Syria's war profiteers

News features and analysis from Financial Times reporters around the world. FT News in Focus is produced by Fiona Symon.

Share on Twitter (opens new window)

Share on Facebook (opens new window)

Share on LinkedIn (opens new window)

Save

OCTOBER 17 2019Print this page

During Syria's eight year civil war, around half a million Syrians have lost their lives and many more have lost their livelihoods. But a few individuals have made millions by helping the Assad regime. Chloe Cornish has been investigating and she tells Josh Noble about some of Syria's war profiteers.

https://www.ft.com/content/3a197a86-8c1a-437b-ae8f-2a9fd79f4a2c

It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Saturday, March 21, 2020

Triggering a Global Financial Crisis: COVID-19 as the Last Straw

by SABRI ÖNCÜ

Photograph Source: Richard Eriksson – CC BY 2.0

Whether a black swan or a scapegoat, Covid-19 is an extraordinary event. Declared by the WHO as a pandemic, Covid-19 has given birth to the concept of the economic “sudden stop.” We need extraordinary measures to contain it.

Initially referred to as the novel coronavirus 2019, the coronavirus disease (Covid-19) originated late in 2019 in Wuhan, China and was first reported to the World Health Organization (WHO) Country Office in China on 31 December 2019. Rapidly becoming an endemic, it was declared by the WHO a “Public Health Emergency of International Concern” on 30 January 2020.

Covid-19, now present in more than 100 countries, has been declared a pandemic by the WHO. However, the global financial markets had declared it a pandemic in the week that started on Monday, 24 February 2020, by overwhelmingly vouching for pandemic. They did this through the fastest equity market correction of all time that took place in about six to seven days, where a correction is defined as at least a 10% drop from the peak. There remains a second question which still is debated, and it is about whether Covid-19 is a swan or a goat.

Swan, Goat or Both?

While the origin of the concept of goat (specifically, scapegoat) is Chapter 16 of Leviticus, one of the early books of the Bible, the origin of the concept of swan in the current context is from Black Swan. There is also the white swan, which originated in Crisis Economics: A Crash Course in the Future of Finance. A scapegoat is a person or an event blamed for the wrongdoings, mistakes, or faults of others, especially for reasons of expediency. As for the two swans, a black swan, as defined by Taleb (2007), is an unpredictable outlier event with an extreme impact, and a white swan, as defined by Roubini and Mihm (2010), is the same as a black swan except that it is predictable.

Although, in a recent essay, Roubini (2020) identified several white swans for 2020 that “could trigger severe economic, financial, political, and geopolitical disturbances,” such as the escalation of the ongoing cold war between the United States (US) and China to a near hot war, and the potentially catastrophic effects of climate change, even he did not refer to Covid-19 as a white swan as it was an undeniably unpredictable event. So the real debate is whether Covid-19 is a black swan or a scapegoat.

Although we could not have predicted it, Covid-19 was not the reason, but just the trigger for the ongoing financial crash as all we needed was the proverbial straw to break the finance sector’s back (Öncü 2015). With asset price bubbles everywhere and the total global debt over 322% of the world gross domestic product in the third quarter of 2019 (IIF 2020), something had to trigger what is happening now.

‘Economic Sudden Stop’

But Covid-19 was not just any trigger as it gave birth to the concept of the economic “sudden stop.” When the global equity markets dropped on 31 January 2020 following the WHO declaration of the Public Health Emergency of International Concern, El-Erian (2020) warned the investors on 2 February 2020 that they should snap out of the “buy the dip” mentality. Pointing out two vulnerabilities, namely structurally weak global growth and less effective central banks, he introduced the concept of “sudden stop” economic dynamics.

Although El-Erian is yet to define what exactly an “economic sudden stop” is, I take it as an abrupt onset of a deep recession. In the case of Covid-19, it is a sudden stop of economic activity resulting in supply and demand shocks to the global economy as major cities in infected countries, more than 100 and counting, are put on lockdown. And, add to that the deepening oil price war between Russia and Saudi Arabia.

Shortly after 6 pm on 8 March 2020 in New York, the futures markets opened and oil futures (both Brent and WTI) are trading about 21% down, gold is above $1,700 per ounce, and all United States (US) equity index futures are trading about 4% down. What is worse is that with the long-term US Treasury yields at their historical lows (10-year yield below 0.5% and 30-year yield below 1% as I write), the capital markets are frozen (not to mention many oil projects that will go bust at these prices).

Disorderly Deleveraging

All this means that what I claimed inevitable in my column (Öncü 2019) has already started: a disorderly global non-financial private sector debt deleveraging, which is likely to lead to deep global debt deflation, followed by a recession (and possibly a depression), thereby creating financial and economic instabilities, and further tensions in international relations with dire consequences for emerging and developing countries, not to mention developed countries.

As mentioned in Öncü (2019), while in developed and high-income developing countries, the non-financial private sector is more over-indebted, in middle-income and low-income developing countries, the public sector is more over-indebted. Given that the global non-financial private sector debt deleveraging has already started, the analysis in Öncü (2019) indicates that the public sector debts of the developed and high-income developing countries will also go up and the governments’ ability to rescue their economies will also decline in these countries. Furthermore, this will severely constrain the governments’ ability to spend on climate change-related projects to address the potentially catastrophic effects of climate change for many years to come, diminishing our hopes to make the necessary investments and innovations to address the now existential climate crisis on time. Last, but not least, the measures we have to take to control the spread of Covid-19 before a cure is found will further challenge the financial system, as people stop earning an income and businesses go bankrupt (Keen 2020b).

Orderly Deleveraging

In this column last year, I looked at the German Currency Reform (GCR) of 1948 as a modern example of debt restructuring to see if it could be adapted for use now (Öncü 2019). Recall that the original plan of the GCR consisted of (i) conversion of currency and debts at a ratio of 10 reichsmarks for one deutschemark, and (ii) a fund built with a capital levy for the equalisation of burdens (Lastenausgleich) to correct part of the inequity between owners of debt, and owners of real assets and shares of corporations. As the actual GCR deviated from the planned GCR in that it required all financial institutions to remove from their balance sheets any securities of the Reich and cancel all accounts and currency holdings of the Reich, it impaired the balance sheets of nearly all of the financial institutions. The equalisation claims were the solution, which were interest-bearing government bonds of a then non-existing government and had no set amortisation schedules. They later became bonds of the Federal Republic of Germany, established on 23 May 1949.

In his two Patreon posts, Keen (2020a, 2020b) proposed several extraordinary measures including the “Modern Debt Jubilee” (MDJ) of Keen (2017) that the governments, central banks and financial regulators should take now to stop the health effects of Covid-19 triggering a financial crisis that could in turn make Covid-19 worse. Supporting these immediate measures wholeheartedly, I add a globally coordinated deleveraging framework to be considered later that Ahmet Öncü and I have proposed in Öncü and Öncü (2020a, 2020b). Our proposal is a blend of the MDJ and the GCR.

In our framework, there would be three authorities to maintain a deposit account at the central bank in each country: a deleveraging authority for leverage reduction, Lastenausgleich authority for capital levies, and a climate authority for financing needs in developing national climate plans. These national authorities should be globally coordinated through the appropriate United Nations agencies.

The Lastenausgleich authority would be under the finance ministry, whereas the deleveraging and climate authorities would be not-for-profit corporations promoted by the government. The government would capitalise the deleveraging and climate authorities by the Treasury-issued zero-coupon perpetual bonds, that is, our proposed equalisation claims. The deleveraging authority would then sell its equalisation claims to the central bank in exchange for an increased balance in its deposit account at the bank, while the climate authority would wait until the deleveraging concludes. Further, the climate authority would not be allowed to open deposit accounts to its borrowers to ensure that it would be a pure financial intermediary, not a bank.

