AN EARTHQUAKE has struck in the ocean between Jamaica and Cuba at a huge magnitude of-7.7, and has triggered a tsunami warning.

But where exactly did the quake strike? Here are the latest maps.

By GEORGINA LAUD

PUBLISHED: 20:00, Tue, Jan 28, 2020

A powerful earthquake of magnitude-7.7 struck south of Cuba on Tuesday. The quake has triggered a tsunami waves warning for Cuba, Jamaica and the Cayman Islands, according to the US Geological Survey (USGS) and the International Tsunami Information Center.

By GEORGINA LAUD

PUBLISHED: 20:00, Tue, Jan 28, 2020

A powerful earthquake of magnitude-7.7 struck south of Cuba on Tuesday. The quake has triggered a tsunami waves warning for Cuba, Jamaica and the Cayman Islands, according to the US Geological Survey (USGS) and the International Tsunami Information Center.

Jamaica earthquake: Major 7.7 magnitude quake shakes region

Jamaica earthquake: Is there a tsunami warning? Is Jamaica on alert?

Where did HUGE 7.7 quake hit?

The massive earthquake was initially reported as a magnitude-7.3 before being upgraded to a magnitude-7.7

The epicentre was in the sea between Jamaica, the Cayman Islands and Cuba, at a shallow depth of 6.2 miles (10 km).

According to the USGS the earthquake struck in the ocean 77 miles (125km) north-northwest of Lucea, Jamaica.

Red More: Jamaica earthquake: WATCH Miami buildings shake as residents evacuated

Where did HUGE 7.7 quake hit?

The massive earthquake was initially reported as a magnitude-7.3 before being upgraded to a magnitude-7.7

The epicentre was in the sea between Jamaica, the Cayman Islands and Cuba, at a shallow depth of 6.2 miles (10 km).

According to the USGS the earthquake struck in the ocean 77 miles (125km) north-northwest of Lucea, Jamaica.

Red More: Jamaica earthquake: WATCH Miami buildings shake as residents evacuated

Jamaica earthquake: A huge magnitude-7.7 quake has shaken Jamaica (Image: USGS)

It was centred 86 miles (139km) north-west of Montego Bay, Jamaica, and 87 miles (140km) west-southwest of Niquero, Cuba.

It hit at 2.10pm local time (7.10pm GMT) and now the Cayman Islands disaster management agency has warned residents in coastal and low-lying areas to “evacuate vertically” as a precaution following the quake.

A statement from the International Tsunami Information Center said: "Hazardous tsunami waves from this earthquake are possible within 300 km (186 miles) of the epicentre along the coasts of Jamaica... Cayman Islands and Cuba."

The Center later added: "Hazardous tsunami waves are forecast for some coasts".

It was centred 86 miles (139km) north-west of Montego Bay, Jamaica, and 87 miles (140km) west-southwest of Niquero, Cuba.

It hit at 2.10pm local time (7.10pm GMT) and now the Cayman Islands disaster management agency has warned residents in coastal and low-lying areas to “evacuate vertically” as a precaution following the quake.

A statement from the International Tsunami Information Center said: "Hazardous tsunami waves from this earthquake are possible within 300 km (186 miles) of the epicentre along the coasts of Jamaica... Cayman Islands and Cuba."

The Center later added: "Hazardous tsunami waves are forecast for some coasts".

Jamaica earthquake today: A tsunami warning is in place for several countries (Image: TWITTER) Jamaica: Earthquake creates HUGE holes in road

A tsunami warning of up to three feet has been issued for Belize, Cuba, Honduras, Mexico, Cayman Islands and Jamaica.

Dr Enrique Arango Arias, head of Cuba's National Seismological Service, told state media that there had been no serious damage or injuries reported.

The quake could be felt strongly in Santiago, the largest far-eastern Cuban city, according to those in the area.

Belkis Guerrero who works in a Catholic cultural centre in Santiago said: "We were all sitting and we felt the chairs move.

