China can’t quit coal by 2040, researchers say, despite global climate goals

Reuters | April 23, 2024 |

Cargo terminal for discharging coal cargos by shore cranes during foggy weather. Port Bayuquan, China. Stock image.

China’s coal consumption will fall by just one-third by 2040, according to a report by a European consultancy published on Tuesday, threatening climate targets that call for phasing out much of global coal use by 2040.

The International Energy Agency has said that global coal power capacity has to be eliminated by 2040 to keep average global temperature rises within the key threshold of 1.5 degrees Celsius (2.7 degrees Fahrenheit).

However, Norwegian risk assessment firm DNV said in its report that its findings indicate China’s coal consumption – the world’s biggest – will see a “minor uptick” in the next two years and then fall by one-third by 2040, ending up at around 25% of its peak in 2050.

The findings underscore China’s outlook on fossil fuels. In September, former climate envoy Xie Zhenhua told the COP28 climate talks that it would be “unrealistic to completely phase out fossil fuel energy”.

China will continue using coal despite a massive ramp-up in renewable generation, which will make up 88% of China’s power generation mix in 2050, the report predicts.

China approved another 114GW of coal power plants last year, up 10% from 2022, and the iron and steel sectors are on track to overtake power as the biggest consumers of coal by mid-century. Coal-to-chemicals will also make up a significant share of the remaining demand, according to the report.

Decarbonization of the steel sector through new methods such as cleaner electric arc furnace technology is lagging in China, research has shown.

Natural gas consumption will stay part of the energy mix with consumption falling only 2% from 2022 levels by 2050, the report said.

Still, China is “close” to meeting its own target of carbon neutrality by 2060 if it accelerates decarbonization of some sectors, particularly manufacturing, the report added.

DNV forecasts China’s carbon emissions peaking by 2026, well before the official goal for climate-warming emissions to peak by 2030, but slower than a forecast by the Centre for Research on Energy and Clean Air that emissions could go into “structural decline” in 2024.

China’s total energy demand, which has been growing at around 3% per year, is seen decelerating through the rest of this decade. It will peak in 2030 and then fall another 20% by 2050, the report found.

The world’s biggest crude importer, China is poised to phase out oil more rapidly than coal, driven by electrification. The report sees oil demand in China’s road sector falling by 94% by 2050 – a faster transition than that predicted by China’s oil majors, which forecast gasoline demand halving by 2045.

Total oil consumption will halve by 2050 from its 2027 peak, DNV said, with 84% of that still being met by imports.

But oil’s share of aviation energy demand will fall from 99.6% in 2022 to 59% in 2050 as the use of alternatives such as bioenergy and e-fuels takes hold.

“A faster transition to net zero in 2050 where more oil and gas are replaced by domestically produced renewables or nuclear would significantly boost energy independence,” the report said.

(By Colleen Howe and David Stanway; Editing by Miral Fahmy)

Airbus wins reprieve from Canadian sanctions on Russian titanium

Reuters | April 23, 2024 |

Titanium has been replacing aluminum parts in aircraft manufacturing because of its ability to resist heat and corrosion. (Stock image)

Canada has granted Airbus a waiver to allow it to use Russian titanium in its manufacturing after becoming the first Western government to ban supplies of the strategic metal in the latest package of measures triggered by the war in Ukraine.

The move gives Airbus flexibility in its Canadian plants and is expected to allay concerns that its core operations could be hit by effectively banning the import to Canada of European-built long-range jets that rely most heavily on titanium.

Russian state-backed VSMPO-AVISMA has for years been the industry’s largest titanium supplier.

“Airbus is aware of the Canadian government imposing sanctions on VSMPO and has obtained the necessary authorization to secure Airbus operations in compliance with the applicable sanctions,” Airbus Canada said in response to a Reuters query.

It did not elaborate on the approvals or say how long they would remain in effect. The Canadian government did not respond to requests for comment.

Imports of titanium from the aerospace industry’s largest historical supplier were left off the Western sanctions list after Russia invaded Ukraine, with Airbus arguing that banning imports would backfire economically while barely hurting Russia.

But Canada broke ranks with other aerospace nations in February, when it included VSMPO-AVISMA in a list of entities banned for alleged ties to Russia’s military-industrial complex.

Experts say titanium is mainly used in large lightweight airliners like the Airbus A350 or Boeing 787 rather than the smaller Airbus A220, which is assembled partly in Canada.

But the restrictions have raised alarm bells among suppliers because they could prevent a foreign-built jet containing Russian titanium being imported to Canada barring an exemption.

Industry sources said Airbus had sought a permit from the Canadian government allowing it to tackle such risks.

Earlier on Tuesday, the impact of the little-noticed rule change spread to the United States where supplier RTX announced a $175 million charge linked to the cost of replacing “US- and German-based Russian-owned entities” from which it had been sourcing titanium for use in its Canadian operations.

Significant risk

Ottawa’s stance is expected to raise the stakes in a debate over potential further sanctions targeting Russia’s economy. Ukrainian President Volodymyr Zelenskiy has repeatedly called on Western governments to impose stronger economic sanctions.

Canada is home to a large and politically active Ukrainian diaspora and the government of Prime Minister Justin Trudeau has taken a notably hard line on Russia since the start of the conflict in 2022.

Airbus says titanium accounts for a small part of Russia’s exports but that cutting off supplies abruptly would “massively” damage Western aerospace. The debate intensified after March guidance on Canada’s sanctions raised concern about the impact.

“Our own sanctions shouldn’t cause so much harm that we end up damaging ourselves significantly,” a source directly familiar with Canada’s policy told Reuters.

William Pellerin, a trade lawyer with McMillan in Canada, said the guidance created a “significant risk” for a Canadian carrier buying a foreign-built jet containing Russian titanium.