Assuming that a globally agreed-upon debt reduction percentage that would bring the global non-financial sector leverage well under 100% is determined, and that all countries agree to act simultaneously, the framework is as follows (i) the financial institutions comprising the banks and non-bank financial institutions (NBFIs) write down all the loans and debt securities on both sides of their balance sheets by the required percentage; (ii) the deleveraging authority compensates the banks and NBFIs for the loss if any; and (iii) the deleveraging authority pays each qualified resident their allocated amount less than the debt relief if any. If an NBFI gains after the above debt reduction, it should owe equalisation liabilities to the deleveraging authority of its jurisdiction. Note that as all debts mean all debts, public sector debts will also be written down by the same percentage except the official debts of the sovereigns that fall out of the scope of our proposed framework and should be handled by other means.

After Deleveraging

After deleveraging, the balance of the deleveraging authority account at the central bank goes down whereas the total balance of the bank accounts (reserves) at the central bank go up by the total payment made by the deleveraging authority. Hence, the base money goes up by the total payment of the deleveraging authority. Since NBFIs and residents cannot maintain deposit accounts at the central bank, they have to be paid through a bank which creates deposits for the NBFIs and residents against reserves. Hence, the broad money goes up by the amount of the payment to the NBFIs and residents.

One issue is that in many countries, the bank and NBFI balance sheets are multi-currency balance sheets. However, the deleveraging authority payments are in domestic currency, which may create currency risk for some banks and NBFIs. Backed by the central banks, the globally coordinated national deleveraging authorities should stand ready to intervene to avoid potential crises.

The authorities would require their domestic banks and other financial institutions to spend an internationally agreed-upon percentage of their newly found money, if any, after the deleveraging on the interest-bearing, finite-maturity bonds the national climate authorities would issue. Since the promoter of the climate authority is the government, the bonds of the climate authority would have the same credit with the government bonds, and the central bank would accept the climate authority bonds in its open market operations. Therefore, the climate authority bonds would be the main tool to manage the reserves and deposits created through the equalisation claims. In addition, the climate authority bonds could be used for the greening of the financial system through the investment of foreign exchange reserves of the central banks proposed by the Bank of International Settlements (BIS 2019).

Lastly, equipped with a “globally coordinated wealth registry” (Stiglitz et al 2019), the Lastenausgleich authorities would collect progressive wealth taxes from the owners of real and non-debt financial assets for the equalisation of burdens. While a part of these taxes could be used to retire some of the equalisation claims and the corresponding reserves and deposits created in the deleveraging process, another part could be transferred to the climate authorities, and the rest could be spent in the interests of the society.

References

BIS (2019): Green Bonds: The Reserve Management Perspective, Bank of International Settlements, https://www.bis.org/publ/qtrpdf/r_qt1909f.htm, viewed on 18 December 2019.

El-Erian, M (2020): “Coronavirus Should Snap Investors Out of ‘Buy the Dip’ Mentality,” Financial Times, 2 February.

IIF (2020): Global Debt Monitor, International Institute of Finance, January, https://www.iif.com/Research/Capital-Flows-and-Debt/Global-Debt-Monitor.

Keen, S (2017): Can We Avoid Another Financial Crisis? Cambridge and Malden: Polity Press.

— (2020a): “A Modern Jubilee as a Cure to the Financial Ills of the Coronavirus,” 3 March, https://www.patreon.com/posts/modern-jubilee-34537282.

— (2020b): “Thinking Exponentially about Containing the Coronavirus (corrected),” 3 March, https://www.patreon.com/posts/thinking-about-34565061.

Öncü, T S (2015): “When Will the Next Financial Crisis Start?” Economic & Political Weekly, Vol 50, No 24, pp 10–11.

— (2019): “Non-financial Private Debt Overhang,” Economic & Political Weekly, Vol 54, No 45, pp 10–11.

Öncü, A and T S Öncü (2020a): “A New Framework for Global Debt Deleveraging: Globally Coordinated Deleveraging Authorities,” forthcoming.

— (2020b): “Debt, Wealth and Climate: Globally Coordinated Climate Authorities for Financing Green,” forthcoming.

Roubini, N and S Mihm (2010): Crisis Economics: A Crash Course in the Future of Finance, New York: Penguin.

Roubini, N (2020): “The White Swans of 2020, Project Syndicate,” 17 February, https://www.project-syndicate.org/commentary/white-swan-risks-2020-by-nouriel-roubini-2020-02.

Stiglitz, J E, T N Tucker and G Zucman (2019): “The Starving State: Why Capitalism’s Salvation Depends on Taxation,” https://www.foreignaffairs.com/articles/united-states/2019-12-10/starving-state.

Taleb, N (2007): The Black Swan: The Impact of the Highly Improbable, New York: Penguin.

More articles by:SABRI ÖNCÜ

Sabri Öncü is an economist based in Istanbul, Turkey. He can be reached at: sabri.oncu@gmail.com.

by SABRI ÖNCÜ

Photograph Source: Richard Eriksson – CC BY 2.0

Whether a black swan or a scapegoat, Covid-19 is an extraordinary event. Declared by the WHO as a pandemic, Covid-19 has given birth to the concept of the economic “sudden stop.” We need extraordinary measures to contain it.

Initially referred to as the novel coronavirus 2019, the coronavirus disease (Covid-19) originated late in 2019 in Wuhan, China and was first reported to the World Health Organization (WHO) Country Office in China on 31 December 2019. Rapidly becoming an endemic, it was declared by the WHO a “Public Health Emergency of International Concern” on 30 January 2020.

Covid-19, now present in more than 100 countries, has been declared a pandemic by the WHO. However, the global financial markets had declared it a pandemic in the week that started on Monday, 24 February 2020, by overwhelmingly vouching for pandemic. They did this through the fastest equity market correction of all time that took place in about six to seven days, where a correction is defined as at least a 10% drop from the peak. There remains a second question which still is debated, and it is about whether Covid-19 is a swan or a goat.

Swan, Goat or Both?

While the origin of the concept of goat (specifically, scapegoat) is Chapter 16 of Leviticus, one of the early books of the Bible, the origin of the concept of swan in the current context is from Black Swan. There is also the white swan, which originated in Crisis Economics: A Crash Course in the Future of Finance. A scapegoat is a person or an event blamed for the wrongdoings, mistakes, or faults of others, especially for reasons of expediency. As for the two swans, a black swan, as defined by Taleb (2007), is an unpredictable outlier event with an extreme impact, and a white swan, as defined by Roubini and Mihm (2010), is the same as a black swan except that it is predictable.

Although, in a recent essay, Roubini (2020) identified several white swans for 2020 that “could trigger severe economic, financial, political, and geopolitical disturbances,” such as the escalation of the ongoing cold war between the United States (US) and China to a near hot war, and the potentially catastrophic effects of climate change, even he did not refer to Covid-19 as a white swan as it was an undeniably unpredictable event. So the real debate is whether Covid-19 is a black swan or a scapegoat.

Although we could not have predicted it, Covid-19 was not the reason, but just the trigger for the ongoing financial crash as all we needed was the proverbial straw to break the finance sector’s back (Öncü 2015). With asset price bubbles everywhere and the total global debt over 322% of the world gross domestic product in the third quarter of 2019 (IIF 2020), something had to trigger what is happening now.

‘Economic Sudden Stop’

But Covid-19 was not just any trigger as it gave birth to the concept of the economic “sudden stop.” When the global equity markets dropped on 31 January 2020 following the WHO declaration of the Public Health Emergency of International Concern, El-Erian (2020) warned the investors on 2 February 2020 that they should snap out of the “buy the dip” mentality. Pointing out two vulnerabilities, namely structurally weak global growth and less effective central banks, he introduced the concept of “sudden stop” economic dynamics.

Although El-Erian is yet to define what exactly an “economic sudden stop” is, I take it as an abrupt onset of a deep recession. In the case of Covid-19, it is a sudden stop of economic activity resulting in supply and demand shocks to the global economy as major cities in infected countries, more than 100 and counting, are put on lockdown. And, add to that the deepening oil price war between Russia and Saudi Arabia.

