China property developers' shares, bonds dive as sector worries deepen

STATE CAPITALI$M IS STILL CAPITALI$M

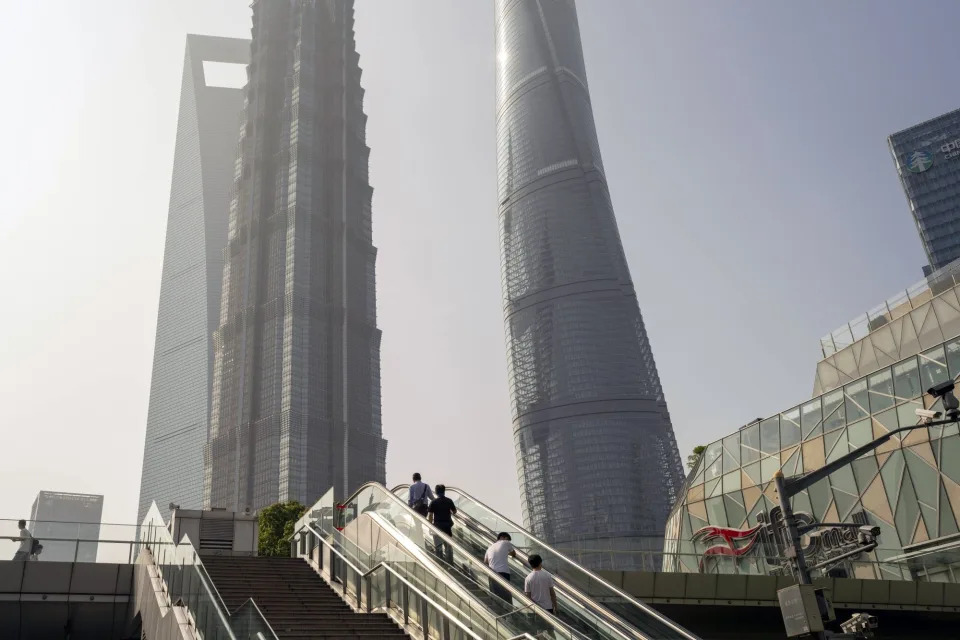

Workers walk past a construction site of residential buildings by property developer Country Garden in Kunming, Yunnan

1

Updated Mon, July 24, 2023

By Jason Xue and Tom Westbrook

SHANGHAI/SYDNEY (Reuters) -Stocks and bonds in China's real estate industry fell to around eight-month lows on Monday as repayment concerns at two of the country's biggest developers deepened a crisis of confidence in the sector.

Cash shortages at giants Country Garden and Dalian Wanda show funding issues have reached what many hoped were the largest and safest players in a business that once contributed a quarter of China's gross domestic product and is all but frozen.

Doubts are growing any official support will be forthcoming, and investors do not expect any aid to be aimed at shareholders.

Country Garden shares fell by 8.7% to HK$1.26, an eight-month low and shares in its services arm tumbled 17.9% to HK$7.4. Country Garden dollar bonds fell to less than a fifth of their face value.

Shares at rival Longfor dropped 8.5%, while an asset sale at Wanda failed to revive bond prices as investors waited on whether the cash actually reaches bondholders' pockets.

"As market sales continue to weaken and policy expectations continue to fall short, it will be difficult for real estate developers to repay bonds by their own operations," said Yao Yu, founder of credit analysis firm Ratingdog.

"Investors must become more and more pessimistic."

Property development has ground to a halt in China as a government crackdown on debts and crumbling public confidence have left builders unable to sell apartments or refinance their dues.

Guidelines promoting urban redevelopment published late on Friday were seen as small scale, leaving investors hoping for more from a Politburo meeting expected this week. That big names were struggling, however, highlighted the depth of the problems.

An index of mainland developers fell 6.4% on Monday and recorded its worst session of 2023.

"Everything is falling," said a Hong Kong debt fund manager, who spoke on condition of anonymity.

"The major thing that we see now is onshore-traded Country Garden bonds going down," he said. "That is the largest one. People get scared if that one cannot survive."

DOWNGRADES AND DEFAULTS

Country Garden is a giant with thousands of projects in nearly 300 Chinese cities. Its move to refinance a 2019 loan facility surprised and unnerved investors, and follows ratings downgrades and new defaults elsewhere.

Li Changjiang, the president of Country Garden Services, sold 3.2 million shares of the company last week, reducing his stake to 0.11% from 0.21%.