Airbus has pledged to accelerate plans to diversify supplies. Norway’s Norsk Titanium said on Tuesday it had finalized a new agreement to supply the planemaker.

Boeing said after the Ukraine invasion it had suspended purchases of titanium from Russia, though it has not said to what extent the metal is still used in its supply chain.

A spokesperson said on Tuesday it buys titanium mainly in the US and has substantial inventory due in part to an initiative several years ago to diversify sources.

(By Allison Lampert, David Ljunggren, Tim Hepher, Andrew Gray and Daphne Psaledakis; Editing by Peter Henderson)

LME takes aim at traders’ Russian metal games with new rules

Bloomberg News | April 23, 2024 |

Stock image.

The London Metal Exchange is imposing new rules surrounding the movement of metal in its warehousing network, taking aim at a lucrative and complex trading opportunity that emerged after the imposition of sanctions on Russian metal earlier this month.

The measures announced on Tuesday are designed to undercut the economic rationale for withdrawing Russian metal that’s already on the LME and selling it back on the exchange under a new, less-desirable category.

It’s a trade that has captivated the metals world since the sanctions were unveiled, with Bloomberg reporting last week that Glencore Plc and Trafigura Group were ordering large volumes of aluminum from the exchange with a plan to redeliver it as so-called Type 2 metal. As a result, available LME aluminum stocks have fallen close to the lowest level in at least 25 years.

The trade relies on the fact that, under the UK sanctions, Type 1 Russian metal can be traded by UK citizens and companies, whereas Type 2 Russian metal cannot. The aim of the trade is to take a share of the rent that warehouses will collect from future owners, and the longer it sits there the more they stand to make.

The new rules will increase scrutiny of so-called “rent share” deals, where traders and warehousing companies split the future revenue for as long as metal remains in the same warehouse. In particular, the LME could refuse to permit traders’ applications to redeliver the metal if the deals are deemed to block other buyers from accessing it.

The exchange also sought to undermine the logic for putting on the trades in the first place. In cases where traders have redelivered metal without it physically leaving a warehouse, the exchange will allow buyers to convert it back to Type 1 metal — making it freely tradable for UK nationals.

The exchange has also expedited the process for placing Russian metal that has previously been ordered for withdrawal back into the LME system. The move reduces the paperwork required to replenish LME inventories should traders decide the play no longer makes sense.

(By Mark Burton and Jack Farchy)

First Quantum Minerals cuts debt by over $1bn in first quarter

Reuters | April 23, 2024 | 7:05 pm Top Companies Canada Copper

Cobre Panamá mine. (Image by First Quantum Minerals).

Canadian miner First Quantum Minerals said on Tuesday that it has cut its debt by $1.14 billion in the first quarter.

The company in February had announced a series of capital restructuring measures that would strengthen its balance sheet and cut debt, a move that will help the Canadian miner deliver on its “operational objectives.”

The company’s total debt as of March 31 stands at $5.99 billion, down from its previous debt of $7.38 billion.

The copper miner reported a net loss attributable to shareholders of the company at $159 million for the quarter ended March. 31, as the company continues to be impacted by Cobre Panama mine closure. It had posted a profit of $75 million in the year-ago quarter.

The Cobre Panama project, one of the world’s largest open-pit copper mines, was forced to shut down after Panama’s top court ruled that its contract was unconstitutional.

(By Tanay Dhumal; Editing by Shailesh Kuber)

First Quantum could remove copper from Panama mine after election, CEO says

Reuters | April 24, 2024

Cobre Panama copper mine. (Image courtesy of Franco-Nevada assets handbook.)

Canadian miner First Quantum Minerals (TSX: FM) believes it will be able to take the already mined 121,000 tonnes of copper concentrate out of its disputed mine in Panama after the national elections there in May, the company’s chief executive said on Wednesday.

Panama’s current government ordered the closure of the Cobre Panama copper mine last year after public protests over environmental damage from mining in the country. Cobre Panama accounted for about 1% of the global copper output, and contributed about 40% to First Quantum’s revenue last year.

First Quantum has been negotiating with Panama’s government to allow it to sell the copper that it mined before the dispute began. Copper was trading at $9772 a metric tonne at the London Metals Exchange on Wednesday. Any proceedings from the sale could help cover the costs of maintaining the mine.

“Obviously, in the context of election politics and a strong debate around that, the balance of probability probably spills over after the election,” said Tristan Pascall, CEO of First Quantum Minerals, when asked during an analyst call when the company expects to take out the copper concentrate from the mine site.

Cobre Panama is under dispute after the Panama Supreme Court nullified its mining contract and the country’s president closed the mine following the public protests.

A new government in Panama could overturn that, however polls show that people of Panama are still against mining.

The closure pushed First Quantum to undertake a series of debt restructuring measures, including issuing equity worth $1 billion and corporate debt worth $1.6 billion. It is also considering bringing in an equity partner for its Zambian mines.

Reuters in March reported that First Quantum officials met with Chinese government officials to discuss the prospect of copper miner Jiagnxi Copper buying the disputed copper from Panama after the elections.

Shares of First Quantum were up 2% on the Toronto Stock Exchange around midday.

On the proposed minority sale of the Zambian mines, the company said that it will enter into an partnership only if it brings value to shareholders and the South African government.

“The recent financing transaction that we put forward through Q1 means we don’t have to enter into a transaction here,” Ryan MacWilliam, CFO of First Quantum said, referring to the Zambia mines.

(Reporting by Divya Rajagopal and Seher Dareen; Editing by Krishna Chandra Eluri, Michael Erman, Elaine Hardcastle)

Related: Panama election unlikely to shift outlook for First Quantum’s copper mine

Codelco defends lithium deal ahead of SQM shareholder meeting

Bloomberg News | April 24, 2024

Flamingos at Salar de Atacama, home to lithium mines. (Image courtesy of Dan Lundberg | Flickr Commons..)

