The global shipping industry is recording a continuing decline in large vessel losses despite the sector facing growing risks. Global insurer Allianz released its Safety and Shipping Review 2024 which shows shipping losses hit an all-time low, maintaining a trend that has been developing in recent years.

The review contends that despite the global fleet grappling with growing volatility and uncertainties from war and geopolitical events, climate change, and the resurgence of piracy among other risks, the sector lost just 26 large ships in 2023. This represented a decline of more than one-third year-on-year and by 70 percent over the past decade. In 2022 and 2021, a total of 41 and 59 losses were recorded respectively while 729 ships have been lost over the past decade.

Allianz highlights the decline in losses is taking place in an increasingly dangerous environment. The shipping industry is confronting a broad range of issues, including the conflicts in Gaza and Ukraine, the re-emergence of Somali piracy after a long lull, climate change instigated drought, shift towards even larger vessels due to decarbonization pressures. The challenge is that these issues are fast evolving changing the operating environment for shipping companies.

“The speed and extent of the way the industry’s risk profile is changing is unprecedented in modern times,” said Captain Rahul Khanna, Allianz Commercial Global Head of Marine Risk Consulting.

The 2024 review shows that Southeast Asia remains the global loss hotspot. The South China, Indochina, Indonesia, and the Philippines maritime region accounted for almost a third of vessels lost last year, eight in total. Over the past decade, 184 large ships have been lost in the region. The East Mediterranean and Black Sea regions ranked second with six losses in 2023.

The review highlights that cargo ships accounted for over 60 percent of vessels lost globally during the year. Foundering was the main cause of the losses, accounting for 50 percent, of all vessel casualties. Extreme weather was reported as being a factor in at least eight vessel losses around the world in 2023, with the final total likely higher.

The trend of declining losses also carried over into the number of total incidents in 2023. Allianz calculates that globally, the number of incidents declined slightly from 3,036 to 2,951 in 2023. The British Isles had the highest number of incidents at 695.

Allianz continues to spotlight fires aboard vessels, a perennial concern of the shipping industry. The fact that fire remains a key safety issue on larger vessels given the potential threat to life, the scale of the damage, and as a result, the associated costs can be severe. Allianz says the constant high numbers of fire incidents remain a major concern. In 2023, 205 fire incidents were reported, the second-highest total for a decade after 2022. Over the past five years, 55 losses have been caused by fires.

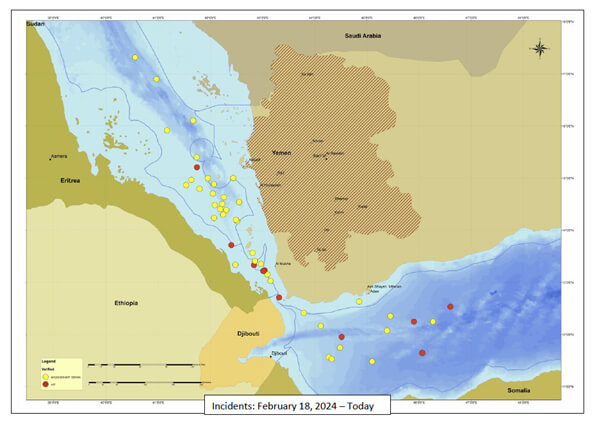

In the review, Allianz highlights a picture of the current dangers facing global shipping. The conflict in Gaza is a case in point of how global shipping has become vulnerable to proxy wars, disputes, and geopolitical events. They point out that more than 100 ships have been targeted in the Red Sea alone by Houthi militants.

Russia’s invasion of Ukraine, a war that is now in its third year, has also resulted in a significant increase in the “shadow fleet” of tankers being used to transport Russian oil. Allianz projects that in an effort to evade sanctions, the size of the dark fleet has ballooned to between 600 and 1,400 vessels. Considering that the dark fleet consists of mostly older, often poorly maintained vessels that operate outside international regulation, and often without proper insurance, their high number presents serious environmental and safety risks Allianz cautions.

“Both the war in Ukraine and the Red Sea attacks have also revealed the increasing threat to commercial shipping posed by new technology, such as drones, which are relatively cheap and easy to make, and difficult to defend against without a large naval presence,” noted Khanna.

While external factors continue to cause vulnerabilities to the global fleet, the pressure to decarbonize is also bringing about challenges. This is because the industry needs to develop infrastructure to support vessels using alternative fuels, such as bunkering and maintenance. This comes with potential safety issues considering that terminal operators and vessels’ crew face the prospects of handling alternative fuels that can be toxic or highly explosive.