"Although this is not his first time selling shares of the company, the number of shares sold was one of the largest," said J.P.Morgan analysts in a note.

J.P.Morgan downgraded Country Garden Holdings from neutral to underweight, and cut its price target to HK$0.9 from HK$2.3. The bank also reduced the price target of Country Garden Services Holdings to HK$6.7 from HK$22.

Country Garden's onshore-traded bonds dropped to less than half of their face value on Monday and dollar bonds due in 2025 and 2031 fell below 20 cents on the dollar.

Wanda, China's largest commercial developer, was also seeking cash for one of its subsidiaries to make an already-late coupon payment due before the end of a grace period on July 30.

It sold part of another subsidiary to streaming company China Ruyi for $320 million, which a source familiar with the matter said would help it to repay a separate $400 million bond.

State-backed developer Greenland Holdings has missed repayments this month, while Sino-Ocean Group proposed extended terms for a 2 billion yuan ($278 million) bond due on Aug. 2.

The new problems have squashed a nascent rally after China lifted COVID-19 controls and opened its borders ending years of movement restrictions.

Restructuring plans at Evergrande, which was the poster-child of the sector's 2021 plunge into funding stress, are before the courts in Hong Kong and the Cayman Islands, while property sales are in a new slowdown.

"Distressed Chinese property developers’ bond restructurings can buy them some room," Fitch Ratings said in a report on Monday. "But most will continue to face repayment difficulties if home sales do not recover for a sustained period."

($1 = 7.1972 Chinese yuan renminbi)

(Reporting by Jason Xue in Shanghai and Tom Westbrook in Sydney; Additional reporting by Clare Jim, Xie Yu and Georgina Lee in Hong Kong. Editing by Kim Coghill, Jamie Freed and Barbara Lewis)

China Addresses Investor Concerns in Meeting With Global Funds

Bloomberg News

Sat, July 22, 2023

Bloomberg News

Sat, July 22, 2023

(Bloomberg) -- Chinese regulators met with global investors on Friday, according to people familiar with the matter, stepping up the government’s bid to boost market confidence as the country’s economic recovery loses steam.

China Securities Regulatory Commission Vice Chairman Fang Xinghai met with some global venture capital and private equity firms to hear their concerns about investment in the country, the people familiar said, requesting not to be named because the matter is private. Among those present were Neil Shen, founding partner of HongShan — formerly known as Sequoia Capital China — and representatives from GIC Pte. and Warburg Pincus. Temasek Holdings Ltd.’s China head Wu Yibing also joined.

Fang was accompanied by regulators from the securities watchdog and the Asset Management Association of China, the people said. Neither agency responded to questions about the meeting outside of business hours, nor did HongShan or GIC. Temasek couldn’t immediately provide a comment while Warburg Pincus representative declined to when contacted by text message.

The rare meeting with global funds comes after Chinese President Xi Jinping’s administration voiced its strongest support in recent years for the country’s private tech enterprises just days earlier. The government’s efforts, however, have been met with skepticism, as investors call for more concrete measures and stronger stimulus to revive growth.

Topics discussed at Friday’s meeting included steps that can be taken to ensure global funds can continue to invest in China, the people said. Regulators were urged to expedite procedures for overseas initial public offering registrations, accelerate listings in mainland China and relax merger-and-acquisition rules, one of the people said.

Escalating Tensions

Escalating tensions between China and the US, Beijing’s multi-year crackdown on its private sector and the country’s weakening economy are dampening investor interest. Private equity and venture capital firms have been struggling to attract institutional money from US endowments and pensions because of these long-term concerns.

This week, a US congressional committee said it was investigating four venture capital firms for their investment in Chinese technology companies, the latest sign of Washington’s increasing scrutiny of American funds suspected of helping develop sensitive industries in China. The entities under investigation are GGV Capital, GSR Ventures, Walden International and Qualcomm Ventures.

The US Department of State also recommended in June that Americans reconsider traveling to mainland China because of arbitrary enforcement of local laws and the risk of wrongful detentions, which spooked the business community.

Concerns about regulatory crackdowns in China have also weighed on the investment community. This month the Communist Party and the government issued a rare joint statement with 31 measures to improve conditions for businesses, including pledges to treat private firms the same as state-owned enterprises.