Chile’s state copper company Codelco defended its proposed lithium production tie-up with SQM in response to criticism that the negotiation process has been opaque.

The deal is both transparent and beneficial for Chile, Codelco chairman Maximo Pacheco said in a presentation late Tuesday. Initially, the Chilean state will get an estimated 70% of proceeds from new production, rising to 85% from 2031, he said. Pacheco said he couldn’t divulge exact figures because of confidentiality and ongoing talks.

On Wednesday, SQM is holding a shareholder meeting that was requested by its second-largest shareholder Tianqi Lithium Corp. The Chinese firm is seeking further clarity and the right to vote on the proposed Codelco deal.

While SQM management will provide an update on negotiations and answer questions in the meeting, the Santiago-based firm says the deal only requires board approval. Under a framework accord announced late last year, SQM will hand over a majority stake in its brine assets to Codelco in exchange for extending operations for three more decades.

The tensions between SQM and its Chinese shareholder add risk to a deal that would allow the latter to ramp up production. If it’s scrapped, SQM may have to wind down mining operations when its contract expires in 2030.

Tianqi has endured restrictions to SQM’s sensitive information since buying its stake for $4 billion in 2018. SQM’s top shareholder is Julio Ponce.

(By James Attwood)

Vale, BHP, and Samarco seek new deal on Mariana disaster

Staff Writer | April 24, 2024 |

The collapse of the Fundao tailings dam in 2015 killed 19 people and polluted hundreds of miles of rivers. (Image: Agência Brasil Fotografias).

Samarco and its shareholders, Vale (NYSE: VALE) and BHP (ASX: BHP) , have presented a new reparation proposal to the Brazilian government and the states of Minas Gerais and Espírito Santo for the breach of the Fundão dam in Mariana in 2015.

The Brazilian Attorney General’s Office confirmed the information to CBN Radio. However, the values were not disclosed due to a confidentiality clause.

The collapse of the dam in Mariana left 19 dead when approximately 40 million cubic meters of mining waste destroyed communities and contaminated the Doce River. It was the biggest environmental disaster ever in Brazil.

Negotiations for reparation resumed this week after the Brazilian government and the states rejected the value of R$40 billion ($7.75 billion) offered by the companies in December. The government and the states are demanding approximately R$120 billion ($23.3 billion).

To this day, none of the 12 lawsuits regarding the disaster have been ruled on.

According to the Federal Public Prosecutor’s Office (MPF), the reparation actions carried out in recent years by the Renova Foundation, an entity created for this purpose, have been insufficient. The foundation has already invested R$28.1 billion ($5.45 billion) in reparation and compensation initiatives, according to Vale.

Vale and BHP have not commented on the new agreement. Samarco informed CBN Radio that it remains open to dialogue, seeking solutions based on technical criteria that meet the demands of society. The company added that it remains committed to fully repairing the damages caused.

Battery recycling shatters the myth of electric-vehicle waste

Bloomberg News | April 24, 2024 |

Credit: Li-Cycle

Making a battery for an electric vehicle typically requires mining hundreds of pounds of hard-to-extract minerals. That’s put a spotlight on batteries’ heavy environmental toll, at least upfront.

But the latest advances in battery recycling, including by leading US battery recycler Redwood Materials, are shrinking EVs’ footprint.

