still in its infancy, the board makes no attempt to predict whether coal gas will make up for all the forecast decline in conventional wells or even cause total production to resume growing.

Meahwhile the Tories deliberate underestimation of the cost of gas and oil has allowed them to avoid having any real budget plan based on a realistic estimation of the province's real earnings on the increase price of oil and gas.Energy windfalls may last decade

Gordon Jaremko

The Edmonton Journal

September 16, 2005

EDMONTON - Alberta's energy boom -- and consumers' pain at the gas pumps -- will last at least 10 years, a radically revised government forecast says.

Oil prices of $50 US per barrel and corresponding high values for natural gas are no temporary windfall, the Alberta Energy and Utilities Board said Thursday in a state-of-the-industry report.

The AEUB's 2005 reserves review double its '04 forecasts, predicting oil will average $55 to $60 a barrel this year and next, then take until 2009 to settle back down to $50 as consumers cut back and supply grows.

The board predicts $50 oil will last at least until the end of its current 10-year projection through 2014. Natural gas is expected to average $7.50 to $8 per gigajoule this year and next, then drop no lower than $7 for the rest of the forecast period.

Although the new AEUB expectations are higher than Alberta Finance's budget projections, the board outlook is within the price zones of industry forecasters, such as FirstEnergy Capital Corp. and Gilberg Laustsen Jung Associates.

But even annual average oil prices of $30 US per barrel and corresponding values for natural gas are high enough to sustain Alberta's oilsands development wave and current record drilling activity, the CERI economist said.

The AEUB echoes industry forecasts that oilsands production will double into a range of two million barrels daily over the next 10 years, while gas drilling continues at record levels and coalbed methane development accelerates.

Alberta Finance and Alberta Energy officials could not be reached to say whether provincial budget and savings policies should change to manage repeated huge annual energy revenue surpluses.

Instead they act like its Christmas every quarter, with that 'aw shucks I never expected to get that,' attitude. Which avoids the actuality of what those earnings are or could be planned and budgeted for.Leaving the rest of Canada wondering about just what the heck is going on in Alberta. And when the gas price at the pump rises, that what the heck becomes, what the hell lets nationalize. Which makes Calgary Oil Boys very jumpy, and Ralph responds in kind on their behalf.

'Conflict' looms over Alberta's oil wealth

Revenue sharing a potentially explosive campaign issue, survey results indicate

Asked, for example, whether provincial resources should belong to all Canadians or only to those living in the province where the resource is found, 76 per cent said they belong to all. Even in Alberta, 55 per cent of respondents said the resources belong to the country. And on the more general question of whether provinces should share royalty payments from resources, 42 per cent said at least part of the money should go to other Canadians. Forty-seven per cent of Albertans also felt this way.

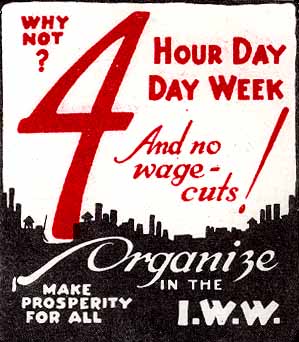

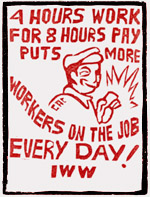

This is the reason we need Public ownership of Oil/Gas and the Oil/Gas industry under community and workers control as I blogged here.

The harmony, however, appears to break down when the more specific question on the oil windfall is asked. Mr. Gregg suggested that may be because leaders in Alberta tend to inflame rhetoric by arguing that the surplus belongs solely to the province. "Once you get a political exhortation, like Ralph Klein saying 'keep your hands off it,' I think that's when you get regional interest overarching the national interest," he said.

Alta. won't share energy windfall: Klein

Alta. won't share energy windfall: KleinCanadian Press

Friday, September 16, 2005

CALGARY -- Alberta Premier Ralph Klein says the rest of Canada can forget about getting an extra slice of the province's energy windfall.

"It's not in the cards," Klein told reporters Friday after a poll suggested Canadians outside the oil-rich province want to share the wealth being generated by soaring energy prices.

