Jeff Lagerquist

Updated Mon, March 4, 2024

RYDAF

-0.98%

SHEL

-1.12%

EBBGF

-0.38%

EBBNF

-0.09%

EBGEF

+0.69%

ENB

-0.23%

ENBFF

0.00%

ENBHF

0.00%

ENBMF

0.00%

ENBRF

0.00%

WDS

-1.93%

WOPEF

0.00%

A module that arrived by ship is seen at the dock at the LNG Canada export terminal under construction in Kitimat, B.C., on Wednesday, September 28, 2022.

Expanding Canada’s liquefied natural gas (LNG) industry in response to the U.S. pause on approving new export projects is “not supported by market fundamentals,” according to the Institute for Energy Economics and Financial Analysis (IEEFA).

The U.S.-based non-profit’s findings come as a top Canadian oil and gas executive and the federal minister of energy and natural resources frame the situation as a potential opportunity to boost Canada’s share of the global trade.

“It makes little sense for Canadian industry to aggressively push more LNG into the ocean when new supply is not needed,” IEEFA energy finance analyst Mark Kalegha and LNG/gas specialist Christopher Doleman wrote in a new analysis published on Monday.

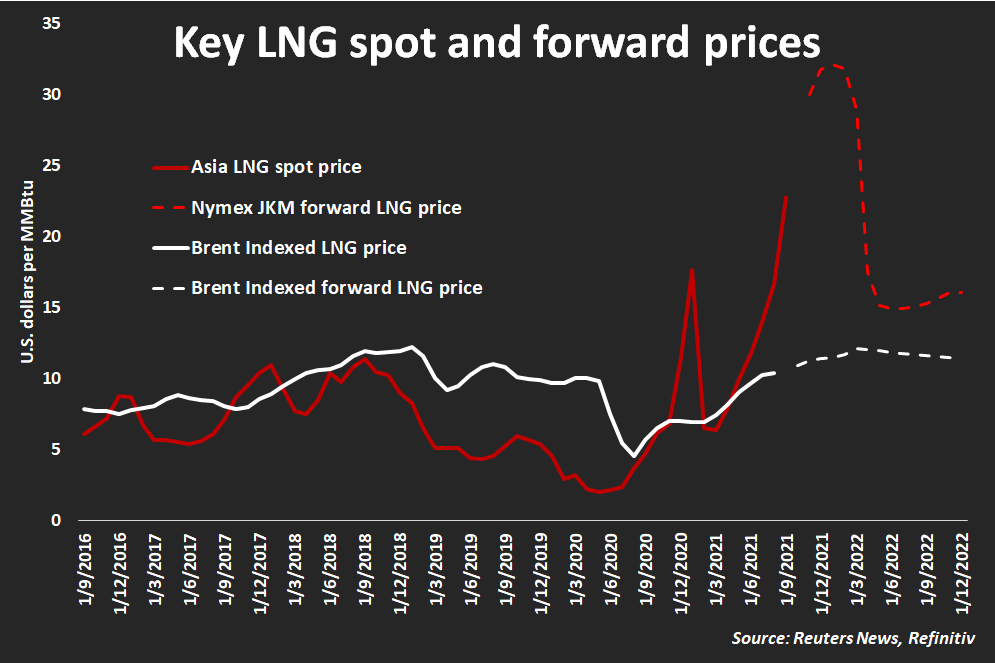

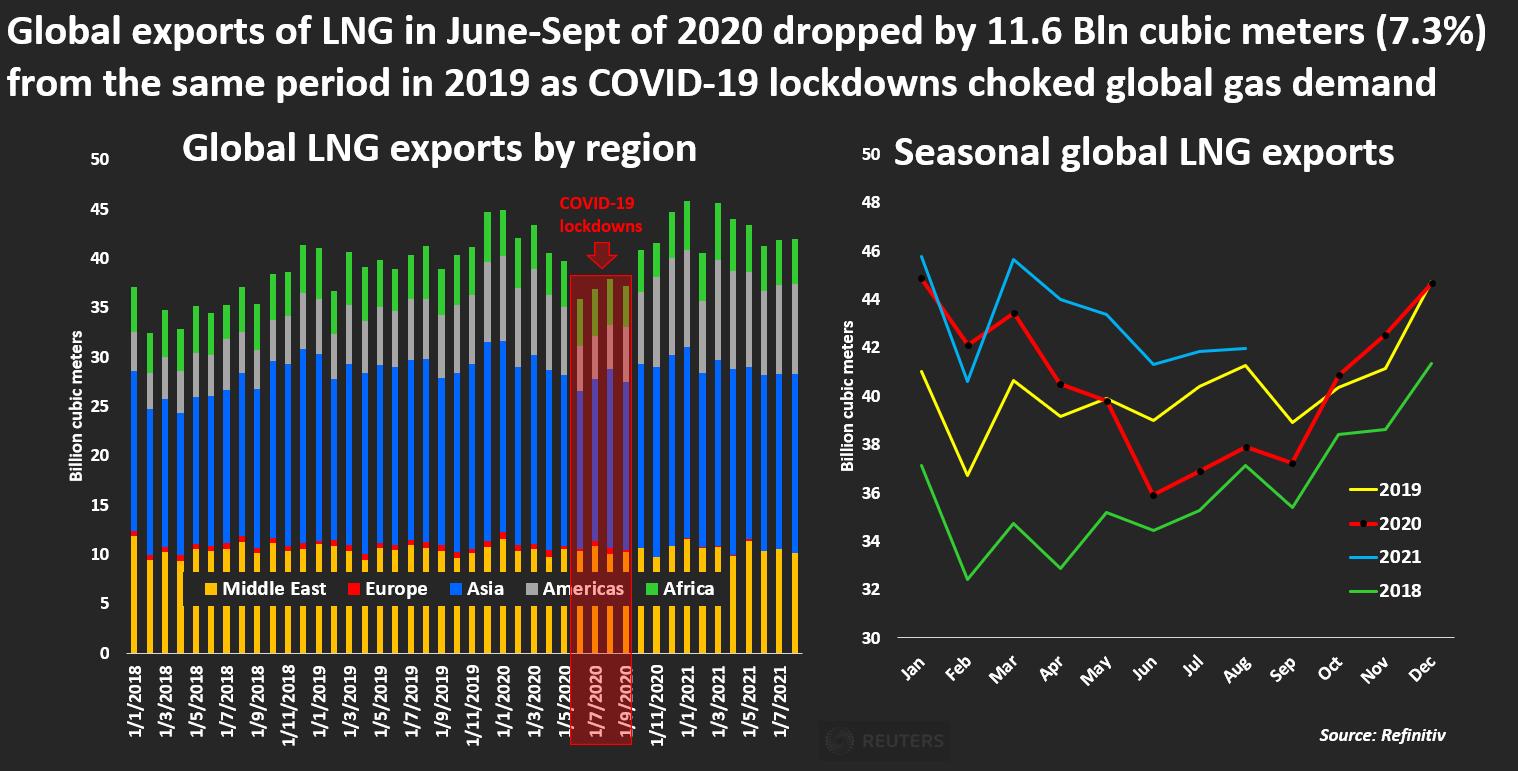

Russia’s full-scale invasion of Ukraine in 2022 sent shockwaves through the global energy market as the Kremlin cut supplies to Europe, causing price spikes, while drawing attention to national energy security concerns.

The response from the global energy industry was swift. In its 2023 World Energy Outlook, the International Energy Agency says an “unprecedented surge in new LNG projects is set to tip the balance of markets” starting in 2025. IEEFA predicts a “global LNG glut” in the later half of this decade, following a historic rise in LNG supply capacity.

