CGTN interview: Bolivian President Luis Arce discusses failed coup attempt

Dan Collyns

@yachay_dc

Published June 29, 2024

It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Investigation after Ryanair Boeing 737 plunges 2,000ft in 17 seconds reaching 321mph

A Ryanair Boeing 737-Max airliner is under investigation after it descended at high speed on approach to Stansted Airport last year.

Flight FR1269 dived at 321mph after a two-hour journey from Klagenfurt, Austria to London on 4 December 2023.

According to flight data, the Boeing 737-Max made a steady descent to 2,350ft to prepare for landing in light rain at Stansted, but aborted the approach to climb for a go-around.

Brendan Murray, Bloomberg News

, Bloomberg

(Bloomberg) -- The two largest golf cart producers in the US are asking for relief from an existential hazard: a flood of Chinese imports.

Club Car LLC and Textron Specialized Vehicles Inc., both based near Augusta, Georgia, asked the Biden administration this week to slap a 100% tariff on golf carts and other low-speed, often battery-powered personal vehicles made in China — putting them on par with the US tariff on regular Chinese electric automobiles.

“Chinese import volumes have rapidly increased, taking greater consumer vehicle market share while using price benefits from Chinese government subsidies to drive their advantage,” Club Car President and CEO Mark Wagner said in an emailed statement Friday. “We had to take action.”

US imports of Chinese golf carts and other recreational buggies have increased sixfold since 2020, partly because they’re shipped under a product classification where the tariff is lower than those coded as normal-sized EVs. The Chinese carts often avoid higher levies by crossing the border at the lower tariff rate and then undergoing modifications in the US, according to the American companies’ attorneys.

As a result, the golf carts and similar vehicles “are able to skirt the proposed increased duties on electric vehicles” announced by the Biden administration in May, according to a letter filed this week with the US Trade Representative in Washington.

The skirmish between the world’s largest economies is narrow, but it illustrates the scores of loopholes, workarounds, unintended consequences and legal quandaries that accompany the imposition of tariffs across a swath of the economy.

Comment Deadline

Friday was the deadline for public comment on USTR’s so-called 301 case, under which tariffs on Chinese goods are justified.

The filing from Club Car and Textron, which makes E-Z-GO and Cushman carts, was among hundreds of other pleas for either tariff protection or relief posted during USTR’s comment window. The two companies made their case jointly under a group called the American Personal Transportation Vehicle Manufacturers Coalition.

According to the filing, imports of Chinese golf carts and another tariff classification for similar products called “specially designated vehicles” totaled $916 million last year, up from $148 million in 2020.

Club Car and Textron’s competitors in China have “substantially and systematically undersold domestically produced” vehicles, “resulting in a deterioration in the domestic industry’s performance and a sharp decline in the US industry’s production, capacity utilization, shipments, employment, and financial performance in 2024,” according to the June 25 letter to USTR from the Wiley law firm in Washington.

Their outreach to USTR follows a related case filed with the US Commerce Department and the US International Trade Commission, which alleged dumping of Chinese golf carts and sought relief in the form of anti-dumping and countervailing duties.

Robert DeFrancesco, a partner in Wiley’s international trade practice, said the process in that case will take about a year.

--With assistance from Chris Miller.

©2024 Bloomberg L.P.

Chinese automakers retain grip over

Southeast Asia's booming electric car

market

Space is a tough place filled with strong radiation. Spacecraft and satellite manufacturers need to use materials that can overcome harsh conditions.

In a paper published in January 2024, Ahmad Kirmani from the Rochester Institute of Technology shared with astronomy.com that his team of materials researchers had found that a new semiconductor material, called ‘metal-halide perovskite’—a material discovered back in 1839 and commonly found in Earth’s crust—can actually repair itself after being damaged by radiation.

From the surface, Earth’s crust extends about 5-70 kilometres into the interiors. It covers the entire planet’s surface. The crust is rich in such minerals as silicon, aluminium and oxygen. Temperatures range from cool at the surface to about 500°C-1,000°C in the deepest parts.

Metal-halide perovskites are effective in absorbing sunlight and converting it into electricity. This makes them a promising option for solar panels in space, which could power satellites or future space habitats. Scientists produce perovskites as inks, which they then apply to glass or plastic surfaces. This process creates thin, film-like devices that are both lightweight and flexible.

Amazingly, these thin-film solar cells work just as well as regular silicon solar cells in lab tests, despite being nearly 100 times thinner than traditional ones. However, these thin films can break down when they come into contact with moisture or oxygen. Scientists and companies are now trying to solve these stability problems to make them suitable for use on Earth.

To see how they would perform in space, a technical team created a radiation test. Perovskite solar cells were exposed to both low- and high-energy protons and a unique property was discovered. The high-energy protons repaired the damage caused by the low-energy protons, enabling the device to recover and keep working. Traditional and conventional semiconductors used in space electronics do not have this self-healing ability.