Shortly after 6 pm on 8 March 2020 in New York, the futures markets opened and oil futures (both Brent and WTI) are trading about 21% down, gold is above $1,700 per ounce, and all United States (US) equity index futures are trading about 4% down. What is worse is that with the long-term US Treasury yields at their historical lows (10-year yield below 0.5% and 30-year yield below 1% as I write), the capital markets are frozen (not to mention many oil projects that will go bust at these prices).

Disorderly Deleveraging

All this means that what I claimed inevitable in my column (Öncü 2019) has already started: a disorderly global non-financial private sector debt deleveraging, which is likely to lead to deep global debt deflation, followed by a recession (and possibly a depression), thereby creating financial and economic instabilities, and further tensions in international relations with dire consequences for emerging and developing countries, not to mention developed countries.

As mentioned in Öncü (2019), while in developed and high-income developing countries, the non-financial private sector is more over-indebted, in middle-income and low-income developing countries, the public sector is more over-indebted. Given that the global non-financial private sector debt deleveraging has already started, the analysis in Öncü (2019) indicates that the public sector debts of the developed and high-income developing countries will also go up and the governments’ ability to rescue their economies will also decline in these countries. Furthermore, this will severely constrain the governments’ ability to spend on climate change-related projects to address the potentially catastrophic effects of climate change for many years to come, diminishing our hopes to make the necessary investments and innovations to address the now existential climate crisis on time. Last, but not least, the measures we have to take to control the spread of Covid-19 before a cure is found will further challenge the financial system, as people stop earning an income and businesses go bankrupt (Keen 2020b).

Orderly Deleveraging

In this column last year, I looked at the German Currency Reform (GCR) of 1948 as a modern example of debt restructuring to see if it could be adapted for use now (Öncü 2019). Recall that the original plan of the GCR consisted of (i) conversion of currency and debts at a ratio of 10 reichsmarks for one deutschemark, and (ii) a fund built with a capital levy for the equalisation of burdens (Lastenausgleich) to correct part of the inequity between owners of debt, and owners of real assets and shares of corporations. As the actual GCR deviated from the planned GCR in that it required all financial institutions to remove from their balance sheets any securities of the Reich and cancel all accounts and currency holdings of the Reich, it impaired the balance sheets of nearly all of the financial institutions. The equalisation claims were the solution, which were interest-bearing government bonds of a then non-existing government and had no set amortisation schedules. They later became bonds of the Federal Republic of Germany, established on 23 May 1949.

In his two Patreon posts, Keen (2020a, 2020b) proposed several extraordinary measures including the “Modern Debt Jubilee” (MDJ) of Keen (2017) that the governments, central banks and financial regulators should take now to stop the health effects of Covid-19 triggering a financial crisis that could in turn make Covid-19 worse. Supporting these immediate measures wholeheartedly, I add a globally coordinated deleveraging framework to be considered later that Ahmet Öncü and I have proposed in Öncü and Öncü (2020a, 2020b). Our proposal is a blend of the MDJ and the GCR.

In our framework, there would be three authorities to maintain a deposit account at the central bank in each country: a deleveraging authority for leverage reduction, Lastenausgleich authority for capital levies, and a climate authority for financing needs in developing national climate plans. These national authorities should be globally coordinated through the appropriate United Nations agencies.

The Lastenausgleich authority would be under the finance ministry, whereas the deleveraging and climate authorities would be not-for-profit corporations promoted by the government. The government would capitalise the deleveraging and climate authorities by the Treasury-issued zero-coupon perpetual bonds, that is, our proposed equalisation claims. The deleveraging authority would then sell its equalisation claims to the central bank in exchange for an increased balance in its deposit account at the bank, while the climate authority would wait until the deleveraging concludes. Further, the climate authority would not be allowed to open deposit accounts to its borrowers to ensure that it would be a pure financial intermediary, not a bank.

Assuming that a globally agreed-upon debt reduction percentage that would bring the global non-financial sector leverage well under 100% is determined, and that all countries agree to act simultaneously, the framework is as follows (i) the financial institutions comprising the banks and non-bank financial institutions (NBFIs) write down all the loans and debt securities on both sides of their balance sheets by the required percentage; (ii) the deleveraging authority compensates the banks and NBFIs for the loss if any; and (iii) the deleveraging authority pays each qualified resident their allocated amount less than the debt relief if any. If an NBFI gains after the above debt reduction, it should owe equalisation liabilities to the deleveraging authority of its jurisdiction. Note that as all debts mean all debts, public sector debts will also be written down by the same percentage except the official debts of the sovereigns that fall out of the scope of our proposed framework and should be handled by other means.

After Deleveraging

After deleveraging, the balance of the deleveraging authority account at the central bank goes down whereas the total balance of the bank accounts (reserves) at the central bank go up by the total payment made by the deleveraging authority. Hence, the base money goes up by the total payment of the deleveraging authority. Since NBFIs and residents cannot maintain deposit accounts at the central bank, they have to be paid through a bank which creates deposits for the NBFIs and residents against reserves. Hence, the broad money goes up by the amount of the payment to the NBFIs and residents.

One issue is that in many countries, the bank and NBFI balance sheets are multi-currency balance sheets. However, the deleveraging authority payments are in domestic currency, which may create currency risk for some banks and NBFIs. Backed by the central banks, the globally coordinated national deleveraging authorities should stand ready to intervene to avoid potential crises.

The authorities would require their domestic banks and other financial institutions to spend an internationally agreed-upon percentage of their newly found money, if any, after the deleveraging on the interest-bearing, finite-maturity bonds the national climate authorities would issue. Since the promoter of the climate authority is the government, the bonds of the climate authority would have the same credit with the government bonds, and the central bank would accept the climate authority bonds in its open market operations. Therefore, the climate authority bonds would be the main tool to manage the reserves and deposits created through the equalisation claims. In addition, the climate authority bonds could be used for the greening of the financial system through the investment of foreign exchange reserves of the central banks proposed by the Bank of International Settlements (BIS 2019).

Lastly, equipped with a “globally coordinated wealth registry” (Stiglitz et al 2019), the Lastenausgleich authorities would collect progressive wealth taxes from the owners of real and non-debt financial assets for the equalisation of burdens. While a part of these taxes could be used to retire some of the equalisation claims and the corresponding reserves and deposits created in the deleveraging process, another part could be transferred to the climate authorities, and the rest could be spent in the interests of the society.

References

BIS (2019): Green Bonds: The Reserve Management Perspective, Bank of International Settlements, https://www.bis.org/publ/qtrpdf/r_qt1909f.htm, viewed on 18 December 2019.

El-Erian, M (2020): “Coronavirus Should Snap Investors Out of ‘Buy the Dip’ Mentality,” Financial Times, 2 February.

IIF (2020): Global Debt Monitor, International Institute of Finance, January, https://www.iif.com/Research/Capital-Flows-and-Debt/Global-Debt-Monitor.

Keen, S (2017): Can We Avoid Another Financial Crisis? Cambridge and Malden: Polity Press.

— (2020a): “A Modern Jubilee as a Cure to the Financial Ills of the Coronavirus,” 3 March, https://www.patreon.com/posts/modern-jubilee-34537282.

— (2020b): “Thinking Exponentially about Containing the Coronavirus (corrected),” 3 March, https://www.patreon.com/posts/thinking-about-34565061.

Öncü, T S (2015): “When Will the Next Financial Crisis Start?” Economic & Political Weekly, Vol 50, No 24, pp 10–11.

— (2019): “Non-financial Private Debt Overhang,” Economic & Political Weekly, Vol 54, No 45, pp 10–11.

Öncü, A and T S Öncü (2020a): “A New Framework for Global Debt Deleveraging: Globally Coordinated Deleveraging Authorities,” forthcoming.

— (2020b): “Debt, Wealth and Climate: Globally Coordinated Climate Authorities for Financing Green,” forthcoming.

Roubini, N and S Mihm (2010): Crisis Economics: A Crash Course in the Future of Finance, New York: Penguin.

Roubini, N (2020): “The White Swans of 2020, Project Syndicate,” 17 February, https://www.project-syndicate.org/commentary/white-swan-risks-2020-by-nouriel-roubini-2020-02.

