Bitcoin may just prove be an accelerating factor for the current global warming situation.

Bitcoin Is Viewed As Dirty Currency.

The problem is cryptocurrency mining 'farms', which are usually large spaces housing computers dedicated to mining the coins; sometimes, these farms will have thousands of computers all working simultaneously to increase profitability. This process requires an enormous amount of computing power and thus tends to consume immense amounts of energy. The result of this is that bitcoin-mining operations are constantly chasing cheap electricity. Cheap electricity can be found in China, which now accounts for more than 75% of bitcoin mining around the world. The problem with this is that coal and other fossil fuels are currently a major source of electricity worldwide, with two-thirds of all power plants globally burning fossil fuels for energy.

RELATED: Bill Gates Talks Synthetic Meat, COVID, & Climate Change In New Reddit AMA

It's More Than Just Energy Consumption

The high turnover of these specialized machines creates a lot of electronic waste, electronic products which have reached the end of their usefulness. ASICs serve no other purpose than to mine cryptocurrencies, so when they can no longer mine them profitably, they cease to serve a purpose. According to a new analysis by economists from the Dutch central bank and MIT, because of the high churn of these machines, a single bitcoin transaction creates the same amount of electronic waste as throwing away two iPhones. There were 253,000 transactions last month.

De Vries and Stoll write in the paper, “We estimate that the whole bitcoin network currently cycles through 30.7 metric kilotons of equipment per year. This number is comparable to the amount of small IT and telecommunication equipment waste produced by a country like the Netherlands.”

Countries Are Starting To Take Notice

In Malaysia, police seized and destroyed more than 1000 bitcoin mining rigs by crushing them with a steamroller after the miners had allegedly stolen almost $2 million worth of electricity to power their machines. The miners were charged with stealing energy.

A lot of Chinese mining operations that have been shuttered are relocating to neighboring Kazakhstan. The move might be short-lived, however, as a new law signed by the president will introduce extra taxes for crypto miners starting in 2022, making the country less attractive for miners.

Bitcoin mining producing tonnes of waste

Bitcoin mining produces electronic waste (e-waste) annually comparable to the small IT equipment waste of a place like the Netherlands, research shows.

Miners of the cryptocurrency each year produce 30,700 tonnes of e-waste, Alex de Vries and Christian Stoll estimate.

That averages 272g (9.5oz) per transaction, they say. By comparison, an iPhone 13 weighs 173g (6.1oz).

Miners earn money by creating new Bitcoins, but the computing used consumes large amounts of energy.

They audit Bitcoin transactions in exchange for an opportunity to acquire the digital currency.

Attention has been focused on the electricity this consumes - currently more than the Philippines - and the greenhouse gas pollution caused as a result.

But as the computers used for mining become obsolete, it also generates lots of e-waste.

The researchers estimate Bitcoin mining devices have an average lifespan of only 1.29 years.

As a result, the amount of e-waste produced is comparable to the "small IT and telecommunication equipment" waste of a country like the Netherlands researchers said - a category that includes mobile phones, personal computers, printers, and telephones.

The research is published in the journal Resources, Conservation & Recycling.

Efficiency drive

As electricity is a key cost for Bitcoin miners, they have sought out ever more efficient processors.

That has seen a move to highly specialised chips called Application-specific Integrated Circuits (ASICs).

But ASICs are so specialised that as they become obsolete, they cannot be "repurposed for another task or even another type of cryptocurrency mining algorithm", the researchers write.

But while the chips can't be reused, much of the weight of Bitcoin mining equipment is made up of components such as "metal casings and aluminium heat-sinks" which could be recycled.

Globally just over 17% of all e-waste is recycled. However, the number is probably less in some of the countries in which most miners are based, where in many cases regulations on e-waste are also poor.

Chip shortage

Many industries are struggling with a global chip shortage.

In addition to producing large amounts of e-waste the researchers argue that "rapidly cycling through millions of mining devices may disrupt the global supply chain of various other electronic devices".

They suggest that one solution to the problem of e-waste would be for Bitcoin to change the way transactions are verified, to a different less computing-intensive system.

Why Bitcoin uses more electricity than many countries

Cryptocurrencies have emerged as one of the most captivating, yet head-scratching, investments in the world. They soar in value. They crash. They’ll change the world, their fans claim, by displacing traditional currencies like the dollar, rupee or ruble. Some of them are named after dog memes.

And in the process of simply existing, cryptocurrencies like Bitcoin, one of the most popular, use astonishing amounts of electricity.

We’ll explain how that works in a minute. But first, consider this: The process of creating Bitcoin consumes around 96 terawatt-hours of electricity annually, more than is used by the Philippines, a nation of about 110 million.

That usage, which is close to half-a-percent of all the electricity consumed in the world, has increased about tenfold in just the past five years.

The Bitcoin network uses about the same amount of electricity as Washington state does in a year.

And more than one-third of what residential cooling in the United States uses up.

More than seven times as much electricity as all of Google’s global operations.

So why is it so energy intensive?

