Rio Tinto to favour development over acquisition of copper mines — exec

MINING.COM Editor | April 17, 2024 |

Bold Baatar. (Image courtesy of Rio Tinto | X Feed.)

Rio Tinto (ASX, LON, NYSE: RIO) will prioritize developing new copper mines over acquiring new ones to achieve its goal of producing one million tonnes of the metal annually within the next five years, copper boss Bold Baatar has said.

Speaking at the CRU World Copper Conference in Chile, the executive noted that to boost production from the roughly 700,000 tonnes of copper it currently churns out, Rio is looking mainly at organic growth.

Most of the planned output expansion, Baatar said, will be driven by Rio Tinto’s expansion in Mongolia, Utah, and global exploration efforts, including a partnership with Chile’s owned Codelco, the world’s largest copper producer.

“For us, the focus is organic growth, supply growth and where in projects can we partner rather than necessarily acquiring an existing production,” Baatar, who was recently appointed as Rio’s next chief commercial officer, told reporters in Santiago.

Baatar said Rio would invest more in Chile if the country streamlines its permitting process, not only for new developments, but also for projects to optimize current operations.

Cost-effective

Despite the increasing cost and time required for project development, Baatar believes that building mines is still more cost-effective than buying existing ones, a stance that may disappoint industry watchers betting on a new wave of mergers and acquisitions.

Consolidation in the industry is only logical if it increases the supply of the metal used in wiring, considering the anticipated acceleration in demand growth due to the worlds’ ongoing energy transition, Baatar noted.

“Just bringing one and one together doesn’t add more copper,” he said. “The key question is how can we bring more supply.”

MINING.COM Editor | April 17, 2024 |

Bold Baatar. (Image courtesy of Rio Tinto | X Feed.)

Rio Tinto (ASX, LON, NYSE: RIO) will prioritize developing new copper mines over acquiring new ones to achieve its goal of producing one million tonnes of the metal annually within the next five years, copper boss Bold Baatar has said.

Speaking at the CRU World Copper Conference in Chile, the executive noted that to boost production from the roughly 700,000 tonnes of copper it currently churns out, Rio is looking mainly at organic growth.

Most of the planned output expansion, Baatar said, will be driven by Rio Tinto’s expansion in Mongolia, Utah, and global exploration efforts, including a partnership with Chile’s owned Codelco, the world’s largest copper producer.

“For us, the focus is organic growth, supply growth and where in projects can we partner rather than necessarily acquiring an existing production,” Baatar, who was recently appointed as Rio’s next chief commercial officer, told reporters in Santiago.

Baatar said Rio would invest more in Chile if the country streamlines its permitting process, not only for new developments, but also for projects to optimize current operations.

Cost-effective

Despite the increasing cost and time required for project development, Baatar believes that building mines is still more cost-effective than buying existing ones, a stance that may disappoint industry watchers betting on a new wave of mergers and acquisitions.

Consolidation in the industry is only logical if it increases the supply of the metal used in wiring, considering the anticipated acceleration in demand growth due to the worlds’ ongoing energy transition, Baatar noted.

“Just bringing one and one together doesn’t add more copper,” he said. “The key question is how can we bring more supply.”

Rising costs to build QB2, Teck’s flagship copper project in Chile, shows how the industry is struggling to expand supply on budget. (Image courtesy of Teck.)

