There’s a place for B.C.’s gas in a net-zero future. But not for long

Story by The Canadian Press •

In 2020, Susannah Pierce, a senior fossil fuel executive from Shell, offered a rosy outlook for a highly anticipated west coast gas liquefaction and export facility.

Speaking on a podcast produced by an oilpatch lobby group, she said LNG Canada would usher in an era of jobs and Indigenous prosperity for decades to come.

“We are a new project with a long lifeline,” she said at the time. “I think [it’s] a very positive shift to the extent to which many of these Indigenous communities have an opportunity and they have the control over that opportunity that they’ve never had before.”

Pierce stressed the value of the project in terms of creating jobs for northern communities that “suffered through the ups and downs of the mining sector, the forestry sector.”

“Here’s a new opportunity,” she said. “An opportunity for 40 years.”

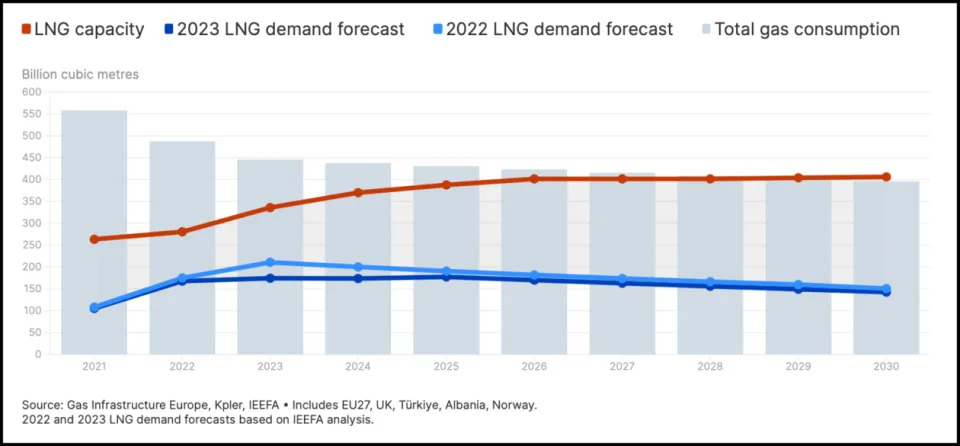

But as countries around the world commit to ambitious emissions reductions and global gas markets react to unforeseen events, a new federal report suggests the long-term outlook of the Kitimat, B.C., project is up in the air.

The Canada Energy Regulator released the report in late June. It offers an analysis of the country’s energy future in three scenarios: business as usual, Canada achieving its climate goals and a world in which countries around the globe reach net-zero emissions targets by 2050. According to the latter two scenarios, B.C.’s burgeoning liquefied natural gas (LNG) export industry isn’t facing imminent collapse — but it doesn’t have the “long lifeline” Pierce promised.

That shouldn’t be surprising, said Jean-Denis Charlebois, the regulator’s chief economist. On a call with The Narwhal, he explained the analysis was informed by a “predetermined outcome” in which global climate commitments are achieved.

“Exports start in the late 2020s and keep going until the mid 2040s, at which point the global price declines so much that only projects that are electrified … can be cost competitive on a global basis,” Charlebois said. “The projects that are not electrified then have costs to manage emissions from their operations [which] bites into the value that they extract for shareholders.”

He said companies in a net-zero world need to be prepared to operate in a “low price environment.”

“Because if not the case, then it makes no sense to actually either build or continue to operate.”

Charlebois stressed the new analysis of the impacts of net-zero scenarios on the oil and gas sector shouldn’t be taken as an oracle.

“Ultimately, it’s not a prediction of what will happen,” he said. “It’s actually one and two scenarios that we think are possible but we haven’t gone into the analysis of looking at how likely any of those are.”

LNG Canada — which is owned by a group of foreign companies including Shell, Petronas and PetroChina — is working towards being the first large-scale facility to ship liquefied gas from B.C. to buyers in Asia. When its first phase comes online around 2025, it plans to power its energy-intensive operations by burning some of the 2.1 billion cubic feet of gas it would receive daily from the Coastal GasLink pipeline. A second phase would double production — and correspondingly double the amount of gas it burns domestically. For context, one year’s supply of gas at 2.1 billion cubic feet per day can generate enough power to keep the lights on and living rooms warm in nearly 10 million homes.

The consortium dismissed The Narwhal’s questions about the regulator’s scenarios, suggesting the project remains viable.

“A joint venture of five global energy companies with substantial experience in natural gas and liquefied natural gas, LNG Canada is a 40-year asset designed to be the world’s lowest carbon producing LNG facility of its size,” a spokesperson wrote in an email to The Narwhal.

Electrification isn’t off the table for LNG Canada but it’s far from a sure thing, and questions remain about whether B.C. can generate enough power to support the industry while meeting increasing demand from other sectors, such as transportation.

According to the regulator’s global net-zero scenario, gas production in Canada peaks this year, holds until 2026, then steadily drops, with LNG Canada and Squamish-based Woodfibre LNG exporting until around 2044, at which point the market drops out.

