Bloomberg News | April 22, 2022 |

Rough diamonds on a grader’s table. (Image courtesy of Alrosa.)

Russia’s luxury goods industry is the latest to be targeted under new UK sanctions announced on Thursday, with the government slapping import bans on caviar and other high-end wares.

Silver and wood products from Russia will also be prohibited and tariffs will be increased by 35 percentage points on 130 million pounds ($170 million) worth of diamonds and other products, including some from Belarus, according to a government statement. That takes the total value of Russian goods affected to more than one billion pounds.

The UK’s measures are intended “to inflict maximum damage” to Russian President Vladimir Putin’s regime, “reducing the resources and funds he needs to carry out this illegal war,” International Trade Secretary Anne-Marie Trevelyan said.

Britain has already imposed its broadest set of sanctions ever on Russia since the invasion of Ukraine in February, and Prime Minister Boris Johnson’s government is working with other Group of Seven nations and the European Union to coordinate regular sets of new sanctions and trade restrictions, while enforcing measures implemented so far.

(By Charles Capel)

The diamond world is scrambling to keep buying Russian gems

Bloomberg News | April 22, 2022

Image source: ALROSA- PEAR DIAMOND

US sanctions on Russia’s giant diamond miner are causing chaos through the industry, leaving traders and manufacturers hunting for workarounds to keep tapping one of the world’s main sources of precious gems.

Buyers across the big trading centers in Antwerp and Dubai and manufacturing hubs in India have spent the past two weeks consulting lawyers to determine what the US sanctions on Alrosa PJSC mean and how they can continue to buy, according to people familiar with the matter. In the meanwhile, diamonds have stopped flowing from Russian mines to Surat — the world’s diamond-cutting epicenter — because Indian banks are unable or unwilling to process payments.

A delegation from Alrosa visited India earlier this week and held meetings with customers and trade groups to discuss how to facilitate sales, people familiar with the matter said. The disruption is already being felt in diamond prices, as the cost of the smaller stones that Alrosa specializes in has started to rise in the past week.

Alrosa is effectively state controlled: the federal government owns 33% and another 25% is held by local authorities. Losing its supply over a longer period would be seismic for the diamond world — the company accounts for about a third of global supply of rough stones, about the same level as De Beers, which had a monopoly until the start of this century.

Alrosa was scheduled to hold its next sale this coming week — one of the 10 it holds each year — but it’s unlikely it’ll be able to sell any stones because banks are unable to process payments, according to the people.

Yet as western governments levy sanctions on Russia and companies pull away from the country, many in India’s diamond industry still want to keep buying, according to people familiar with the matter. And while big-name US jewelers Tiffany & Co. and Signet Jewelers Ltd. have said they will stop buying new diamonds mined in Russia, retailers in places like China, India and the Middle East have not followed suit.

Alrosa’s meetings in India this week included discussions on how to allow Indian manufacturers and traders to pay for Alrosa’s diamonds, the people said. While the discussions included paying in rubles or rupees, no firm arrangements were made. Any deal will need the support of the Indian government, which was not involved in the discussions.

Alrosa declined to comment.

For Alrosa, one option could be to sell its gems to the Russian government, as it did during the 2008 financial crisis. The Russian Finance Ministry declined to comment.

The disruptions around Russian diamonds are being felt through the global industry, which was already facing a shortage of rough stones even before the war in Ukraine. Rough diamond prices have surged in the past year as US consumers, by far the most important market, bought a record amount of jewelery. That created a boom for the companies that trade, cut and manufacture diamonds.

Rough-diamond prices began to weaken last month as inflation concerns started to hit consumer confidence. However, the prices for smaller stones are rising again now as the trade looks to secure supplies.

(By Thomas Biesheuvel)

World’s top diamond miner Alrosa hit by US sanctions

Cecilia Jamasmie | April 8, 2022

The US has increased sanctions on Alrosa.