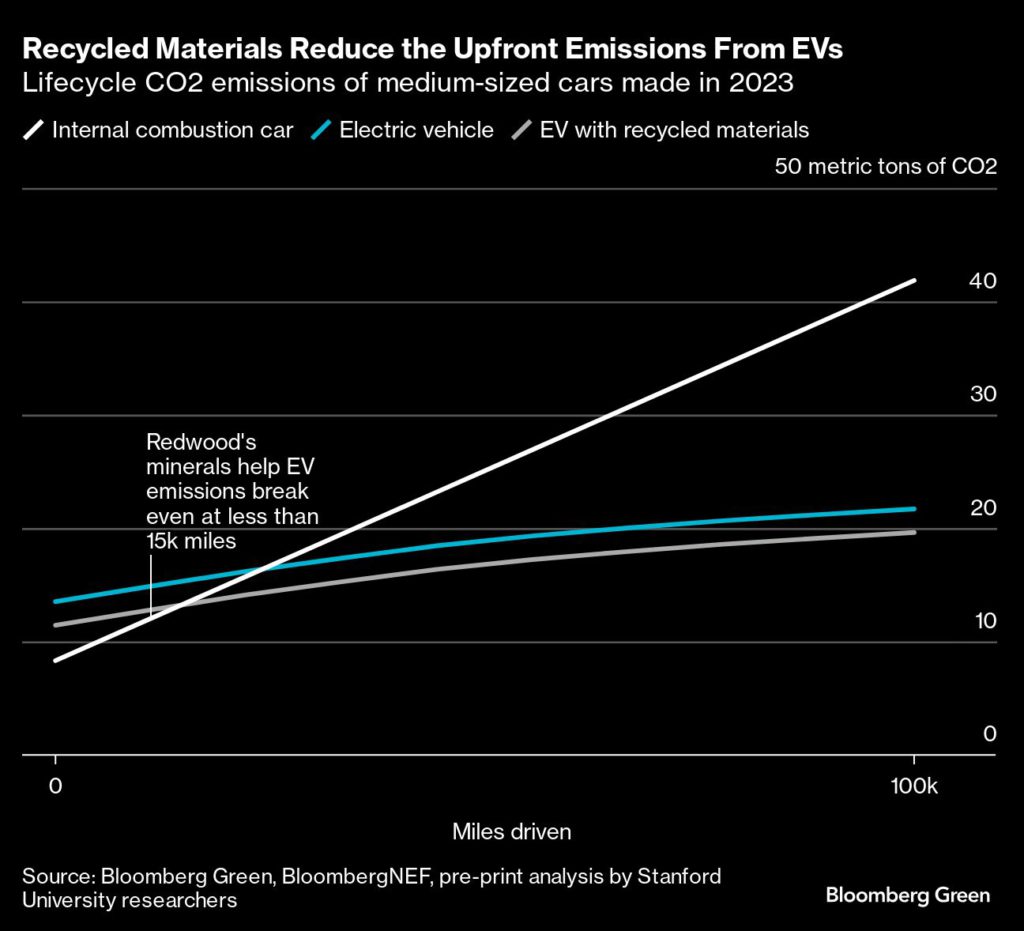

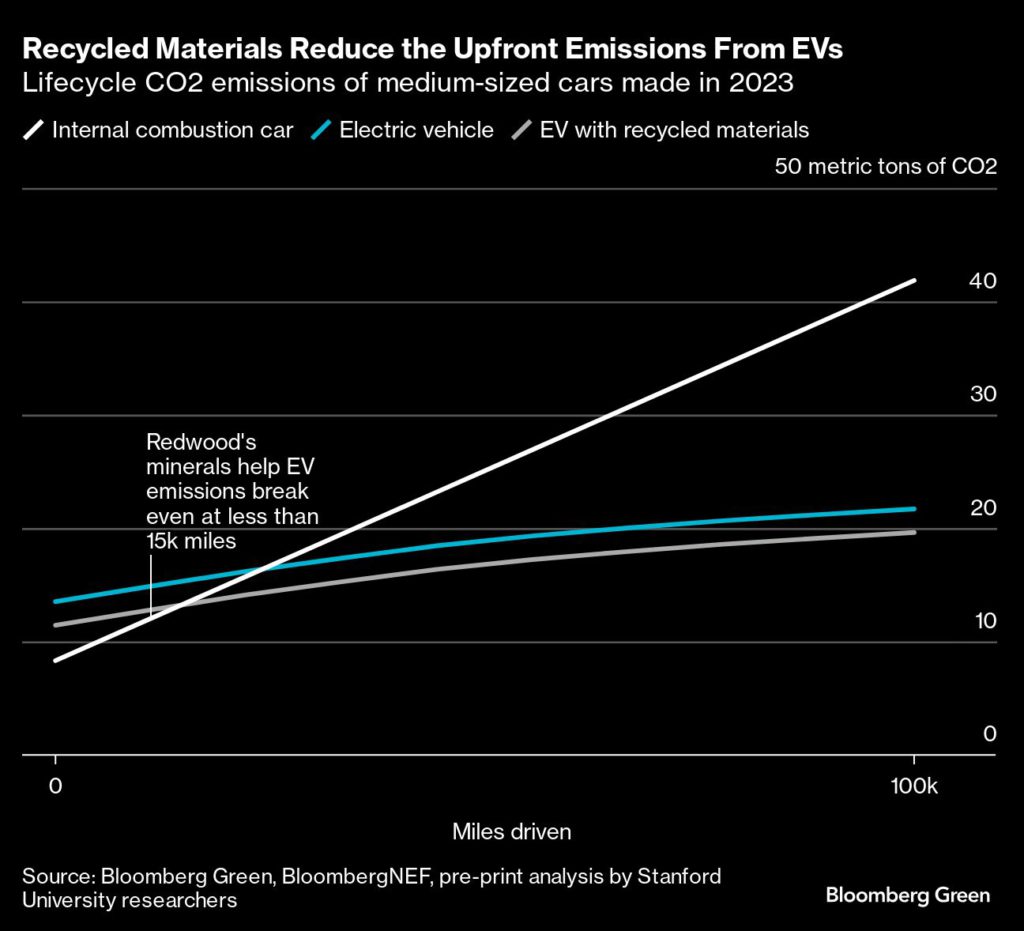

Traditional methods of ripping materials out of the ground and refining them for battery backs requires enormous amounts of energy. As a result, the initial carbon footprint of an EV is higher than a comparable internal combustion engine vehicle. Those upfront emissions are paid back over time with the superior efficiency of electric motors, leading to a 70% reduction in total emissions over the average life of the vehicle.

In the US, it takes about 25,500 miles (41,000 kilometers) of driving for an EV to break even, according to a BloombergNEF analysis. That payback figure, however, assumes that every EV is made with newly mined lithium, nickel and cobalt — as if all the materials will end up in a landfill at the end of a vehicle’s life. But that’s not what’s happening. EV batteries are simply too valuable to toss out, and a new industry of recyclers is busy snatching them all up.

