Report: Greek Prime Minster Says “Time Has Come” to Restrict Cruise Ships

Greece is reported to be the latest popular tourist destination considering limits or restrictions on the number of cruise visitors to its popular destinations. In an interview with Bloomberg, Prime Minister Kyriakos Mitsotakis said they are thinking the restrictions could start next year causing shockwaves in the cruise industry and sending the price of cruise stocks tumbling after a Wall Street analyst also reported the pricing for cruises had soften in June.

Tourism is a major part of the Greek economy and Greek Island cruising started in the 1950s and has become one of the most popular destinations. Truist Securities writes that Greece saw cruise ship passenger arrivals jump 50 percent in 2023 mostly centered on the popular ports of Santorini and Mykonos. Cruises generally originate in Piraeus or outside Greece, stopping at the popular ports on trips ranging from a few days to a week or more. There is also a strong interisland ferry trade.

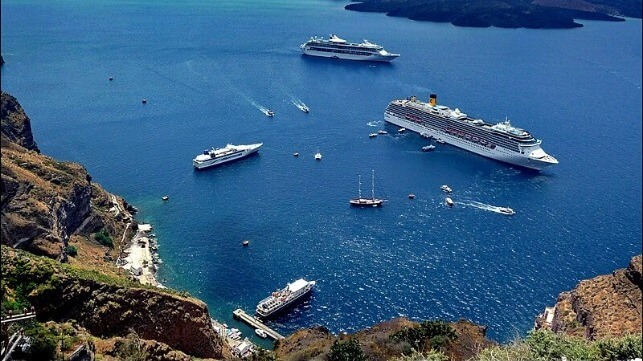

Bloomberg cites data from the Hellenic Ports Association reporting that 800 vessels called at Santorini in 2023 carrying 1.3 million visitors. They report that was up 17 percent over 2022. Many visitors to Santorini, where cruise ships must anchor and tender passengers to the volcanic island, report long waits. One of the most popular attractions requires taking a cable car up to the top of the crater with long lines to board the cable car. Santorini nearly a decade ago began to seek controls on cruise ships due to overcrowding and the ships have only gotten larger since then.

The second most popular destination is Mykonos, which is a frequent tourist destination in general. Bloomberg cites 749 cruise ship visits in 2023. They report that was up 23 percent.

Speaking to Bloomberg the Prime Minister speculated that the time has come to place restrictions on cruise ship visits to the most popular islands. He suggested it would start in 2025 and might take the form of restricting the number of berths or establishing a bidding process for cruise lines to gain slots. Bidding already takes place in other destinations such as Glacier Bay National Park in Alaska which restricts the number of cruise ships permitted to enter the park each day.

“While somewhat vague, the news from Greece is clearly not a positive,” writes analyst Patrick Scholes of Truist to their clients. However, he warns that it is “much too early to precisely financially quantify.” The team at Truist estimates that the major cruise lines have an exposure of between 5 and 14 percent to the Eastern Mediterranean.

The price of cruise line stocks however was off as much as 7.5 percent today after the Bloomberg story. Cruise lines have argued that they can stagger their ships’ arrival times and coordinate schedules not to bunch larger ships at individual ports. The lines have in the past due to geopolitical issues at times been forced to cancel cruises in the Eastern Mediterranean and move ships to other destinations. Also contributing to today's declines in stock prices was a report from Bank of America that found "cruise prices appearing modestly softer in June," raising fears that the industry can not maintain its strong advances in prices and bookings.

Greece joins a growing list of tourist destinations struggling with overtourism and problems ranging from crowded streets to complaints that the ports are overrun with cruise passengers attracting fewer people for the hotels and guesthouses. In Europe, Venice has shifted cruise ships away from the lagoon because of an outcry over damage to the historic buildings blamed on the large ships while cities from Amsterdam to Barcelona have taken steps to move the ships out of the city center. In the U.S., Juneau, Alaska just reached a voluntary agreement with the cruise industry to regulate the number of daily passengers starting in 2026, while destinations ranging from Bar Harbor, Maine to Key West, Florida have also sought to ban large cruise ships.

Top photo by Patano - CC BY-SA 3.0

Prosecutors Detain "Dirty" Cruise Ship Chartered to House Italian Police

A police union alleges that the vessel had "terrible sanitary conditions"

A cruise ship that was chartered to house thousands of security officers for this week's G7 summit has been detained by police over allegations of poor onboard hygiene.

The vessel Goddess of the Night (ex name Mykonos Magic) was scheduled to provide temporary lodging for about 2,000 police officers near Borgo Egnazia, a resort where G7 leaders will gather for a summit beginning Thursday. Officers and their union representatives complained that the conditions on board were unlivable, including broken heads, inoperable HVAC and leaking pipes. The secretary of the police union, Domenico Pianese, told local media that the ship "was in terrible sanitary conditions, with dirty and damaged accommodation, unusable toilets, dilapidated showers, flooded cabins."

