Cecilia Jamasmie | April 22, 2022

Chile’s constitutional drafters have sent back to the drawing board dozens of articles regarding mining, water and environmental rights. (Image courtesy of Chile’s constitutional convention.)

Chile’s constitutional assembly has rejected a proposal from the environmental committee seeking to tighten up rules related to the protection of the country’s natural resources, which would have hit the mining sector if they became law.

Among the changes suggested, there was one granting nature the status of a legal subject with rights, keeping environmental crimes free of any statutes of limitations and extend protections of water sources, glaciers, wetlands and native forest.

The articles had already been toned down amid criticism from miners and analysts concerned about radical proposals such as nationalizing key assets.

Constituents rejected the 52 articles presented by five votes, preventing voting on individual items and returned the entire proposal to the environmental committee for further revision. To make it into the new constitution, each article needs to receive at least 103 out of the 154 possible votes.

This is the second time the committee’s report has been sent back to the drawing board, as the first presentation saw only six of 40 articles approved

Among the approved items there was one that makes it compulsory for the state to deal with a the current climate and ecological crisis and one that grants nature the status of a legal subject with rights, including acknowledging the rights of all animals to be protected from abuses.

“We interpret the vote as a signal in the sense that, in addition to raising environmental standards, it is necessary that there are regulations that provide certainty and stability for the development of mining activity,” Chile’s mining council executive president Joaquín Villarino said in a statement.

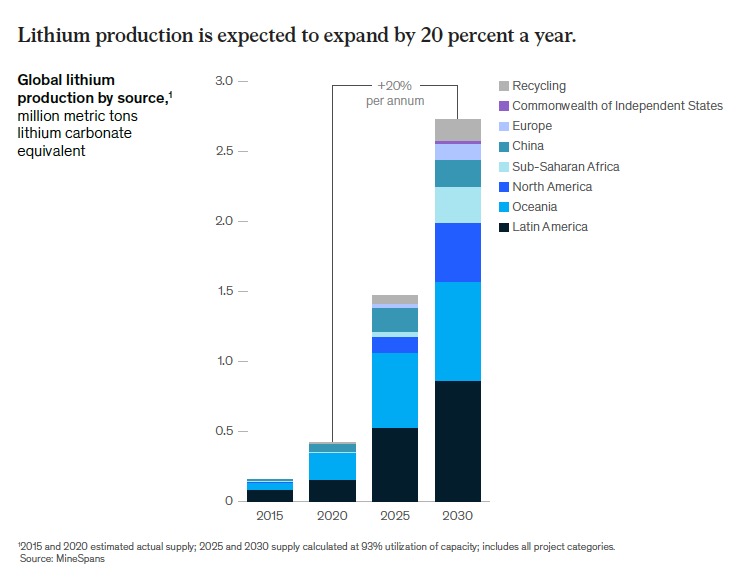

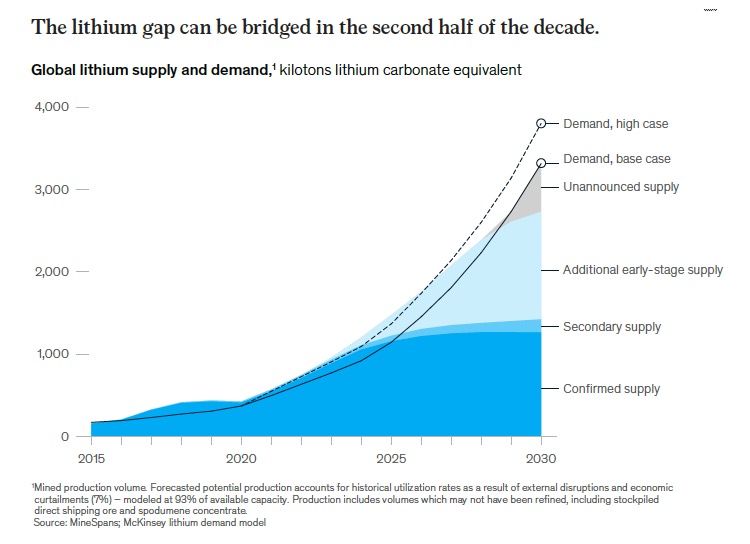

Mining has historically been one of the country’s most important economic sectors, with copper representing the lion’s share of the sector’s contribution to gross domestic product. The country also hosts the world’s largest known lithium reserves.

Any major changes affecting the sector could dramatically impact the supply of minerals that are critical for the world’s industrialization and energy transition, the mining sector has warned.

The assembly has until mid-May to approve articles for the draft constitution and until July to have the draft fully completed. Chileans will vote to approve or reject the new constitution on Sept. 4.