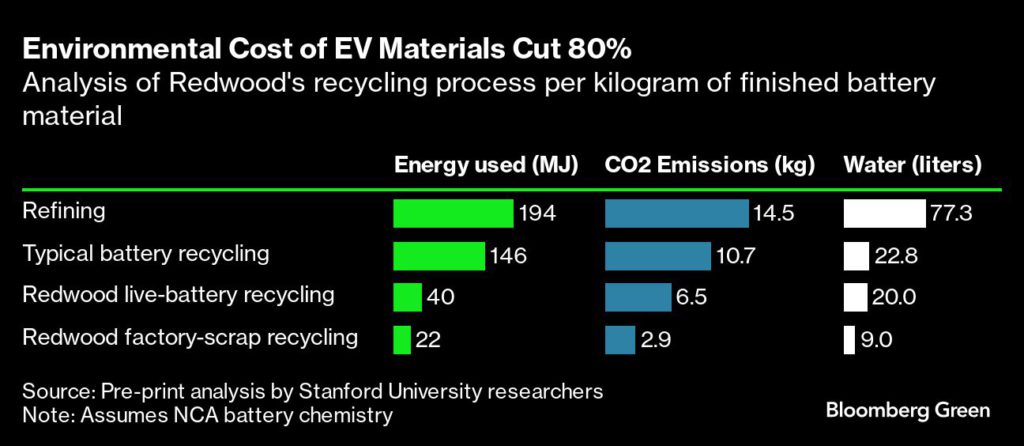

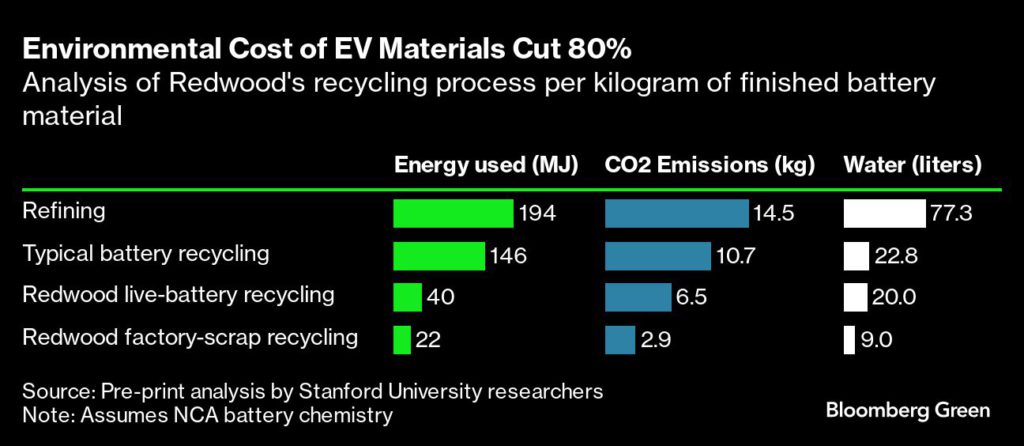

Though still in its infancy, EV recycling is already profitable and capable of recovering more than 95% of the key minerals. A new analysis by Stanford University researchers, which is still under peer review, found that Redwood Materials’ recycling process produces up to 80% fewer emissions than the traditional supply chain using CO2 belching refineries. That’s enough to shorten an average EV’s environmental breakeven time with an internal combustion vehicle to less than 15,000 miles. Every mile thereafter is a carbon win against the internal combustion engine.

Clean electricity matters

Fully assessing when an EV hits its breakeven point depends on the source of electricity used for battery manufacturing and charging the vehicle. Cleaner electricity means a shorter payback period, but even in regions that still get electricity from coal, EVs eventually win out.

The boom in renewable energy will make EVs even less polluting. Solar installations have set annual records worldwide for 22 consecutive years, and the pace appears to be accelerating, according to data from the International Energy Agency. By 2030, when the US grid is expected to get two thirds of its power from carbon-free sources, an EV built with recycled materials could break even on emissions in a matter of months.

The Stanford report found that recycling batteries used 79% less energy and resulted in 55% fewer CO2 emissions compared to traditional refining. Additional savings come from keeping the recycling supply chain local compared to the globe-circling refining process for freshly extracted minerals. Closing the loop brings the total CO2 savings to 80%.

The benefits of recycling are only just beginning to accrue, according to Will Tarpeh, an assistant professor of chemical engineering and one of the Stanford paper’s senior authors. That’s because EVs are still new, and only relatively small numbers are ready for the recycling heap.

Still, the world is already on track to recycle twice as much lithium-ion battery supply in 2024 as it manufactured in 2014. When considering the environmental toll of an EV, it’s increasingly important to measure the footprint of the materials going in and how it shrinks when some inevitably get a second life.

As recycling grows to rival traditional mining and refining operations, simplicity will become more central to battery design, said Tarpeh.

“Recycling is just catching up to the batteries that we’ve made,” Tarpeh said. “Not very many people are looking at recyclability when they develop battery chemistry, but I think that’s really starting to change.”

(By Tom Randall)

ESG Watch: Why climate change is leaving mining firms between a rock and a hard place

Reuters | April 23, 2024 |

Stock image.

For most of us, when we think about mining and the environment, it tends to be about water and air pollution, disasters such as the fatal collapse of tailings dams, or the global warming consequences of coal mining.

But the extraction of metals such as copper, nickel and cobalt will be increasingly important as we urgently seek ways to cut emissions from other building blocks of the global economy such as steel, cement and aluminum.

By 2050, the World Bank forecasts that demand for the metals and minerals used to produce the clean energy technologies that will be needed to meet Paris Climate Agreement goals will increase by almost 500%.

New mines will bring increased risks to nature and biodiversity. Conservation group Re:wild warned recently, for example, that more than a third of Africa’s great apes are at risk because of the surge in demand for the minerals that are vital for green technologies.

At the same time, the sector is itself becoming more vulnerable to the impacts of climate change, including increased flooding, heatwaves, drought and increased competition for water. A McKinsey study found that 30%-50% of production for copper, gold, iron ore and zinc is in areas of high water stress, and those figures are predicted to rise.

“In Chile, 80% of copper production is already located in extremely high water-stressed and arid areas; by 2040, it will be 100%,” the consultancy says, adding that 40% of Russian iron ore production will suffer from extreme water stress by 2040.

Recently, mines from Brazil to Germany have had to shut down temporarily because of water shortages, costing their operators millions of dollars. Reducing the water intensity of mining operations will be crucial to improve the resilience of production assets. Extreme heat and sea level rise are other climate impacts the sector will have to address.

The industry also faces pressure to cut its own emissions as businesses across the world increasingly look at the carbon impact of their supply chains.

“Although metals are not yet priced on their CO2 footprint, that day could come,” McKinsey points out.

Coal, which currently accounts for about half of the global mining market, may be flying high at the moment, but demand, not just from power generation but also from steelmakers and cement producers, will recede as the pressure to decarbonize increases. Many mining companies face having to rebalance their portfolios to replace revenues from coal production.

