December 8, 2021

Article/Editing:

Govind Bhutada

Graphics/Design:

Amy Realey

The following content is sponsored by the Carbon Streaming Corporation.

The Briefing

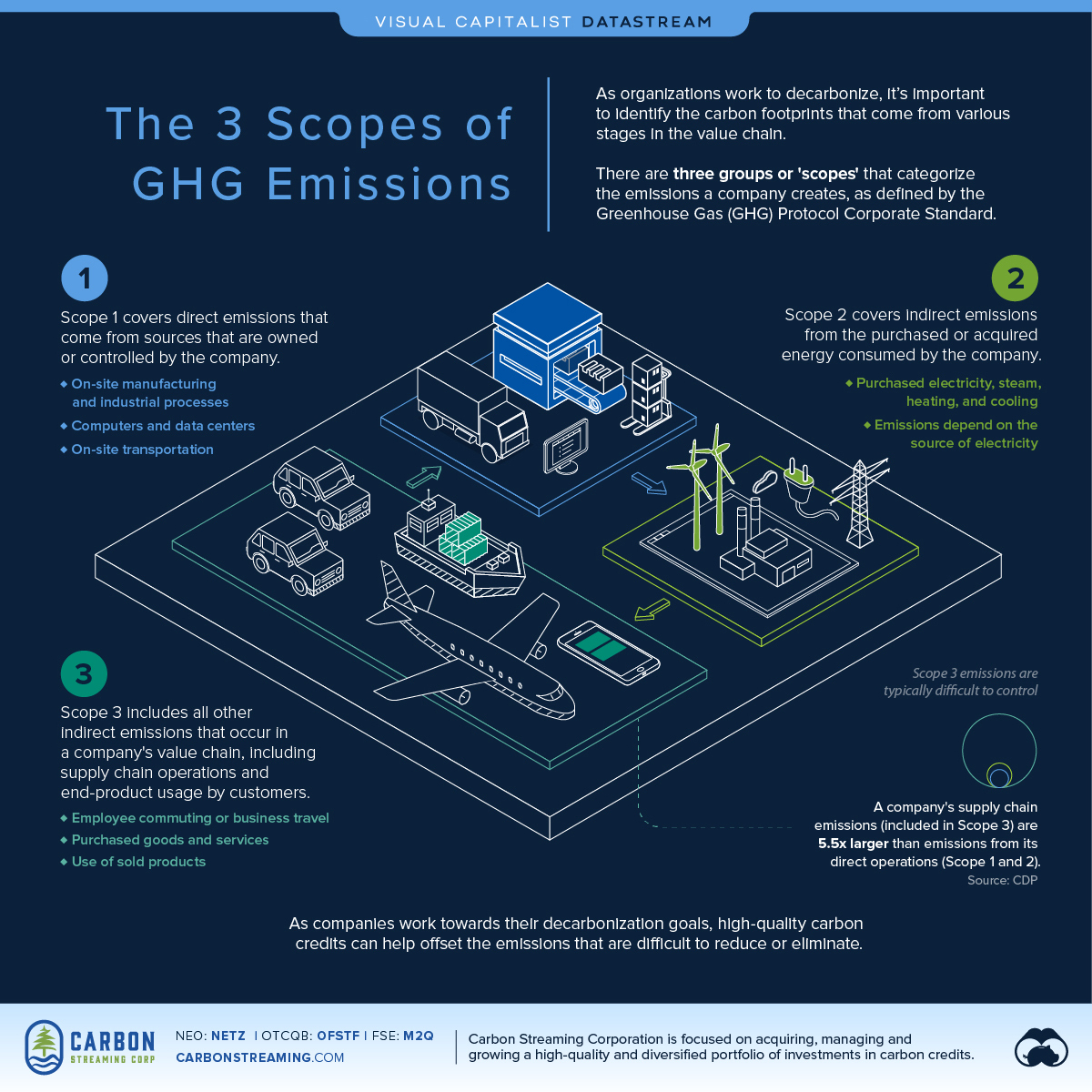

There are three groups or ‘scopes’ of emissions as defined by the Greenhouse Gas (GHG) Protocol Corporate Standard

A company’s supply chain emissions (included in Scope 3) are on average 5.5 times more than its direct operations (Scope 1 and Scope 2)

Visualizing the 3 Scopes of Greenhouse Gas Emissions

Net-zero pledges are becoming a common commitment for nations and corporations striving to meet their climate goals.

However, reaching net-zero requires companies to shrink their carbon footprints, which comprise greenhouse gas (GHG) emissions from various stages in the value chain. As more companies work to decarbonize, it’s important for them to identify and account for these different sources of emissions.

The 3 Scopes of GHG Emissions

According to the Greenhouse Gas Protocol, there are three groups or ‘scopes’ that categorize the emissions a company creates. The GHG Protocol Corporate Accounting and Reporting Standard, referred to as the GHG Protocol Corporate Standard, provides the most widely accepted standards for reporting and accounting for emissions and is used by businesses, NGOs and governments.

Scope 1 Emissions

These are direct emissions from sources that are owned or controlled by the company. Consequently, they are often the easiest to identify and then reduce or eliminate. Scope 1 emissions include:

On-site manufacturing or industrial processes

Computers, data centers, and its owned facilities

On-site transportation or company vehicles

Scope 2 Emissions

These are indirect emissions from the generation of purchased or acquired energy that the company consumes. Scope 2 emissions physically occur at the site that produces the energy and the emissions depend on both the company’s level of consumption and the means by which the energy was generated (e.g. fossil fuels vs renewable energy). Scope 2 emissions include:

Purchased electricity, heating, cooling, and steam

Scope 3 Emissions

Scope 3 includes all other indirect emissions that occur throughout a company’s value chain. These occur from sources not owned or controlled by the company and are typically difficult to control and thereby reduce.

Scope 3 emissions often make up the largest portion of a company’s carbon footprint. According to the CDP, a company’s supply chain emissions (included in Scope 3) are on average 5.5 times more than emissions from its direct operations (Scope 1 and 2). These include emissions from:

Employee commuting or business travel

Purchased goods and services

Use of sold products

Transportation and distribution of products

Companies can reduce their Scope 1 and Scope 2 emissions by improving operational efficiency and using renewable energy sources. However, managing and reducing Scope 3 emissions can be difficult depending on the company’s upstream and downstream activities.

For example, controlling the emissions from the extraction of raw materials used in a company’s end-product or from the usage of such product by a customer is not entirely in the company’s hands. But this is where carbon offsets can help.

Offsetting Emissions with Carbon Offsets

One carbon offset, also referred to as a carbon credit, represents one metric ton of GHG emissions that has been avoided, reduced or removed from the atmosphere. By purchasing carbon credits, companies can offset the emissions that are difficult to reduce or eliminate, such as Scope 3 emissions.

In fact, the voluntary carbon markets will surpass $1 billion in annual transaction value for the first time in 2021. As decarbonization plans pick up pace, carbon credits will play an important role in helping companies achieve their climate goals.

Carbon Streaming Corporation is focused on acquiring, managing and growing a high-quality and diversified portfolio of investments in carbon credits.