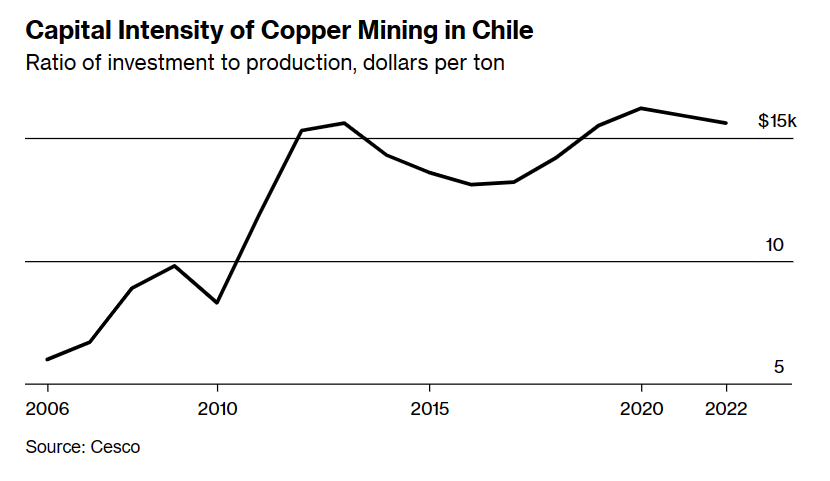

The cost of building new copper mines has significantly increased over the years. In 2000, the average capital needed for a new copper mine sat between $4,000-5,000 to produce a tonne of copper. By 2012, this had risen to $10,000 per tonne, and recent analyses pegged current costs to up to $44,000 per tonne of production.

Robert Friedland, founder and chairman of Ivanhoe Mines, recently estimated the price of copper needed to reach close to $15,000 a tonne and remain there for a long period of time, before the industry can really gear up and build much needed new copper mines.

Baatar, who joined Rio in 2013 and was appointed copper chief in 2021, played a key role in leading the company to successfully complete the underground expansion of the Oyu Tolgoi copper mine in Mongolia.

He takes the post of chief commercial officer in September and industry insiders say he is likely to become Rio Tinto’s next chief executive officer.

(With files from Bloomberg)

The cost of building new copper mines has significantly increased over the years. In 2000, the average capital needed for a new copper mine sat between $4,000-5,000 to produce a tonne of copper. By 2012, this had risen to $10,000 per tonne, and recent analyses pegged current costs to up to $44,000 per tonne of production.

Robert Friedland, founder and chairman of Ivanhoe Mines, recently estimated the price of copper needed to reach close to $15,000 a tonne and remain there for a long period of time, before the industry can really gear up and build much needed new copper mines.

Baatar, who joined Rio in 2013 and was appointed copper chief in 2021, played a key role in leading the company to successfully complete the underground expansion of the Oyu Tolgoi copper mine in Mongolia.

He takes the post of chief commercial officer in September and industry insiders say he is likely to become Rio Tinto’s next chief executive officer.

(With files from Bloomberg)

Bloomberg Opinion | April 17, 2024 |

Chuquicamata mine. Credit: Codelco

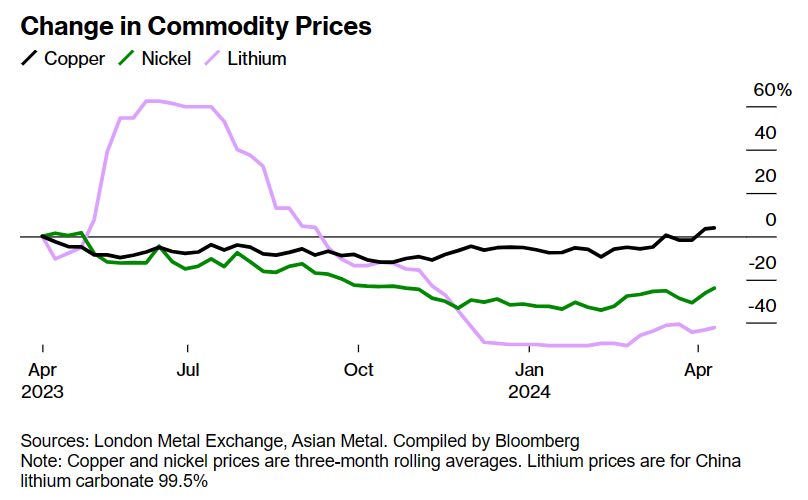

Representatives from the world’s biggest copper producers had reason to celebrate when they convened in Santiago on April 15-17 for their annual conference. Global prices for the metal have climbed about 6% over the past year, while those for lithium and nickel have taken double-digit dives.

All three have starring roles in the energy transition, the race to wean economies off planet-warming fossil fuels. But copper has a great many uses besides battery packs—it’s in indoor plumbing, cars and electrical wiring—which has helped buttress prices.