The Global Investor Commission on Mining 2030 was launched in 2023 to address key systemic risks that challenge the mining sector’s ability to meet the demands of the low-carbon transition. As they scale up production of transition minerals, “they must do so responsibly and without harm to communities and the environment – or risk conflict and opposition from host communities that will in turn undermine the global climate transition,” it says.

The commission, backed by $13 trillion of assets under management, is chaired by Adam Matthews, who is also chief responsible investment officer of the Church of England Pensions Board. He says the commission’s focus areas include artisanal mining, child labour, the impact of automation and the future workforce, indigenous communities’ and First Nations’ rights, impacts on biodiversity, climate change, tailings dams, conflict reconciliation and corruption.

“To meet our climate targets, a lot of mines need to be expanded or developed from scratch in areas with a lot of complex dynamics,” Matthews says. “We need a global focus on what is needed for the transition, and where those assets are located, communities need to benefit.”

Energy analysts Wood Mackenzie say the switch to net zero “will require a total rethink of what the mining and metals space is, and where it needs to be”.

The industry will have to electrify its operations as much as possible, not just through the use of renewable electricity but also by replacing giant diesel-fuelled trucks with alternatives powered by batteries or fuel cells, or using LNG, hydrogen and e-fuels. There will also be opportunities to improve efficiency through the use of autonomous fleets, while artificial intelligence and machine learning should also streamline operations and identify opportunities to cut emissions.

Matthews, however, stresses that mining works on a multi-decadal time frame that often comes up against short-term investor horizons. “A lot of these things take a considerable amount of work, real engagement with communities and challenge business models that focus on shorter time frames than the industry actually works to,” he says.

While there are a number of initiatives to help operators to reduce their impacts, these are not always well developed or universally applied. “There is a complex landscape of standards and we need some consolidation,” Matthews points out. “And in some areas, there are no standards. There was no standard for tailings until recently, for example, but one is now being developed.”

Schneider Electric’s Materialize platform, which it launched in April with the Global Mining Guidelines group and Glencore, is an initiative that aims to bring mining and minerals groups together to cut emissions in the sector’s global supply chain.

“There is a multitude of different players across mining, minerals and metals, of different sizes and with different capabilities to be able to decarbonize,” says Rob Moffitt, president, mining, minerals and metals at Schneider Electric. “Materialize was formed to help those companies create a critical mass across the value chain.”

One area where the platform could have a significant effect is in increasing the use of renewable energy. “By combining the purchasing power of different companies, we can accelerate the deployment of clean energy through utility-scale PPAs (power-purchase agreements),” Moffitt says.

The platform will also be used to engage thousands of suppliers, share best practice and allow companies to track emissions from suppliers.

“There will be far more pressure on the supply of critical minerals in future,” he says. “If we are going to decarbonize, we really need these industries. But we need to work out how to produce these minerals in a more sustainable way.”

(The opinions expressed here are those of the author, Mike Scott, a freelance writer for Reuters.)

E-haul trucks could result in major savings for miners but adoption is slow – report

Staff Writer | April 24, 2024 |

Caterpillar haul truck. (Image by Caterpillar).