Stiglitz, J E, T N Tucker and G Zucman (2019): “The Starving State: Why Capitalism’s Salvation Depends on Taxation,” https://www.foreignaffairs.com/articles/united-states/2019-12-10/starving-state.

Taleb, N (2007): The Black Swan: The Impact of the Highly Improbable, New York: Penguin.

More articles by:SABRI ÖNCÜ

Sabri Öncü is an economist based in Istanbul, Turkey. He can be reached at: sabri.oncu@gmail.com.

New Report – Fear, Inc.: War Profiteering in the Central African Republic and the Bloody Rise of Abdoulaye Hissène

Posted by Enough Team on November 13, 2018

Posted by Enough Team on November 13, 2018

The Sentry’s latest report focuses on the financial drivers of the protracted crisis in the Central African Republic, and follows the path of Abdoulaye Hissène — a notorious warlord, one-time minister and businessman who has been deeply involved in the country’s conflict for almost a decade.

The Sentry’s investigation reveals that Hissène has built a profitable business network from the ashes of devastating sectarian violence. By inciting hatred and sowing divisions between ethnic and religious communities, he has gradually become one of the most influential war profiteers in the CAR conflict. Acting as a “minister” and a leader of multiple armed groups, while also advertising his control of rich mining sites, Hissène has benefited from the illicit trade in diamonds and gold.

Mass violence is a billion-dollar business in the Central African Republic. Unscrupulous political and economic actors, including foreigners, fuel and perpetuate warfare for personal gain. By capturing the country’s rich resources with the complicity of perpetrators of mass atrocities like Abdoulaye Hissène, these networks have sunk the people of the Central African Republic into a terrifying realm of deep injustice, crushing poverty, and overwhelming fear.” — Nathalia Dukhan, Central African Republic Researcher and Analyst at the Enough Project.

Hissène’s rise illustrates the violent system endemic in CAR that incentivizes conflict over peace. War profiteers and their allies, national and foreigners, hamper peace efforts, given that conflict and state collapse are viewed as lucrative business and smart politics.

It is time to change this dynamic and ensure that there is meaningful accountability for individuals like Hissène, and their networks, with consequences that can create leverage for more sustainable peace processes. The Sentry report includes recommendations intended to provide policymakers with strategies to end the incentives for violence, and ultimately encourage accountability and leverage to pave the way for a lasting peace.

Click here to read the full report and recommendations. Cliquez ici pour lire le rapport.

Click here to read a one-pager on the report.

The Sentry’s investigation reveals that Hissène has built a profitable business network from the ashes of devastating sectarian violence. By inciting hatred and sowing divisions between ethnic and religious communities, he has gradually become one of the most influential war profiteers in the CAR conflict. Acting as a “minister” and a leader of multiple armed groups, while also advertising his control of rich mining sites, Hissène has benefited from the illicit trade in diamonds and gold.

Mass violence is a billion-dollar business in the Central African Republic. Unscrupulous political and economic actors, including foreigners, fuel and perpetuate warfare for personal gain. By capturing the country’s rich resources with the complicity of perpetrators of mass atrocities like Abdoulaye Hissène, these networks have sunk the people of the Central African Republic into a terrifying realm of deep injustice, crushing poverty, and overwhelming fear.” — Nathalia Dukhan, Central African Republic Researcher and Analyst at the Enough Project.

Hissène’s rise illustrates the violent system endemic in CAR that incentivizes conflict over peace. War profiteers and their allies, national and foreigners, hamper peace efforts, given that conflict and state collapse are viewed as lucrative business and smart politics.

It is time to change this dynamic and ensure that there is meaningful accountability for individuals like Hissène, and their networks, with consequences that can create leverage for more sustainable peace processes. The Sentry report includes recommendations intended to provide policymakers with strategies to end the incentives for violence, and ultimately encourage accountability and leverage to pave the way for a lasting peace.

Click here to read the full report and recommendations. Cliquez ici pour lire le rapport.

Click here to read a one-pager on the report.

The Economics of War: Profiteering, Militarism and Imperialism

Bad things occur and persist because of the presence of powerful beneficiaries. In this provocative and illuminating book, Imad Moosa illustrates the economic motivations behind the last 100 years of international conflict, citing the numerous powerful individual and corporate war profiteers that benefit from war.

Inspired and informed by War is a Racket, the 1935 work of General Smedley Butler, the author explores historic and contemporary incidents of war profiteering, identifying individuals and groups that have increased their wealth through the supply of weaponry, mercenaries, provisions and finance in times of war. This book offers a caustic indictment of the military-industrial complex, exploring the privatisation of conflict that has fuelled war across the globe.

Providing a contemporary, in-depth analysis of the economics of war, this book is critical for academics and students of war studies, international relations and military and political history. Policy makers will also benefit from this book's comprehensive analysis of wartime policy and practice.

Review

'The Economics of War makes an important contribution to our understanding of the causes of war. By identifying the economic incentives motivating wars of aggression, Imad Moosa pulls back the curtain to reveal the stark realities of a foreign policy grounded in militarism and imperialism.'

--Christopher Coyne, George Mason University, US

'A passionate, uncompromising analysis of historical events that makes a compelling case that most wars were motivated by the economic gains of the few able to exercise political power that was a catastrophic cost to the many. A well-chronicled proposition that immoral acts of violence were imperialist or profiteering pursuits under the guise of humanitarian and moral actions.'

--John Vaz, Monash University, Australia

'Moosa looks beyond the explicit aims of war to reveal the economic and financial incentives and dimensions underpinning wars of aggression in our modern society. Not since Smedley Butler (1935) has an author so bravely critiqued the true drivers of modern warfare to reveal an uncomfortable truth: wars are about money, rather than noble causes. The book is an informative and enthralling read for anyone interested in the history and causes of war, the international legalisation of war, the micro- and macro-economic impacts of war, and war profiteering.'

--Kelly Burns, Curtin University, Australia

--Christopher Coyne, George Mason University, US

'A passionate, uncompromising analysis of historical events that makes a compelling case that most wars were motivated by the economic gains of the few able to exercise political power that was a catastrophic cost to the many. A well-chronicled proposition that immoral acts of violence were imperialist or profiteering pursuits under the guise of humanitarian and moral actions.'

--John Vaz, Monash University, Australia

'Moosa looks beyond the explicit aims of war to reveal the economic and financial incentives and dimensions underpinning wars of aggression in our modern society. Not since Smedley Butler (1935) has an author so bravely critiqued the true drivers of modern warfare to reveal an uncomfortable truth: wars are about money, rather than noble causes. The book is an informative and enthralling read for anyone interested in the history and causes of war, the international legalisation of war, the micro- and macro-economic impacts of war, and war profiteering.'

--Kelly Burns, Curtin University, Australia

About the Author

Imad A. Moosa, Professor of Finance, Royal Melbourne Institute of Technology (RMIT), Australia

The Virus and Capitalism

by ROB URIE MARCH 20, 2020

Photograph Source: NIAID – CC BY 2.0

The U.S. is in the midst of a full-blown public health crisis made worse by systemic political dysfunction. The benchmark Imperial College study suggesting that up to two million people in the U.S. could die from the coronavirus epidemic assumes that the U.S. has an adequate healthcare system— that no one dies from not getting treatment. It doesn’t. Without one, expected deaths are much higher. Should the U.S. experience be similar to Italy or Wuhan to date, add another eleven million* dead to the worst case scenario.

The point here isn’t to create fear or panic, but to illustrate the difference in outcomes that a robust government response can make. In trying to corner the market for virus test kits, Donald Trump assured that few, if any, would be available. In like fashion, House Democrats passed a paid-time-off bill so fraudulent that even Pravda-on-the-Hudson, the New York Times, called them on it. The official plan to date is financial, to bail out Wall Street and the airlines, a payroll tax cut and token checks to the masses, and hope that it all works out.