The technical team was astonished by the discovery. How is it possible for a material that breaks down on exposure to moisture and oxygen not only withstand the powerful radiation of space, but also self-repair under conditions that typically damage conventional silicon semiconductors?

The team’s research highlights an interesting property of perovskites—their ability to withstand damage and defects. These crystals belong to a category of soft materials, allowing their atoms to shift into various vibrational states, which scientists refer to as ‘vibrational modes’.

Perovskite’s atoms are normally formed into a lattice structure. However, radiation can displace these atoms, causing damage to the material. The vibrations within the material might help realign the atoms, although the technical team is still uncertain about the exact mechanism behind this process.

The research suggests that soft materials could be particularly useful in harsh environments, such as those found in space. Radiation is just one of the many challenges that materials face in space. Scientists are still unsure how perovskites will perform when subjected to vacuum conditions, extreme temperature changes and radiation—all at the same time. Temperature might influence the healing behaviour observed by researchers, but more studies are necessary to understand its exact role.

These findings indicate that soft materials could help scientists create technology that functions well in extreme conditions. Scientists now want to research what role vibrations play in enhancing the self-healing abilities of these materials.

Scientists believe that, in the next 10 years, the number of satellites launched into near-Earth orbit will grow rapidly. Additionally, such space agencies as NASA plan to set up bases on the Moon. Materials that can withstand extreme radiation and repair themselves would be a game-changer.

Researchers estimate that sending just a few pounds of perovskite materials into space could produce up to 10 million watts of power. Currently, it costs about $4,000 (INR 3.3 lakh) per kilogram to launch materials into space, so using efficient materials is crucial.

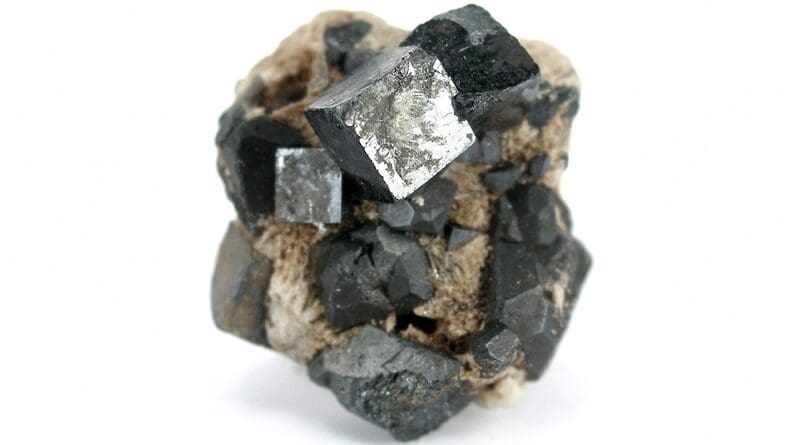

ScreenshotCrystals of perovskite on matrix. Photo Credit: Rob Lavinsky, iRocks.com, Wikipedia Commons

Girish Linganna is a Defence, Aerospace & Political Analyst based in Bengaluru. He is also Director of ADD Engineering Components, India, Pvt. Ltd, a subsidiary of ADD Engineering GmbH, Germany. You can reach him at: girishlinganna@gmail.com

The post-World War II era witnessed the emergence of a complex global order characterised by a strong emphasis on peace, security, sustained human development, and international cooperation. The United States, Russia, France, China, and the United Kingdom serve as permanent members of the United Nations Security Council (UNSC), holding considerable sway and bearing a distinctive obligation to uphold international peace and security. This essay aims to explore the multifaceted responsibilities entrusted to these major powers. Specifically, it examines their roles in diplomatic leadership, arms control, conflict resolution, support for international institutions, peacekeeping contributions, humanitarian aid, non-proliferation efforts, promotion of human rights and stability, economic and environmental protection, counter-terrorism, and transparency and trust-building.

Diplomatic leadership is a crucial responsibility for these five nations. Through active engagement in international diplomacy, they possess the capacity to utilize their influence to prevent conflicts and peacefully facilitate resolutions. The ability to mediate and negotiate settlements is particularly important in deescalating tensions before they escalate into full-scale conflicts. Notable examples include the United States’ involvement in the Camp David Accords and China’s recent mediation efforts in the Korean Peninsula. Without proactive diplomatic engagement, numerous conflicts could spiral out of control, leading to devastating consequences for global stability and security.

The threat posed by nuclear and other weapons of mass destruction necessitates robust efforts in arms control and disarmament. Major powers must lead by example, adhering to and advocating for treaties such as the Treaty on the Non-Proliferation of Nuclear Weapons (NPT). An excellent example of bilateral efforts to reduce nuclear arsenals and promote global security is the New START Treaty between the USA and Russia. By committing to arms control, these nations can mitigate the risks of catastrophic warfare and establish standards for other countries to follow. This, in turn, contributes to global disarmament and non-proliferation initiatives. The ability to mediate conflicts plays a crucial role in maintaining global peace. These nations often act as intermediaries, facilitating dialogue between conflicting parties. France’s involvement in the Normandy Format talks regarding the Ukraine crisis and the UK’s role in the Good Friday Agreement are notable instances of successful mediation. Effective conflict mediation not only resolves disputes immediately but also fosters long-term stability by addressing underlying issues and promoting reconciliation among conflicting parties.

