Anti-nuclear group blasts UK Gov for talks on building new power plant in Wales

An anti-nuclear group has blasted the UK Government for having talks on building another large-scale multi-billion pound nuclear power plant in Wales.

Dylan Morgan, Co-ordinator for PAWB, has reacted furiously to the discussions with US reactor manufacturer Westinghouse to build a new facility on Anglesey.

The UK Government say that the move is part of an effort to reduce the UK’s carbon emissions to net zero by 2050, but according to Morgan it isn’t an effective way to “counter climate change”.

He argues that nuclear power is “slow, dangerous and extortionately expensive”.

According to the UK Government, a new nuclear power plant at the decommissioned Wylfa site could become operational in the mid-2030s and generate power for six million homes.

Dylan Morgan said: “We have an immediate crisis now. Building huge reactors at a nuclear power station take at least 15 years.

“For example, EdF are involved in building their EPR at Olkiluoto in Finland. Comstruction started in 2005 with the boast it would be completed by 2009.

“It still hasn’t been completed in 2021. Nuclear power is slow, dangerous and extortionately expensive. It will do nothing to address the current energy crisis, neither will it be effective to counter climate change.

“The UK and Welsh governments should divert resources and support away from wasteful and outdated nuclear power projects towards developing renewable technologies that are much cheaper and can provide faster and more sustainable solutions to the energy crisis and the challenges of climate change.”

‘Rising energy prices’

The new Energy Secretary Kwasi Kwarteng is said to be keen on the idea, amid concern about rising energy prices and the fact that nuclear will only provide 8% of the UK’s energy by 2024.

The project is also being promoted by Welsh Secretary Simon Hart.

Projects over 350MW in size are reserved to Westminster and can be pushed through without the Welsh Government’s consent.

UK Government sources have told the Times that there is now “growing backing” for the idea to go ahead.

An attempt to build a nuclear plant at Wylfa with Hitachi collapsed last September.

“If our current situation shows anything it is that we need more stable home grown, low carbon generation in the UK,” the source said. “This is an important project that we’re very keen to try and get off the ground.”

A nuclear power plant at Hinkley Point in Somerset is already in the works, but has caused controversy as mud has been dumped off the coast of Cardiff.

Wylfa 'plan' based on this US nuclear development in Georgia put forward to UK Government

'Exploratory' discussions are underway over the proposals although US project is delayed and massively over-budget

By Owen Hughes

12:01, 24 SEP 2021

A nuclear sector consortium “has a plan” to build a large nuclear plant at Wylfa - with UK Government saying “exploratory” talks were taking place.

US firm Westinghouse says the Anglesey site is the “perfect location” for a new nuclear site while partner Bechtel, an engineering giant, has a proposal in place.

The development would be based on a nuclear scheme in Georgia in the United States - although that project has been dogged by long delays and doubled in price from the original cost estimate.

Talking at the Welsh Affairs Committee a senior Government official said initial discussions were taking place with consortiums interested in bullding a nuclear plant at Wylfa.

Horizon/Hitachi withdrew from developing the site after failing to reach a deal with UK Government on funding the project.

Barbara Rusinko, President of the Nuclear, Security and Environment Division at Bechtel, said: “It is regarded as the best site in the UK to build a large scale nuclear power station.

“Our team has a plan to facilitate the build on the most advanced nuclear technology today, the Westinghouse AP1000.

“It is capable of delivering clean power to the latest carbon budget commitments by 2035. It can prove transformational for Anglesey.”

She said it “strengthens the trans-Atlantic security partnership” and unlocks the "economic potential that exists on Anglesey and across Welsh communities".

Plans would be based on Plant Vogtle in Georgia where two additional reactor units are going into commercial operation in 2022.

Those units are to be the first major commercial nuclear reactors built from scratch in the United States in the last 30 years.

But the development has been hit by delays and rising costs.

Vogtle's two additional units were originally scheduled to be ready in 2016 and 2017 while the cost also has gone from $14 billion to a potential $27 billion final price.

Customers in Georgia will pay 11% extra on energy bills to fund the site.

Ms Rusinko said the failure of Wylfa Newydd demonstrated the need for “more Government intervention” in the UK to get these projects across the line.

She said they had developed an approach to leverage backing and said they needed UK Government to “demonstrate commitment” in the spending review.

