Thu, February 1, 2024

View of a Pakistan International Airlines passengers plane, taken through a glass panel, at the Allama Iqbal International Airpor in Lahore

By Asif Shahzad

ISLAMABAD (Reuters) - Ahead of elections next week, Pakistan's caretaker administration is making binding plans for a new government to sell loss-making Pakistan International Airlines, according to the minister in charge of the process and other officials.

In the past, elected governments have shied away from undertaking unpopular reforms, including the sale of the flag carrier. But Pakistan, in deep economic crisis, agreed in June to overhaul loss-making state-owned enterprises under a deal with the International Monetary Fund (IMF) for a $3 billion bailout.

The government decided to privatise PIA just weeks after signing the IMF agreement.

The caretaker administration, which took office in August to oversee the Feb. 8 election, was empowered by the outgoing parliament to take any steps needed to meet the budgetary targets agreed with the IMF.

"Our job is 98% done," Privatisation Minister Fawad Hasan Fawad told Reuters when asked about the plan to sell the airline. "The remaining 2% is just to bring it on an excel sheet after the cabinet approves it."

Fawad said the plan, drawn up by transaction adviser Ernst & Young, will be presented to the cabinet for approval before the tenure of the administration ends following the election. The cabinet will also decide whether to sell the stake by tender or through a government-to-government deal, Fawad said.

"What we have done in just four months is what past governments have been trying to do for over a decade," Fawad said. "There is no looking back."

Details of the privatisation process have not been previously reported.

PIA had liabilities of 785 billion Pakistani rupees ($2.81 billion) and accumulated losses of 713 billion rupees as of June last year. Its CEO has said losses in 2023 were likely to be 112 billion rupees.

Progress on the privatisation will be a key issue if the incoming government goes back to the IMF once the current bailout programme expires in March. Caretaker Finance Minister Shamshad Akhtar told reporters last year that Pakistan would have to remain in IMF programmes after the expiry.

Two sources close to the process told Reuters that a 51% stake with full management control would be offered to buyers after parking the airline's debts in a separate entity, under the 1,100 page report from Ernst & Young.

Reuters could not independently confirm the contents of the report. Fawad did not give specific details of the size of the stake to be sold, but confirmed the plan involved the carrier's debts being spun off into a separate entity.

Ernst & Young did not respond to requests for comment.

PIA spokesman Abdullah Hafeez Khan said the airline was assisting the privatisation process, extending "full cooperation" to the transaction adviser.

FAST-TRACKED

Besides operational and technical measures for PIA's divestment, the caretaker government has also amended a 2016 law that had blocked selling off its majority shares, according to a draft posted on the Pakistan parliament's website.

The Pakistan Muslim League-Nawaz party of former Prime Minister Nawaz Sharif is tipped by analysts to win the election with support from the powerful military. Its main political rival has been decimated by the arrest of its leader Imran Khan and a crackdown on its members.

Sharif's close aide Ishaq Dar, who has been his finance minister previously and has been named by the party to retain the portfolio if it forms the next government, told Reuters that the sale of PIA will be fast-tracked.

"It will, God willing, move ahead with fast speed," he said.

In a report in mid-January, the IMF expressed satisfaction over the measures initiated by the caretaker government to accelerate reforms of state-owned enterprises, specifically mentioning the amendment of the PIA privatisation law.

Under the privatisation plan submitted by Ernst & Young to the government on Dec. 27, government-guaranteed legacy debt and payables - which are held by a consortium of seven domestic banks - will be parked in a holding company, Fawad and two sources involved in the process said.

Fawad said the government and the consortium had an agreement in place regarding the settlement of the legacy debt, which includes negative equity of 825 billions rupees in loans, creditors' money and the losses. He provided no further details.

The sources had earlier said the banks wanted a five-year bond issued against the debt with a 16.5% coupon on the paper, while the finance ministry was offering only 10%.

The banks have not commented on the deal.

Besides its losses and debt, PIA's governance and safety standards have been questioned by global aviation authorities for some years.

In early 2020, Czech and Hungarian air force jets were scrambled to intercept a PIA flight with 300 people on board as it went astray due to an "avoidable human error" by its pilot, according to a previously unreported confidential report by a PIA inquiry board, which was reviewed by Reuters.

In May that year, the crash of a PIA plane in Karachi killed nearly 100 people and a fake pilot licence scandal erupted later in 2020.

The scandal led to the European Union Aviation Safety Agency (EASA) banning the airline from flying to its most lucrative routes in Europe and the UK.

The 2020 ban is still in place and has cost the airline nearly 40 billion rupees in revenue annually, according to government records presented in parliament.

The airline has been pleading with EASA to lift the ban even provisionally, but to no avail, according to correspondence between it and PIA reviewed by Reuters.

Pakistan's financial crisis has also led to seizure of PIA aircraft by creditors in recent months, according to the airline. One aircraft was taken at Kuala Lumpur airport for non-payment of lease fees, and another in Toronto for non-payment of ground handling, PIA said.