The support of international institutions, such as the United Nations, is essential for establishing and maintaining a stable world order. The five countries with permanent seats on the United Nations Security Council (UNSC) play a crucial role in reinforcing and upholding the mandates of these institutions. Their financial and political contributions are essential for the effective functioning of the United Nations and other international bodies. Without their support, these institutions would face significant challenges in securing necessary resources and maintaining legitimacy to effectively carry out their missions.

Peacekeeping missions play a vital role in ensuring peace in conflict-affected areas. The financial and logistical support that personnel from various nations provide to United Nations peacekeeping operations is essential. The growing participation of China in UN peacekeeping missions, as well as the longstanding commitment of the United Kingdom in Cyprus, are prime examples of their unwavering dedication to these endeavours. Through their involvement in peacekeeping, these countries contribute to the stabilization of regions, the protection of civilians, and the establishment of conditions that foster enduring peace.

Humanitarian aid is of utmost importance in promptly addressing the immediate needs of populations affected by conflicts and natural disasters. The response to humanitarian crises, such as the Syrian refugee crisis and the aftermath of the 2010 Haiti earthquake, highlights the significance of swift and substantial support from nations. Through humanitarian aid, suffering is alleviated and goodwill is fostered, ultimately enhancing global stability and security.

Preventing the proliferation of weapons of mass destruction is a fundamental responsibility. Non-proliferation treaties and initiatives empower nations to work towards ensuring that these weapons do not fall into the wrong hands and spread to unstable regions. The efforts to secure nuclear materials, as exemplified by initiatives in the Nuclear Security Summits, demonstrate the dedication of these nations to fulfilling this responsibility. By prioritizing non-proliferation, these countries mitigate the risk of nuclear terrorism and other catastrophic threats. Promoting and protecting human rights worldwide is a crucial responsibility that all nations must fulfil. They should champion human rights and use their influence to pressure regimes that violate these rights. Additionally, they should support international mechanisms that monitor and enforce human rights standards. The promotion of human rights is essential in fostering equitable and peaceful societies where the rule of law prevails and individuals can live with dignity and freedom.

Global economic stability is crucial for promoting peace and security. The powers involved in this endeavour can minimize economic disparities, which often trigger conflicts, by encouraging economic cooperation and stability. Their participation in institutions like the International Monetary Fund (IMF) and the World Bank plays a pivotal role in achieving this objective. Economic stability also lessens the probability of conflicts arising from resource competition and economic grievances, thus contributing to a more peaceful world order.

Furthermore, environmental degradation and climate change pose significant global security threats. Major powers have a crucial role to play in addressing these issues, especially about the scarcity of resources, which often contributes to conflict. Their involvement in international agreements, such as the Paris Agreement, is indispensable for global efforts aimed at combating climate change. By tackling environmental challenges, these nations can assist in preventing conflicts driven by resource shortages and environmental disasters.

International collaborative initiatives to counter-terrorism are vital for global security. These nations play a central role in sharing intelligence, conducting joint military operations, and addressing the underlying causes of extremism. A prime example of such cooperation is the global coalition against ISIS. Effective counter-terrorism measures disrupt terrorist networks, prevent attacks, and combat the factors that drive individuals toward extremism.

Finally, transparency in military practices and efforts to build trust among nations is crucial in mitigating the risk of misunderstandings and inadvertent conflicts. Confidence-building measures and open lines of communication are necessary to foster a climate of trust and cooperation. By promoting this transparency, nations can help prevent conflicts and cultivate a more stable and predictable international environment.

In conclusion, the responsibilities of the United States, France, Russia, China, and the United Kingdom in maintaining international peace and security are profound and multifaceted. These nations play crucial roles as diplomatic leaders, advocates for arms control, mediators in conflicts, supporters of international institutions, peacekeepers, providers of humanitarian aid, promoters of non-proliferation and human rights, facilitators of economic stability, protectors of the environment, combatants against terrorism, and proponents of transparency. Their commitment to these responsibilities is indispensable for establishing a stable and peaceful global order, especially as the international landscape continues to evolve. The ongoing prosperity and security of the international community rely on the continued commitment of these nations.

The opinions expressed in this article are the author’s own.

References

Diplomatic Leadership

Arms Control and Disarmament

Conflict Resolution

Support for International Institutions

Peacekeeping Contributions

Humanitarian Aid

Non-Proliferation Efforts

Promotion of Human Rights and Stability

Economic and Environmental Protection

Counter-Terrorism

Transparency and Trust-Building