ALTERNATIVE FUELS

Belgium and Namibia to Develop Africa’s First Hydrogen Ship, Infrastructure

Partners from Belgium and the African nation of Namibia mapped out a plan to develop the continent’s hydrogen infrastructure for the production and export of the energy source as well as launching Africa’s first hydrogen-fueled vessel. It is part of an ambitious plan to make Namibia a frontrunner in the global green hydrogen economy and supply the alternative energy source both to passing ships and industrial users in Belgium, Germany, and other industrial clusters in Europe.

The plan was unveiled during an event at Walvis Bay, Namibia that included His Majesty King Philippe of the Belgians and Dr. Nangolo Mbumba, President of the Republic of Namibia. During the event, they officiated at the ceremonial first filling of a dual-fuel truck at the hydrogen refueling station, which is expected to be operational in the fourth quarter of 2024 as part of the Cleanenergy Green Hydrogen site.

Cleanergy Solutions Namibia is a joint venture between CMB.TECH and the Ohlthaver & List (O&L) Group, a privately held group of companies with interests ranging from food to technology, steel, marine engineering, and real estate. The Port of Antwerp Bruges and the Namibian Ports Authority are also participating.

H.E. Dr. Nangolo Mbumba - President of the Republic of Namibia, His Majesty King Philippe of the Belgians, Sven Thieme - Executive Chairman Ohlthaver & List, Marc Saverys - Chairman of the CMB Board of Directors, Alexander Saverys - CEO of CMB.TECH during the launch ceremony

The Cleanenergy Green Hydrogen facility uses only solar energy for the on-site production of green hydrogen. Among the first projects will be the hydrogen refueling station used for hydrogen-powered trucks, port equipment, railway applications, and small ships.

The Port of Antwerp Bruges plans to invest approximately $265 million for the development of a hydrogen and ammonia storage and export facility at Walvis Bay which will be jointly run with the Namibian Ports Authority. They expect to develop the site within three to five years adjacent to the existing port both for the bunkering operations and the export to Europe.

“The port of Walvis Bay will also be in a unique position in Africa: our project will enable them to offer low-carbon logistics supply chains to their customers. This will pave the way for attracting additional logistics flows and investors,” said Alexander Saverys, CEO of CMB.TECH.

They look to leverage the experience of developing Hydrotug, the world’s first hydrogen-fueled tug supported by a fueling operation in Antwerp to develop Africa’s first hydrogen-powered vessel. Cleanenergy, together with CMB.TECH, the Port of Antwerp Bruges, and Namport will launch the vessel. It will be a Multifunctional Port Utility Vessel (MPHUV) powered by dual-fuel hydrogen engines. According to the partnership, the MPHUV's versatile design will enable the integration of different equipment needed for a range of port operations, significantly reducing greenhouse gas emissions during operations.

Partnership will launch Africa's first hydrogen-fueled vessel (CMB.TECH)

Given the ability of ports to act as hubs for hydrogen technology implementation and efforts to reduce carbon emissions, the partners said the Port of Walvis Bay and Namport emerge as an ideal partner to operate Africa's first hydrogen vessel. The port's involvement will provide invaluable insights into the vessel's specifications during development and refine the concept based on operational experience and feedback from users once it is commissioned.

Other elements of the project include a green hydrogen academy. Working with European universities as well as suppliers and customers they will educate a Namibian workforce for hydrogen operations. The partners said this is part of a 5-year plan that includes projects at different locations for ammonia bunkering, pipelines, and large-scale hydrogen and ammonia production.

Holland America’s Cruise Ship Rotterdam Begins Sustained Biofuel Pilot Test

Holland America Line’s flagship cruise ship, Rotterdam (99,935 gross tons) started a long-term test using 100 percent low carbon intensity biofuel while cruising the Norwegian fjord this season. It marks the next advancement in a series of tests by Carnival Corporation using cruise ships from Holland America and AIDA and moving from biofuel blends to 100 percent certified biofuel mirroring similar tests in other parts of the commercial maritime industry.

The cruise ship bunkered with the biofuel derived from feedstocks by GoodFuels and supplied by FincoEneries before leaving the Port of Rotterdam in the Netherlands on April 27. Built by Fincantieri and delivered on July 30, 2021, she is the newest ship operated by the line and one of the newest in the industry. Past experience has confirmed that the Holland America cruise ship can operate on biofuels without modifications to the engine or the fuel structure.