Canada’s first large-scale LNG export facility in Kitimat, B.C. is nearly complete. LNG Canada, a joint venture between Shell, PETRONAS, PetroChina, Mitsubishi Corporation and Korea Gas, is expected to begin shipping fuel to Asia in 2025. Two smaller export terminals, Cedar LNG and Woodfibre LNG, are also approved for construction in British Columbia.

"The LNG Canada project in Kitimat, B.C., set to come online in 2025, will be joined by projects in Mexico, the Republic of Congo, Mauritania, Russia, Australia, and Gabon," Kalegha and Doleman wrote. "With its current capacity of 12.3 billion cubic feet per day already projected to almost double by 2028, the United States will continue to produce an abundance of LNG to supply global markets. Other major suppliers, such as Qatar, plan to boost production, and are currently building massive new projects."

Within the LNG industry, Australia's Woodside Energy Group (WDS.AX) recently said it expects consumption to rise 50 per cent over the next decade, pushing the company to consider further expansion. Earlier this month, Shell (SHEL) pared back its forecast to consumption to an increase of more than 50 per cent by 2040.

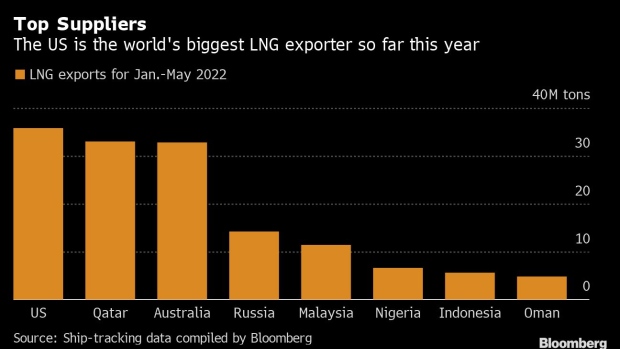

Shortly after the Biden administration’s pause was announced in January, Enbridge CEO (ENB.TO)(ENB) Greg Ebel called the situation a “second chance” for Canada, following America’s emergence as the world’s top LNG exporter over the past decade.