She said they needed investment in “front end design” that would be funded by the UK Government to “jump start” Wylfa.

David Durham, President of Energy Systems at Westinghouse, said it was the “safest reactor in the world” and designed specifically to deal with “station blackout” where all alternative electric connections are severed, as happened with Fukushima.

He said it was unlikely to ever see nuclear builds that weren’t part of a regulated market backed by state or national governments.

He said one of the reasons nuclear is expensive is that “everything needs to be precise” due to the safety issues.

He said even with Government support they “assumed” substantial risks and weren’t putting all costs and risks on UK Government and British tax and electricity bill payers.

Lindsay Roche, Director of Government affairs at Westinghouse UK, said the “geography and geology” of the area make Wylfa a “perfect site”.

She said it would be a modular build approach with work spread across North Wales and further afield.

This would reduce the number of construction roles based on Anglesey but also ease the pressure on the island’s infrastructure over that build period.

She said UK Government had a chance to be “ahead of the game” on nuclear or rely on international markets and import power.

Ms Roche said there had been “good discussions” with UK Government and they were asking for “modest funding” (tens of millions) to take the first steps forward.

She added: “This is a project that can level up the economy, impact the regional economy of Anglesey, North Wales and North West England.”

Declan Burke, director of nuclear projects and development at the Department of Business, Energy and Industrial Strategy, (BEIS), said the previous offer to Horizon/Hitachi had been a one third equity stake to underwrite financing and providing a strike price for 35 years of £75 (per MWh) - but they could not reach a commercial agreement.

He added that although a very significant offer had been made to Hitachi/Horizon there was a point ministers were “not willing to go beyond despite us all very much wanting that project to work”.

He said they remain in regular contact with them as site owners but understood they were “moving into different areas” making it unlikely they would revive their own interest in Wylfa Newydd.

He said the discussions with new developers were so far were “exploratory” so they can learn more about the proposals and how they could be funded.

Responding to a question from Aberconwy MP Robin Miller over potential liability for taxpayers, he said the cost to taxpayers and consumers was “front and centre of our minds" and were part of those exploratory talks with potential developers.

He added: “We absolutely think nuclear would be a very critical part of Net Zero but it does need to work for the taxpayer perspective as well.”

He said they were looking at the Regulated Asset Base model where revenue is made by the investors while construction is taking place due the huge cost and long period of capital investment.

This would come from consumers and/or taxpayers ahead of the plant being completed.

He said calibrating the funding mechanism gives confidence to investors and protects the consumer as well.

Uranium: what the explosion in prices means for the nuclear industry

It is a year since Horizon Nuclear Power, a company owned by Hitachi, confirmed it was pulling out of building the £20 billion Wylfa nuclear power plant on Anglesey in north Wales. The Japanese industrial conglomerate cited the failure to reach a funding deal with the UK government over escalating costs, and the government is still in negotiations with other players to try and take the project forward.

Hitachi’s share price duly went up 10%, reflecting investors’ negative sentiment towards building complex, highly regulated large nuclear power plants. With governments reluctant to subsidise nuclear power because of the high costs, particularly since the 2011 Fukushima disaster, the market has undervalued the potential of this technology to tackle the climate emergency by providing abundant and reliable low-carbon electricity.

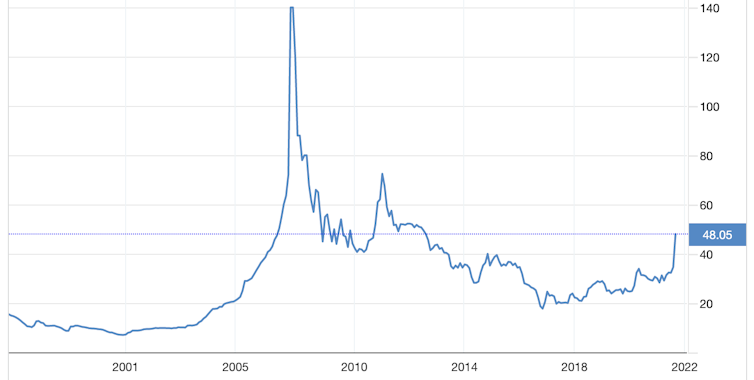

Uranium prices long reflected this reality. The primary fuel for nuclear plants was sliding for much of the 2010s, with no signs of a major turnaround. Yet since mid-August, prices have surged by around 60% as investors and speculators scramble to snap up the commodity. The price is around US$48 per pound (453g), having been as cheap as US$28.99 on August 16. So what lies behind this rally, and what does it mean for nuclear power?