Under this scenario, LNG Canada would only support jobs for 20 years or less.

It was a different time and cooler climate when the B.C. government hedged its bets on the LNG export industry, wooing international fossil fuel giants like Malaysia’s state-owned Petronas, Shell and others to the province. In the early 2010s, a flurry of proposed projects popped up in places like Prince Rupert, Kitimat, Vancouver and Squamish. Back then, LNG was touted as an economic saviour and a climate champion. More than a decade later, things have changed — in B.C. and around the world.

The impacts of climate change are intensifying and the world is hurtling towards surpassing 1.5 C of warming above pre-industrialization levels, a point the Intergovernmental Panel on Climate Change has warned will “intensify multiple and concurrent hazards” with a disproportionate impact on Indigenous Peoples worldwide. Canada is currently experiencing its worst wildfire season in history, with smoke from millions of acres of burning forests blanketing major cities like Toronto and New York and wafting across the Atlantic Ocean.

The scientific consensus is “human activities, principally through emissions of greenhouse gases, have unequivocally caused global warming.” Most of those emissions are a product of getting fossil fuels — like gas — out of the ground and burning them to produce energy. To set a path for “deep, rapid and sustained [emissions] reductions” as recommended by the international panel, governments around the globe are committing to aggressive decarbonization policies. Many, including Canada, have set a mid-century deadline. The goal is net-zero emissions across all sectors.

Industry groups, proponents and supporters of the sector maintain an argument that LNG produced in Canada is a lesser of evils and a means to wean countries off of other fossil fuels. The idea is Canada has tighter environmental and emissions regulations than, say, jurisdictions like Qatar. In B.C., the provincial energy regulator is strengthening methane regulations and if dreams of electrification — including upstream, transport and liquefaction — are realized, the overall carbon footprint of burning the gas for energy is reduced.

“We believe LNG, especially highly competitive Canadian LNG, has a significant place in the transition to a net-zero world, now and in the long term,” the LNG Canada spokesperson wrote. “LNG Canada will continue to support global LNG supply as global demand evolves.”

“It’s really good rhetoric. It sounds good but I don’t think it lines up,” Tom Green, senior climate policy advisor with the David Suzuki Foundation, told The Narwhal in an interview. “Even if you deal with all the upstream methane emissions, it’s still fossil fuel that you’re burning. It’s adding to total emissions in the atmosphere and it’s helping displace investments in renewables in receiving countries.”

By that he means locking in projects to export LNG only diverts or delays potential investment in alternative ways of producing energy, such as wind, solar, hydro and nuclear.

“We hear this with oil, that Canadian oil is ethical oil,” he said. “It’s almost as if we mix a little bit of maple syrup with it and then we say there’s this special Canadian flavour. But with LNG and oil and whatnot, it’s not like wine — it’s not like people want a certain vintage. Yeah, carbon intensity matters but ultimately price is what drives it.”

LNG Canada did not respond to The Narwhal’s follow-up questions prior to publication.

Under the scenarios developed by the federal regulator, global economics are the lynchpin for how and when declines in B.C.’s gas sector will play out.

“Producers are highly influenced by the price of natural gas worldwide,” Charlebois said. “In the two net-zero scenarios, we used the global price of the International Energy Agency, which sees a downward trend pretty significantly through the projection period.”

Marla Orenstein, natural resources director with Canada West Foundation, a policy think-tank based in Calgary, Alta., said she’s not sure the federal regulator’s numbers hold up in the real world.

“I’m not convinced … that those estimates of what demand would be for Canadian LNG are accurate,” she told The Narwhal in an interview. “There’s a sort of bifurcation of response from different countries to LNG, depending on where they are economically.”

She said when Russia invaded Ukraine, prompting a European energy crisis as gas supplies were suddenly cut off, it prompted a wide conversation about energy security. Countries like Japan and Germany want a “secure supply from a diverse group of suppliers,” she said.

But the International Energy Agency and others, such as British multinational oil and gas giant, BP, say the war is spurring calls for greener energy.

In BP’s 2023 energy outlook, Spencer Dale, the company’s chief economist, said the repercussions of Russia’s actions are “likely to accelerate the pace of the energy transition.” He noted countries are looking to “bolster their energy security by reducing their dependency on imported energy — dominated by fossil fuels — and instead have access to more domestically produced energy — much of which is likely to come from renewables and other non-fossil energy sources.”

The Canadian Association of Petroleum Producers declined an interview request but told The Narwhal in a written statement the impacts of world events, such as the COVID-19 pandemic and the conflict in eastern Europe, “can rapidly alter the trajectories of energy trade and production.”

“What we know today is global demand for oil and natural gas is rising and Canada has an important role to play in ensuring a secure supply of reliable energy is available to Canadians as well as our trading partners and allies around the world,” Lisa Baiton, president of the industry group, told The Narwhal in an email.

Baiton did not provide any specific comments about the implications of the net-zero scenarios, saying only that it is “important to look at long-term scenarios and consider a range of credible sources to inform pragmatic pathways with the goal of lowering emissions and protecting our economic prosperity.”