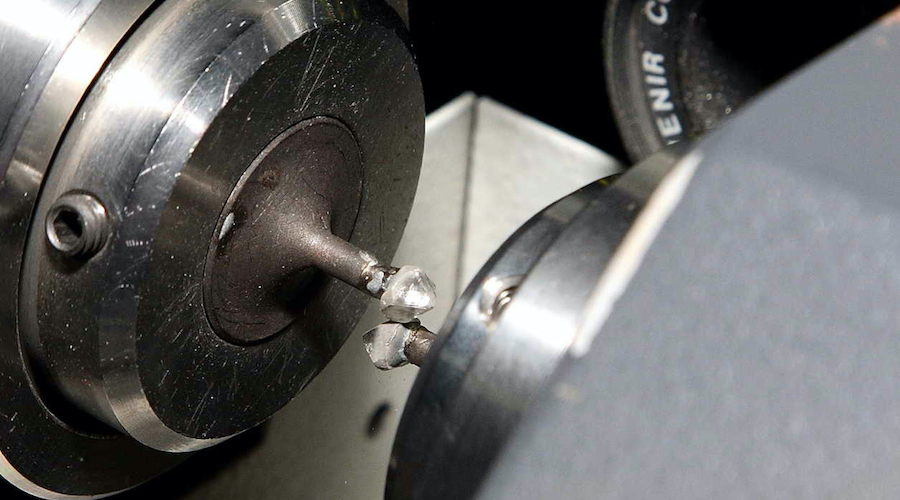

(Image courtesy of Alrosa’s cutting and polishing division).

Alrosa (MCX: ALRS), the world’s top diamond producer by output, has been hit by fresh sanctions imposed by the US Department of the Treasury’s Office of Foreign Assets Control (OFAC).

The OFAC announced late on Thursday it had placed Alrosa on the Specially Designated Nationals (SDN) list, which effectively kicks a sanctioned company out of the US banking system and bans its trade with Americans.

The measure against the Russian state-owned diamond miner seeks to cut off additional sources of revenue for Moscow, the government agency said.

It also affects any entities in which Alrosa has a 50% interest or more, either directly or indirectly.

The company’s customers well as other counterparties must stop all dealings with the state-controlled Russian miner by May 7, Treasury said.

Shares in the company collapsed on the news, closing nearly 13% lower on Friday trading in Moscow.

Alrosa and its chief executive Sergei S. Ivanov were included in the first wave of restrictions announced by Washington, which restricted the company’s ability to raise new debt and equity in the US.

“These actions, taken with the Department of State and in coordination with our allies and partners, reflect our continued effort to restrict the Kremlin’s access to assets, resources, and sectors of the economy that are essential to supplying and financing Putin’s brutality,” Treasury said in the statement.

The European Union and the UK have also imposed sanctions on the miner following Russia’s invasion of Ukraine.

Diamonds are one of Russia’s top ten non-energy exports by value, with exports in 2021 totalling over $4.5 billion, it noted.

Alrosa is responsible for 90% of Russia’s diamond output and 28% of global supply, with 32.4 million carats produced in 2021 and sales topping $4 billion thanks mainly to consumer demand from the US.

Loopholes

Experts have noted the sanctions against the miner carry a significant loophole. Russia’s rough diamonds are sent to another country — usually India — where they are polished and cut, which makes them the product of that nation in the global market.

Another issue is that diamonds of various origins are often mixed once polished, which can make it more difficult for companies that independently vow to stop buying Russian goods.

The Responsible Jewellery Council (RJC), the leading standards organization of the global jewellery and watch industry, took steps into that direction in early April and suspended Alrosa’s membership.

“Fundamentally, we remain focused on RJC’s purpose, which is to ensure all jewellery is responsibly sourced,” the group’s char David Bouffard said in the statement.

Alrosa (MCX: ALRS), the world’s top diamond producer by output, has been hit by fresh sanctions imposed by the US Department of the Treasury’s Office of Foreign Assets Control (OFAC).

The OFAC announced late on Thursday it had placed Alrosa on the Specially Designated Nationals (SDN) list, which effectively kicks a sanctioned company out of the US banking system and bans its trade with Americans.

The measure against the Russian state-owned diamond miner seeks to cut off additional sources of revenue for Moscow, the government agency said.

It also affects any entities in which Alrosa has a 50% interest or more, either directly or indirectly.