Jamaica earthquake: Ground opens up in Cayman Islands [VIDEO]

WATCH as a terrifying 6.7 magnitude earthquake rocks Turkey [VIDEO]

RELATED ARTICLES

A tsunami warning of up to three feet has been issued for Belize, Cuba, Honduras, Mexico, Cayman Islands and Jamaica.

Dr Enrique Arango Arias, head of Cuba's National Seismological Service, told state media that there had been no serious damage or injuries reported.

The quake could be felt strongly in Santiago, the largest far-eastern Cuban city, according to those in the area.

Belkis Guerrero who works in a Catholic cultural centre in Santiago said: "We were all sitting and we felt the chairs move.

Jamaica earthquake: Ground opens up in Cayman Islands [VIDEO]

WATCH as a terrifying 6.7 magnitude earthquake rocks Turkey [VIDEO]

RELATED ARTICLES

Stockton earthquake MAP: Where did earthquake strike in UK today?

Earthquakes: Turkey, Peru and Papua New Guinea rocked by HUGE quakes

Earthquakes today: Alaska, Russia and Indonesia ROCKED by earthquakes

"We heard the noise of everything moving around."

Ms Guerrero said there was no apparent damage in the heart of the colonial city.

She added: "It felt very strong but it doesn't look like anything happened."

The quake was not strongly felt in the Cuban capital of Havana or in Kingston, Jamaica, according to witnesses.

"We heard the noise of everything moving around."

Ms Guerrero said there was no apparent damage in the heart of the colonial city.

She added: "It felt very strong but it doesn't look like anything happened."

The quake was not strongly felt in the Cuban capital of Havana or in Kingston, Jamaica, according to witnesses.

Jamaica earthquake today: Workers wait outside buildings in Miami after the quake struck (Image: GETTY)

Meanwhile, Mikhail Campbell, a police media relations officer in the Cayman Islands, said he was not immediately aware of any reports of serious damage.

The earthquake was also felt a little farther east at the US Navy base at Guantanamo Bay, Cuba, on the south-eastern coast of the island.

Several South Florida buildings were evacuated as a precaution, according to city of Miami and Miami-Dade County officials.

The quake also hit the Cayman Islands, leaving cracked roads and what appeared to be sewage spilling from cracked mains.

There have been reported aftershocks close to the Cayman Islands, the largest of which was recorded as measuring magnitude-6.5.

Claude Diedrick, 71, who owns a fencing business in Montego Bay, said he was sitting in his vehicle reading when the earth began to sway.

He said: "It felt to me like I was on a bridge and like there were two or three heavy trucks and the bridge was rocking but there were no trucks."

Mr Diedrick said he had seen no damage around his home in northern Jamaica.

Large undersea earthquake strikes in the Caribbean

The epicenter was located south of Cuba and northwest of Jamaica, prompting initial fears of a tsunami, though those concerns have since passed. The tremors peaked at a strength of 7.7, the US Geological Survey recorded.

A powerful magnitude 7.7 earthquake struck in the Caribbean Sea between Jamaica and Cuba on Tuesday, causing tremors from Mexico to Florida. However, there were no casualties were reported.

The quake's epicenter was 117 kilometers (73 miles) northwest of Jamaica's town of Lucea and just south of Cuba, and had a depth of 10 kilometers, according to the US Geological Survey.

The quake was felt across much of the island of Jamaica, lasting for several seconds, the Kingston-based Jamaica Observer newspaper reported.

People gather outside after evacuating buildings in Miami, Florida

In Cuba's capital Havana, residents were evacuated out of buildings when the city was rattled by the quake (pictured), which was also felt in Guantanamo, Santiago de Cuba and Cienfuegos.

It was not immediately clear if the earthquake caused any damage or injuries. The International Tsunami Information Center (ITC) issued an initial warning, though this was later lifted.

"The tsunami threat has now largely passed," the ITC said.

Meanwhile, the US Pacific Tsunami Warning Center said that based on all available data, waves reaching 0.3 to 1 meter above the tide level were possible for portions of Belize, Cuba, Honduras, Mexico, the Cayman Islands and Jamaica.