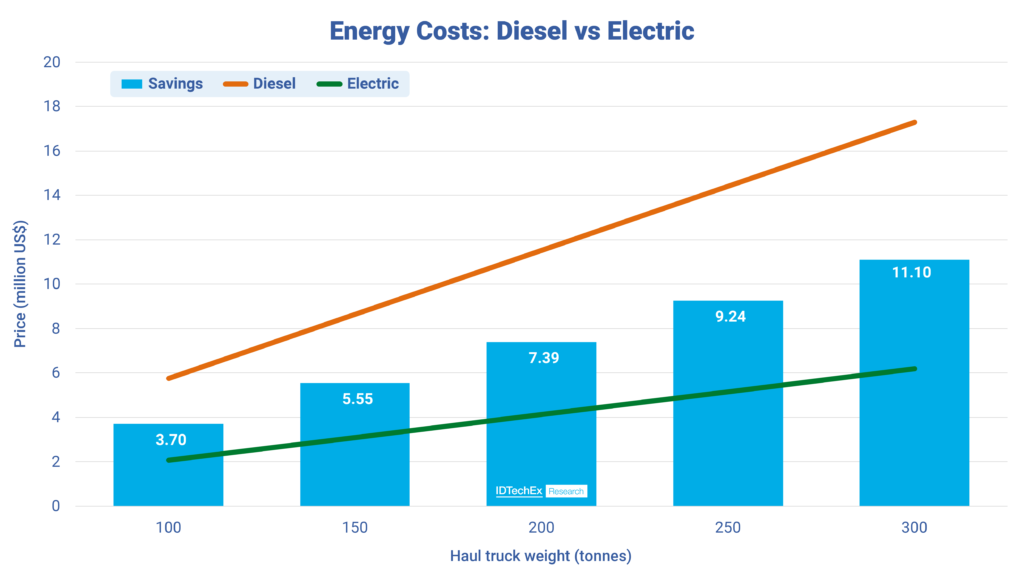

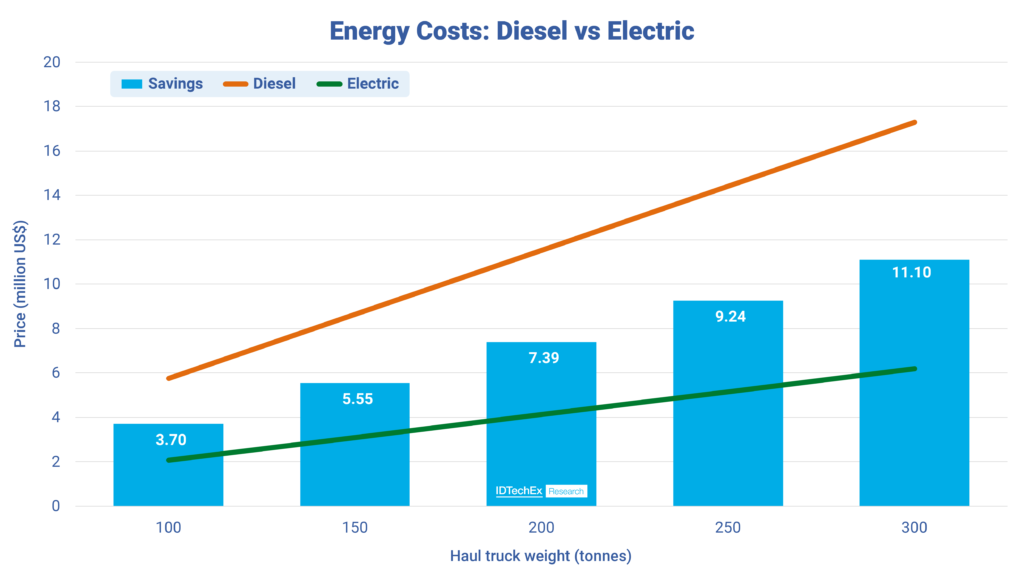

A new report by IDTechEx states that investing in e-haul trucks could result in major savings for miners due to the replacement of diesel with cheaper electricity, as these vehicles have the most intensive duty cycles of any vehicle in a mine.

“A single 150-tonne haul truck can save over $5.5 million in energy costs alone,” the report reads. “This is widely applicable across all vehicle weights, with heavier trucks providing even greater upside, highlighting the potential savings that can be generated when an entire fleet of haul trucks is electrified.”

Yet, the document points out that miners worry about the size and cost of haul truck batteries, as well as about the fact that they will need multiple replacements within a 10-year window.

“The large batteries needed for electric haul trucks have perhaps been the largest technological and financial bottlenecks inhibiting their adoption, but they are now sufficiently developed and competitively priced for wider use. These batteries regularly exceed 1 MWh, with the largest ones approaching 2 MWh,” the report reads.

“IDTechEx has collated a database of all existing EV haul truck models, showing that current vehicle runtimes remain under six hours on a single charge. For a 150-tonne haul truck to operate for this duration, it will require a battery pack of over 1700 kWh and cost over $500,0000.”

(Graph by IDTechEx).

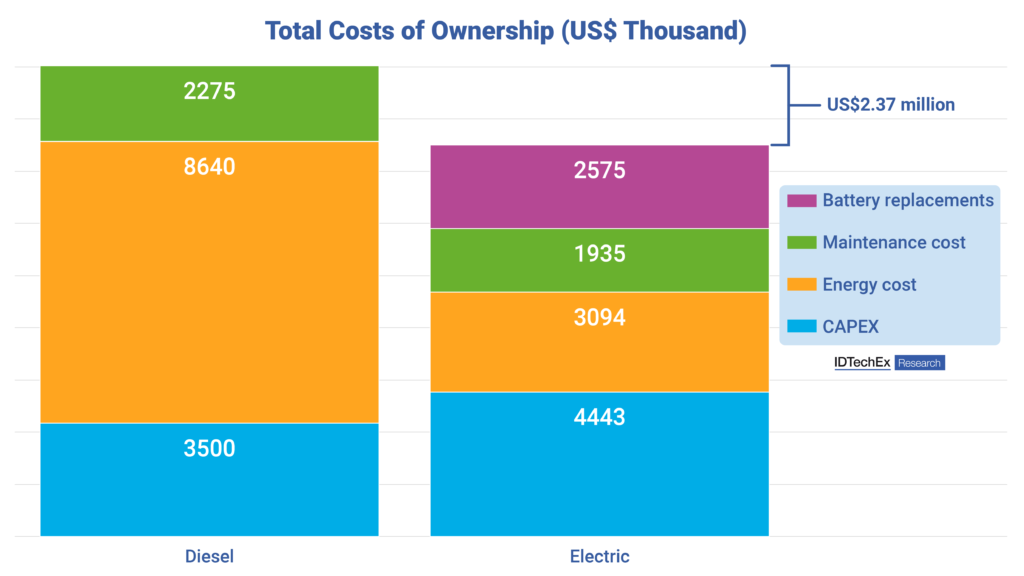

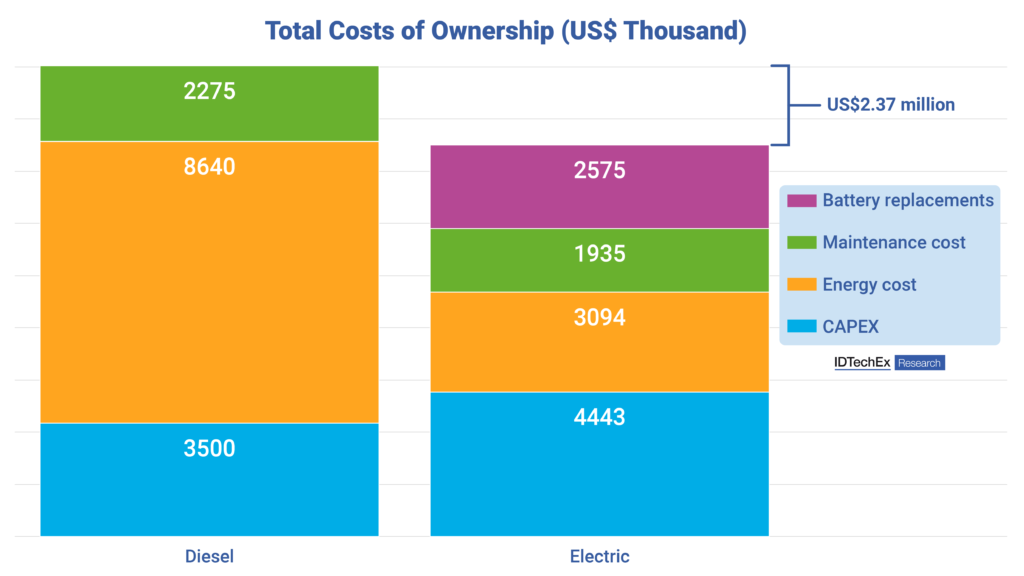

In the market analyst’s view, energy savings will comfortably exceed the added cost of a single battery. However, the firm’s experts forecast electric haul trucks will need an additional five battery replacements per vehicle on average, costing an extra $2.6 million.

