BHP to speed up Jansen potash mine as Ukraine war weighs on supplies

Cecilia Jamasmie | May 18, 2022 |

BHP plans accelerate Jansen Stage 1 first production into 2026. (Image courtesy of BHP.)

BHP’s (ASX: BHP) chief executive Mike Henry wants to gear up on the company’s $5.7 billion Jansen potash project in Canada as Russia’s invasion of Ukraine has caused major disruptions to global fertilizer supplies.

The ongoing war in Ukraine has left the world not only short of important grains but also fertilizers since neighbours Russia and Belarus account for almost 40% of global production.

Belarus state-owned potash miner Belaruskali set off alarm bells mid-February by declaring force majeure on its contracts. This shook up a market that was already contending with soaring prices.

Sanctions on Russia after invading Ukraine have made the situation worse.

BHP approved last year a $5.7 billion investment in the Jansen potash mine in northern Saskatchewan to bring it to production. The company had mulled a final decision on the asset for at least eight years, during which it spent about $4.5 billion laying the ground for the crop nutrient-producing project.

“[Supply-side disruption linked to the war in Ukraine] has positively reinforced the decision we’ve taken to enter potash,” Henry said at the Bank of America Metals and Mining conference this week. “We are making good progress and we’re looking at potential to accelerate Jansen Stage 1 first production into 2026.”

BHP had originally planned to kick off production at Jansen in 2027. The company, Henry noted, has also begun studies for a second phase of development.

BHP to start potash production at Jansen a year earlier than planned.

(Image courtesy of BHP.)

“BHP is trying to accelerate first tonnes at Jansen, but it still seems best case is first tonnes come late 2026 with a two-year ramp,” BMO Fertilizers and Chemicals analyst, Joel Jackson, said in a note to investors.

“We believe BHP needs to hire about 600 miners for Jansen with the labour per tonne deemed lower than [competitors] Nutrien and Mosaic’s incumbent mines as BHP expected to employ less equipment per tonne and other innovation,” Jackson noted.

Of the $5.7 billion investment, BHP had awarded roughly $1.4 billion in contracts so far and another $200 million since the company published half year results in February, which cover port infrastructure, underground mining systems and other shaft and surface construction activities.

Jansen is expected to produce around 4.2 million tonnes a year of potash during a first phase. Stage 2 would add an additional 4 million tonnes per year, at a capital intensity of between $800 and $900 per tonne, almost 30% lower than expected for Stage 1.

The cost reduction would be possible because phase two will be able to leverage the infrastructure built along with Stage 1, including the shafts, Henry said.

Quarter of global supply

Potash is seen by farmers as an attractive resource because of its use as fertilizer, which also boosts drought tolerance and improves crop quality.

BHP expects potash demand to increase by 15 million tonnes to roughly 105 million tonnes by 2040 or 1.5% to 3% a year, along with the global population and pressure to improve farming yields given limited land supply.

Jansen had the potential to produce 17 million tonnes a year under a four phased development. This would account for about 25% of current global potash demand.

“If we decide to bring on all four stages, and at prices just half of where they are today, we’d be generating around $4 billion to $5 billion of EBITDA [earnings before interest, depreciation, tax and amortisation] per year,” Henry said

“BHP is trying to accelerate first tonnes at Jansen, but it still seems best case is first tonnes come late 2026 with a two-year ramp,” BMO Fertilizers and Chemicals analyst, Joel Jackson, said in a note to investors.

“We believe BHP needs to hire about 600 miners for Jansen with the labour per tonne deemed lower than [competitors] Nutrien and Mosaic’s incumbent mines as BHP expected to employ less equipment per tonne and other innovation,” Jackson noted.

Of the $5.7 billion investment, BHP had awarded roughly $1.4 billion in contracts so far and another $200 million since the company published half year results in February, which cover port infrastructure, underground mining systems and other shaft and surface construction activities.

Jansen is expected to produce around 4.2 million tonnes a year of potash during a first phase. Stage 2 would add an additional 4 million tonnes per year, at a capital intensity of between $800 and $900 per tonne, almost 30% lower than expected for Stage 1.

The cost reduction would be possible because phase two will be able to leverage the infrastructure built along with Stage 1, including the shafts, Henry said.

Quarter of global supply

Potash is seen by farmers as an attractive resource because of its use as fertilizer, which also boosts drought tolerance and improves crop quality.

BHP expects potash demand to increase by 15 million tonnes to roughly 105 million tonnes by 2040 or 1.5% to 3% a year, along with the global population and pressure to improve farming yields given limited land supply.

Jansen had the potential to produce 17 million tonnes a year under a four phased development. This would account for about 25% of current global potash demand.

“If we decide to bring on all four stages, and at prices just half of where they are today, we’d be generating around $4 billion to $5 billion of EBITDA [earnings before interest, depreciation, tax and amortisation] per year,” Henry said

.