In lieu of providing an adequate level of healthcare to address the pandemic, which even hardened D.C. hacks know can’t be conjured out of thin air in a timely enough fashion, what is left is ‘social distancing.’ This is polite speak for quarantines variably undertaken. China was able to reduce the mortality rate after Wuhan by 4/5ths through a combination of draconian quarantines and a rapid buildout of healthcare provision. However, the infection rate reportedly began rising as soon as the quarantine measures were relaxed.

The strategy of ‘flattening the curve,’ of slowing the spread of the virus so that the healthcare system isn’t overwhelmed at any one time, could bring the mortality rate in the U.S. down by matching healthcare need to capacity. But implied in the structure of the economic stimulus is a couple of weeks at home watching Netflix and then it’s back to the races. This is a low probability outcome. Eighteen months, the anticipated duration of the pandemic if effective action to mitigate it is taken, means that a radically changed world will emerge from the other side.

the structure of the economic stimulus is a couple of weeks at home watching Netflix and then it’s back to the races. This is a low probability outcome. Eighteen months, the anticipated duration of the pandemic if effective action to mitigate it is taken, means that a radically changed world will emerge from the other side.

the structure of the economic stimulus is a couple of weeks at home watching Netflix and then it’s back to the races. This is a low probability outcome. Eighteen months, the anticipated duration of the pandemic if effective action to mitigate it is taken, means that a radically changed world will emerge from the other side.

the structure of the economic stimulus is a couple of weeks at home watching Netflix and then it’s back to the races. This is a low probability outcome. Eighteen months, the anticipated duration of the pandemic if effective action to mitigate it is taken, means that a radically changed world will emerge from the other side.

The idea being floated by Wall Street that pandemics are ‘black swans,’ unanticipated and unanticipatable events that legitimate extraordinary responses like government bailouts of private enterprises, suggests that history be made a required subject in business schools. Here is a partial list of epidemics and pandemics. They are so common that a functioning society would have thousands of permanent staff that do nothing but plan for them. And they are one of several thousand reasons why a functioning society would have a functioning healthcare system.

To understand why Wall Street should be left to rot this go around, look back to January 1980, when the current bull market can be estimated to have begun. The S&P 500 has to fall by another 2/3rds, from 2,400 to 910, to get to the normal valuation level (CAPE P/E = 8.5) at which this epoch of finance capitalism began. Understand, the S&P 500 at 910 wouldn’t represent a crisis, just a more reasonable valuation level. The financial crisis, to the extent there is one, is due to systemic leverage, the same problem that Wall Street faced in 2008.

The pandemic is but the catalyst for current financial troubles, not the cause. As was warned in 2009, 2010, 2011, 2012, 2013, 2014, etc., the Obama Administration’s bailouts were to make rich people rich again, not to ‘save the economy.’ So, here we are ten years later and the previously bailed out are once again telling us that the Federal government has to bail out corporations and the rich to ‘save the economy.’ ‘The economy’ is indeed in trouble, but it is in trouble because of the fragility created to benefit corporations and the rich, not because stock prices have fallen.

If ever there was a time for bold government action, this is it. The problem is that four decades of neoliberalism have instantiated the ethos that the role of government is to make rich people richer. Naomi Klein call this ‘disaster capitalism.’ I defer to Marx and Lenin. The idea that bailouts for corporations benefit workers begs the question: if the goal is to help workers, why not give the money to workers? It is the CEOs and corporate boards that loaded up their companies with debt to raise the value of their stock options that made these corporations so economically fragile.

More broadly, through the self-serving mythology of rugged individualism, capitalism has been used to shape and reshape social relations. This makes its dependence on serial bailouts both ridiculous and pathetic. Conceived several centuries ago to shift power from Aristocrats to a burgeoning business class, without a large and intrusive government to prevent consolidation and self-dealing, it quickly creates a new Aristocracy to close the door behind it. What is left is the privileged, remote and self-dealing oligarchy that now stands before us.

During ‘normal’ times, when this oligarchy isn’t acting to destroy other nations and the world, malgovernance for its own benefit is made the ordinary working of government. For instance, the U.S. military is wildly overfunded while the healthcare system is structured to let the people die at a politically acceptable pace. During ‘not normal’ times, a hierarchy of privilege is set in motion. First, save the wealth of the rich through bailouts. Second, secure the rights of corporations to profit from catastrophe. Last, let the people die at a politically acceptable pace.

A pandemic forces the afterthought— the pace at which the people are allowed to die, to the fore. The U.S. is currently working through bailouts to secure the wealth of the oligarchs and corporate monopoly plays to profit from catastrophe. Threatening to overturn the applecart is people dying at a politically unacceptable pace. The edifice of unenlightened self-interest risks being exposed. A few days without a paycheck and the rent doesn’t get paid. Without the rent, the landlord can’t pay the mortgage. Without the mortgage being paid, the bank goes under.

Suddenly the ‘richest country in the history of the world’ looks like some crappy third-world backwater. The social brutality of working paycheck to paycheck is transformed from individual to systemic failure. Bailouts for the rich expose how they got rich in the first place. And corporate chieftains scrambling to extort profits from sick and dying people exposes the class dynamic by which the rich get rich— by making poor people poor. The risk for the rich is that the logic of the guillotine begins to make sense. The risk for the rest of us can be counted in the sick and dying.

The coronavirus pandemic was both predictable, in that pandemics have been regular occurrences throughout human history, and it is external to how social organization is conceived under capitalism. Neoliberalism is a theory of governance without governing, of letting nature, in the form of markets, decide. Letting nature decide in a pandemic means the passive acceptance of mass deaths, which ties to the neoliberal refusal to create a functioning healthcare system. Political economy premised on individual desires is antithetical to the social nature of a pandemic. As with environmental degradation, it produces the logic of collective suicide.

The official American response to the pandemic has been exceptional only in the sense that markets have failed so spectacularly. The insipid, bi-partisan house ideology hasn’t worked because capitalism doesn’t solve social problems. It isn’t intended to. Donald Trump’s clumsy effort to corner the market in virus test kits for ‘American’ corporations has meant that we simply don’t have them. Obamacare certainly hasn’t produced any. The strategy that is unfolding of ad hoc quarantines and wishful thinking will either be converted into a robust response or the existing political order will end.

The hope that Democrats will fix what the Republicans broke is running up against three decades of Democrats breaking things. Joe Biden, who wholeheartedly supported George W. Bush’s $4 trillion war against Iraq, just last week claimed that the U.S. can’t afford a functioning healthcare system. Mr. Biden’s actual history in elected office has been to the right of Ronald Reagan. He spent decades trying to cut Social Security and Medicare. He supported bankruptcy legislation that shifted the onus for unpayable loans from banks to poor people. He is the worst person the Democrats could put forward in a pandemic if they care about governing.

The question of bailouts is fundamentally different from that of taking care of people. An adequate response to the pandemic will require years of dedicated effort, not tossing a trillion dollars at ‘the economy’ and hoping for the best. Social distancing and quarantines might require income and material support for tens of millions of people for as long as eighteen months. Nancy Pelosi is reportedly already balking at spending government money to do what is necessary. It would be a benefit to workers if she forced her corporate sponsors to provide paid time off for their employees, but she won’t do this.

The economic fragility behind the rapid descent into economic crisis isn’t a product of nature. It was purposely created by the bi-partisan political establishment at the behest of oligarchs and academic economists. NAFTA was meant to make workers economically insecure. Welfare ‘reform’ was passed to make life outside of capitalist employment intolerably tenuous. The minimum wage hasn’t been a living wage for forty years. And plans to cut Social Security and Medicare are meant to increase economic fragility. Likewise, austerity is the enforcement mechanism to keep the rich in control of American political economy.

This combination of manufactured social fragility and neoliberal governance will sooner or later produce a political rupture. The election of Donald Trump was the first act of one. An extended economic crisis can produce social solidarity or a deeply ugly political response. The Democrats’ choice to stick with their neoliberal program means that they are indifferent between electing Joe Biden and a second term for Donald Trump. Add the widespread unemployment that is already baked into their reflexive austerity and a more perfect formula for fascist ascendance is difficult to imagine.

The question of who would be to blame for such an outcome depends who gets to decide the answer. That makes it about power, not truth. As this pandemic plays out, finger pointing will be the least of our worries.