The personnel who were stationed on board have been moved to other lodging locations.

While onboard deficiencies might be treated as a matter for port state control inspection in other circumstances, this vessel was chartered to a government agency, and the conditions affected law enforcement personnel. Local prosecutors in Brindisi are looking at the conditions of the lodging service provided, and they have issued an order for the vessel's detention.

According to La Stampa, the Central Operational Police Service and the Brindisi police station are investigating. The Brindisi police told Italian media that their investigative units found hygiene, health and accommodations shortcomings on board, and that the conditions are serious enough to hypothesize "the crime of fraud in public supplies."

Goddess of the Night (ex names Mykonos Magic, Costa Magica) is a 2004-built cruise ship with a capacity of 2,700 passengers. According to cruise industry media, the vessel's beneficial owner is Seajets, a Greek-Cypriot ferry operator based in Piraeus. The firm began acquiring and trading used cruise ships during the pandemic-era industry downturn, and reportedly purchased Goddess of the Night last year. As is standard in the industry, the registered owner is a holding company with a mailing address matching a third-party shipmanager.

The Goddess of the Night was reported to be in drydock in Turkey last month, preparing to enter service for adults-only startup line Neonyx Cruises. Travel-industry media have identified Neonyx as a Seajets-related enterprise.

Neonyx has advertised a series of cruises headlined by well-known DJ entertainers, with departures starting in July. The effects of the detention on the ship's schedule are not clear, and Seajets and Neonyx have not yet commented on the police unions' allegations.

Mein Schiff 7 Delivered as First Methanol-Ready Cruise Ship

The first cruise ship designed for operations on methanol and eventually green methanol was delivered on June 10 to Germany’s TUI Cruises. Named Mein Schiff 7 she also marks the first new ship since 2019 for the cruise line and the seventh ship in the Mein Schiff fleet to be built in Finland at what is today the Meyer Turku yard.

As the company explains it, for the commissioning of the Mein Schiff 7, all the currently possible technical equipment, such as tanks and pipe systems for methanol or green methanol propulsion, have been installed. However, a technical component for the methanol drive of four-stroke engines is not yet available and is not expected to be delivered until sometime in 2025. The cruise line currently plans for the Mein Schiff 7 to be equipped and commissioned in 2026 so that it can be one of the first cruise ships to run on methanol.

Initially, the 115,000 gt cruise ship will be operated exclusively with low-emission marine diesel (sulfur content max. 0.1%). The line notes it is the first ship in their fleet to exclusively use this low-emission fuel and its environmental impact will be further enhanced with catalytic converters that will reduce nitrogen oxide emissions by approximately 75 percent. The ship is also equipped to use shore power connections.

"It is a special moment for us to receive this ship," said Wybcke Meier, CEO of TUI Cruises. “Ten years ago, we picked up our first Blu Motion class ship here in Turku. The Mein Schiff 3 was the first new build for TUI Cruises and by 2019 we had built a total of six ships.”

The Mein Schiff concept was launched as a partnership between German tour company TUI (Touristik Union International) and Royal Caribbean Group in 2009. It is marketed exclusively to German-speaking tourists. The brand was launched with cruise ships from Celebrity Cruises and started its newbuild program in 2011 with the Blu Motion concept, 97,000 gt cruise ships. They built four of the ships with STX Finland (later Meyer Turku) and then three enlarged ships, the last on order is Mein Schiff 7.

The company highlights several design changes to the ship versus her earlier sisters. This includes new stateroom categories including single occupancy staterooms. They are also introducing new specialty restaurants and other amenities for the passengers. Double occupancy is 2,896 passengers with approximately 1,000 crew. Registered in Malta, Mein Shiff 7 is 1.036 feet in length (315 meters).

The new ship is scheduled to enter service tomorrow, June 12, with a 2-night preview cruise, which is exactly two years to the day since construction began with the first steel cut. It will be cruising in Northern Europe and Scandinavia before moving to the Mediterranean for the winter months.

TUI looks to learn about methanol operations with Mein Schiff 7 but notes that a conversion is also an option for the future of its existing fleet. The company is also exploring other options as it is due to launch in 2025 its next new cruise ship Mein Schiff Relax (approximately 161,000 gt). Being built at Fincantieri in Italy the next ship will be LNG-fueled and the first of two on order for the cruise line.

Several other cruise lines have indicated interest in following the broader shipping industry into methanol. Meyer Group is also working with Disney Cruise Line which is completing the Global Dream cruise ship started at MV Werften for Genting Hong Kong. While Disney has not released details, they said the ship would be converted to methanol. Celebrity Cruises is also building a new ship in France and Wartsila is converting the engine to be tri-fuel including able to handle methanol. Norwegian Cruise Line working with Fincantieri also announced that the fifth and sixth ships of its Prima class would be designed for methanol, while the cruise line is also working with MAN to explore methanol conversions for its existing cruise ships.