For a long time, money has been thought of as something you can hold in your hand — say, a dollar bill.

Currencies like these seem like such a simple, brilliant idea. A government prints some paper and guarantees its value. Then we swap it among ourselves for cars, candy bars and tube socks. We can give it to whomever we want, or even destroy it.

On the internet, things can get more complicated.

Traditional kinds of money, such as those created by the US or other governments, aren’t entirely free to be used any way you wish. Banks, credit-card networks and other middlemen can exercise control over who can use their financial networks and what they can be used for — often for good reason, to prevent money laundering and other nefarious activities. But that could also mean that if you transfer a big amount of money to someone, your bank will report it to the government even if the transfer is completely on the up-and-up.

So a group of freethinkers — or anarchists, depending on whom you ask — started to wonder: What if there was a way to remove controls like these?

In 2008, an unknown person or persons using the name Satoshi Nakamoto published a proposal to create a cashlike electronic payment system that would do exactly that: Cut out the middlemen. That’s the origin of Bitcoin.

Bitcoin users wouldn’t have to trust a third party — a bank, a government or whatever — Nakamoto said, because transactions would be managed by a decentralized network of Bitcoin users. In other words, no single person or entity could control it. All Bitcoin transactions would be openly accounted for in a public ledger that anyone could examine, and new bitcoins would be created as a reward to participants for helping to manage this vast, sprawling, computerized ledger. But the ultimate supply of bitcoins would be limited. The idea was that growing demand over time would give bitcoins their value.

This concept took a while to catch on.

But today, a single bitcoin is worth about $45,000 — although that could vary wildly by the time you read this — and no one can stop you from sending it to whomever you like. (Of course, if people were to be caught buying illegal drugs or orchestrating ransomware attacks, two of the many unsavory uses for which cryptocurrency has proved attractive, they would still be subject to the law of the land.)

However, as it happens, managing a digital currency of that value with no central authority takes a whole lot of computing power.

1. It starts with a transaction.

Let’s say you want to buy something and pay with Bitcoin. The first part is quick and easy: You would open an account with a Bitcoin exchange like Coinbase, which lets you purchase Bitcoin with dollars.

You now have a “digital wallet” with some Bitcoin in it. To spend it, you simply send Bitcoin into the digital wallet of the person you’re buying something from. Easy as that.

But that transaction, or really any exchange of Bitcoin, must first be validated by the Bitcoin network. In the simplest terms, this is the process by which the seller can be assured that the bitcoins he or she is receiving are real.

This gets to the very heart of the whole Bitcoin bookkeeping system: the maintenance of the vast Bitcoin public ledger. And this is where much of the electrical energy gets consumed.

2. A global guessing game begins.

All around the world, companies and individuals known as Bitcoin miners are competing to be the ones to validate transactions and enter them into the public ledger of all Bitcoin transactions. They basically play a guessing game, using powerful, and power-hungry, computers to try to beat out others. Because if they are successful, they’re rewarded with newly created Bitcoin, which of course is worth a lot of money.

This competition for newly created Bitcoin is called “mining.”

You can think of it like a lottery, or a game of dice. An article published by Braiins, a bitcoin mining company, provides a good analogy: Imagine you’re at a casino and everyone playing has a die with 500 sides. (More accurately, it would have billions of billions of sides, but that’s hard to draw.) The winner is the first person to roll a number under 10.

The more computer power you have, the more guesses you can make quickly. So, unlike at the casino, where you have just one die to roll at human speed, you can have many computers making many, many guesses every second.

The Bitcoin network is designed to make the guessing game more and more difficult as more miners participate, further putting a premium on speedy, power-hungry computers. Specifically, it’s designed so that it always takes an average of 10 minutes for someone to win a round. In the dice game analogy, if more people join the game and start winning faster, the game is recalibrated to make it harder. For example: You now have to roll a number under 4, or you have to roll exactly a 1.

That’s why Bitcoin miners now have warehouses packed with powerful computers, racing at top speed to guess big numbers and using tremendous quantities of energy in the process.

3. The winner reaps hundreds of thousands of dollars in new Bitcoin.

The winner of the guessing game validates a standard “block” of Bitcoin transactions, and is rewarded for doing so with 6.25 newly minted bitcoins, each worth about $45,000. So you can see why people might flock into mining.

Why such a complicated and expensive guessing game? That’s because simply recording the transactions in the ledger would be trivially easy. So the challenge is to ensure that only “trustworthy” computers do so.

A bad actor could wreak havoc on the system, stopping legitimate transfers or scamming people with fake Bitcoin transactions. But the way Bitcoin is designed means that a bad actor would need to win the majority of the guessing games to have majority power over the network, which would require a lot of money and a lot of electricity.

In Nakamoto’s system, it would make more economic sense for a hacker to spend the resources on mining Bitcoin and collecting the rewards, rather than on attacking the system itself.

This is how Bitcoin mining turns electricity into security. It’s also why the system wastes energy by design.

Bitcoin’s growing energy appetite

In the early days of Bitcoin, when it was less popular and worth little, anyone with a computer could easily mine at home. Not so much anymore.

