BBC April 12, 2020

The US, like other countries, is grappling with shortages of medical supplies, but shies away from central directives

In a normal year Michael Rubin's athletic apparel factory in Pennsylvania would be ramping up for the start of baseball season, churning out team uniforms and clothing to sell to fans. Instead his company, Fanatics, has remade itself into a gown and mask manufacturer for hospitals facing shortages of protective gear as they fight the coronavirus.

Fanatics isn't alone. Thousands of companies across the US have responded to pleas for help from hospitals facing shortages of critical health supplies.

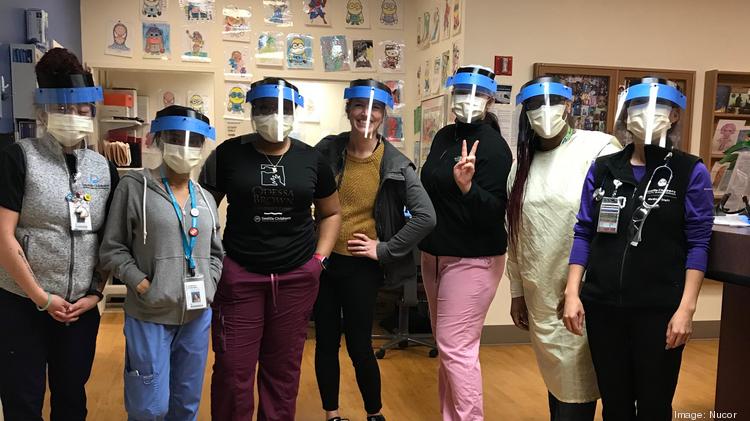

Clothing companies like Gap and Hanes are making gowns and scrubs. Ford and General Motors are repurposing fans and batteries, typically used in cars, to make ventilators. Boeing and Apple are making face shields. Luxury brands, distilleries - even state prisoners - are producing hand sanitiser.

"We felt it was our responsibility to help pitch in," says Mr Rubin. Firms responding in what he calls this "dire time of need" aren't necessarily going to profit from the enterprise but they are proving a point: The private sector is famously good at responding nimbly and quickly to changing demands.

Fanatics used baseball uniform material to make non-surgical masks

'Supply chain 101'

The shortages in the US are are not unique, nor is the response from the private sector.

In the UK, engineering firm Dyson has designed a new ventilator; in France, Chanel is contributing masks; in Germany, Volkswagen and other firms are manufacturing protective equipment.

But the White House has been notably hands-off when it comes to establishing any co-ordinated, centralised response, says Nada Sanders, professor of supply chain management at Northeastern University. This has led to a free-for-all, as local governments and hospitals competed to buy products or find donations, scam artists emerged, and prices skyrocketed.

The US has allowed "pure capitalism to serve as an incentive" says Dr Sanders.

"Companies want to step up to the plate and so many are. I really applaud them, but I also find it even more frustrating because I see the chaos."

What are ventilators and why are they important?

Coronavirus: New York warns of major medical shortages

Coronavirus: Can we 3D-print our way out of the PPE shortage?

In the European Union, the shortages were caused by inadequate reserves of equipment, as coronavirus cases surged and shipments from overseas were delayed. But in the US, which has a national stockpile of supplies, including badly-needed ventilators, a slow federal response has added to the problem, says Prashant Yadav, a senior fellow at the Center for Global Development and a professor at INSEAD.

"Outcomes are pretty bad in both [Europe and America], but in one place they don't have large resources in a stockpile. They didn't have a large manufacturing base," he says. "Our decision-making wasn't working right or our coordinating mechanisms weren't working right."

Converting factories to make basic products like sanitiser or masks isn't necessarily that difficult or expensive. Mr Rubin's factory shipped its first masks within three days and now produces about 10,000 daily.

But getting companies to start making machines like ventilators - which have dozens of parts sourced globally - is far more complex and requires government intervention, says Dr Sanders.

While some states, including California, have voluntarily sent existing ventilators to virus hotspots like New York, Dr Sanders says a national response is needed, to ensure there is a clear inventory of what's on hand and the ability to shift resources to the places that need it most.

"This is supply chain 101 ... it's not like it's really that hard," she says. "The lack of coordinated national response is really infuriating."

'A national system'

Under pressure to act, President Donald Trump has targeted some companies with orders to produce items in high demand and banned exports of medical supplies. Federal health officials also announced a $50m deal with General Motors to produce 30,000 ventilators.

But for weeks Mr Trump resisted using the full extent of his authority to compel firms to produce equipment and prioritise deliveries.

"We're a country not based on nationalising our business," he said last month. "Call a person over in Venezuela. Ask them, how did nationalisation of their businesses work out? Not too well. The concept of nationalising our business is not a good concept."

New York Senator Chuck Schumer, a leading Democrat, last week called on the president to appoint a national 'czar' to oversee distribution and production. "The hunting and pecking isn't working," he told reporters.

It is not clear that the president will change tack.

Luckily in some places the private sector efforts are coming through. St Luke's University Health Network, which worked with Fanatics to design its masks, now has about 30 days worth of protective gear on hand, says vice president Chad Brisendine. Contributions from non-traditional suppliers account for "a quarter or more" of that.

"Between the external, local, non-traditional suppliers, plus the donations, that really helped us," Mr Brisendine says.

But the Pennsylvania hospital system has still been forced to introduce new cleaning procedures so it can reuse masks and other equipment more intensively, he adds.

Mr Brisendine says he's worried the wider needs are so great, even a stronger federal response wouldn't resolve the problems his health network now faces.

"I just wonder how fast they can move," he says. "When you need it, you needed it yesterday."

• Food services company Aramark’s ARMK,