The company’s customers well as other counterparties must stop all dealings with the state-controlled Russian miner by May 7, Treasury said.

Shares in the company collapsed on the news, closing nearly 13% lower on Friday trading in Moscow.

Alrosa and its chief executive Sergei S. Ivanov were included in the first wave of restrictions announced by Washington, which restricted the company’s ability to raise new debt and equity in the US.

“These actions, taken with the Department of State and in coordination with our allies and partners, reflect our continued effort to restrict the Kremlin’s access to assets, resources, and sectors of the economy that are essential to supplying and financing Putin’s brutality,” Treasury said in the statement.

The European Union and the UK have also imposed sanctions on the miner following Russia’s invasion of Ukraine.

Diamonds are one of Russia’s top ten non-energy exports by value, with exports in 2021 totalling over $4.5 billion, it noted.

Alrosa is responsible for 90% of Russia’s diamond output and 28% of global supply, with 32.4 million carats produced in 2021 and sales topping $4 billion thanks mainly to consumer demand from the US.

Loopholes

Experts have noted the sanctions against the miner carry a significant loophole. Russia’s rough diamonds are sent to another country — usually India — where they are polished and cut, which makes them the product of that nation in the global market.

Another issue is that diamonds of various origins are often mixed once polished, which can make it more difficult for companies that independently vow to stop buying Russian goods.

The Responsible Jewellery Council (RJC), the leading standards organization of the global jewellery and watch industry, took steps into that direction in early April and suspended Alrosa’s membership.

“Fundamentally, we remain focused on RJC’s purpose, which is to ensure all jewellery is responsibly sourced,” the group’s char David Bouffard said in the statement.

The main markets for Alrosa, which employs about 32,000 people, are the US and Asia (Photo: Dmitry Amelkin, Transformation Director of Alrosa’s Polishing Division. Courtesy of Alrosa | Twitter. )

US-based jewellers Tiffany & Co. and Signet Jewelers said in March they would no longer buy new diamonds mined in Russia.

Alrosa withdrew in March from the Natural Diamond Council (NDC), a market alliance of the world’s leading producers of precious stones. By doing so, the company not only stepped down from the board, but it also cut all financial contributions.

The Mirny, Sakha-based miner also has a 41% stake in Angolan diamond production firm Catoca, which is not affected by the latest US sanctions given the OFAC.

While the full effects of the sanctions on the already undersupplied global rough diamonds market are not yet clear, the Antwerp World Diamond Centre (AWDC) has said there was a chance the restrictions could prove counterproductive.

“It is a blow that should hurt Russia but there is a chance that we do more damage to ourselves,” spokesman Tom Neys told Belgian newspaper Gazet van Antwerpen. “The Russians can easily trade their diamonds with non-EU countries and outside the US.”

The diamond jewelry industry is going into the year with diamond supply at historically low levels, estimated by Bain & Company at 29 million carats in 2021. “Upstream inventories declined ~40%, driven by high demand and slow production recovery, and are near the minimal technical level,” the report stated.

US-based jewellers Tiffany & Co. and Signet Jewelers said in March they would no longer buy new diamonds mined in Russia.

Alrosa withdrew in March from the Natural Diamond Council (NDC), a market alliance of the world’s leading producers of precious stones. By doing so, the company not only stepped down from the board, but it also cut all financial contributions.

The Mirny, Sakha-based miner also has a 41% stake in Angolan diamond production firm Catoca, which is not affected by the latest US sanctions given the OFAC.

While the full effects of the sanctions on the already undersupplied global rough diamonds market are not yet clear, the Antwerp World Diamond Centre (AWDC) has said there was a chance the restrictions could prove counterproductive.

“It is a blow that should hurt Russia but there is a chance that we do more damage to ourselves,” spokesman Tom Neys told Belgian newspaper Gazet van Antwerpen. “The Russians can easily trade their diamonds with non-EU countries and outside the US.”

The diamond jewelry industry is going into the year with diamond supply at historically low levels, estimated by Bain & Company at 29 million carats in 2021. “Upstream inventories declined ~40%, driven by high demand and slow production recovery, and are near the minimal technical level,” the report stated.

No comments:

Post a Comment