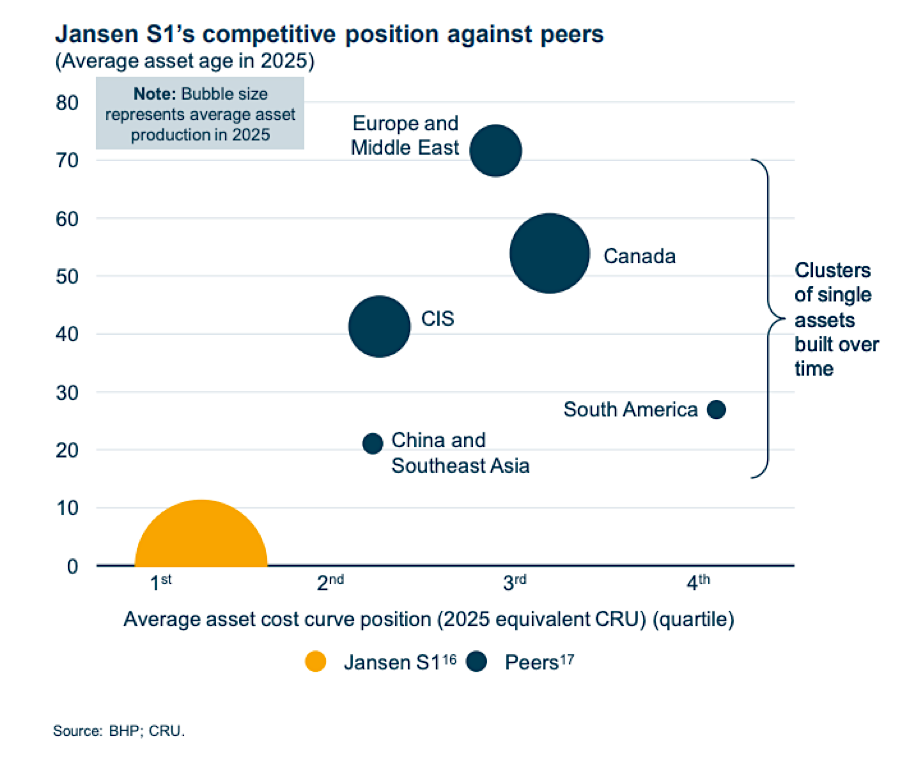

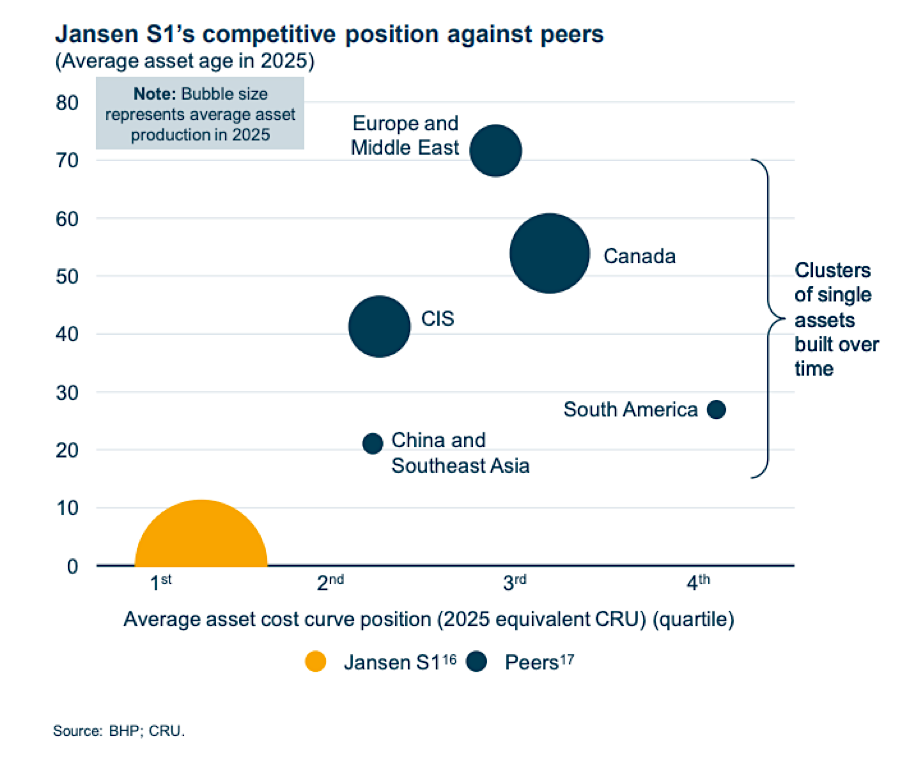

Taken from BHP’s presentation at BMO Farm to Market Conference.

This compares to a five-year average of $3 billion a year from the miner’s petroleum business.

“Realistically, BHP has shown a path to 16 million tonnes of potash capacity for well over a decade, and there seems much in flux still how the phases would come,” BMO Jackson wrote.

BHP had tried to tap into the fertilizers market for some time. In 2010, it unsuccessfully bid $38.6 billion for Potash Corp. of Saskatchewan, which in 2018 merged with Agrium Inc. to form Nutrien (TSE, NYSE: NTR).

