A Canadian investment fund almost singlehandedly launched uranium spot prices into orbit with a buying spree that has put the nuclear power industry on alert.

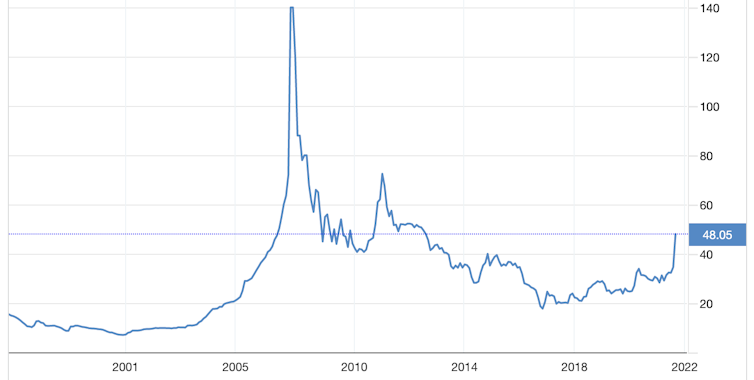

The spot uranium price for deliveries this month leapt 30.8% over 30 days to $39.75/lb as of 1 p.m. on Sept. 7 — a steep rise for a commodity market that previously saw years of sagging prices, according to data from S&P Global Platts. Market analysts credited Sprott Asset Management LP, a uranium trust formed in July to buy up low-cost uranium on the spot market and hold it for the long-term, for jolting the market with a wave of purchases.

The nuclear power industry, which largely buys fuel on long-term contracts, is not panicking as it can absorb even a one-third increase in price, but the industry is wary that the fund could continue to push up fuel costs.

For Sprott, this is all part of the plan.

"We're just a conduit for investors to express their view, right?" Sprott CEO John Ciampaglia told S&P Global Market Intelligence. "Our job is [to] go out and buy more pounds. If that has a knock-on effect on the price, then I guess indirectly we've got that influence on price discovery."

Big fish, small pond

The thesis Sprott provided to investors was simple: If they were given funding, they would purchase material out of a spot market that was flooded with excess supply following the 2011 nuclear disaster at Fukushima Daiichi in Japan.

Between Sept. 2 and Sept. 7, the trust acquired more than 3 million pounds of uranium on the spot market. As of Sept. 7, the trust held 24 million pounds at a market value of more than US$1 billion.

Sprott's Ciampaglia said the investment outfit learned the power of a single market catalyst during the "meme stock" boom earlier in the year. Retail investors made a coordinated purchase of stock in game seller GameStop and sent the stock price soaring despite no change in the fundamentals of the stock. A silver trust held by Sprott benefited when retail investors moved from specific equities to silver-focused market offerings.

The relatively small size of the uranium market could mean an unpredictable level of explosivity if the investor audience broadened, Ciampaglia said.

"You just can't predict how explosive it could be," Ciampaglia said.

The uranium trust benefited from market conditions improving in nuclear energy, as the world moves toward lower carbon energy sources, said Scott Melbye, executive vice president of U.S.-based miner Uranium Energy Corp. However the "correlation" between the trust's buying activity and the rising price is undeniable, Melbye said.

"Sprott coming in has really been the tipping point. It's been very significant."

Nuclear power is watching

After the Fukushima disaster, nuclear power plant operators experienced lower contracting prices. That trend lasted until the coronavirus pandemic knocked major sources of uranium offline, creating a supply shock that drove up prices and incentivized new investment in the space, though that upward trend calmed when the Sprott uranium trust arrived in July.

Power companies with nuclear reactors said they are not worried about price increases resulting from the trust's buying activity — at least not yet.

The fuel cost associated with nuclear energy is far lower than for coal and natural gas generators, so nuclear plants are "relatively insensitive" to a "bump in the spot price," American Nuclear Society president Steve Nesbit told S&P Global Market Intelligence. For nuclear utilities to feel the pain, prices would need to be an "order of magnitude" larger, even twice as high, Nesbit said.

"It takes a while for it to sink in," Nesbit said.

Utilities are monitoring buying activity by the trust, but "it's nothing that's worrying them at this point," Nima Ashkeboussi, senior director of fuel and radiation safety programs at the Nuclear Energy Institute, said.

"Their views [of Sprott] are still forming. They're watching it very closely," Ashkeboussi said.

