When it comes to energy bets, Tajikistan is all-in on hydropower.

Having spent much of the last decade and several billion dollars building the Roghun "megadam," the project is clearly too big to fail from the point of view of Tajikistan's leadership.

But amid spiraling costs and long-standing questions about the environmental and human impacts, its critics contend that Roghun is also too big to be sustainable.

Tajikistan is not alone in eying Roghun's potential 3,600 megawatts of installed capacity.

While millions of Tajiks continue to live without power or have it for just a few hours per day, especially in the colder months, Roghun is an important piece of the energy-security puzzle in Tajikistan's electricity-strapped neighborhood, with Uzbekistan, Afghanistan, and Pakistan all potential customers.

So there is a lot at stake.

And that is without considering whether large-scale hydropower is a wise direction for a region where climate change is set to continue the erosion of river-feeding glaciers.

But while some of Tajikistan's Central Asian neighbors are already diverting resources to smaller solar and wind projects to plug their deficits, megadams new and old are still the order of the day for Dushanbe.

Supply Outrunning Demand

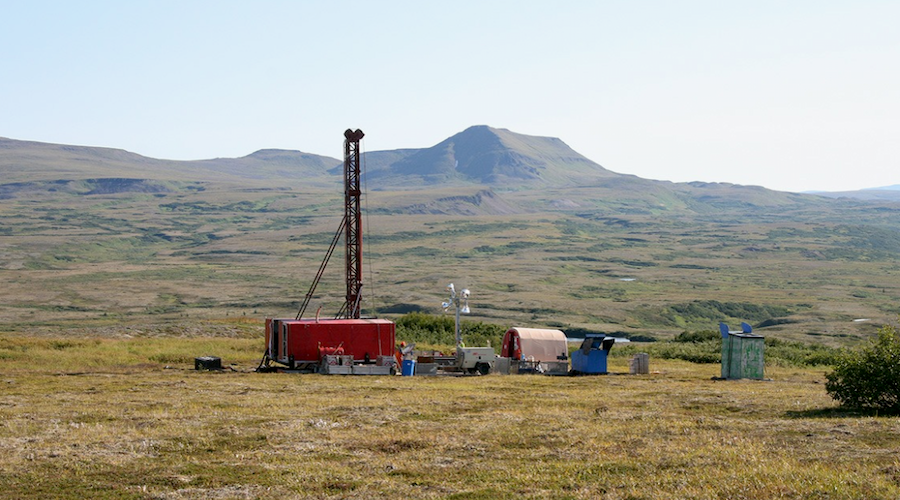

On March 9, a delegation from the board of executive directors at the World Bank Group wrapped up a regional tour of Central Asia that included talks in Tajikistan with Roghun's ultimate champion, President Emomali Rahmon, as well as a trip to the dam's partly operational hydropower plant (HPP).

The group's press release gave little in terms of the details of the talks, but they included "a particular focus on climate change within the prism of the water-energy nexus."

The visit came on the back of both negative and positive developments for Tajikistan's power sector.

The negative was a massive and as-yet-unexplained power outage that plunged the vast majority of the country, including the capital, Dushanbe, into darkness for several hours on March 1.

Local media outlet Asia-Plus cited a source that attributed the outage to an "accident" at the Norak HPP that currently supplies around half of Tajikistan's power.

Another outlet, Dushanbe TV, cited a source claiming a "technical accident on the main republican high-voltage lines."

State power company Barki Tojik did not provide RFE/RL's Tajik Service with a comment.

Just days later, on March 4, Deputy Energy and Water Minister Sorbon Kholmuhammadzoda was dismissed. A government decree said he would assume a new post, although it is unclear what that will be.

More encouraging was news issued by the World Bank last month, and confirmed by the Taliban last week, that the all-important Afghan leg of CASA-1000 -- a four-country regional power project in which Tajikistan is expected to play the role of top provider -- is back on track.

CASA-1000 had been de facto suspended since the Taliban's return to power in Afghanistan in 2021, but the World Bank announced it would move forward with financing pylons and other infrastructure in the Afghan section "in a ring-fenced manner" to ensure distance from the radical government that is yet to gain international recognition.