Notes.

* 330 million people X 80% infection rate X 5% mortality rate = 13.2 million dead in U.S.; 330 million is the U.S. population, 80% is the expected infection rate from the Imperial College study and 5% is the realized mortality rate in Italy and Wuhan.

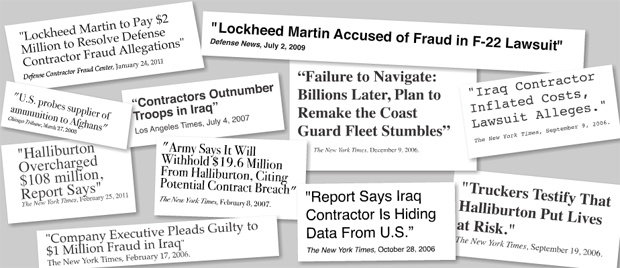

CORPORATE POWER & PROFITEERING

Large defense contractors have played a central role in fighting the post-9/11 wars. They have provided workers who have engaged in direct combat and provided supplies, logistical services, and arms to coalition forces and the new Iraqi and Afghan governments. Private contracting has grown to such a level that, by 2011, there were more private contract employees involved in the wars in Iraq and Afghanistan than uniformed military personnel.

Critics have raised major economic and security concerns including the concentration of defense contracts among just a handful of large firms, exorbitant prices for goods and services, fraudulent contracts, and the “revolving door” between the large defense contractors and government, such as that between Halliburton and the Bush administration.

The growth of private contracting has increased not only in the military, but also in the Central Intelligence Agency (CIA), National Security Agency (NSA), and the Department of Homeland Security (DHS), where private contract employees outnumber government employees in United States intelligence operations.

Defense contractors have also played a significant role in arms sales to the Iraqi government. Those sales put a budgetary strain on Iraq when it has yet to restore important services disrupted by the war. Significant numbers of those arms have also since been diverted to the Islamic State or otherwise misused. https://watson.brown.edu/costsofwar/costs/social/corporate

Beyond Sanctioning Elusive War Criminals, Prosecute the Profiteers

by Holly Dranginis

April 4, 2019

Bidibidi is the world’s second-largest refugee camp. A sea of tents and huts spilling into Uganda from its northern border, the settlement now hosts more than a quarter million South Sudanese seeking safety from a range of horrors in their country, including routine electrocution in torture camps and rape by government soldiers. Last summer, militias perpetrated gender-based violence “on a massive scale” in Unity State, the pride of South Sudan’s oil barons. This is where industry and militarization meet, with government militias paid in revenues reaped from petrol extraction, and repressive tactics surging in service of control over lucrative land.

Survivors of these crimes, along with concerned members of the international community, are searching for justice. The barriers are many, including both an utter lack of will by the South Sudanese government, a co-opted, gutted judicial system, and weakened regional and international systems. For those affected, and for those who care, there has been nowhere to turn to hold the perpetrators of atrocities directly accountable in a court of law.

But an innovative legal strategy being tried by a few advocacy groups and prosecutors holds new promise. In short: Follow the money.

Financial sanctions have long been a critical intervention. But teams that investigate and prosecute the world’s most serious crimes in court are largely ignoring the financial dimensions. In so doing, they’re missing valuable testimony, documentary evidence, and a deeper understanding of criminal networks. As a result, we rarely see executives and corporate entities face consequences in courtrooms, despite their crucial roles in modern armed conflict and atrocities.

In February, a United Nations commission on South Sudan warned, “Impunity is…deeply entrenched in South Sudan’s political culture and legal systems, effectively placing government forces and officials and their allied forces above the law.” Absent the possibility of domestic prosecutions, the next options such as international courts are also non-starters. The government of South Sudan has not agreed to participate in the most obvious venue of recourse, the International Criminal Court. And while the 2018 peace agreement includes commitments to establish a specialized hybrid court of international and South Sudanese jurists, the government has blocked any meaningful follow-through, and the African Union, which has the authority to step in, also has opted out.

From South Sudan to Syria to Myanmar, it has become clear the world lacks adequate mechanisms to prosecute state actors for extreme violence against their own citizens. But state-sponsored mass atrocities are often driven by greed and massive profiteering. Probing the financial dimensions of the world’s deadliest armed conflicts could lead to unexplored avenues for war crimes prosecutions, and improve the credibility of justice efforts overall.

Crimes like forced disappearance and sexual violence may seem detached from illicit finance streams and commercial interests, but they can be part of complex strategies supported by corporate networks. Reporting on one of the Democratic Republic of Congo’s most dangerous armed groups, a U.N. agency said in 2016, “The FDLR have structured a dense and diversified economic web, which in return shapes their military activities.” Another example came in June 2018: French authorities indicted the cement company La Farge on evidence of its complicity in the self-styled Islamic State’s brutalities in Syria.

Violent actors rely on business networks, financing, and equipment to inflict harm on a large scale. In turn, brokers, extractives companies, banks, arms dealers, and shell companies stand to earn millions by facilitating violent strategies on resource-rich land.

More Bloody, Costly, and Intractable Wars

With widespread impunity, many of the most powerful co-conspirators and facilitators of atrocities continue operating quite profitably. And their roles are far from negligible. As scholar James G. Stewart has put it, “As a consequence of the illegal trade in minerals, metals, timber, and natural resources, armed conflicts in which participants are able to draw upon easily accessible natural resource wealth are often more bloody, financially costly, and intractable than other forms of armed violence.”

These dirty money dynamics are often quite clear to those directly impacted. Last summer, a man forced to flee South Sudan spoke to me at a hotel bar in a neighboring capital city. He held a position close enough to power that he met me in secret and could not reveal his identity for this piece. I asked about the objectives of the war. “Frustrate these people,” he said, referring to South Sudanese seeking refuge from attacks in their communities. “Let them leave.”

He paused, his gaze training on the ice in his glass. “And it worked.” Indeed, the refugee flow from South Sudan to bordering countries is one of the fastest-growing in the world. Many are leaving areas endowed with lucrative timber, oil, and strategic trafficking routes. The government’s end goal? I asked. He tipped his eyes up to look at me directly. “They’re rich now.”

Network sanctions and anti-money laundering measures, deployed to create consequences for abusive regimes, are crucial responses to this dynamic. Much more could be done on that front.

But in addition, targeting financial accomplices and illicit cash flows directly through courts could have a transformative impact on the drive for justice. Prosecutors could map corporate profiles of army commanders, investigate complicit executives operating abroad, and seize criminally derived assets.

The ICC, the new hybrid court emerging in the Central African Republic, and war crimes units in the U.S. and Europe have the tools to do this integration, but they’re leaving those innovations on the table. To be sure, investigating and prosecuting war crimes is complex and challenging enough without adding this extra dimension. The stakes are high, and the money for training and expertise is tight. But financial motivations, impacts, and actors are a crucial part of the perpetration of war crimes. Incorporating mechanisms to probe them could produce a fuller picture of how atrocity crimes are executed, illuminate vital documentary evidence, and generate funds with asset seizures to pay for much-needed reparations.

Multiplying Jurisdictions

Moreover, financial investigations could have a multiplier effect on the number of potential jurisdictions with the authority to prosecute. Case in point: When the rebel group Nationalist and Integrationist Front committed atrocities during Congo’s second civil war, they were running a lucrative gold cartel out of one of the country’s largest mining areas. The direct perpetrators were never prosecuted for their crimes, but diligent investigations into the gold supply chains, who profited, and where the money wound up, revealed six different countries with authority to investigate, including the U.K.

Authorities in every government concerned with ending the world’s worst humanitarian crises should take a closer look at the commercial actors in their backyards. Many countries providing perpetrators a financial safe haven have war crimes and transnational crimes units. With the right resources, those specialized teams can investigate and pursue the financial facilitators and impacts of ongoing atrocity crimes. Domestic and international courts can seize criminally derived assets in the course of both criminal and civil trials, and that money should furnish reparations programs designed by survivors and their communities.