"When you have money, everyone wants some, including the rest of Canada," he said, adding that the current situation is no different than when Alberta was booming in 1980.

"The rest of Canada was saying the same thing: 'Give me, give me, give me,"' said the premier. "Then the price of oil went down and the rest of Canada was wringing their hands in glee saying, 'You deserved it."'

He noted the rest of Canada didn't send economic aid to Alberta when the oil boom collapsed and Alberta was thrown into economic turmoil.

While the rest of the country looks on Alberta's record surpluses with envy they are as much based on sin taxes; tobbacco and VLT's as they are on the royalties and taxes from oil and gas. And those taxes and royalties are on limited conventional reserves, which have around a decade of life left in them.

The Tar Sands are not yet at production levels to match the conventional reserves. The government is tossing the dice in the hopes that by the time the conventional reserves dry out they will be replaced with the equivalent in Tar Sands production.

Ralph and the oil boys have the high hopes of the Riverboat gambler.

Which is why Ralph plays the NEP card, because he knows that this province is gambling on living off declining resources while waiting for the Tar Sands to pay back their investment.

It's all a bit of slight of hand to avoid the real issue of the need to increase taxes and royalties on the current conventional reserves.

And Albertan's recognize that, they too support the public ownership of the oil and gas resources in Alberta. And if the royalties and taxes were at the level of Venezuala's for instance then Albertan's would be overwhelmingly in favour of sharing them.

Which is why the Tories have NOT changed the royalty/tax relief they gave Big Oil back after the last market crash in 1984 which coincided with the NEP.

Of course the 'rest of Canada' did not bail out Alberta when we crashed, because we had boomed during the crash in the rest of Canada, and we simply joined the declining economy of the day.

To put it into perspective, the oilsands are estimated to contain 174.1 billion barrels of bitumen reserves."The size of that reserve would put Canada in about second place in the world behind Saudi Arabia in terms of total oil reserves," said Curran."At current production rates, that's about 400 years of supply," he said. The forecast for bitumen production closely mirrors figures from the Canadian Energy Research Institute. CERI is forecasting production to be 2.5 million barrels per day by 2014 said global energy analyst Vincent Lauerman.

Tar Sands production is of bitumen, shale based oil, the production is not through conventional oil and gas extraction but costly factories that literarly dredge the tar sands of their oil. Its the largest open pit mining operation in the world. And those factories do not employ the same amount of workers as it takes to construct them. The current boom in Alberta is a 'construction boom' not an 'oil' boom! We have yet to have the production levels of extraction out of the Tar Sands that would match our conventional oil production!

"Despite improving technologies, costs (of production) are going up to turn this stuff into usable product," said Lauerman. "The cost is about $30 per barrel and a year before it was about $25 per barrel. The main thing that has changed that is driving this thing forward is light oil prices have increased quite a bit," he said. Higher natural gas prices and higher costs for labour has added to production costs said Lauerman. ........"Mostly because it's a mining operation more than anything else. There's not a lot in it in terms of finding and development costs - it's more on how much does it cost to build a factory," he said.

Teck Cominco pays $475 M for stake in oilsands project

VANCOUVER (CP) -- Teck Cominco Ltd. made a splash in the Alberta oilsands Tuesday with a $475-million deal for a 15 per cent stake in the Fort Hills Energy project owned by Petro-Canada and UTS Energy Corp. -- bringing with it a wealth of experience in open-pit mining.

It takes energy to make energy in the Tar Sands. Part of the cost is the use of water and steam extraction. For thirty years the Tories have tried to find a way to use Nuclear powered steam injection to get the oil out of the Tar Sands. Scary thought that.

Oil sands players eye nuclear option

Soaring price of natural gas has producers looking for an alternative

Tar Sands oil is energy intensive, hence capital intensive. It is NOT an economical production model unless oil prices are high, alot higher than they are even now. At $80 a barrel Tar Sands oil only becomes feasible due to its energy inputs cost.