During the initial phase of this test, the Rotterdam will operate one of her four engines during cruises this month using the biofuel which is expected to yield an estimated 86 percent reduction in life-cycle greenhouse gas emissions. The fuel will be used while cruising in Norway’s fjords including Geirangerfjord and Naeroyfjord. The cruise line said there is a potential to expand to multiple engines during the summer as the test progresses.

Carnival Corporation began its tests with biofuels in 2022. AIDA Cruises tested the use of regenerated biofuels in marine diesel engines together with research partners at the University of Rostock. Based on those tests, the cruise line proceeded to bunker a biofuel blend on July 21, 2022, aboard the AIDAPrima ( 125,572 gross tons), becoming the first larger-scale cruise ship to take on a blend of marine biofuel. Tests were conducted while the ship was cruising in Northern Europe between Rotterdam, Hamburg, and Norway.

The cruise ship entered service in 2016 and was one of the first two cruise ships outfitted with dual-fuel engines that could also burn LNG supplied by trucks while alongside in the port. The AIDAPrima loaded a second delivery of biofuel in December 2022 receiving that time 140 metric tons of 100 percent biofuel.

Holland America also conducted the first sustained trial of biofuel aboard its cruise ship Volendam (61,214 gross tons) in August and September 2022 while the vessel was docked in Rotterdam on a temporary charter to house Ukrainian refugees. For the first five days of that test, they used a 70-30 mix of biofuel and marine gas oil in one of the ship’s main auxiliary engines. For the next 15 days, they used 100 percent sustainable biofuel. They reported achieving a minimum 78 percent decrease in lifecycle CO2 emissions compared to marine gas oil emissions.

The cruise sector is catching up to other parts of the commercial shipping industry that have also tested biofuels. Royal Caribbean Group also began tests in 2022 and in the summer of 2023 tested sustainable biofuel blends on Royal Caribbean International’s Symphony of the Seas (228,000 gross tons) sailing from Barcelona and Celebrity Cruises’ Celebrity Apex (129,500 gross tons) sailing from Rotterdam. The company completed 12 consecutive weeks of biofuel testing in Europe calling it a “pivotal moment for Royal Caribbean Group’s alternative fuel journey.”

The tests of biofuels have been successful. The broad shipping industry however reports it is limited by the availability of biofuel.

Trafigura Joins Pioneers Ordering Ammonia-Fueled Vessels from HD Hyundai

Global commodities trader Trafigura group is joining the growing list of pioneers committing to ammonia-fueled vessels. The company has ordered four dual-fueled product tankers for LPG or ammonia transport as part of the group’s growing efforts to decarbonization. With the vessels scheduled for delivery in 2027, Trafigura will be at the forefront of ammonia-fueled propulsion.

The company provided only a few basic details reporting that it ordered four medium gas carriers capable of using ammonia for propulsion when they are delivered. The vessels, which will be used to transport ammonia or LPG, will be built at HD Hyundai Mipo Dockyard in Ulsan, South Korea. Hyundai reported the order is valued at $286 million.

In placing the order, they join a select group of shipping companies that have already moved forward on ammonia while the engine technology is still being perfected and the infrastructure for bunkering is just being explored. Earlier this year Fortescue and Singapore’s Maritime and Port Authority reported the first-ever ammonia bunkering and tests on the Fortescue’s converted offshore supply vessel renamed Fortescue Green Pioneer. Worldwide, DNV calculates that there are just 19 vessels on order for ammonia-fueled propulsion with most of the orders for bulkers and only two gas carriers, so far. Only two shipyards, Hyundai Mipo and Qingdao Beihai Shipbuilding in China have received orders for ammonia vessels.

“We are excited to embark together with HD Hyundai Mipo on this ambitious project which supports our commitments to decarbonizing shipping and will help us to develop the global low-carbon ammonia bunkering infrastructure needed for zero-carbon shipping to become a reality,” said Andrea Olivi, Head of Wet Freight for Trafigura.

Trafigura is one of the world’s largest charterers of vessels, responsible for more than 5,000 voyages a year with around 400 ships currently under management. The company highlights its commitment to helping to develop low-carbon fuels and vessels while highlighting the range of programs it is testing. They purport to be one of the few operators to have tested a full range of alternative shipping fuels including LNG, methanol, LPG, and biofuels on its owned and chartered vessels.

Investments are also being made by Trafigura in wider efficiency measures such as silicone hull coating, wake equalizing ducts, ultrasonic propeller antifouling technology, and continuous underwater hull cleaning and propeller polishing. It has also co-sponsored the development of a two-stroke engine by MAN Energy Solutions that can run on green ammonia and is investing in onboard carbon capture technology.