Under the “current measures” scenario, where Canada and other countries fail to meet climate targets, LNG exports steadily increase over the coming decades, with production rising to 21 billion cubic feet per day.

In all three scenarios, the regulator said most of Canada’s gas will be extracted from vast underground shale deposits in northeast B.C. But access to the gas is constrained by agreements between the provincial government and some Treaty 8 nations. Following a historic B.C. Supreme Court win in 2021, Blueberry River First Nations signed an agreement with B.C. that, among many other things, restricts new oil and gas development on the 38,300-square-kilometre territory.

The federal analysis did not examine potential implications of the agreements but it flagged uncertainties, noting a rapid decline in LNG exports could come sooner than 2044 or they could continue past 2050. “Small changes to economics can alter which projects are built and when, or when projects might shut down,” the report’s authors wrote.

The International Institute for Sustainable Development recently warned Canada should not wait for global markets to dictate whether fossil fuel projects proceed or when they start winding down operations.

“If oil and gas infrastructure and investments are rendered uneconomic — that is, are stranded — by falling demand, the effects will go beyond the people employed in the sector to risk the destruction of a vast amount of national wealth, to the detriment of all Canadians,” the institute wrote in a recent report on managing the decline of domestic oil and gas production.

Green, with the David Suzuki Foundation, also worries about what would happen if the market drops out, rendering LNG Canada, Coastal GasLink and other developments uneconomical.

“My fear for the Indigenous nations in B.C.’s north is that there’s quite a risk of stranding assets on peoples’ territories,” he said. “And then there’ll be no money to decommission them.”

In the short term, at least, buyers appear to be lined up. Orenstein said the ambassadors of South Korea and Japan — two countries B.C. Premier David Eby visited in early June — gave introductory statements at a recent webinar presented by Canada West Foundation. She said those ambassadors told attendees their countries are ready and waiting.

“They want this stuff. If we can produce it, they will gobble it up.”

Under the federal regulator’s global net-zero scenario, demand for electricity skyrockets as oil and gas production tapers off.

“When we model the electricity demand for B.C., there is this incredible growth — 84 per cent from what we see today,” Charlebois said, noting the spike in demand modelled by the regulator includes electrifying LNG Canada’s first phase. Electrifying other facilities is outside of the scope of the scenarios, he added.

“Either more electricity would need to be produced — and at the margin what we see is a lot more wind, solar energy and also small modular reactors relying on nuclear energy,” he said. “If that cannot occur, then something else needs to give. It’s not for us to arbitrate what gives, but it’s rather to provide those two pathways for Canada to inform a conversation.”

The regulator’s analysis did not include a number of projects on the books in B.C. In the lower mainland, Fortis BC is working on plans to expand its Tilbury LNG facility. A few kilometres from where the LNG Canada facility is being built in Kitimat is Cedar LNG, a Haisla-led export project. Recently approved by the B.C. government, the liquefaction plant plans to use electricity supplied by BC Hydro to power its operations. And on nearby Nisga’a territory, a proposed floating liquefaction and export facility called Ksi Lisims is currently undergoing environmental assessment. It, too, is banking on a steady supply of electricity.

According to a recent Pembina Institute report, B.C. is facing an electricity shortfall if it powers the LNG sector with hydro.

“If only LNG Canada and Woodfibre LNG proceed, about 13 [terawatt-hours] of additional electricity will be required to electrify the terminal and upstream processes,” the report noted. “This is 2.5 times greater than what is generated by B.C.’s Site C hydroelectric dam.”

There are also a trio of pipelines previously approved by the B.C. government to transport gas to the Pacific coast.

Enbridge, which owns two of those pipelines and has a 30-per-cent stake in Woodfibre LNG, said it is diversifying its energy portfolio, including investing in wind, hydrogen-blending projects and ammonia production, and didn’t appear to be concerned about the future of its pipeline projects.

“In 2022, we announced our investment in Woodfibre LNG, and believe expanding global access to natural gas through liquefied natural gas (LNG) is a key part of reducing global emissions,” a spokesperson wrote in an email to The Narwhal. “To that end, we have two proposed natural gas transmission projects in B.C. that could support future LNG development. The Westcoast Gas Transmission Connector and Pacific Trail Pipeline could be used to provide natural gas to Asian markets and displace more carbon intensive forms of energy.”

But Enbridge’s bottom line will ultimately decide what happens. Whether or not those pipelines will be built hinges on what happens with global gas prices.

Green noted context is important to keep in mind. He said the regulator’s global net-zero scenario is one “where the world acts to avoid an even worse climate outcome than what we are already experiencing.”

“It shows that anything beyond [the first phase of] LNG Canada is an increasingly dubious prospect and such projects are at high risk of stranding before they break even,” he said. He added LNG Canada required “generous public financing, infrastructure provision and other concessions” to be economically viable.

“We built this plant and assumed it would be good for 40 years,” he said. “The world has shifted so fundamentally … from when the assumptions around LNG Canada were made, the assumptions that it was going to bring all these jobs and riches to the province. I just don’t think they’re going to materialize.”

Matt Simmons, Local Journalism Initiative Reporter, The Narwhal