Low economic growth can help keep climate change within the 1.5°C threshold, says study

A new study shows that economic growth rates make a big difference when it comes to prospects for limiting global warming to 1.5°C, as per the Paris Agreement. A recent study by the Institute for Environmental Science and Technology of the Universitat Autònoma de Barcelona (ICTA-UAB) shows that pursuing higher economic growth may jeopardize the Paris goals and leave no viable pathways for humanity to stabilize the climate. On the contrary, slower growth rates make it more feasible to achieve the Paris goals.

The scientific study, published recently in the journal One Earth, was conducted in collaboration with researchers from the University of Barcelona, the University of Leeds, and the London School of Economics and Political Science (LSE), and led by Aljoša Slameršak, Giorgos Kallis, Daniel W. O'Neill, and Jason Hickel.

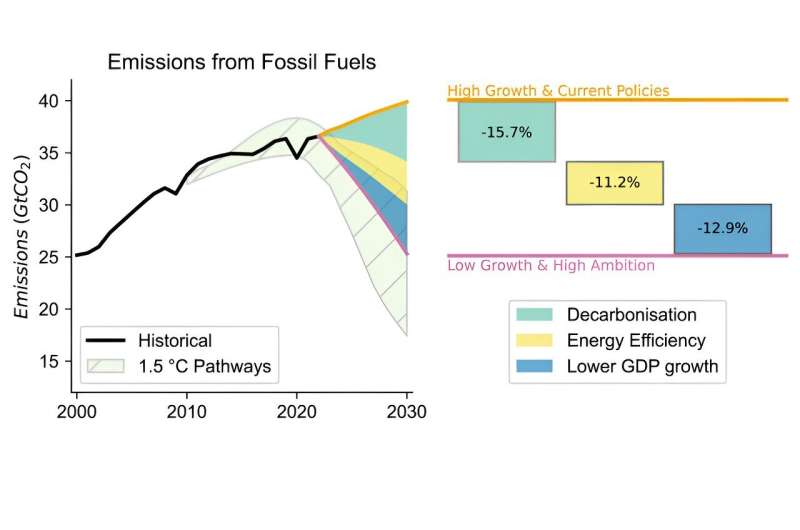

The article focuses on the period between 2023 and 2030, crucial for keeping the goals of the Paris Agreement alive and challenges the established assumption of high economic growth in existing scenarios of climate mitigation, since growth itself is a major driver of greenhouse gas emissions.

The study demonstrates that global economic growth of 4% per year, which is currently assumed in the mitigation scenarios, is incompatible with the goals of the Paris Agreement even if the most ambitious mitigation plans of any major country were implemented globally.

"To reduce global emissions fast enough to limit warming to 1.5°C, we find it is necessary to pursue ambitious mitigation and shift away from growth. Even with highly ambitious mitigation, global economic growth would need to fall below the recent historical trend of ⁓2% per year, with high-income economies transitioning to post-growth," says Aljoša Slameršak, ICTA-UAB researcher and lead author of the study.

Scenario analysis demonstrates that lower economic growth makes a notable difference in the reduction in CO2 emissions. "By comparing scenarios of low and high growth, we show that lower economic growth alone can reduce CO2 emissions by 10%–13% by 2030. By moving beyond the pursuit of economic growth in wealthy nations, we could substantially narrow the gap between the current trajectory of dangerously high emissions and the pathways that can keep us within a safe climate space," adds Daniel O'Neill from the University of Barcelona and University of Leeds.

The authors warn that their scenarios provide only a simple global analysis of the climate implications of economic growth. ICTA-UAB researcher Jason Hickel explains that "our scenarios do not account for important differences between higher and lower-income countries when it comes to mitigation responsibilities and development needs. A detailed analysis across these dimensions would mean lower-income nations could reach higher rates of economic growth, while high-income nations would need to pursue post-growth demand reduction strategies."

Hickel provides a brief outline of interventions that could pave the way to a post-growth scenario. The objective of post-growth is to prioritize production of what is important for human well-being and environmental sustainability, while reducing less-necessary forms of production and consumption. Key features of such a scenario are reduction of inequalities, universal access to necessary goods and services, and increased public investment for a low-carbon energy transition.

"Our study shows that pursuing growth constrains the possibilities of limiting dangerous climate change. This finding should encourage policymakers in high-income nations to abandon growth as an objective and consider post-growth policies to achieve improvements in well-being and ecology. In the next step of our work on post-growth scenarios, we aim to provide more clarity on how different economic sectors and activities contribute to emissions and social well-being. Doing so will allow us to identify what sectors and activities should be reduced or increased in order to achieve social and ecological goals," concludes ICTA-UAB researcher Giorgos Kallis.

More information: Aljoša Slameršak et al, Post-growth: A viable path to limiting global warming to 1.5°C, One Earth (2023). DOI: 10.1016/j.oneear.2023.11.004

Journal information: One Earth

Provided by Autonomous University of BarcelonaA low-carbon energy transition may result in substantial emissions