Staff Writer | May 18, 2022

Autonomous trucks at West Angelas mine.

(Image: Christian Sprogoe Photography | Rio Tinto.)

The number of autonomous haul trucks in operation globally reached 1,068 by May 2022, representing an annual increase of 39%, according to figures tallied by GlobalData. The UK-based data analytics firm also expects this total to exceed 1,800 (a 70% increase on current levels) by the end of 2025.

The major additions this month came from BHP, which has plans to automate up to 500 haul trucks across its Western Australia iron ore and Queensland coal mines through to 2023. Both Canadian Natural Resources and Suncor Energy also plan to add over 100 autonomous trucks to their oil sands mines before the end of 2025.

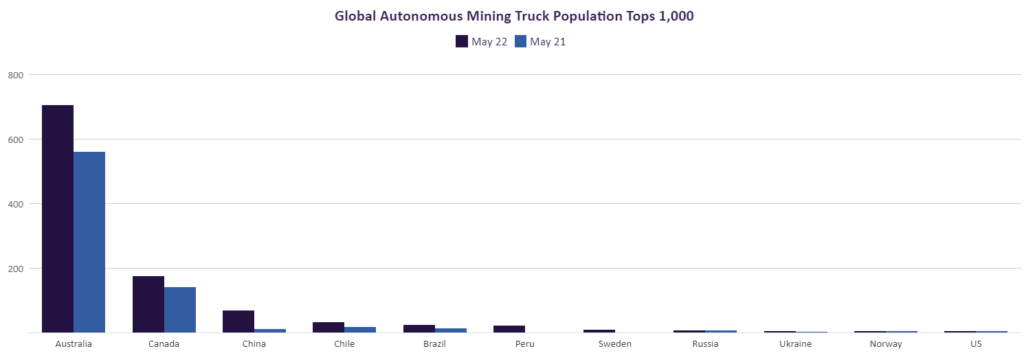

By country, the largest population of autonomous trucks is in Australia with 706, up from 561 in 2021 and 381 two years earlier. It is followed by Canada with 177, up from 143 in 2021, China with 69, and Chile with 33. Autonomous haul trucks are present at 25 mines in Australia alone, compared with 19 across the rest of the world.

The number of autonomous haul trucks in operation globally reached 1,068 by May 2022, representing an annual increase of 39%, according to figures tallied by GlobalData. The UK-based data analytics firm also expects this total to exceed 1,800 (a 70% increase on current levels) by the end of 2025.

The major additions this month came from BHP, which has plans to automate up to 500 haul trucks across its Western Australia iron ore and Queensland coal mines through to 2023. Both Canadian Natural Resources and Suncor Energy also plan to add over 100 autonomous trucks to their oil sands mines before the end of 2025.

By country, the largest population of autonomous trucks is in Australia with 706, up from 561 in 2021 and 381 two years earlier. It is followed by Canada with 177, up from 143 in 2021, China with 69, and Chile with 33. Autonomous haul trucks are present at 25 mines in Australia alone, compared with 19 across the rest of the world.

Credit: GlobalData

Company wise, BHP currently accounts for the largest number of autonomous trucks in operation with 300, followed by Fortescue Metals Group with 193 trucks and Rio Tinto with 187 trucks. BHP’s numbers include 95 at the Goonyella Riverside mine and have been boosted by its roll out of a fleet of 34 trucks at the Daunia Mine, where the mine’s entire truck fleet is now autonomous, and 42 Komatsu 930E-5 ultra- class haul trucks at its South Flank iron ore mine in the Pilbara region of Western Australia.

Meanwhile, Anglo American’s first fleet of autonomous mining trucks has been deployed at its Quellaveco copper project. At the moment, there are 22 fully autonomous trucks on site, with plans for a full fleet of 27 automated trucks by the second half of 2022.

Caterpillar and Komatsu are the two main suppliers of autonomous vehicles, accounting for 86.5% of the trucks tracked by the Mining Intelligence Center, with the 793F and 930E the most popular models for the two OEMs respectively.

Company wise, BHP currently accounts for the largest number of autonomous trucks in operation with 300, followed by Fortescue Metals Group with 193 trucks and Rio Tinto with 187 trucks. BHP’s numbers include 95 at the Goonyella Riverside mine and have been boosted by its roll out of a fleet of 34 trucks at the Daunia Mine, where the mine’s entire truck fleet is now autonomous, and 42 Komatsu 930E-5 ultra- class haul trucks at its South Flank iron ore mine in the Pilbara region of Western Australia.

Meanwhile, Anglo American’s first fleet of autonomous mining trucks has been deployed at its Quellaveco copper project. At the moment, there are 22 fully autonomous trucks on site, with plans for a full fleet of 27 automated trucks by the second half of 2022.

Caterpillar and Komatsu are the two main suppliers of autonomous vehicles, accounting for 86.5% of the trucks tracked by the Mining Intelligence Center, with the 793F and 930E the most popular models for the two OEMs respectively.

No comments:

Post a Comment