Oil sands trigger race for diluent supply

EnCana secures imports of little-known commodity needed to dilute bitumen

Diluent is a mostly unknown commodity outside the oil business and had a low profile even in Alberta until last winter when the industry was slammed hard by severe shortage. Roughly one barrel of diluent is needed to move two barrels of bitumen through a pipeline, a significant cost, and high diluent prices actually made bitumen production briefly unprofitable. "It became clear that we were not just facing a long-term diluent shortage but we were already pretty much on the doorstep of one," Mr. Bird said.EnCana has not yet secured a supply of diluent but the company believes it can probably get it on the spot market from countries that export liquefied natural gas.Not all oil sands production requires diluent. EnCana drills for its bitumen. Others, like Suncor Energy Inc., mine bitumen and then upgrade the heavy oil into synthetic oil, which flows through a pipeline without problem.

The Alberta economy is a game of three card monty; time limited construction jobs created due to the building oil sands factories, reliance on limited reserves of conventional oil and gas while the Tar Sands comes into operation, wait for 25 years before the Tar Sands companies begin to pay back taxes and royalties.Don't believe little old left winger me, then here it is from the horses mouth:

Reality check needed

By NEIL WAUGH, EDMONTON SUN

The Alberta Energy and Utilities Board (EUB) issued its energy supply-and-demand outlook document last week.

"While non-renewable energy sources and more efficient energy use are increasingly contributing to lower the global demand," the EUB reported, "oil is still the dominant fuel."

As a result the board is upping its long-range price forecast from $28 to $50 US a barrel. Natural gas prices are expected to stay at $7.50 to $8 a gigajoule for the next two years.

That alone should sent Alberta royalties revenues through the roof.

Even though the EUB noted that natural gas production peaked in 2001.

But what's also of note - although scary might be a better word - is the radical shift from conventional oil produced from a pumpjack to synthetic crude manufactured by an oilsands plant.

"Last year synthetic crude oil production equalled light and medium crude oil production for the first time," the report said.

By 2014 it will make up 83% of Alberta's oil production. There's no doubt that oilsands plant construction is a massive engine for the Alberta and Canadian economies.

But it's happening under a royalty regime of a token 1% until the capital costs are fully paid out.

And with conventional oil and gas declining, Albertans could soon find themselves in a revenue squeeze.

Unlike the bubble in the 1980's this is a serious crisis in oil and gas stock and refining capacity. We are hitting the peak oil in reserves of conventional oil and the price will only go up. While good for Alberta in the short term, it will quickly become a burden as we wait for Tar Sands and Coal Bed Gas production to take up the slack. And we have only a decade.Focus: Oil

It is the great liberator that has changed the course of history. But it has brought misery as well as wealth, and the latest global convulsions triggered by this corrupting substance show how perilous is the world's dependence on it. By Adrian Hamilton

The end of the oil era is upon us. Soon oil output from conventional sources will peak. The strain will then have to be taken by other fuel sources and changes in demand. What we don't know is how high the price will have to go and how great the supply shocks will be before we get there; whether the market alone will effect a solution or whether governments will have to act to suppress demand and preserve supplies.Crude slips on forecasts of slowing global growth; Venezuela predicts higher prices

Canadian Press

September 16, 2005

Although crude oil prices are more than $6 US lower than the record of $70.85 US set Aug. 30, prices remain nearly 50 per cent higher compared to this time last year. Yet South America's biggest producer, Venezuela, warned that oil prices could reach $100 US a barrel because of the world's limited reserves. Venezuela - an OPEC member and South America's largest producer - said prices could rise to $100 US per barrel because members of the 11-country cartel are pumping at near capacity, Venezuelan President Hugo Chavez said Thursday. "OPEC is practically already at its production ceiling," Chavez told reporters at a UN summit in New York. "The problem is the oil reserves are running out," said Chavez, whose comments were carried by Venezuelan state television. "It is a true crisis." Venezuela is the world's fifth-largest oil exporter, a major fuel supplier to the United States and one of few countries with proven reserves. Rising demand, primarily from the United States and China, has been blamed for the tight supplies worldwide.