While that move won the backing of Chinese entrepreneurs including Tencent Holdings Ltd.’s billionaire co-founder Pony Ma, foreign companies are looking for more than rhetoric after two years of crackdowns and pandemic controls. The European Union Chamber of Commerce in China said its companies have been accustomed to “sweeping pro-business statements being made with little concrete action being taken.”

The government showed support for private equity and venture capital earlier this month when Premier Li Qiang approved the final rules on the 20 trillion yuan ($2.8 trillion) private fund market almost six years after a draft was released. While penalties on irregularities were toughened significantly, the new rule sets out a special chapter for venture capital, with looser requirements. It also exempted parent funds from some restrictions, benefiting private equity’s secondary market.

China’s sputtering economic recovery has sent a chill through global markets. Beijing has opted for targeted steps — instead of a broad stimulus — pushing for lower interest rates, easier access to credit and a series of measures to kickstart the moribund housing market.

Businesses are still waiting for signals from Xi’s new economic team that the policy environment will be more transparent and predictable. The president has repeatedly insisted that economic development is the Communist Party’s top priority, even as his government makes protecting national security a central focus.

--With assistance from Amanda Wang and David Ramli.

China Securities Regulatory Commission Vice Chairman Fang Xinghai met with some global venture capital and private equity firms to hear their concerns about investment in the country, the people familiar said, requesting not to be named because the matter is private. Among those present were Neil Shen, founding partner of HongShan — formerly known as Sequoia Capital China — and representatives from GIC Pte. and Warburg Pincus. Temasek Holdings Ltd.’s China head Wu Yibing also joined.

Fang was accompanied by regulators from the securities watchdog and the Asset Management Association of China, the people said. Neither agency responded to questions about the meeting outside of business hours, nor did HongShan or GIC. Temasek couldn’t immediately provide a comment while Warburg Pincus representative declined to when contacted by text message.

The rare meeting with global funds comes after Chinese President Xi Jinping’s administration voiced its strongest support in recent years for the country’s private tech enterprises just days earlier. The government’s efforts, however, have been met with skepticism, as investors call for more concrete measures and stronger stimulus to revive growth.

Topics discussed at Friday’s meeting included steps that can be taken to ensure global funds can continue to invest in China, the people said. Regulators were urged to expedite procedures for overseas initial public offering registrations, accelerate listings in mainland China and relax merger-and-acquisition rules, one of the people said.

Escalating Tensions

Escalating tensions between China and the US, Beijing’s multi-year crackdown on its private sector and the country’s weakening economy are dampening investor interest. Private equity and venture capital firms have been struggling to attract institutional money from US endowments and pensions because of these long-term concerns.

This week, a US congressional committee said it was investigating four venture capital firms for their investment in Chinese technology companies, the latest sign of Washington’s increasing scrutiny of American funds suspected of helping develop sensitive industries in China. The entities under investigation are GGV Capital, GSR Ventures, Walden International and Qualcomm Ventures.

The US Department of State also recommended in June that Americans reconsider traveling to mainland China because of arbitrary enforcement of local laws and the risk of wrongful detentions, which spooked the business community.

Concerns about regulatory crackdowns in China have also weighed on the investment community. This month the Communist Party and the government issued a rare joint statement with 31 measures to improve conditions for businesses, including pledges to treat private firms the same as state-owned enterprises.

While that move won the backing of Chinese entrepreneurs including Tencent Holdings Ltd.’s billionaire co-founder Pony Ma, foreign companies are looking for more than rhetoric after two years of crackdowns and pandemic controls. The European Union Chamber of Commerce in China said its companies have been accustomed to “sweeping pro-business statements being made with little concrete action being taken.”

The government showed support for private equity and venture capital earlier this month when Premier Li Qiang approved the final rules on the 20 trillion yuan ($2.8 trillion) private fund market almost six years after a draft was released. While penalties on irregularities were toughened significantly, the new rule sets out a special chapter for venture capital, with looser requirements. It also exempted parent funds from some restrictions, benefiting private equity’s secondary market.

China’s sputtering economic recovery has sent a chill through global markets. Beijing has opted for targeted steps — instead of a broad stimulus — pushing for lower interest rates, easier access to credit and a series of measures to kickstart the moribund housing market.

Businesses are still waiting for signals from Xi’s new economic team that the policy environment will be more transparent and predictable. The president has repeatedly insisted that economic development is the Communist Party’s top priority, even as his government makes protecting national security a central focus.

--With assistance from Amanda Wang and David Ramli.

No comments:

Post a Comment