Federal Energy Minister Jonathan Wilkinson has said he sees “an opportunity” for Canada on the basis the industry here has already significantly lowered its emissions.

Lisa Baiton, head of Canada’s main oil and gas industry group, says she wants Canada to “leverage the hell out of” the situation by drawing attention to the country’s tough environmental standards.

“The U.S. a decade ago was nowhere on LNG. Now, they’re the largest exporter on the planet,” she told Yahoo Finance Canada in an interview last month. “That should have been Canada’s opportunity.”

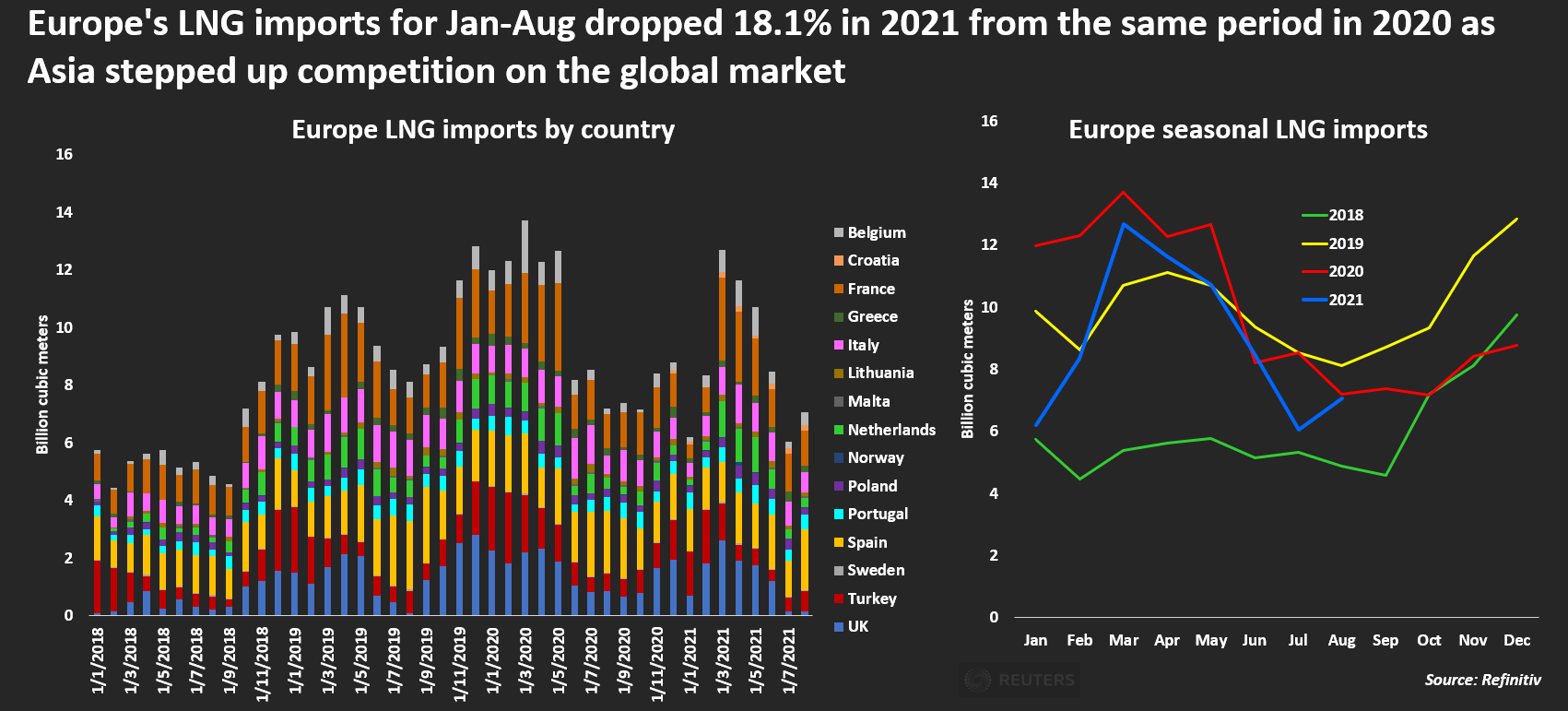

On top of having to navigate “a global market awash with LNG,” IEEFA warns Canadian producers will face an uncertain outlook in Asian growth markets, while Europe cuts its gas demand in line with decarbonization goals.

“The global LNG market is currently saturated with numerous projects under construction,” Kalegha and Doleman wrote. “With a high share of uncontracted volumes, proposed Canadian projects are especially vulnerable.”

Jeff Lagerquist is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jefflagerquist.