War is a moneyed place, and greed is often the fuel and incentive behind the world’s most horrific war crimes. Accepting that fact, acting on it, could be pivotal for the pursuit of justice. Without such a shift, some of the most powerful engines of violence will continue operating, and victims and survivors will almost certainly remain without adequate reparations – a perversion given the exorbitant wealth the facilitators and profiteers have stashed away.

Just last month, South Sudan’s oil minister heralded new international interest in the country’s black gold, promising to bring development “back to pre-war levels.” These announcements are alarming, given mounting links between oil and mass atrocities and a sense that for South Sudan’s government, business ambition and militarization are corollaries. Each new effort to probe those links will add volume to a crucial global message: no matter where they operate, war crimes profiteers will be held accountable. That warning is currently a murmur.

This article is based on a new report by the author published at The Sentry, “Prosecute the

by Holly Dranginis

April 4, 2019

Profiteers: Following the Money to Support War Crimes Accountability.”

IMAGE: Two men walk in March 2014 near the Paloch oil fields in Upper Nile State, the site of an oil complex and key crude oil processing facility in the north of the country near the border with Sudan. Fighting in South Sudan had cut production from the country’s lifeline oilfields by about 29 percent, according to the press secretary to President Salva Kiir at the time. In late February that year, rebels loyal to rival Riek Machar had captured Malakal, the capital of Upper Nile state where most of South Sudan’s oil was produced. (Photo by ALI NGETHI/AFP/Getty Images)

IMAGE: Two men walk in March 2014 near the Paloch oil fields in Upper Nile State, the site of an oil complex and key crude oil processing facility in the north of the country near the border with Sudan. Fighting in South Sudan had cut production from the country’s lifeline oilfields by about 29 percent, according to the press secretary to President Salva Kiir at the time. In late February that year, rebels loyal to rival Riek Machar had captured Malakal, the capital of Upper Nile state where most of South Sudan’s oil was produced. (Photo by ALI NGETHI/AFP/Getty Images)

Bidibidi is the world’s second-largest refugee camp. A sea of tents and huts spilling into Uganda from its northern border, the settlement now hosts more than a quarter million South Sudanese seeking safety from a range of horrors in their country, including routine electrocution in torture camps and rape by government soldiers. Last summer, militias perpetrated gender-based violence “on a massive scale” in Unity State, the pride of South Sudan’s oil barons. This is where industry and militarization meet, with government militias paid in revenues reaped from petrol extraction, and repressive tactics surging in service of control over lucrative land.

Survivors of these crimes, along with concerned members of the international community, are searching for justice. The barriers are many, including both an utter lack of will by the South Sudanese government, a co-opted, gutted judicial system, and weakened regional and international systems. For those affected, and for those who care, there has been nowhere to turn to hold the perpetrators of atrocities directly accountable in a court of law.

But an innovative legal strategy being tried by a few advocacy groups and prosecutors holds new promise. In short: Follow the money.

Financial sanctions have long been a critical intervention. But teams that investigate and prosecute the world’s most serious crimes in court are largely ignoring the financial dimensions. In so doing, they’re missing valuable testimony, documentary evidence, and a deeper understanding of criminal networks. As a result, we rarely see executives and corporate entities face consequences in courtrooms, despite their crucial roles in modern armed conflict and atrocities.

In February, a United Nations commission on South Sudan warned, “Impunity is…deeply entrenched in South Sudan’s political culture and legal systems, effectively placing government forces and officials and their allied forces above the law.” Absent the possibility of domestic prosecutions, the next options such as international courts are also non-starters. The government of South Sudan has not agreed to participate in the most obvious venue of recourse, the International Criminal Court. And while the 2018 peace agreement includes commitments to establish a specialized hybrid court of international and South Sudanese jurists, the government has blocked any meaningful follow-through, and the African Union, which has the authority to step in, also has opted out.

From South Sudan to Syria to Myanmar, it has become clear the world lacks adequate mechanisms to prosecute state actors for extreme violence against their own citizens. But state-sponsored mass atrocities are often driven by greed and massive profiteering. Probing the financial dimensions of the world’s deadliest armed conflicts could lead to unexplored avenues for war crimes prosecutions, and improve the credibility of justice efforts overall.

Crimes like forced disappearance and sexual violence may seem detached from illicit finance streams and commercial interests, but they can be part of complex strategies supported by corporate networks. Reporting on one of the Democratic Republic of Congo’s most dangerous armed groups, a U.N. agency said in 2016, “The FDLR have structured a dense and diversified economic web, which in return shapes their military activities.” Another example came in June 2018: French authorities indicted the cement company La Farge on evidence of its complicity in the self-styled Islamic State’s brutalities in Syria.

Violent actors rely on business networks, financing, and equipment to inflict harm on a large scale. In turn, brokers, extractives companies, banks, arms dealers, and shell companies stand to earn millions by facilitating violent strategies on resource-rich land.

More Bloody, Costly, and Intractable Wars

With widespread impunity, many of the most powerful co-conspirators and facilitators of atrocities continue operating quite profitably. And their roles are far from negligible. As scholar James G. Stewart has put it, “As a consequence of the illegal trade in minerals, metals, timber, and natural resources, armed conflicts in which participants are able to draw upon easily accessible natural resource wealth are often more bloody, financially costly, and intractable than other forms of armed violence.”

These dirty money dynamics are often quite clear to those directly impacted. Last summer, a man forced to flee South Sudan spoke to me at a hotel bar in a neighboring capital city. He held a position close enough to power that he met me in secret and could not reveal his identity for this piece. I asked about the objectives of the war. “Frustrate these people,” he said, referring to South Sudanese seeking refuge from attacks in their communities. “Let them leave.”

He paused, his gaze training on the ice in his glass. “And it worked.” Indeed, the refugee flow from South Sudan to bordering countries is one of the fastest-growing in the world. Many are leaving areas endowed with lucrative timber, oil, and strategic trafficking routes. The government’s end goal? I asked. He tipped his eyes up to look at me directly. “They’re rich now.”

Network sanctions and anti-money laundering measures, deployed to create consequences for abusive regimes, are crucial responses to this dynamic. Much more could be done on that front.

But in addition, targeting financial accomplices and illicit cash flows directly through courts could have a transformative impact on the drive for justice. Prosecutors could map corporate profiles of army commanders, investigate complicit executives operating abroad, and seize criminally derived assets.

The ICC, the new hybrid court emerging in the Central African Republic, and war crimes units in the U.S. and Europe have the tools to do this integration, but they’re leaving those innovations on the table. To be sure, investigating and prosecuting war crimes is complex and challenging enough without adding this extra dimension. The stakes are high, and the money for training and expertise is tight. But financial motivations, impacts, and actors are a crucial part of the perpetration of war crimes. Incorporating mechanisms to probe them could produce a fuller picture of how atrocity crimes are executed, illuminate vital documentary evidence, and generate funds with asset seizures to pay for much-needed reparations.

Multiplying Jurisdictions

Moreover, financial investigations could have a multiplier effect on the number of potential jurisdictions with the authority to prosecute. Case in point: When the rebel group Nationalist and Integrationist Front committed atrocities during Congo’s second civil war, they were running a lucrative gold cartel out of one of the country’s largest mining areas. The direct perpetrators were never prosecuted for their crimes, but diligent investigations into the gold supply chains, who profited, and where the money wound up, revealed six different countries with authority to investigate, including the U.K.

Authorities in every government concerned with ending the world’s worst humanitarian crises should take a closer look at the commercial actors in their backyards. Many countries providing perpetrators a financial safe haven have war crimes and transnational crimes units. With the right resources, those specialized teams can investigate and pursue the financial facilitators and impacts of ongoing atrocity crimes. Domestic and international courts can seize criminally derived assets in the course of both criminal and civil trials, and that money should furnish reparations programs designed by survivors and their communities.

War is a moneyed place, and greed is often the fuel and incentive behind the world’s most horrific war crimes. Accepting that fact, acting on it, could be pivotal for the pursuit of justice. Without such a shift, some of the most powerful engines of violence will continue operating, and victims and survivors will almost certainly remain without adequate reparations – a perversion given the exorbitant wealth the facilitators and profiteers have stashed away.