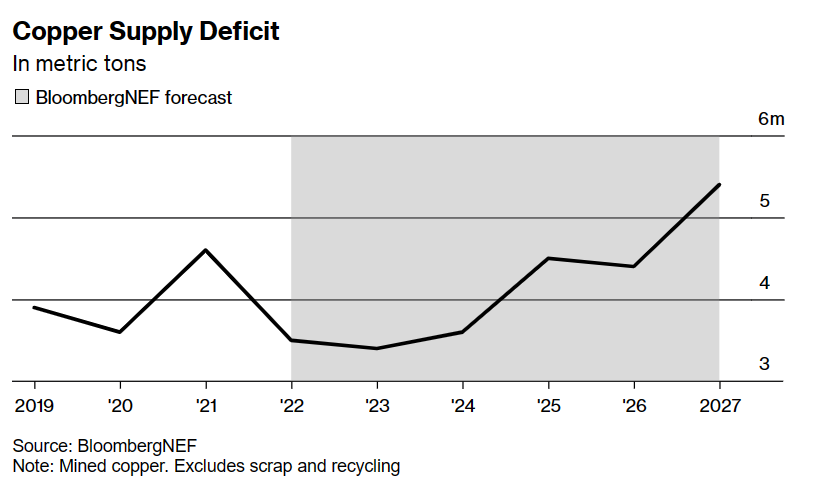

Even the more conservative forecasters see demand growing by a third over the next decade, as governments and businesses step up investments in decarbonization. At the same time, the industry faces numerous obstacles to meaningfully boosting output. The new deposits that are needed to replace maturing mines are getting harder to find and develop, with heightened social and environmental scrutiny and long waits for permits. All of that makes projects more time-consuming and expensive, and also tougher to finance.

To get a close-up look at how the confluence of factors is restraining supply, travel almost 1,000 miles north of Chile’s capital to Chuquicamata, where copper has been mined since pre-Columbian times. (A mummy dating from circa 550 A.D. was unearthed in an old mine shaft in the late 19th century, the apparent victim of a rock fall.)

The world’s largest open-pit copper mine in terms of excavated volume, Chuqui, as locals call it, appears in satellite images as some terraced city buried into the Mars-like landscape of the Atacama Desert. Copper pulled from the 2,350-acre pit has helped turn Chile into the world’s No. 1 supplier of the metal—and one of the most prosperous nations in Latin America.

More than a century of commercial production reduced the amount of ore that can profitably be extracted from the surface, so two decades ago state-run Codelco began drawing up plans to build a modern underground mine at the site to tap the riches deep below.

The company originally envisioned a $2 billion investment. By the time its board signed off on the project in 2014, the budget had risen to $4.2 billion. At the time of the 2019 ribbon-cutting, it had climbed to $5.5 billion. The latest estimate, including related infrastructure, is $7 billion, making it the biggest outlay Codelco’s history.

Behind the budget blowouts is a combination of tricky engineering and geology—building more than 90 miles of tunnels right under an open pit is no mean feat—but there have also been missteps in planning and execution.

The underground portion opened in 2019, pretty much in line with a revised schedule. But because of setbacks, including design adjustments, collapses and glitches with the conveyor belt that transports rock to the surface, the operation won’t reach full production capacity until 2030, at least four years later than planned.

The hiccups caused Chuquicamata’s overall output to dip below 250,000 tons last year, compared with half a million tons in 2010. In an April 15 interview, Codelco Chairman Maximo Pacheco highlighted the complexity involved in what ranks as one of the world’s biggest mining projects. “The rock reacts in a way that we don’t necessarily know exactly how it’s going to be,” he said. “We are in the frontier of knowledge of the technology of underground mining in the world.”

Other miners operating in Chile have run into difficulties on projects designed to extend the profitable life of their assets. Teck Resources Ltd.’s expansion of its Quebrada Blanca copper mine came in at $4 billion over budget. Anglo American Plc has spent at least 14 years doing environmental studies and other paperwork for an around $3 billion overhaul of Los Bronces, its flagship mine in Chile.