Analysts see hard times ahead

Ciampaglia said the fund hoped to drive up the price of uranium, but high nuclear fuel costs in the long run could hurt nuclear power's competitiveness against cheaper forms of renewable power. And the industry already faces a declining market for its product going forward: Nuclear power capacity is expected to shrink by more than 20 GW through 2050, according to the U.S. Energy Information Administration.

The entire global nuclear sector could be constrained from future growth, Morningstar analyst Travis Miller said. While nuclear fuel typically makes up a relatively small percentage of utilities' operational costs, a long-term shift in uranium producers' favor could create an issue for any company looking to expand its nuclear fleet, especially in the face of falling renewable power costs.

If uranium prices continue to rise, that puts nuclear power at a competitive disadvantage to other carbon-free sources of energy, Miller said.

"There's a delicate balance here because in the long-run more supply should lead to lower, more stable prices," Miller added. "But in the short-run, higher prices to bring on that supply is going to be a headwind."

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.

Scientists fear that the technology used to extract plutonium from spent fuel could be used to make nuclear bombs

Author of the article: Diane Francis

Publishing date: August 13, 2021

In May, the Geneva-based International Campaign to Abolish Nuclear Weapons (ICAN) called out Prime Minister Justin Trudeau’s government over a deal he has approved and funded that critics say will undermine the goal of nuclear non-proliferation, according to an article published in the Hill Times and recently republished in the Bulletin of the Atomic Scientists.

The article describes how prominent scientists are concerned about the Government of Canada approving a project, and subsidizing it to the tune of $50.5 million, that’s being developed by a startup called Moltex Energy.

Moltex Energy was selected by NB Power and the Government of New Brunswick to develop its new reactor technology and locate it at the Point Lepreau nuclear plant site by the early 2030s. Moltex is one of several companies that are promoting small, “next generation” nuclear reactors to replace fossil fuels in the production of electricity.

Moltex, a privately owned company that is based in the United Kingdom and has offices in Saint John, N.B., says it will “recycle nuclear waste” from New Brunswick’s closed Point Lepreau nuclear plant for use in its small-scale nuclear reactor. Federal funding and approval was announced on March 18 by Dominic LeBlanc, a New Brunswick MP who serves as minister of intergovernmental affairs.

The scientists dispute the claim that this is “recycling” and are concerned because the technology Moltex wants to use to extract plutonium, a key ingredient in nuclear weapons, from spent fuel could be used by other countries to make nuclear bombs. Decades ago, the U.S. and many of its allies, including Canada, took action to prevent this type of reprocessing from taking place.

“The idea is to use the plutonium as fuel for a new nuclear reactor, still in the design stage. If the project is successful, the entire package could be replicated and sold to other countries if the Government of Canada approves the sale,” reads the article.

On May 25, nine high-level American non-proliferation experts sent an open letter to Trudeau expressing concern that by “backing spent-fuel reprocessing and plutonium extraction, the Government of Canada will undermine the global nuclear weapons non-proliferation regime that Canada has done so much to strengthen.”

The signatories to the letter include senior White House appointees and other government advisers who worked under six U.S. presidents and who hold professorships at the Harvard Kennedy School, Princeton University and other eminent institutions.

The issue of nuclear proliferation dates back to 1974, when Canada got a black eye after India tested its first nuclear weapon using plutonium that was largely extracted using the CIRUS reactor, which was supplied by Canada for peaceful uses. Shortly after, other countries attempted to repurpose plutonium from reactors and were stopped — except for Pakistan, which, like India, succeeded in creating atomic weapons.

The Hill Times pointed out that, “To this day, South Korea is not allowed to extract plutonium from used nuclear fuel on its own territory — a long-lasting political legacy of the 1974 Indian explosion and its aftermath — due to proliferation concerns.”

The letter to Trudeau concluded: “Before Canada makes any further commitments in support of reprocessing, we urge you to convene high-level reviews of both the non-proliferation and environmental implications of Moltex’s reprocessing proposal including international experts. We believe such reviews will find reprocessing to be counterproductive on both fronts.”

The scientists’ letter has not yet been answered by the government. However, Canadians deserve to be fully briefed on all this and its implications. They deserve to know who owns Moltex, what the risks are to non-proliferation and why taxpayers are sinking millions of dollars into a project that’s morally questionable and potentially hazardous.

Read and sign up for Diane Francis’ newsletter on America at dianefrancis.substack.com.