B.C. First Nation and Western LNG partner to purchase natural gas pipeline project

The Canadian Press

A B.C. First Nation and a Houston-based firm are buying a ready-to-construct pipeline project that would supply a proposed floating LNG export terminal north of Prince Rupert.

The Nisga’a Nation — whose lands are located on the northwest coast of B.C. near the city of Terrace — and its partner, Texas-based Western LNG, announced Thursday they will be acquiring the Prince Rupert Gas Transmission project from Calgary-based TC Energy Corp.

Financial details of the transaction were not disclosed, but TC Energy said in a news release that initial proceeds from the transaction will not be material. Instead, the company said it has the potential to receive additional payments contingent upon the pipeline getting built and beginning operation.

“Today is a historic day for the Nisga’a Nation and represents a sea change in major industrial development in this country,” said Eva Clayton, President of the Nisga’a Lisims government, in a news release.

“In taking an equal ownership role in this pipeline, we are signalling a new era for Indigenous participation in the Canadian economy."

The Prince Rupert Gas Transmission project is a permitted and ready-to-build 900-km natural gas pipeline that would run from Hudson’s Hope to Lelu Island, near Prince Rupert.

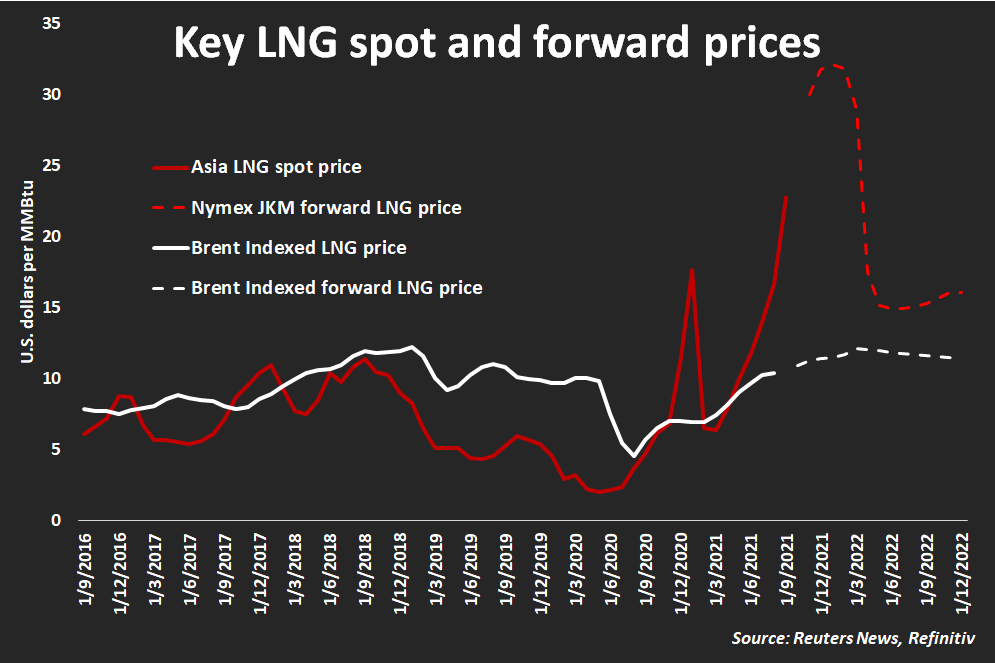

It is the same proposed pipeline that was meant to supply the Pacific NorthWest liquefied natural gas facility, a $36-billion project that was spearheaded by Malaysian energy giant Petronas but scrapped in 2017 due to falling LNG prices and other factors.

Pacific NorthWest had already been approved by the federal government. But its cancellation meant that the shovel-ready pipeline never got built.

The Nisga'a Nation and Western LNG have since proposed their own project, the Ksi Lisims LNG project, which they say would be a floating production facility capable of producing 12 million tonnes per year of liquefied natural gas off of B.C.'s northwest coast.

The partners have not yet made a final investment decision on whether to go ahead with the terminal, which is in the early stages of consultations and hasn't received regulatory approval yet.

But the purchase of the Prince Rupert pipeline project means Ksi Lisims now has an advanced-stage piece of natural gas supply infrastructure.

“We want to acknowledge TC Energy’s efforts developing the project to this point,” said Davis Thames, CEO of Western LNG.

"(The project) is fully engineered, permitted and ready to construct ... We will move this critical project forward with renewed momentum and a fresh perspective."

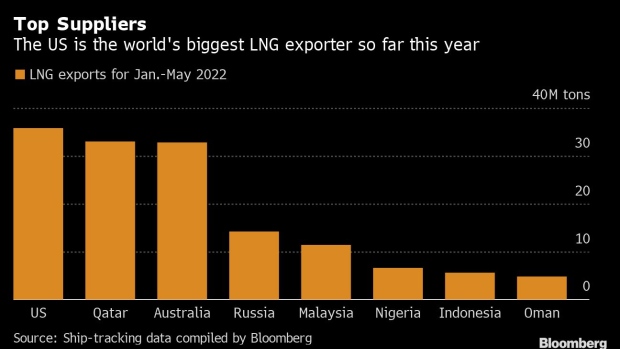

Canada's LNG industry has been slow to take off, especially compared to the U.S., which already has seven LNG terminals in operation, making it the largest LNG exporter in the world.

But the massive Shell-led LNG Canada facility being built near Kitimat is nearing completion, giving Canada its first opportunity to ship domestically produced natural gas in the form of LNG to customers in global markets from this country's own shores.

Two other facilities, Cedar LNG and Woodfibre LNG, have also been proposed.

Proponents of a Canadian LNG industry say liquefied natural gas from Canada could help reduce global greenhouse gas emissions by replacing coal in countries that still rely on the dirtier fuel.

But environmentalists argue that LNG creates its own emissions through the liquefaction and transportation process, as well as through the drilling and flaring of natural gas in Western Canada.

Last month, the Gitanyow Hereditary Chiefs of B.C. challenged Ksi Lisims LNG to prove its greenhouse gas reduction promises and urged the British Columbia Environmental Assessment Office to halt the project's review.

The Nisga’a Nation and Western LNG said they intend to enter into an agreement soon with a construction manager to build the pipeline. The companies said they anticipate being able to contract with many of the same companies that have worked on other recent pipeline projects in B.C., including the now-complete Coastal GasLink and the almost-complete Trans Mountain pipeline expansion.

This report by The Canadian Press was first published March 14, 2024.