German LNG Terminal Operator Sues EU Over Competitor's Subsidy

Two years after Germany rushed to launch its first onshore LNG import terminals, the operators are struggling to gain the upper hand in the market as they move from temporary operations toward the future energy markets. The operator of the first terminal opened at Stade confirmed on Thursday that it has filed suit against the European Commission in a move to block government subsidies to one of its competitors.

After the Russian invasion of Ukraine, Germany launched an ambitious plan to gain energy independence ending its massive gas imports from Russia. The government led the efforts and formed partnerships with private companies to develop floating storage and regasification facilities. They entered into multiyear charters with the owners of FSRUs that could be docked in major German ports and linked to the existing gas infrastructure. The government reportedly committed up to €740 million for the development of the LNG import infrastructure and operations.

The first of the terminals was established in Wilhelmshaven with the FSRU Hoegh Esperanza and the FSRU Hoegh Gannet which was placed in Brunsbüttel. The partnership Deutsche Energy Terminal was established with the goal of building a permanent facility in Brunsbüttel with financial support through the German industrial bank KfW. The German federal government has a 50 percent stake in the company along with Dutch pipeline operator Gasunie (40 percent) and German energy group RWE (10 percent).

Another one of the onshore import terminals was started nearby in Stade, Germany as part of the Hanseatic Energy Hub. Participants include Buss Gruppe, a Hamburg port logistics company, Swiss investment firm Partners Group, Spain’s Enagas, and US chemical company Dow. The FSRU Energos Force was stationed in Stade.

Separately, Deutsche Regas also established LNG terminal operations in Lubmin and Mukran in eastern Germany. These projects were privately financed by Deutsche Regas. Deutsche Energy Terminal is also scheduled to position another FSRU, Excelsior from Excelerate Energy at a floating terminal on the Jade at Wilhelmshaven later this year.

The long-term plans called for the construction of permanent facilities both in Brunsbüttel and Stade. Work began in June 2024 in Stade to build what is being billed as Germany's first land-based terminal for liquefied gases. The design includes Europe's two largest LNG tanks, each with a capacity of 240,000 cubic meters, which critically are also being built ready for ammonia. The facility is scheduled to be online in 2027.

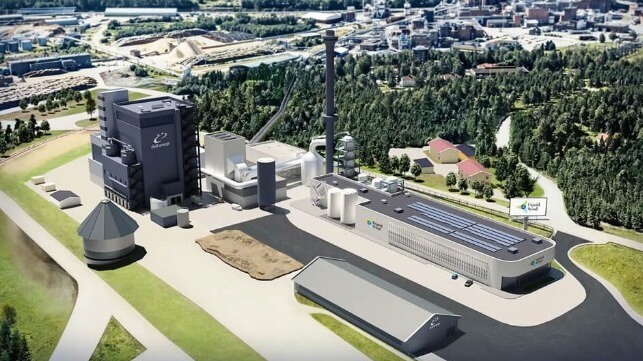

RWE developed the infrastructure at Brunsbüttel and as planned transitioned it as of the beginning of 2024 to Deutsche Energy Terminals. The plan calls for the construction of a permanent facility at the site which like its nearby rival in Stade is designed to handle a form of hydrogen derivates.

The German government filed with the European Commission and won approval in 2023 to provide a state subsidy for the development of the Brunsbüttel terminal. The European Commission approved an initial amount of €40 million and under certain circumstances, it could increase to a total of €125 million.

HEH is now seeking to block the subsidy arguing that the work at Brunsbüttel could and should proceed without government support. They contend the subsidy encourages the operators to be less economically efficient. They also said a normal business would have raised prices to customers to pay for its expansion.