Given the current political climate, as well as the continuing effects of the covid-19 pandemic worldwide, BHP is expecting the current supply chain issues in the mining sector to take up to three years to resolve.

This compares to a five-year average of $3 billion a year from the miner’s petroleum business.

“Realistically, BHP has shown a path to 16 million tonnes of potash capacity for well over a decade, and there seems much in flux still how the phases would come,” BMO Jackson wrote.

BHP had tried to tap into the fertilizers market for some time. In 2010, it unsuccessfully bid $38.6 billion for Potash Corp. of Saskatchewan, which in 2018 merged with Agrium Inc. to form Nutrien (TSE, NYSE: NTR).

Given the current political climate, as well as the continuing effects of the covid-19 pandemic worldwide, BHP is expecting the current supply chain issues in the mining sector to take up to three years to resolve.

BHP CEO says supply disruptions may last years; could speed up Jansen project

Reuters | May 17, 2022

BHP CEO Mike Henry.

Reuters | May 17, 2022

BHP CEO Mike Henry.

(Screenshot from Sky News Australia | YouTube)

Supply chain disruptions in the mining sector could take up to three years to resolve, the chief executive of the world’s largest listed miner BHP Group said on Tuesday.

Mike Henry also said that the Anglo-Australian miner may accelerate its Jansen potash project in Canada by a year, as Russia’s invasion of Ukraine has tightened supplies.

“Both Ukraine and covid-19 have led to lowered expectations for Chinese and global GDP growth in the near term,” Henry said at the Bank of America Global Metals, Mining & Steel Conference.

“We also expect that the current supply chain disruptions may also take 2-3 years to resolve,” he added.

Henry said he expected some economic growth in China to spill over into next year.

“We expect a degree of catch-up when lockdowns do ease,” he added.

In a wide-ranging speech, Henry said the company’s decision to invest in the Jansen project will bring greater cash flow stability and returns resilience.

The fundamentals for potash remain strong and were reinforced by supply-side disruption linked to the war in Ukraine, whose neighbours Russia and Belarus account for almost 40% of global production.

“This has positively reinforced the decision we’ve taken to enter potash,” Henry said. “So we are making good progress and we’re looking at potential to accelerate Jansen Stage 1 first production into 2026.”

The company has also begun studies for Stage 2 of the project, he said.

As global miners push into the metals needed for the green energy transition, Henry said BHP continues to favour copper and nickel over lithium, which is used to make electric vehicle batteries.

“It is something that we keep a watching brief over but if you look at the amount of lithium out there, it’s significant, so we don’t see a real long-time constraint in terms of resource,” he said.

“We believe there is more to do in copper and nickel where we see better cost curve shape.”

BHP announced a record dividend payout in February after reporting estimate-beating first-half profits, helped by higher commodity prices, despite a cutback in demand from top metals consumer China.

The miner, however, recorded lower estimates for iron ore production for the March quarter as a pandemic-related labour crunch weighed on efforts to boost output.

(By Praveen Menon and Clara Denina; Editing by Bernadette Baum and Barbara Lewis)

Supply chain disruptions in the mining sector could take up to three years to resolve, the chief executive of the world’s largest listed miner BHP Group said on Tuesday.

Mike Henry also said that the Anglo-Australian miner may accelerate its Jansen potash project in Canada by a year, as Russia’s invasion of Ukraine has tightened supplies.

“Both Ukraine and covid-19 have led to lowered expectations for Chinese and global GDP growth in the near term,” Henry said at the Bank of America Global Metals, Mining & Steel Conference.

“We also expect that the current supply chain disruptions may also take 2-3 years to resolve,” he added.

Henry said he expected some economic growth in China to spill over into next year.

“We expect a degree of catch-up when lockdowns do ease,” he added.

In a wide-ranging speech, Henry said the company’s decision to invest in the Jansen project will bring greater cash flow stability and returns resilience.

The fundamentals for potash remain strong and were reinforced by supply-side disruption linked to the war in Ukraine, whose neighbours Russia and Belarus account for almost 40% of global production.

“This has positively reinforced the decision we’ve taken to enter potash,” Henry said. “So we are making good progress and we’re looking at potential to accelerate Jansen Stage 1 first production into 2026.”

The company has also begun studies for Stage 2 of the project, he said.

As global miners push into the metals needed for the green energy transition, Henry said BHP continues to favour copper and nickel over lithium, which is used to make electric vehicle batteries.

“It is something that we keep a watching brief over but if you look at the amount of lithium out there, it’s significant, so we don’t see a real long-time constraint in terms of resource,” he said.

“We believe there is more to do in copper and nickel where we see better cost curve shape.”

BHP announced a record dividend payout in February after reporting estimate-beating first-half profits, helped by higher commodity prices, despite a cutback in demand from top metals consumer China.

The miner, however, recorded lower estimates for iron ore production for the March quarter as a pandemic-related labour crunch weighed on efforts to boost output.

(By Praveen Menon and Clara Denina; Editing by Bernadette Baum and Barbara Lewis)

No comments:

Post a Comment