“More cost factors also play into the total cost of ownership of electric haul trucks. On average, a 150-tonne truck will be able to save around $340,000 in maintenance costs in its lifetime. However, an electric driveline is needed for $70,000, plus the labour of retrofitting which IDTechEx estimates at $360,000.

While these are relevant and substantial costs, they pale in comparison to the amounts spent on diesel or batteries and are not the key determinants in haul truck economics,” the dossier notes.

The market researcher’s figures show that despite multiple battery replacements, total ownership costs are strongly in favour of electrification as mining companies will be able to save nearly $2.5 million per electrified haul truck, and trucks will break even on their added CAPEX in under three years.

The report also points out that given that the volumes of electric haul trucks are still so small, there is room for the cost of batteries to fall below the estimated $300/kWh.

(Graph by IDTechEx).

Not there yet

Despite electric haul trucks being cheaper to operate, more productive and environmentally friendlier than existing diesel trucks, IDTechEx’s file notes that haul truck electrification is still in its nascent stages.

“Only one or two electric haul trucks have been made per year, and only in 2023 did the total number of these vehicles tip into the double digits. The majority of these have been prototypes and testing models developed by the mining companies themselves and independent retrofitters instead of OEMs,” the report reads. “They repurpose existing diesel machines to install batteries or fuel cells for zero-emission operation. First Mode and WAE have been the two most active players in this area and are expanding their retrofitting capacities in the near term.”

According to the market researcher, more recently, major mining OEMs such as Caterpillar and Komatsu are seeking to develop and commercialize e-haul trucks, with Caterpillar building the 793 Electric prototype, currently in testing and with aims for commercialization by 2027, and Komatsu developing its 830E electric, aiming for production pre-2030.

“If electric haul trucks are so financially attractive, why are they not yet widespread? First and most importantly, batteries require size and endurance that are in line with the demands of haul truck duty cycles while still maintaining relative affordability.

This aspect has only recently been achievable from battery suppliers such as CATL, ABB, and Northvolt, and the industry is now expanding in response,” the dossier states. “Development of haul truck batteries is in its infancy – a wide range of designs and chemistries are currently being employed to meet performance demands, and there is yet to be an industry-wide consensus.”

For IDTechEx’s analysts, productivity is another sticking point in the adoption of electric haul trucks as currently, an electric truck can’t match the uptime of diesel.

“Where a diesel truck only needs 10 minutes a day to refuel, EVs need to be charged multiple times a day for two to three hours in total. Mining companies will not be willing to adopt a technology if it means sacrificing the productivity and output of their operations,” the report concludes.

European firms, banks must boost investment in critical minerals, official says

Reuters | April 23, 2024 |

The Mina do Barroso project is set to be one of Europe’s first significant producer of spodumene, a hard-rock form of lithium. (Image courtesy of ASMAA | YouTube.)

European firms such as automakers and financial institutions need to step up investment in critical minerals for the region to develop domestic sources of the key raw materials for the energy transition, the head of an EU-funded organisation said.

The European Union has launched an ambitious roadmap to accelerate production of minerals such as lithium and rare earths needed for electric vehicles (EVs) and wind turbines.

“There’s literally no equity being invested by financial institutions into the sector,” Bernd Schaefer, CEO of EIT RawMaterials, told Reuters.

“We also need more commitment from downstream players,” he said, referring to end users of the materials. “That has to change if we really want to move forward and act accordingly to what is stipulated in the Critical Raw Materials Act (CRMA).”

EIT RawMaterials is helping to implement an EU plan to provide the critical raw materials needed to meet the bloc’s target of net zero greenhouse gas emissions by 2050.

Under the CRMA, due to enter into force in coming months, the bloc has set 2030 targets for domestic production of minerals required for its green transition – 10% of annual needs mined, 25% recycled and 40% processed in Europe.

Demand for 34 raw materials including copper, nickel and rare earths is forecast to rise sharply. The European Commission has estimated that the EU will require 18 times more lithium in 2030 than in 2020 and fives times more cobalt.

Governments such as France, Germany and Italy have launched national investment funds which include support for critical mineral projects, but more needs to be done, Schaefer said.

The situation in Europe contrasts with the US, where the Inflation Reduction Act offers $369 billion in tax breaks over 10 years for the domestic production of electric vehicles, batteries, hydrogen or solar panels.

Schaefer noted that Germany’s Vacuumschmelze (VAC) is working with General Motors to build a North American factory to make rare earth permanent magnets.

The VAC/GM deal, which will help the automaker meet its EV growth ambitions, highlights the need to implement an EU action plan for permanent magnets proposed in 2021, Schaefer added.

“Up until now, the biggest Western-world magnet producer has been in Germany. In two years time, it is most likely to be in the US,” he said.

“Risk aversion in Europe is prevailing. I think European companies are on a learning curve and I’m hopeful and positive they will step up.”

Neo Performance Materials is building a rare earths permanent magnet factory in Estonia, which is due to launch output next year. The company already has a plant for separating rare earths in the country.

(By Eric Onstad; Editing by Jan Harvey and Mark Potter)