When CASA-1000 eventually becomes reality, Tajikistan should transmit 70 percent of an approximately 1.3 gigawatts of electricity to the power-starved Afghan and Pakistani grids, with Kyrgyzstan due to receive the remainder.

But the power-transportation infrastructure is of little use if Tajikistan doesn't have the spare energy.

With colder-than-usual temperatures recently hitting Central Asia in the final lap of winter, Tajikistan's annual but now worsening power shortages have had some tragic consequences.

In recent weeks, RFE/RL's Tajik Service has reported multiple carbon-monoxide deaths, including of children, as rural families load up their stoves to get through the freezing nights.

And if reports of the Dushanbe blackout being connected to an accident at the Soviet-era Norak HPP are true, that means progress at Roghun -- where only two of six 600-megawatt units are currently online -- cannot come fast enough.

Bulldozing On

In December, Rahmon said he expected the third unit of Roghun to come online in 2025.

His personal attachment to the project is clear. In 2016, when construction began, he clambered into a bulldozer to move earth around the site in a grandiose ground-laying ceremony. Some political subordinates of the long-serving leader have even called for the HPP to take his name.

At the time of its ground-laying, the government's estimate for the total cost was just under $4 billion. Following a long construction delay during the coronavirus pandemic, the most recent government estimate put the project's total cost at $6 billion.

The Italian-based company Webuild (formerly Salini Impregilo) is the project's principal contractor. But there is no clear path to financing the final stages of a facility that Dushanbe wants to be the tallest of its kind in the world at 335 meters.

Norak, which is 300 meters high, once held this honor but was displaced from the top more than a decade ago by China's Jinping-I dam, which has a height of 305 meters.

Roghun has thus far been financed with a combination of state budget funds and borrowed money. The former have been disproportionately large for Central Asia's poorest country, reportedly outweighing all other infrastructural spending.

The latter has included a $500 million, 7.1 percent-yield eurobond issued in 2017, the success of which Reuters hailed as "the latest indication of the undiminished thirst for high-yield debt, even from frontier markets -- so-called because of their poverty and rock-bottom credit scores."

Tajikistan is clearly hoping that international institutions will pick up the rest of the tab.

In a release this month, a group of 17 environment- and government-focused nonprofit organizations -- including the Prague-headquartered watchdog CEE Bankwatch Network -- called on the World Bank, the Asian Infrastructure Investment Bank, and the European Investment Bank to "reconsider" an apparent collective-funding pledge of up to $600 million to support Roghun, branding the project's current Environmental and Social Impact Assessment unfit for its purpose.

The coalition had in February referred to Roghun as "a sad reminder of the Soviet ideology of exerting total control over nature," while pointing out that at least 46,000 people would have to be displaced for a dam that it said might not reach full operational capacity until 2040.

"The development of the [Roghun] HPP project on the Vakhsh River is of great concern due to its enormous associated social and environmental risks, not only to Tajikistan but to the region as a whole," the organizations wrote.

One important former Roghun critic has in recent years become a cautious supporter.

That is partly because Tajikistan's downstream neighbor Uzbekistan -- a water-stressed country of around 35 million people -- has prioritized better regional relations under President Shavkat Mirziyoev than did his late, hard-line predecessor, Islam Karimov.

But it is also because Uzbekistan is increasingly unsure which it needs more -- water or electricity -- with deliveries from Tajikistan potentially easing one of those problems.

Tajikistan, for its part, has begun talking up other "green technologies" to plug its deficits.

But in comparison to the region's renewable pacesetters, Uzbekistan and Kazakhstan -- which are also mulling nuclear power -- this appears to currently be little more than an idea.

At the Effective Energy In Tajikistan conference in Dushanbe in October, Tajik officials said solar and wind energy could contribute up to 70 megawatts to Tajikistan's energy mix by 2030.

But then-Deputy Energy and Water Minister Kholmuhammadzoda was clear what the government's priority was. "In the next seven years, energy [production] capacity in Tajikistan will increase by an additional 4,000 megawatts of electricity due to the commissioning of the Roghun hydroelectric power station and the reconstruction of other hydroelectric power stations, such as Norak, Sarband and Kairakkum," he said.

So it's hydro or bust. Or perhaps, "hydro and bust."

By RFEE/RL