Today you need highly specialized machines, a lot of money, a big space and enough cooling power to keep the constantly running hardware from overheating. That’s why mining now happens in giant data centers owned by companies or groups of people.

In fact, operations have consolidated so much that now, only seven mining groups own nearly 80% of all computing power on the network. (The aim behind “pooling” computing power like this is to distribute income more evenly so participants get $10 per day rather than several bitcoins every 10 years, for example.)

Mining happens all over the world, often wherever there’s an abundance of cheap energy. For years, much of the Bitcoin mining has been in China, although recently, the country has started cracking down. Researchers at the University of Cambridge who have been tracking Bitcoin mining said recently that China’s share of global Bitcoin mining had fallen to 46% in April from 75% in late 2019. During the same period, the United States’ share of mining grew to 16% from 4%.

Bitcoin mining means more than just emissions. Hardware piles up, too. Everyone wants the newest, fastest machinery, which causes high turnover and a new e-waste problem. Alex de Vries, a Paris-based economist, estimates that every year and a half or so, the computational power of mining hardware doubles, making older machines obsolete.

“Bitcoin miners are completely ignoring this issue, because they don’t have a solution,” said de Vries, who runs Digiconomist, a site that tracks the sustainability of cryptocurrencies. “These machines are just dumped.”

Could it be greener?

What if Bitcoin could be mined using more sources of renewable energy, like wind, solar or hydropower?

It’s tricky to figure out exactly how much of Bitcoin mining is powered by renewables because of the very nature of Bitcoin: a decentralized currency whose miners are largely anonymous.

Globally, estimates of Bitcoin’s use of renewables range from about 40% to almost 75%. But in general, experts say, using renewable energy to power Bitcoin mining means it won’t be available to power a home, a factory or an electric car.

A handful of miners are starting to experiment with harnessing excess natural gas from oil and gas drilling sites, but examples like that are still sparse and difficult to quantify. Also, that practice could eventually spur more drilling. Miners have also claimed to tap the surplus hydropower generated during the rainy season in places like southwest China. But if those miners operate through the dry season, they would primarily be drawing on fossil fuels.

“As far as we can tell, it’s mostly baseload fossil fuels that are still being used, but that varies seasonally, as well as country to country,” said Benjamin A. Jones, an assistant professor in economics at the University of New Mexico, whose research involves the environmental effect of cryptomining. “That’s why you get these wildly different estimates,” he said.

Could the way Bitcoin works be rewritten to use less energy? Some other minor cryptocurrencies have promoted an alternate bookkeeping system, where processing transactions is won not through computational labor but by proving ownership of enough coins. This would be more efficient. But it hasn’t been proved at scale, and isn’t likely to take hold with Bitcoin because, among other reasons, Bitcoin stakeholders have a powerful financial incentive not to change, since they have already invested so much in mining.

Some governments are as wary of Bitcoin as environmentalists are. If they were to limit mining, that could theoretically reduce the energy strain. But remember, this is a network designed to exist without middlemen. Places like China are already creating restrictions around mining, but miners are reportedly moving to coal-rich Kazakhstan and the cheap-but-troubled Texas electric grid.

For the foreseeable future, Bitcoin’s energy consumption is likely to remain volatile for as long as its price does.

Although Bitcoin mining might not involve pickaxes and hard hats, it’s not a purely digital abstraction, either: It is connected to the physical world of fossil fuels, power grids and emissions, and to the climate crisis we’re in today. What was imagined as a forward-thinking digital currency has already had real-world ramifications, and those continue to mount.

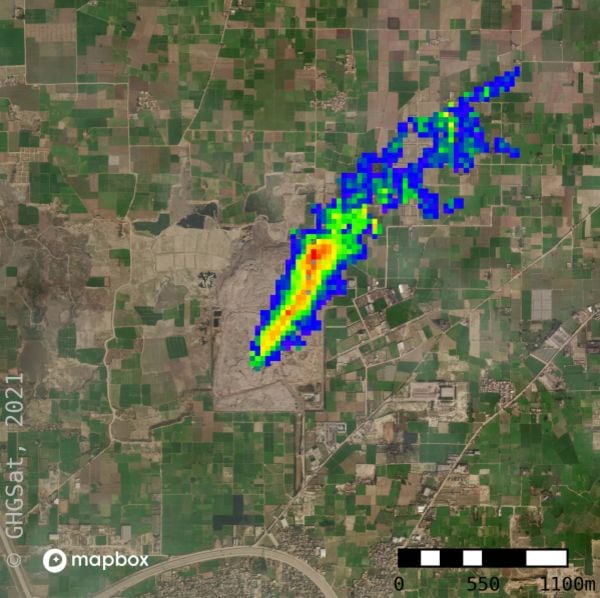

Methane plume over Lakhodair landfill in Lahore, Pakistan, spotted on July 1, 2021.(GHGSat/Bloomberg)

Methane plume over Lakhodair landfill in Lahore, Pakistan, spotted on July 1, 2021.(GHGSat/Bloomberg)