Uranium price

The uranium market

The demand for uranium is limited to nuclear power production and medical equipment. Annual global demand is 150 million pounds, with nuclear power plants looking to secure contracts roughly two years ahead of use.

While uranium demand is not immune to economic downturns, it is less exposed than other industrial metals and commodities. The bulk of demand is distributed across some 445 nuclear power plants operating in 32 countries, with supply concentrated in a handful of mines. Kazakhstan is easily the largest producer with over 40% of output, followed by Australia (13%) and Namibia (11%).

Since most mined uranium is used as fuel by nuclear power plants, its intrinsic value is closely tied to both current demand and future potential from this industry. The market includes not only uranium consumers but also speculators, who buy when they think the price is cheap, potentially bidding up the price. One such long-term speculator is Toronto-based Sprott Physical Uranium Trust, which has bought nearly 6 million pounds (or US$240 million worth) of uranium in recent weeks.

Why investor optimism may be rising

While it is widely believed that nuclear energy should play an integral role in the clean energy transition, the high costs have made it uncompetitive compared with other energy sources. But thanks to sharp rises in energy prices, nuclear’s competitiveness is improving. We are also seeing greater commitment to new nuclear power stations from China and elsewhere. Meanwhile, innovative nuclear technologies such as small modular reactors (SMRs), which are being developed in countries including China, the US, UK and Poland, promise to reduce upfront capital costs.

Combined with recent optimistic releases about nuclear power from the World Nuclear Association and the International Atomic Energy Agency (the IAEA upped its projections for future nuclear-power use for the first time since Fukushima) this is all making investors more bullish about future uranium demand.

The effect on the price has also been multiplied by issues on the supply side. Due to the previously low prices, uranium mines around the world have been mothballed for several years. For example, Cameco, the world’s largest listed uranium company, suspended production at its McArthur River mine in Canada in 2018.

Global supply was further hit by COVID-19, with production falling by 9.2% in 2020 as mining was disrupted. At the same time, since uranium has no direct substitute, and is involved with national security, several countries including China, India and the US have amassed large stockpiles – further limiting available supply.

Hang on tight

When you compare the cost of producing electricity over the lifetime of a power station, the cost of uranium has a much smaller impact on a nuclear plant than the equivalent effect of, say, gas or biomass: it’s 5% compared to around 80% in the others. As such, a big rise in the price of uranium will not massively affect the economics of nuclear power.

Yet there is certainly a risk of turbulence in this market over the months ahead. In 2021, markets for the likes of Gamestop and NFTs have become iconic examples of speculative interest and irrational exuberance – optimism driven by mania rather than a sober evaluation of the economic fundamentals.

The uranium price surge also appears to be catching the attention of transient investors. There are indications that shares in companies and funds (like Sprott) exposed to uranium are becoming meme stocks for the r/WallStreetBets community on Reddit. Irrational exuberance may not have explained the initial surge in uranium prices, but it may mean more volatility to come

We could therefore see a bubble in the uranium market, and don’t be surprised if it is followed by an over-correction to the downside. Because of the growing view that the world will need significantly more uranium for more nuclear power, this will likely incentivise increased mining and the release of existing reserves to the market. In the same way as supply issues have exacerbated the effect of heightened demand on the price, the same thing could happen in the opposite direction when more supply becomes available.

You can think of all this as symptomatic of the current stage in the uranium production cycle: a glut of reserves has suppressed prices too low to justify extensive mining, and this is being followed by a price surge which will incentivise more mining. The current rally may therefore act as a vital step to ensuring the next phase of the nuclear power industry is adequately fuelled.

Amateur traders should be careful not to get caught on the wrong side of this shift. But for a metal with a half life of 700 million years, serious investors can perhaps afford to wait it out.

Lecturer in Economics, Bangor University

Lecturer in Finance, Bangor University

Reader in Nuclear Materials, Nuclear Futures Institute, Bangor University

Bangor University provides funding as a member of The Conversation UK.

No comments:

Post a Comment