While the airline awaits the government's decision on a sale, it continues to need financial support: 23.7 billion rupees are required to keep it afloat for another five to six months before control is given to a new buyer, three government and PIA sources said.

CHALLENGING SALE

Not everyone agrees with pressing ahead speedily with the sale.

Three senior airline officials who spoke to Reuters on condition of anonymity said a fast sale could devalue the airline's worth, and that it would not be a transparent transaction without due diligence.

"We are not against its privatisation, and all we want is that you don't just throw it away," said one of the officials.

But Singapore-based aviation analyst Brendan Sobie said PIA is in dire straits: the plan submitted to the government was "essentially the only option to save the airline".

"The privatisation will be challenging and a sale is likely not possible unless it first undergoes a deep restructuring and the debts are cleared," he said.

PIA's assets include key slots at the world's busiest airports and air routes to top European destinations, the Middle East and North America.

PIA has air service agreements with more than 150 countries and generates about 280 billion rupees annually in revenues despite the EU ban, airline records show.

It has 10 slots at Heathrow, which, according to two PIA officials, are currently worth 70 billion rupees annually. It has a further nine slots at Manchester and four at Birmingham.

Turkish and Kuwaiti airlines have been operating 70% of the slots under a business arrangement with PIA that also allows the airline to retain them, the PIA officials said.

Separately, PIA's physical assets, which include aircraft, hotels in Paris and New York and other properties, are worth 105.6 billion rupees ($375 million) as per book value, according to the airline's annual report for 2023.

PIA officials, however, said the market value of the assets could be above $1 billion. In any case, the hotels and other properties would not be up for sale, they said.

($1 = 280.0000 Pakistani rupees)

(Reporting by Asif Shahzad; Writing by Asif Shahzad and Gibran Peshimam; Editing by Raju Gopalakrishnan)

Trader’s Guide to Pakistan Elections Ahead of Vital IMF Deal

Abhishek Vishnoi and Ismail Dilawar

Thu, February 1, 2024

(Bloomberg) -- Pakistan is gearing up for two key events in quick succession: a general election and the expiry of an International Monetary Fund bailout program. The election winner will be tasked with striking a new deal with the IMF, which investors say is crucial to the nation’s outlook.

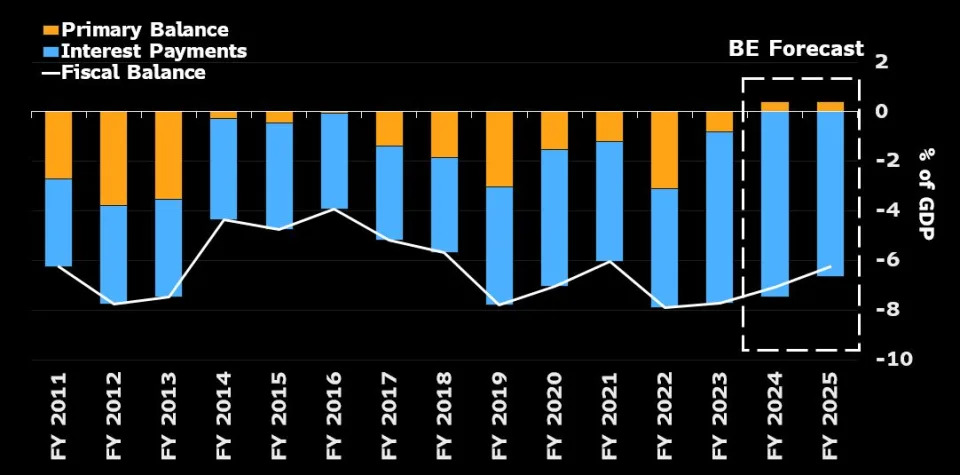

The country heads to the polls to elect a new premier Feb. 8, while the IMF’s current rescue package ends in March, just before $1 billion in dollar bonds come due the following month. Pakistan’s finances will collapse without a new funding agreement, according to all 12 respondents to a Bloomberg survey.

On the flip-side, if the new government is able to agree on a fresh IMF program then Pakistan’s assets can extend their world-beating rallies, according to money managers including NBP Fund Management Ltd. and Asia Frontier Capital Ltd.

“Investors will watch how soon the new government can negotiate a longer-and-larger loan program with the IMF,” said Ruchir Desai, a fund manager at Asia Frontier Capital in Hong Kong. “Very discounted valuations, interest rates peaking out and the prospects for an earnings recovery will add to the optimism surrounding greater political stability.”

Gaining access to a new round of IMF funding is critical to reviving Pakistan’s economy and may help the country secure financing from other creditors such as Saudi Arabia. The cash-strapped nation’s external financing requirements will average about $27 billion every fiscal year from 2025 through 2028, the IMF has said.

The main contenders in the election are three-time former premier Nawaz Sharif, 35-year old previous foreign minister Bilawal Bhutto Zardari and sugar magnate Jahangir Tareen. The most popular candidate Imran Khan is effectively disqualified, being held in jail since last year on corruption charges.