Trafigura looks to lead the industry by example. They are committed to reducing the carbon intensity of its shipping fleet by 25 percent by 2030.

Energy Insetting is the Key to Unlock the Potential of Future Fuels

The maritime industry is facing an ever-tightening regulatory environment in its efforts to achieve its ambitious net-zero target by the middle of this century. For meaningful progress to be achieved, the industry needs two things: practical solutions, together with a detailed understanding of the actual impact of various long and short-term measures on the industry’s future decarbonization pathway.

The maritime industry is facing an ever-tightening regulatory environment in its efforts to achieve its ambitious net-zero target by the middle of this century. For meaningful progress to be achieved, the industry needs two things: practical solutions, together with a detailed understanding of the actual impact of various long and short-term measures on the industry’s future decarbonization pathway.

This extends beyond purely technical considerations, encompassing the entire value chain, and accounting for the broader economic context in which the transition is taking place. It also requires approaching the question using the right lens, by considering shipping’s “greenhouse gas (GHG) budget” to 2050, rather than solely focusing on the emissions levels at the end of the journey. To limit global temperature increases to 1.5 degrees Celsius, in line with the Paris Agreement, we need to account for all emissions released into the atmosphere until the point of carbon neutrality is reached.

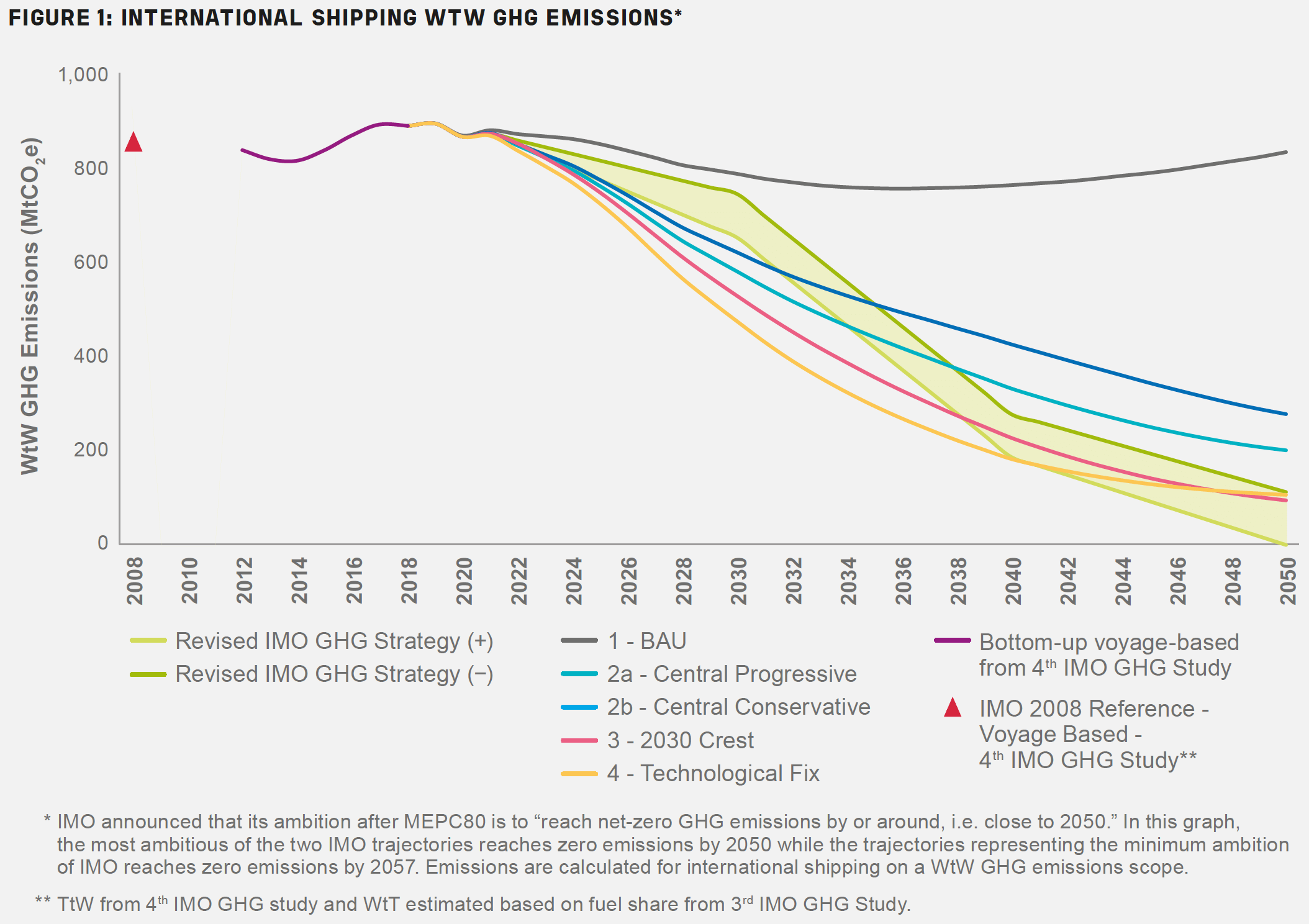

Putting those principles into practice, Bureau Veritas (BV) has recently published a report outlining potential decarbonization trajectories for the maritime industry through five distinct scenarios, each considering several parameters such as socio-economic forecasts for the evolution of demand for maritime transport, the possible speed for the uptake of green fuels, and technical efficiency improvements in shipping.

Our study reveals that for shipping to keep within its carbon budget, all available levers will need to be actioned at different points in time over the next three decades.

A central role for energy efficiency

In practice, our study demonstrated two clear findings. The first is that operational and technical efficiency measures and energy-saving technologies need to be actioned in the short term, when emissions are at their highest. This will involve embracing practical solutions such as reducing speed, voyage optimization, weather routing, energy-saving devices, and wind-assisted propulsion, which will all help to drive decarbonization.

Our modeling confirmed the potential hefty cumulative impact of operational and technical efficiency measures in keeping shipping within its “GHG budget” to 2050. BV’s simulations show that without action to reduce speed or waiting time - while ocean transportation volumes grow - GHG emissions would be 92% higher by midcentury, with 44% more emissions over the period than if these levers had been actioned.

Although future fuels are widely acknowledged as the preeminent solution, the limited availability of biofuels and e-fuels generated from wind and solar sources to replace fossil fuels reflects the monumental investment required for adoption at scale. The industry cannot afford to wait for innovative fuel and propulsion technologies to achieve commercial viability before taking action.