“Projects are becoming bigger, the capital intensities are high, and therefore these are very tough decisions,” says Iván Arriagada, chief executive officer of Antofagasta Plc, which pondered an expansion of its Centinela mine for years before pulling the trigger on a $5.4 billion plan in late 2023. The Center for Copper and Mining Studies (Cesco), the Santiago-based research outfit that put on this week’s event, has crunched the numbers and found that the investment needed to produce a ton of copper in Chile has shot up fivefold since 2006.

Around the world, the challenges of building new mines are often even more daunting. Over the past several years, the time from so-called first discovery to first metal has lengthened by an average of four years, to 14, according to Bloomberg Intelligence. The oil industry is going in the other direction, with modern fields such as those off the coast of Guyana taking only five years to come online.

Miners often complain that mountains of red tape are choking development. “It’s permitting gone mad,” says Roque Benavides, chairman of Buenaventura, whose company is active in Peru. In Chile, Peru and elsewhere, major producers have lobbied strenuously for streamlined regulatory frameworks, touting their shift to cleaner and more socially inclusive practices as proof that the industry is moving past its history of environmental damage and ill treatment of local communities.

That message isn’t getting through in many places. In December, Panama’s government shut down one of the world’s largest copper mines following fierce public protests—one reason prices for the metal have outperformed those of other commodities.

Of the top 40 copper projects around the world, 31 face significant social, environmental, regulatory or economic hurdles, according to an analysis by Flashpoint Capital, a merchant bank in Toronto. “Some of these issues are so severe that the viability of developing the projects is questionable,” says Flashpoint partner Colby Mintram.

Those obstacles can drain miners’ enthusiasm for new projects. Goldman Sachs Group Inc. estimates the industry needs to spend $150 billion over the next decade to address a projected 8-million-ton annual supply shortfall. That would require prices to surpass $10,000 a ton, from the current level of around $9,500, Trafigura Group CEO Jeremy Weir told the conference in Santiago this week.

CRU, a metals research and consulting firm based in London, is less bullish about copper demand than many forecasters but still recognizes the supply-side constraints. Mines are getting smaller and more expensive to build, with more than one-third of future projects located in jurisdictions where investors face significant political and regulatory risks, such as Congo. “The stuff is in the ground,” says CRU’s head of base metals, Simon Morris. “It’s whether there’s really the will to do it.”

Chuquicamata stands as a cautionary tale. The stumbles there are one reason Chile’s copper production has sunk to the lowest level in two decades. Many of Codelco’s woes, and those of copper mines the world over, boil down to declining ore quality. Globally, the amount of mineral that can be extracted from a given amount of rock has been halved over the past two decades, from about 1% to 0.5%, as existing mines mature. Meanwhile, exploration has yielded fewer big finds in the past decade or so.

Codelco is now paying the price—along with Chile’s government—for prioritizing payments into state coffers while putting off investments in overhauling depleting mines. Back in 2016 the company was projecting its average annual output would rise to 2.1 million tons through 2040. That forecast has been slashed to about 1.6 million tons, according to a recent company presentation. The difference between the two amounts to enough copper to make 6 million Teslas a year.

Codelco now finds itself in the unenviable position of having to juggle four giant projects simultaneously as part of a $40 billion pipeline—an undertaking few private-sector rivals would ever attempt. Senior management has been responding to the setbacks at Chuqui and other mines by overhauling reporting structures in a bid to improve decision-making. For example, under Rubén Alvarado, who stepped into the CEO job in September, project development has been decentralized, with responsibilities handed back to the various divisions. Management says a gradual recovery is underway as projects get back on track.

Still, Juan Ignacio Guzmán, who heads GEM, a mineral consulting firm in Chile, sees an ongoing risk of disappointments unless the state-owned giant can streamline decision-making. Of Chuquicamata, he says: “If the fundamental organizational problems aren’t resolved, it is only going to keep losing money.”

Pacheco, the company chairman, acknowledges that previous management bit off more than it could chew. “We should never again try to develop four mega projects simultaneously. The country has limited resources. Our company has limited resources, and the complexity of all these projects clearly shows that it’s a better solution going one by one.”

(By James Attwood)

No comments:

Post a Comment