Fracking Quakes Have Surged Near

Fort St. John, B.C.

May 8, 2024

Experts tracking a tremorous trend in northeastern B.C. notched another data point on April 13. In the early morning hours that day, a fracking-caused earthquake tripped the British Columbia Energy Regulator’s drilling shutdown switch.

The BC Energy Regulator confirmed that 4.2 magnitude quake rattled Wonowon, a small community 88 kilometres northwest of Fort St. John, B.C., in the early hours of April 13.

A fracking operation conducted by U.S. firm ConocoPhillips triggered the tremor, felt by more than 20 Wonowon residents. Fracking involves injecting water or other chemicals underground in order to crack open tight formations containing oil or gas.

The regulator told The Tyee that ConocoPhillips “immediately suspended hydraulic fracturing operations” as per regulations. “Those operations remain suspended and will not resume until further measures are put in place and a plan is submitted to the BCER, focused on mitigating future seismic events.”

The BCER has “advised the company to engage Wonowon residents about these events and the company is actively working on its engagement strategy.”

Many people reported the shaking as “strong” to Earthquakes Canada.

In 2020 seismic hazard expert Gail Atkinson concluded that a 4.5 quake caused by fracking could damage roads and homes located within a five-kilometre radius of the quake’s origin.

According to the regulator’s Northeast B.C. Seismicity Map, the 4.2 quake was preceded by a swarm of smaller tremors as the company injected great volumes of sand, chemicals and water into the Montney formation to fracture rock in order to release hydrocarbons trapped there.

The drilling and completion of one fracked well in the Montney can require as much as 500,000 barrels of water. That’s 79.5 million litres or nearly 80,000 cubic metres.

ConocoPhillips injects nearly three times as much water per fracked well compared with other companies operating in the region.

The Houston-based oil company did not reply to a Tyee query.

Dramatic upsurge of seismic activity

The ConocoPhillips quake is but the latest significant fracking-triggered earthquake in the Montney area. Over the last two years earthquake data from Natural Resources Canada shows a dramatic upsurge in seismic activity there, noted Allan Chapman, a geoscientist who worked for the BC Energy Regulator as its first hydrologist from 2010 to 2017.

“Overall, earthquake frequency in the B.C. Montney has increased over the past two to three years, with 2022 and 2023 having the largest number of NRCAN-measured earthquakes — about 300 per year,” Chapman told The Tyee. “Based on data to April 13, 2024 is projected to possibly experience more than 400 earthquakes in the Montney, which would be a record high.”

The recent increase in drilling-triggered quakes was confirmed by Gail Atkinson, one of the nation’s top seismic hazard experts and professor emeritus at Western University.

“The rates tend to go up and down from one year to the next depending on the overall level of oil and gas activity, and whether the operators ‘get lucky’ in their choice of drilling sites.”

Both Atkinson and Chapman have advised that regulators establish no-go frack zones and engage in more responsive monitoring in the Montney to avoid damage to public infrastructure such as dams, roads and homes in the region.

What’s driving the trend?

Reasons for the increase in earthquake frequency are not immediately clear. But Chapman suspects they may be associated with changes in latent seismicity resulting from cumulative frack water injection, or changes in operator practices during hydraulic fracturing, such as increased water injection per frack stage, increased hydraulic pressure per frack stage or other factors.

The Montney accounts for one-third of Canada’s methane production and will supply LNG Canada with product for export to Asia.

The large shale and siltstone formation, which contains gas, oil and gas liquids that are used for bitumen production, straddles the border of B.C. and Alberta. Since 2012 and the advent of fracking, the previously seismically quiet region around Fort St. John has experienced 10 tremors greater than 4 magnitude.

Experts suspect that industry-caused tremors will increase as demand for methane grows with the completion of the massive LNG Canada project in Kitimat, B.C.

The injection of fluids, whether water or gas, into highly pressurized rock environments can destabilize faults and trigger tremors. Injection depth, cumulative impact of water injection in highly pressurized geologies and distance from the Rocky Mountains all seem to be key triggering mechanisms.

One recent study, using machine learning, warned that

“currently established monitoring areas in B.C., which are based on past induced seismicity [industry-made quakes] occurrences, may not fully capture all areas where [induced seismicity] potential exists.”

One of the largest earthquakes to unsettle the Peace region occurred near Wonowon in January 2023. That 4.5 magnitude quake was also induced by the fracking industry.