A supply chain challenge

Moving the needle on fuel production requires pragmatic solutions to unlock the necessary investments to reach the required scale. As such, the second clear finding from our research established the importance of embracing energy insetting as a means of stimulating the at-scale production of renewable and low-carbon fuels, connecting fuel buyers and sellers across the value chain, while also addressing the cost disparity between conventional and very-low-carbon fuels.

The widespread adoption of low-carbon fuels by the shipping industry will entail significant costs to shipowners and operators compared to fossil fuels. However, energy insetting provides a solution that can help bridge the price gap, whilst making a tangible impact on Scope 3 emissions across value chains.

Digital certificates, known as insets, are issued according to the level of emissions savings achieved using renewable and low-carbon fuels, compared to conventional fossil fuels. These emissions are evaluated using a proof of sustainability (PoS) delivered by an independent body to attest to the sustainability credentials of a given fuel. These insets can then be exchanged using a book-and-claim methodology, which allows the certificates to be verified and exchanged digitally, on a dedicated registry.

Unlike offsets, insets are internationally recognized as concrete reductions realized within the supply chain. So, rather than engaging in compensation through external schemes such as reforestation, insets improve the net environmental performance of the industry as a whole, based on reliable assurance verification. This involves practical measures to monetize the estimated GHG emission savings enabled by using renewable or low-carbon marine fuels and will enable end consumers concerned with sustainable sourcing and supply to exercise their purchasing power to guide upstream decisions.

Ultimately, the development of different iterations of energy insetting could be a vital tool the industry needs to send clear market signals to stimulate the production of renewable and low-carbon fuels at scale.

Furthermore, the use of digitalization to record and validate these emissions savings has the dual benefit of connecting a variety of stakeholders throughout the supply chain. It removes the geographical barriers that arise from sourcing through physical supply chains, bringing the supply and demand sides of low-carbon fuel development together, uniting energy providers, carriers, forwarders and cargo owners, as well as the end consumer. The long-term emergence and efficiency of markets rely on trust and the circulation of information.

It is widely acknowledged that immediate and impactful action needs to be taken to achieve the maritime sector’s decarbonization targets, but these goals will not be achieved without unprecedented levels of collaboration and consensus between different stakeholders across the entire value chain.

While this level of cooperation may strike many within the industry as counterintuitive, it is only by embracing benefit-sharing models – such as energy insetting methodologies – that the industry will achieve its net-zero ambition.

Paul Delouche is the Strategy, Acquisitions, and Advanced Services Director at Bureau Veritas Marine & Offshore.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.