The United Nations issued a somber global economic forecast for 2024 on Thursday, pointing to challenges from escalating conflicts, sluggish global trade, persistently high interest rates and increasing climate disasters.

In its flagship economic report, the U.N. projected that global economic growth would slow to 2.4 per cent this year from an estimated 2.7 per cent in 2023, which exceeds expectations. But both are still below the three per cent growth rate before the COVID-19 pandemic began in 2020, it said.

The U.N. forecast is lower than those of the International Monetary Fund in October and the Organization for Economic Cooperation and Development in late November.

The IMF said it expects global growth to slow from an expected three per cent in 2023 to 2.9 per cent in 2024. The Paris-based OECD, comprising 38 mainly developed countries, estimated that international growth would also slow from an expected 2.9 per cent in 2023 to 2.7 per cent in 2024.

The U.N.’s report -- World Economic Situation and Prospects 2024 -- warned that the prospects of prolonged tighter credit conditions and higher borrowing costs present “strong headwinds” for a world economy saddled with debt, especially in poorer developing countries, and needing investment to resuscitate growth.

Shantanu Mukherjee, director of the U.N.’s Economic Analysis and Policy Division, said fears of a recession in 2023 were averted mainly due to the United States, the world’s largest economy, curbing high inflation without putting the brakes on the economy.

But he told a news conference launching the report: “We’re still not out of the danger zone.”

Mukherjee said that’s because the unsettled situation in the world could fuel inflation. For example, another supply chain shock or problem in fuel availability or distribution could prompt another interest rate hike to bring the situation under control, he said.

“We’re not expecting a recession, per se, but because there is volatility in the environment around us, this is the major source of risk,” he said.

Very high interest rates for a long time and the threat of possible shocks to prices contribute to “quite a difficult balancing act,” Mukherjee said. “So that’s really why we said that we are not yet out of the woods.”

According to the report, global inflation, which was at 8.1 per cent in 2022, is estimated to have declined to 5.7 per cent in 2023, and is projected to decline further to 3.9 per cent in 2023.

But in about a quarter of all developing countries, annual inflation is projected to exceed 10 per cent this year, it said.

While the U.S. economy performed “remarkably well” in 2023, the report said growth is expected to decline from an estimated 2.5 per cent in 2023 to 1.4 per cent this year.

“Amid falling household savings, high interest rates, and a gradually softening labor market, consumer spending is expected to weaken in 2024 and investment is projected to remain sluggish,” the U.N. said. “While the likelihood of a hard landing has declined considerably, the United States economy will face significant downside risks from deteriorating labor, housing and financial markets.”

With elevated inflation and high interest rates, the report said Europe faces “a challenging economic outlook.”

GDP in the European Union is forecast to expand from 0.5 per cent in 2023 to 1.2 per cent in 2024, it said, with the increase driven by “a pick-up in consumer spending as price pressures ease, real wages rise, and labor markets remain robust.”

Japan, the world's fourth largest economy, is projected to see economic growth slow from 1.7 per cent in 2023 to 1.2 per cent this year despite the country’s monetary and fiscal policies, the report said, “Rising inflation may signal an end from the deflationary trend that persisted for more than two decades” in the country, it said.