Earthquakes, whether natural or triggered by industry, can damage well bores, alter the geology of hydrocarbon-bearing formations, change groundwater flows, destroy human infrastructure and accelerate radon and methane migration from the Earth into the atmosphere. They can also generate acoustic and gravity waves that propagate upward and trigger disturbances in the Earth’s lower and higher bands of atmosphere. ![]()

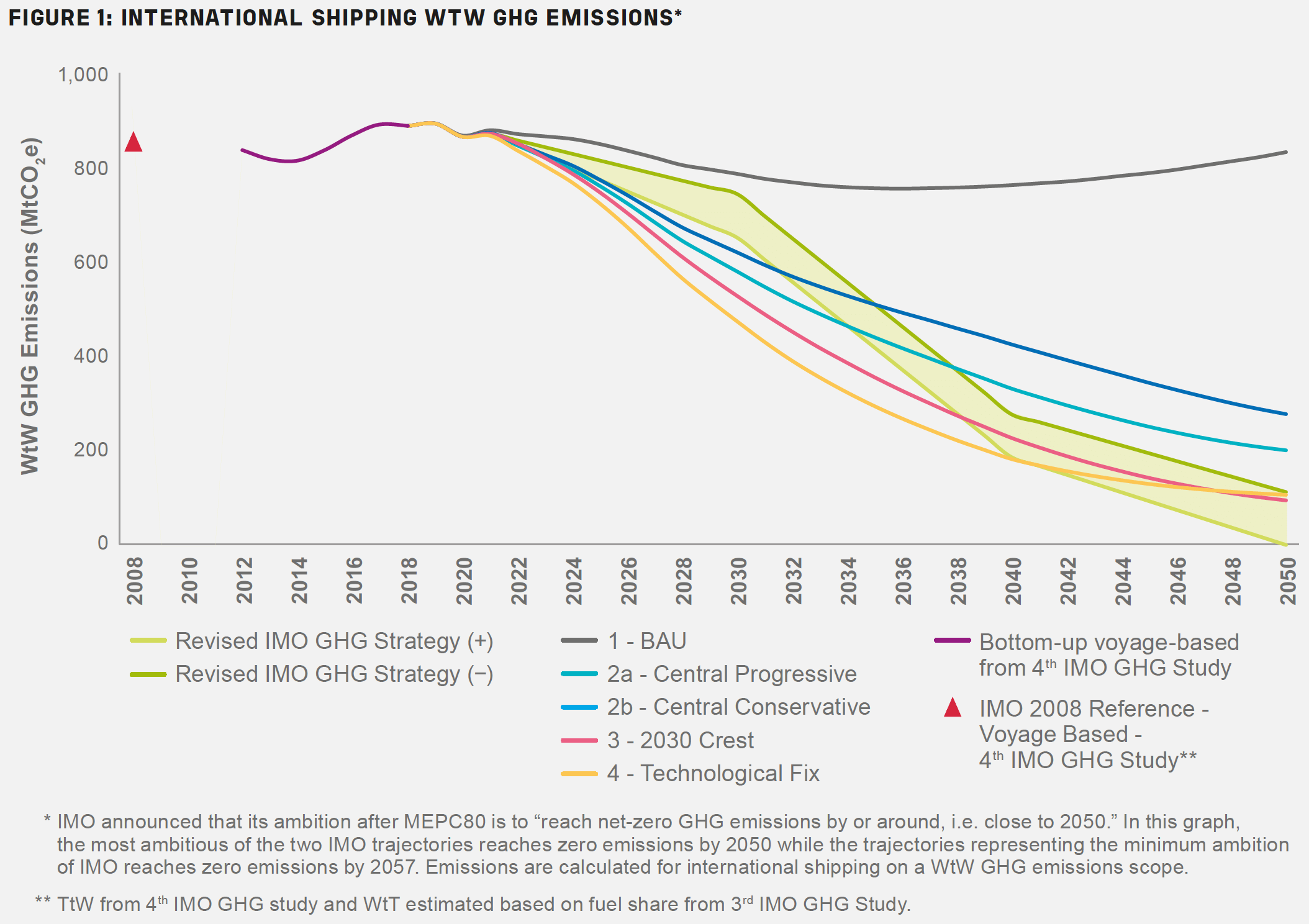

The maritime industry is facing an ever-tightening regulatory environment in its efforts to achieve its ambitious net-zero target by the middle of this century. For meaningful progress to be achieved, the industry needs two things: practical solutions, together with a detailed understanding of the actual impact of various long and short-term measures on the industry’s future decarbonization pathway.

The maritime industry is facing an ever-tightening regulatory environment in its efforts to achieve its ambitious net-zero target by the middle of this century. For meaningful progress to be achieved, the industry needs two things: practical solutions, together with a detailed understanding of the actual impact of various long and short-term measures on the industry’s future decarbonization pathway.