A hole appeared caused by the earthquake at Public Beach on West Bay, Grand Cayman

Indeed, the Cayman Islands recorded an aftershock of magnitude 6.5 as a result of the quake that left cracked roads and what appeared to be sewage spilling from damaged mains.

Meanwhile, Mikhail Campbell, a police media relations officer in the Cayman Islands, said he was not immediately aware of any reports of serious damage.

The earthquake was also felt a little farther east at the US Navy base at Guantanamo Bay, Cuba, on the south-eastern coast of the island.

Several South Florida buildings were evacuated as a precaution, according to city of Miami and Miami-Dade County officials.

The quake also hit the Cayman Islands, leaving cracked roads and what appeared to be sewage spilling from cracked mains.

There have been reported aftershocks close to the Cayman Islands, the largest of which was recorded as measuring magnitude-6.5.

Claude Diedrick, 71, who owns a fencing business in Montego Bay, said he was sitting in his vehicle reading when the earth began to sway.

He said: "It felt to me like I was on a bridge and like there were two or three heavy trucks and the bridge was rocking but there were no trucks."

Mr Diedrick said he had seen no damage around his home in northern Jamaica.

Large undersea earthquake strikes in the Caribbean

The epicenter was located south of Cuba and northwest of Jamaica, prompting initial fears of a tsunami, though those concerns have since passed. The tremors peaked at a strength of 7.7, the US Geological Survey recorded.

A powerful magnitude 7.7 earthquake struck in the Caribbean Sea between Jamaica and Cuba on Tuesday, causing tremors from Mexico to Florida. However, there were no casualties were reported.

The quake's epicenter was 117 kilometers (73 miles) northwest of Jamaica's town of Lucea and just south of Cuba, and had a depth of 10 kilometers, according to the US Geological Survey.

The quake was felt across much of the island of Jamaica, lasting for several seconds, the Kingston-based Jamaica Observer newspaper reported.

People gather outside after evacuating buildings in Miami, Florida

In Cuba's capital Havana, residents were evacuated out of buildings when the city was rattled by the quake (pictured), which was also felt in Guantanamo, Santiago de Cuba and Cienfuegos.

It was not immediately clear if the earthquake caused any damage or injuries. The International Tsunami Information Center (ITC) issued an initial warning, though this was later lifted.

"The tsunami threat has now largely passed," the ITC said.

Meanwhile, the US Pacific Tsunami Warning Center said that based on all available data, waves reaching 0.3 to 1 meter above the tide level were possible for portions of Belize, Cuba, Honduras, Mexico, the Cayman Islands and Jamaica.

A hole appeared caused by the earthquake at Public Beach on West Bay, Grand Cayman

Indeed, the Cayman Islands recorded an aftershock of magnitude 6.5 as a result of the quake that left cracked roads and what appeared to be sewage spilling from damaged mains.

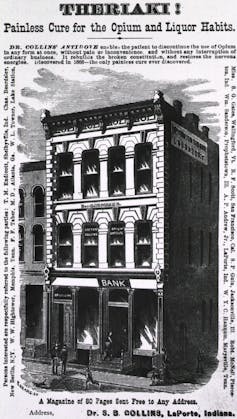

Advertisement for Theriaki, a painless cure for the opium habit. Exterior view of Dr. Collins’ Opium Antidote Laboratory, LaPorte, Indiana. National Library of Medicine

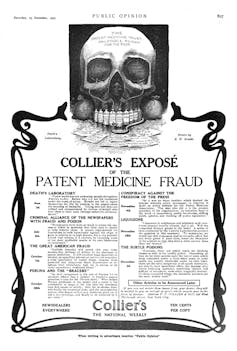

Advertisement for Theriaki, a painless cure for the opium habit. Exterior view of Dr. Collins’ Opium Antidote Laboratory, LaPorte, Indiana. National Library of Medicine Collier’s ad, Dec., 1905, after the publication of articles on patent medicine fraud. Wikimedia Commons

Collier’s ad, Dec., 1905, after the publication of articles on patent medicine fraud. Wikimedia Commons