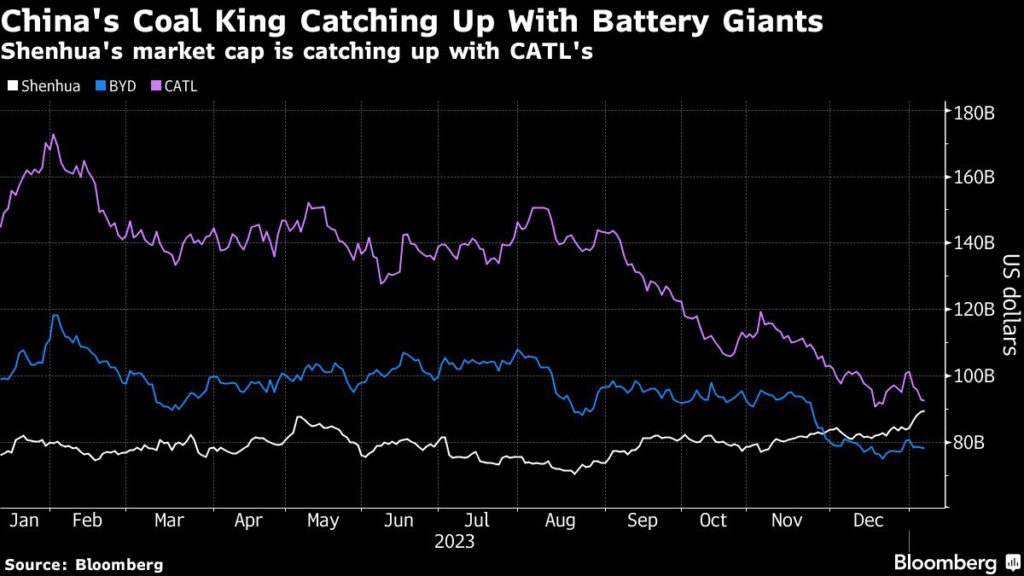

In China, the world’s second-largest economy, the U.N. said recovery from COVID lockdowns has been more gradual than expected “amid domestic and international headwinds.

With economic growth of just 3.0 per cent in 2022, the report said China turned a corner during the second half of 2023 with the growth rate reaching 5.3 per cent. But it said the combination of a weak property sector and faltering external demand for its products “will nudge growth down moderately to 4.7 per cent in 2024.

In developing regions, the U.N. said economic growth in Africa is projected to remain weak with a slight increase from an average of 3.3 per cent in 2023 to 3.5 per cent in 2024.

“The unfolding climate crisis and extreme weather events will undermine agricultural output and tourism, while geopolitical instability will continue to adversely impact several subregions … especially the Sahel and North Africa,” the report said.

The U.N. forecasts a moderate slowdown in East Asia economies from 4.9 per cent in 2023 to 4.6 per cent in 2024. In Western Asia, GDP is forecast to grow by 2.9 per cent in 2024, up from 1.7 per cent in 2023.

In South Asia, GDP rose by an estimated 5.3 per cent last year and is projected to increase by 5.2 per cent in 2024, “driven by a robust expansion in India, which remains the fastest growing large economy in the world.” Its growth is forecast to reach 6.2 per cent this year, similar to its projected 6.3 per cent increase in 2023.

.jpg?ext=.jpg) An illustrative example of how the Pomeranian plant might look (Image: PEJ)

An illustrative example of how the Pomeranian plant might look (Image: PEJ) (Image: Rosatomflot)

(Image: Rosatomflot)

.jpg?ext=.jpg) An image from the Martian surface captured by NASA's Perseverance rover - which uses a radioisotope thermoelectric generator fuelled by Pu-238 - in March 2021 (Image: NASA/JPL-Caltech)

An image from the Martian surface captured by NASA's Perseverance rover - which uses a radioisotope thermoelectric generator fuelled by Pu-238 - in March 2021 (Image: NASA/JPL-Caltech).jpg) The CNIC is an independent organisation of representatives from the Canadian health sector, nuclear industry and research bodies, which was established in 2018 to advocate for Canada's role in the production of the world's radioisotope supply. CNIC Chair James Scongack said the study aligns with the organisation's Isotopes for Hope Campaign, launched in 2023. "Together our companies working with NPX hope to demonstrate another example of why radioisotopes are so important to modern society," he said.

The CNIC is an independent organisation of representatives from the Canadian health sector, nuclear industry and research bodies, which was established in 2018 to advocate for Canada's role in the production of the world's radioisotope supply. CNIC Chair James Scongack said the study aligns with the organisation's Isotopes for Hope Campaign, launched in 2023. "Together our companies working with NPX hope to demonstrate another example of why radioisotopes are so important to modern society," he said.

Now made in FEOC. Stock image.

Now made in FEOC. Stock image.