Joan Meiners, St. George Spectrum & Daily News

Fri, January 7, 2022

A white band of newly exposed rock is shown along the canyon walls at Lake Powell at Antelope Point Marina on Friday, July 30, 2021, near Page, Ariz. It highlights the difference between today's lake level and the lake's high-water mark. This summer, the water levels hit a historic low amid a climate change-fueled megadrought engulfing the U.S. West. (AP Photo/Rick Bowmer)More

The U.S. Bureau of Reclamation announced Friday that it plans to adjust management protocols for the Colorado River in early 2022 to reduce monthly releases from Lake Powell in an effort to keep the reservoir from dropping further below 2021's historic lows.

As of Thursday, the nation's second-largest reservoir — part of a Colorado River system that provides drinking water to approximately 40 million people throughout the West — sat at an elevation of 3,536 feet. That's 27% of the reservoir's capacity, 164 feet below full and just 11 feet above the bureau's target elevation of 3,525 feet, designed to give a 35-foot buffer before "dead pool." Below 3,490 feet of elevation, Lake Powell dips into a zone where the generation of hydropower by water flowing through the Glen Canyon Dam becomes unreliable.

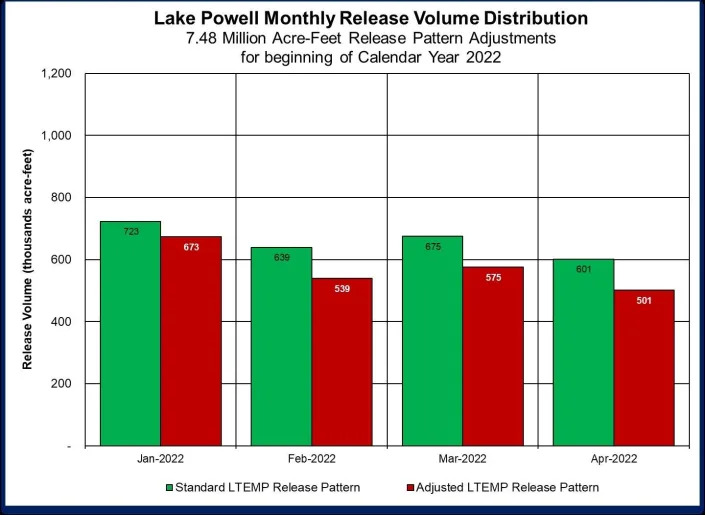

According to a bureau news release, the modified delivery schedule will not alter the total amount of water let through Glen Canyon Dam over the course of the year but will hold back a cumulative 350,000 acre-feet between January and April to help Lake Powell recover from lows that left many boat ramps unusable at the popular recreation site last summer.

Despite a wet October giving water managers hope that the region might make some progress towards recovery amidst a 22-year drought, this past November was the second-driest on record and inflows came up 1.5 million acre-feet short of the Bureau's projections from the previous month. When adjusted December projections anticipated Lake Powell dropping below 3,525 feet as soon as this February, the agency convened partners from the basin states, Tribes, federal agencies, non-governmental organizations and water managers to devise a new management scheme.

"The adjusted releases are designed to help protect critical elevations at Lake Powell until spring runoff materializes," the press release reads.

A graph shared by the U.S. Bureau of Reclamation on Jan. 7, 2022 depicts their new plan for reductions in scheduled releases of water from Lake Powell in an attempt to prevent the reservoir from falling below target levels.

Scientists, however, are not sure spring runoff will materialize. In the 22nd year of regional drought, the term "aridification" is gaining traction as the better way to describe what might be a long-term drying of the American West, influenced by climate change.

"We need to be extra vigilant and careful, because we do not know what lies ahead," said Jack Schmidt, director of Utah State University's Center for Colorado River Studies in response to Friday's announcement. "Looking into the future, none of us can know precisely what's going to happen this year. We have had times when we've looked great at the end of February, and then had an exceptionally dry March and the snowpack evaporated."