Just last month, South Sudan’s oil minister heralded new international interest in the country’s black gold, promising to bring development “back to pre-war levels.” These announcements are alarming, given mounting links between oil and mass atrocities and a sense that for South Sudan’s government, business ambition and militarization are corollaries. Each new effort to probe those links will add volume to a crucial global message: no matter where they operate, war crimes profiteers will be held accountable. That warning is currently a murmur.

This article is based on a new report by the author published at The Sentry, “Prosecute the

War Profiteering is Real

by SARAH ANDERSON

The prospect of war with Iran is terrifying.

Experts predict as many as a million people could die if the current tensions lead to a full-blown war. Millions more would become refugees across the Middle East, while working families across the U.S. would bear the brunt of our casualties.

But there is one set of people who stand to benefit from the escalation of the conflict: CEOs of major U.S. military contractors.

This was evident in the immediate aftermath of the U.S. assassination of a top Iranian military official on January 2. As soon as the news reached financial markets, these companies’ share prices spiked.

Wall Street traders know that a war with Iran would mean more lucrative contracts for U.S. weapons makers. Since top executives get much of their compensation in the form of stock, they benefit personally when the value of their company’s stock goes up.

I took a look at the stock holdings of the CEOs at the top five Pentagon contractors (Lockheed Martin, Boeing, General Dynamics, Raytheon, and Northrop Grumman).

Using the most recent available data, I calculated that these five executives held company stock worth approximately $319 million just before the U.S. drone strike that killed Iranian leader Qasem Soleimani. By the stock market’s closing bell the following day, the value of their combined shares had increased to $326 million.

War profiteering is nothing new. Back in 2006, during the height of the Iraq War, I analyzed CEO pay at the 34 corporations that were the top military contractors at that time. I found that their pay had jumped considerably after the September 11 attacks.

Between 2001 and 2005, military contractor CEO pay jumped 108 percent on average, compared to a 6 percent increase for their counterparts at other large U.S. companies.

Congress needs to take action to prevent a catastrophic war on Iran. De-escalating the current tensions is the most immediate priority.

But Congress must also take action to end war profiteering. In 2008, John McCain, then a Republican presidential candidate, proposed capping CEO pay at companies receiving financial bailouts. He argued that CEOs relying on taxpayer funds should not earn more than $400,000 — the salary of the U.S. president.

That commonsense notion should be extended to all companies that rely on massive taxpayer-funded contracts. Senator Bernie Sanders, for instance, has a plan to deny federal contracts to companies that pay their CEOs excessively. He would set the CEO pay limit for major contractors at no more than 150 times the pay of the company’s typical worker.

Currently, the sky’s the limit for CEO pay at these companies — and the military contracting industry is a prime offender. The top five Pentagon contractors paid their top executives $22.5 million on average in 2018.

CEO pay restrictions should also apply to the leaders of privately held government contractors, which currently don’t even have to disclose the size of their top executives’ paychecks.

That’s the case for General Atomics, the manufacturer of the MQ-9 Reaper that carried out the assassination of Soleimani. Despite raking in $2.8 billion in taxpayer-funded contracts in 2018, the drone maker is allowed to keep executive compensation information secret.

We do know that General Atomics CEO Neal Blue has prospered quite a bit from taxpayer dollars. Forbes estimates his wealth at $4.1 billion.

War is bad for nearly everyone. But as long as we allow the leaders of our privatized war economy to reap unlimited rewards, their profit motive for war in Iran — or anywhere — will persist.

JANUARY 17, 2020

More articles by:SARAH ANDERSON

Meet the Corporate War Profiteers Making a Killing on Trump's Attacks on Iran

As long as the top executives of our privatized war economy can reap unlimited rewards, the profit motive for war in Iran—or anywhere—will persist.

by Sarah Anderson

We can put an end to dangerous war profiteering by denying federal contracts to corporations that pay their top executives excessively. (Photo: Chris Devers / Flickr)

CEOs of major U.S. military contractors stand to reap huge windfalls from the escalation of conflict with Iran. This was evident in the immediate aftermath of the U.S. assassination of a top Iranian military official last week. As soon as the news reached financial markets, these companies’ share prices spiked, inflating the value of their executives’ stock-based pay.

I took a look at how the CEOs at the top five Pentagon contractors were affected by this surge, using the most recent SEC information on their stock holdings.

Northrop Grumman executives saw the biggest increase in the value of their stocks after the U.S. airstrike that killed Qasem Suleimani on January 2. Shares in the B-2 bomber maker rose 5.43 percent by the end of trading the following day.

Wesley Bush, who turned Northrop Grumman’s reins over to Kathy Warden last year, held 251,947 shares of company stock in various trusts as of his final SEC Form 4 filing in May 2019. (Companies must submit these reports when top executives and directors buy and sell company stock.) Assuming Bush is still sitting on that stockpile, he saw the value grow by $4.9 million to a total of $94.5 million last Friday.

New Northrop Grumman CEO Warden saw the 92,894 shares she’d accumulated as the firm’s COO expand in value by more than $2.7 million in just one day of post-assassination trading.

Lockheed Martin, whose Hellfire missiles were reportedly used in the attack at the Baghdad airport, saw a 3.6 percent increase in price per share on January 3. Marillyn Hewson, CEO of the world’s largest weapon maker, may be kicking herself for selling off a considerable chunk of stock last year when it was trading at around $307. Nevertheless, by the time Lockheed shares reached $413 at the closing bell, her remaining stash had increased in value by about $646,000.

What about the manufacturer of the MQ-9 Reaper that carried the Hellfire missiles? That would be General Atomics. Despite raking in $2.8 billion in taxpayer-funded contracts in 2018, the drone maker is not required to disclose executive compensation information because it is a privately held corporation.

We do know General Atomics CEO Neal Blue is worth an estimated $4.1 billion—and he’s a major investor in oil production, a sector that also stands to profit from conflict with a major oil-producing country like Iran.

Suleimani’s killing also inflated the value of General Dynamics CEO Phebe Novakovic’s fortune. As the weapon maker’s share price rose about 1 percentage point on January 3, the former CIA official saw her stock holdings increase by more than $1.2 million.

Raytheon CEO Thomas Kennedy saw a single-day increase in his stock of more than half a million dollars, as the missile and bomb manufacturer’s share price increased nearly 1.5 percent. Boeing stock remained flat on Friday. But Dennis Muilenberg, recently ousted as CEO over the 737 aircraft scandal, appears to be well-positioned to benefit from any continued upward drift of the defense sector.

As of his final Form 4 report, Muilenburg was sitting on stock worth about $47.7 million. In his yet to be finalized exit package, the disgraced former executive could also pocket huge sums of currently unvested stock grants.

Hopefully sanity will soon prevail and the terrifyingly high tensions between the Trump administration and Iran will de-escalate. But even if the military stock surge of this past Friday turns out to be a market blip, it’s a sobering reminder of who stands to gain the most from a war that could put millions of lives at risk.

We can put an end to dangerous war profiteering by denying federal contracts to corporations that pay their top executives excessively. In 2008, John McCain, then a Republican presidential candidate, proposed capping CEO pay at companies receiving taxpayer bailouts at no more than $400,000 (the salary of the U.S. president). That notion should be extended to companies that receive massive taxpayer-funded contracts.

Sen. Bernie Sanders, for instance, has a plan to deny federal contracts to companies that pay CEOs more than 150 times what their typical worker makes.

As long as we allow the top executives of our privatized war economy to reap unlimited rewards, the profit motive for war in Iran—or anywhere—will persist.

Sarah Anderson directs the Global Economy Project of the Institute for Policy Studies, and is a co-editor of Inequality.org. @Anderson_IPS

Military spending: 20 companies profiting the most from war

Samuel Stebbins and Evan Comen

24/7 Wall Street

There was a 1.1 percent increase in global military spending in 2017, according to the Stockholm International Peace Research Institute.