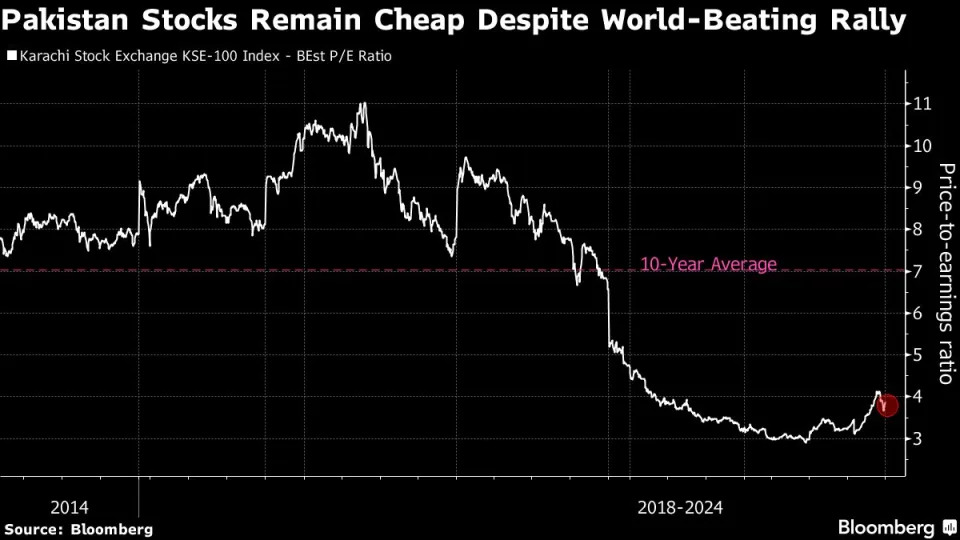

Pakistan’s benchmark KSE-100 Index has jumped about 50% since the nation reached an initial bailout deal with the IMF at the end of June, the best performer of more than 90 equity indexes tracked by Bloomberg. The rupee has strengthened about 2% over the same period, beating all its Asian peers, while the price of the nation’s dollar bonds due 2024 has almost doubled from its low in June.

Even after the KSE-100 Index’s rally, the gauge is still trading at a price-to-earnings ratio of just 3.8, which is a discount of 45% to its 10-year average. That’s even lower than some countries that have defaulted on their external debt.

“If the new government comes in and successfully negotiates a new IMF program, we may see the Pakistan rupee appreciating, interest rates will come down, and the Pakistan stock exchange will surge back to 10-to-12 times P/E,” said Adnan Sami Sheikh, an analyst at Pakistan Kuwait Investment Co. in Karachi.

While the government is now in a better negotiating position than it was before last year’s IMF deal, the Washington-based fund has said Pakistan needs a market-determined exchange rate, larger foreign reserves to help limit external shocks, and a tighter monetary stance to contain inflation.

Pakistan has largely remained committed to those goals. The central bank kept its benchmark interest rate at 22% for a fifth meeting on Jan. 29 in an effort to curb the region’s fastest inflation rate, which has been propelled by rising energy costs and the weakness of the currency in early 2023.

“No matter who wins and who loses the election, our policies going forward will mostly be IMF-dictated,” said Amjad Waheed, chief executive officer in Karachi at NBP Fund Management, which oversees about $820 million. “We can see some upside in equities. Inflation and interest rates will move downward going forward, which should be good for the bond market as well.”

Any steps taken by the next government to narrow the fiscal deficit will help utilities and oil-and-gas businesses, while initiatives to improve tax collection will boost the overall appeal of Pakistani assets. Potential future cuts in central bank interest rates once the economy returns to a surer footing can aid cyclical sectors such as materials.

Analysts are divided on which of the potential new premiers would be best placed to oversee much-needed economic reforms.

Given Sharif and his party have previously performed relatively well at managing the economy, investors are probably placing bets on his comeback, according to an analysis by Bloomberg Intelligence. Meanwhile, Gallup polls show former Prime Minister and cricket star Khan remains the country’s most popular politician.

History Lesson

History shows no matter who wins, putting money into Pakistan stocks before an election has reaped dividends. Those who bought the KSE-100 Index the day before a national vote gained an average 7% over the following month, while the mean advance over a three-month period was 19%, according to data from the past six elections compiled by Bloomberg.

Any such gain this time round will depend on whether the next leader can negotiate a bigger-and-better program with the IMF.

“We believe the IMF will consider sitting with the elected government for a longer-tenor program,” said Amreen Soorani, head of research at JS Global Capital Ltd. in Karachi. “Higher confidence levels would increase the prospects of removing negative sentiment” that is causing the current low multiples in the stock market, she said.

--With assistance from Chiranjivi Chakraborty, Ankur Shukla (Economist) and Faseeh Mangi.

(Updates to add new story in read more box. An earlier version of this story was corrected to amend the spelling of a name in the sixth paragraph.)

Most Read from Bloomberg Businessweek

No comments:

Post a Comment