Schmidt was the senior author of a white paper published by a group of hydrologists last February that analyzed the future of Colorado River flows under various climate change and use scenarios. Their findings predicted that, given drying trends and a growing western population, projected basin-wide rates of water consumption could result in Lake Mead or Lake Powell running dry as soon as 2050, halting hydropower operations and negatively impacting the Grand Canyon ecosystem.

The Water Tap: Climate change and climate denial on the Colorado River

“The big take-home point is that, under the conditions of future drought or progressively decreasing runoff associated with a warming climate, the system tanks, the system is not sustainable," Schmidt explained at the time.

Figure ES-4 from the summary of the Center for Colorado River Studies' White Paper 6 (2021) shows how the combined water storage in Lakes Powell and Mead would decline under management paradigms that imposed various cuts (colored bands) compared to continuing on the current path (red line).

Wayne Pullan, regional director of the bureau's Upper Colorado Basin, agreed Friday that there is uncertainty in the system.

“Although the basin had substantial snowstorms in December, we don’t know what lies ahead and must do all we can now to protect Lake Powell’s elevation,” Pullan said in the press release.

In response to this, the agency plans to continue to monitor the basin’s hydrology and may make further adjustments to protect Lake Powell’s elevation. These could include sending additional water downstream to the reservoir from Colorado River Storage Project units at Flaming Gorge, Blue Mesa and Navajo reservoirs. Bureau officials will also continue to work with Upper Basin states on a Drought Response Operations Plan, due out in April 2022.

A deeper look: The Water Tap: Remembering a year of water, or lack thereof

Schmidt, meanwhile, sees three shades of a silver lining to Friday's doomsday-seeming announcement from the Bureau.

First, his team in February concluded that estimates of future consumptive use calculated by the Upper Colorado River Commission may be overinflated, giving the seven states that rely on this supply some additional wiggle room. If the western states learn to better live within their water means, their populations can grow without tanking the Colorado River system, they argue.

The second point, towards this end and also outlined in the February white paper, is that opportunities to stretch the supply further by improving water conservation efforts still abound. This is an argument often made by environmental groups critical of per capita water use rates in Utah's Washington County which, by many measures, far exceed those in other similar desert communities.

While Washington County officials push for a $2 billion, 140-mile pipeline project to transport water from Lake Powell to St. George, activists argue that the area first needs to consider conservation measures like turf removal and increased water rates. Cuts to Colorado River apportionments for Lower Basin states in 2022 that were announced by the Bureau in August caused some to speculate that "St. George is not going to get their pipeline." This latest announcement underscoring Lake Powell's limitations might further strain this project's prospects and finally push southwest Utah towards conservation.

"St. George is not going to get their pipeline": Some look to Utah amid Colorado River cuts

Schmidt's third note of positivity in reaction to Friday's announcement from the Bureau is that the modified release schedule for Lake Powell actually better mirrors the natural flows of the Colorado River. Ecologists are often critical of the impact dams have on riparian environments. If we're dealing with a situation of diminished overall flows, Schmidt says, it makes sense for artificial releases to be especially reduced in winter months when the river is lowest in its natural state.

“January is traditionally a high volume month used to produce hydropower. It is, to be honest with you, an unnaturally high release. So to withhold water in January, February and March is simply to make the river somewhat more natural because nature used to have low flows in those months," said Schmidt. "So I have no problem with that whatsoever. It makes perfect sense from a natural resource standpoint and it’s even a good thing for the environment."

Joan Meiners is the Environment Reporter for The Spectrum & Daily News through the Report for America initiative by The Ground Truth Project. Support her work by donating to these non-profit programs today. Follow Joan on Twitter at @beecycles or email her at jmeiners@thespectrum.com.

This article originally appeared on St. George Spectrum & Daily News: Feds to slow releases from Lake Powell at Glen Canyon Dam amid drought