Find blog posts, photos, events and more off-site about:

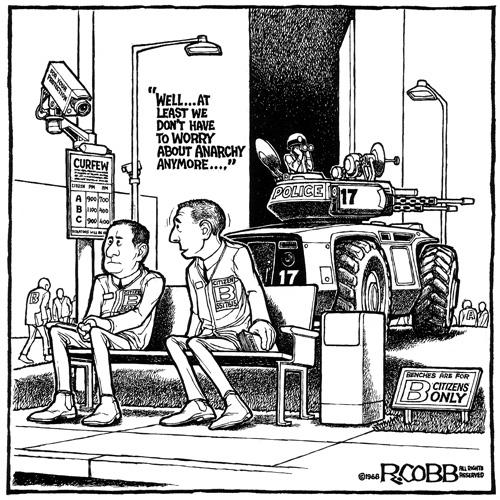

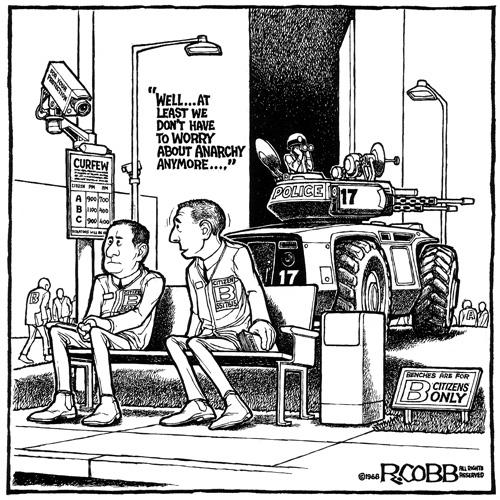

comic, cartoon, R.Cobb, anarchy, underground comics,

It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Find blog posts, photos, events and more off-site about:

carnival of anarchy, anarchy, anarchists, blogs, blogging, weblogs, bloggers, libertarian, libertarian s ocialism, left libertarians, mutualists, individualism, individualists,

Canada's three-largest pension fund managers, unable to meet the long-term needs of retirees with returns from stocks and bonds, plan to increase private-equity investments after spending about C$50 billion ($47 billion) buying companies, toll roads and gas pipelines.

The pension funds added C$31.7 billion to private equity holdings in their most recent fiscal year, almost double the amount of the previous 12 months. The retirement plans are buying riskier assets because they don't expect publicly traded securities to provide high enough returns to pay the more than C$1.56 trillion of benefits owed to retirees over the next 50 years, according to annual reports from the pension funds.

The ability of workers to control, or even to influence, the investment of their deferred wages in pension funds — which are now by far the nation’s largest source of capital — is an old but recurring debate. Unions played a leading role in the creation and expansion of private pension trusts, particularly the traditional defined-benefit plans that are funded almost entirely by employer contributions.4 Yet because control over how pension assets would be invested was

never made a bargaining priority, today at least 90 percent of private sector pension fund assets are controlled exclusively by management.Since the Second World War a number of factors have led to increased investment by institutional investors in public corporations. There has been the use of superannuation and pension schemes. There has been an increase in insurance linked investment products and other forms of indirect investment. Trustee investment rules have been relaxed, enabling trustees to invest in equities

The result is that in Australia, New Zealand, the USA and the UK more than 50% of all equities are held by institutional investors and the tendency is to increase. Add to this the traditional domination by institutions of the bond market and we have the beginning of the growth of a significant counterveiling power if the economic strength is harnessed to a common cause. Listed corporations are becoming the servants of global financial activity rather than its masters.

Peter Drucker argued that this led to a quiet revolution – ‘The Unseen Revolution...The US is the first truly Socialist country."This was simply reflecting what Berle in his later workings had identified and his research student Paul Harbrecht had called ‘The Paraproprietal Society’ – the evolution of a new form of property.

Until the late 1980s the tendency of the institutions was to be a sleeping giant. There were instances of discrete intervention but by and large the institutions voted with their feet and followed the Wall Street Walk – if in doubt, sell.

Institutions themselves came under attack and we see two developments. First, the involvement by them in promotion of improved corporate governance and secondly the use of specialist funds managers. The latter makes it more unlikely for institutions to become activists in particular companies although there have been exceptional cases where a group of funds managers have taken action.

Institutions are primarily focussed on profit and liquidity and have been attacked for short termism in their approach to companies. There is also a problem of lack of coincidence between the interests of institutions and other smaller shareholders in takeover situations. Often institutions collectively have strategically significant holdings.

Institutions sometimes encounter legal problems in increased shareholder activism.

It is sometimes argued that public sector pension funds are more likely to take a long term strategic view and certainly the US and the UK public sector funds have had a tendency at least to mouth the appropriate rhetoric.

Peruvian prehistoric penguins were taller than Danny DeVito

Danny DeVito is 4'11" tall. These penguins topped out at 5 feet, and lived during a particularly sweltering time in Earth's history. 36 million years ago Icadyptes salasi plied the waters off the southern coast of Peru.

A prehistoric penguin has been uncovered that - at more than 5ft tall and with a spear-like 7in beak - is the mother of all penguins.

A giant I salasi skull compared to Peru’s modern Humboldt penguin The giant birds lived around the equator tens of millions of years earlier than expected and during a period when the earth was much warmer than it is now.

Researchers discovered their fossilised remains in Peru.

Evidence that the giant penguins once marched to South America was found by Dr Julia Clarke of North Carolina State University.

"We tend to think of penguins as being cold-adapted species, but the new fossils date back to one of the warmest periods in the last 65 million years," Dr Clarke said. "The evidence indicates that penguins reached low-latitude regions more than 30 million years prior to our previous estimates."

See: