War Profiteering is Real

by SARAH ANDERSON

The prospect of war with Iran is terrifying.

Experts predict as many as a million people could die if the current tensions lead to a full-blown war. Millions more would become refugees across the Middle East, while working families across the U.S. would bear the brunt of our casualties.

But there is one set of people who stand to benefit from the escalation of the conflict: CEOs of major U.S. military contractors.

This was evident in the immediate aftermath of the U.S. assassination of a top Iranian military official on January 2. As soon as the news reached financial markets, these companies’ share prices spiked.

Wall Street traders know that a war with Iran would mean more lucrative contracts for U.S. weapons makers. Since top executives get much of their compensation in the form of stock, they benefit personally when the value of their company’s stock goes up.

I took a look at the stock holdings of the CEOs at the top five Pentagon contractors (Lockheed Martin, Boeing, General Dynamics, Raytheon, and Northrop Grumman).

Using the most recent available data, I calculated that these five executives held company stock worth approximately $319 million just before the U.S. drone strike that killed Iranian leader Qasem Soleimani. By the stock market’s closing bell the following day, the value of their combined shares had increased to $326 million.

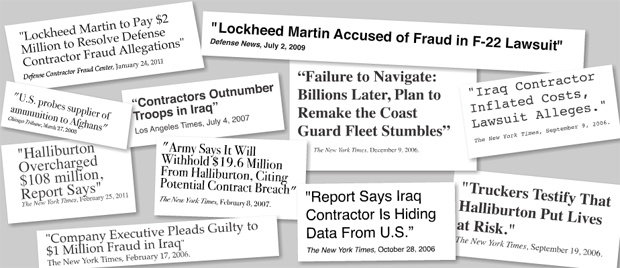

War profiteering is nothing new. Back in 2006, during the height of the Iraq War, I analyzed CEO pay at the 34 corporations that were the top military contractors at that time. I found that their pay had jumped considerably after the September 11 attacks.

Between 2001 and 2005, military contractor CEO pay jumped 108 percent on average, compared to a 6 percent increase for their counterparts at other large U.S. companies.

Congress needs to take action to prevent a catastrophic war on Iran. De-escalating the current tensions is the most immediate priority.

But Congress must also take action to end war profiteering. In 2008, John McCain, then a Republican presidential candidate, proposed capping CEO pay at companies receiving financial bailouts. He argued that CEOs relying on taxpayer funds should not earn more than $400,000 — the salary of the U.S. president.

That commonsense notion should be extended to all companies that rely on massive taxpayer-funded contracts. Senator Bernie Sanders, for instance, has a plan to deny federal contracts to companies that pay their CEOs excessively. He would set the CEO pay limit for major contractors at no more than 150 times the pay of the company’s typical worker.

Currently, the sky’s the limit for CEO pay at these companies — and the military contracting industry is a prime offender. The top five Pentagon contractors paid their top executives $22.5 million on average in 2018.

CEO pay restrictions should also apply to the leaders of privately held government contractors, which currently don’t even have to disclose the size of their top executives’ paychecks.

That’s the case for General Atomics, the manufacturer of the MQ-9 Reaper that carried out the assassination of Soleimani. Despite raking in $2.8 billion in taxpayer-funded contracts in 2018, the drone maker is allowed to keep executive compensation information secret.

We do know that General Atomics CEO Neal Blue has prospered quite a bit from taxpayer dollars. Forbes estimates his wealth at $4.1 billion.

War is bad for nearly everyone. But as long as we allow the leaders of our privatized war economy to reap unlimited rewards, their profit motive for war in Iran — or anywhere — will persist.

JANUARY 17, 2020

More articles by:SARAH ANDERSON

Meet the Corporate War Profiteers Making a Killing on Trump's Attacks on Iran

As long as the top executives of our privatized war economy can reap unlimited rewards, the profit motive for war in Iran—or anywhere—will persist.

by Sarah Anderson

We can put an end to dangerous war profiteering by denying federal contracts to corporations that pay their top executives excessively. (Photo: Chris Devers / Flickr)

CEOs of major U.S. military contractors stand to reap huge windfalls from the escalation of conflict with Iran. This was evident in the immediate aftermath of the U.S. assassination of a top Iranian military official last week. As soon as the news reached financial markets, these companies’ share prices spiked, inflating the value of their executives’ stock-based pay.

I took a look at how the CEOs at the top five Pentagon contractors were affected by this surge, using the most recent SEC information on their stock holdings.

Northrop Grumman executives saw the biggest increase in the value of their stocks after the U.S. airstrike that killed Qasem Suleimani on January 2. Shares in the B-2 bomber maker rose 5.43 percent by the end of trading the following day.

Wesley Bush, who turned Northrop Grumman’s reins over to Kathy Warden last year, held 251,947 shares of company stock in various trusts as of his final SEC Form 4 filing in May 2019. (Companies must submit these reports when top executives and directors buy and sell company stock.) Assuming Bush is still sitting on that stockpile, he saw the value grow by $4.9 million to a total of $94.5 million last Friday.

New Northrop Grumman CEO Warden saw the 92,894 shares she’d accumulated as the firm’s COO expand in value by more than $2.7 million in just one day of post-assassination trading.

Lockheed Martin, whose Hellfire missiles were reportedly used in the attack at the Baghdad airport, saw a 3.6 percent increase in price per share on January 3. Marillyn Hewson, CEO of the world’s largest weapon maker, may be kicking herself for selling off a considerable chunk of stock last year when it was trading at around $307. Nevertheless, by the time Lockheed shares reached $413 at the closing bell, her remaining stash had increased in value by about $646,000.

What about the manufacturer of the MQ-9 Reaper that carried the Hellfire missiles? That would be General Atomics. Despite raking in $2.8 billion in taxpayer-funded contracts in 2018, the drone maker is not required to disclose executive compensation information because it is a privately held corporation.

We do know General Atomics CEO Neal Blue is worth an estimated $4.1 billion—and he’s a major investor in oil production, a sector that also stands to profit from conflict with a major oil-producing country like Iran.

Suleimani’s killing also inflated the value of General Dynamics CEO Phebe Novakovic’s fortune. As the weapon maker’s share price rose about 1 percentage point on January 3, the former CIA official saw her stock holdings increase by more than $1.2 million.

Raytheon CEO Thomas Kennedy saw a single-day increase in his stock of more than half a million dollars, as the missile and bomb manufacturer’s share price increased nearly 1.5 percent. Boeing stock remained flat on Friday. But Dennis Muilenberg, recently ousted as CEO over the 737 aircraft scandal, appears to be well-positioned to benefit from any continued upward drift of the defense sector.

As of his final Form 4 report, Muilenburg was sitting on stock worth about $47.7 million. In his yet to be finalized exit package, the disgraced former executive could also pocket huge sums of currently unvested stock grants.

Hopefully sanity will soon prevail and the terrifyingly high tensions between the Trump administration and Iran will de-escalate. But even if the military stock surge of this past Friday turns out to be a market blip, it’s a sobering reminder of who stands to gain the most from a war that could put millions of lives at risk.

We can put an end to dangerous war profiteering by denying federal contracts to corporations that pay their top executives excessively. In 2008, John McCain, then a Republican presidential candidate, proposed capping CEO pay at companies receiving taxpayer bailouts at no more than $400,000 (the salary of the U.S. president). That notion should be extended to companies that receive massive taxpayer-funded contracts.

Sen. Bernie Sanders, for instance, has a plan to deny federal contracts to companies that pay CEOs more than 150 times what their typical worker makes.

As long as we allow the top executives of our privatized war economy to reap unlimited rewards, the profit motive for war in Iran—or anywhere—will persist.

Sarah Anderson directs the Global Economy Project of the Institute for Policy Studies, and is a co-editor of Inequality.org. @Anderson_IPS

Military spending: 20 companies profiting the most from war

Samuel Stebbins and Evan Comen

24/7 Wall Street

There was a 1.1 percent increase in global military spending in 2017, according to the Stockholm International Peace Research Institute.

The global rise was driven partially by a $9.6 billion hike in U.S. arms expenditure – the United States is the world’s largest defense spender by a wide margin. Though it is yet unclear what the growing arms investments will mean for international relations, major defense contractors around the world stand to benefit.

Total arms sales among the world’s 100 largest defense contractors topped $398 billion in 2017 after climbing for the third consecutive year. Notably, Russia, one of the countries with the fastest growing militaries over the last decade, became the second largest arms-producing country, overtaking the United Kingdom for the first time since 2002. The United States’ position as the top arms-producing nation in the world remains unchanged, and for now unchallenged.

The United States is home to five of the world’s 10 largest defense contractors, and American companies account for 57 percent of total arms sales by the world’s 100 largest defense contractors, based on SIPRI data.

Maryland-based Lockheed Martin, the largest defense contractor in the world, is estimated to have had $44.9 billion in arms sales in 2017 through deals with governments all over the world. The company drew public scrutiny after a bomb it sold to Saudi Arabia was dropped on a school bus in Yemen, killing 40 boys and 11 adults. Lockheed’s revenue from the U.S. government alone is well more than the total annual budgets of the IRS and the Environmental Protection Agency, combined.

24/7 Wall St. reviewed data provided by the Stockholm International Peace Research Institute to identify the companies profiting most from war. Companies were ranked based on arms sale revenue. Chinese companies were not considered due to lack of sufficient data. Total 2017 revenue and arms sales were provided by SIPRI. Profits and total sales came from fiscal year 2017 annual financial disclosures filed with the U.S. Securities and Exchange Commission or published independently. Employee counts are the most recent available estimates, and are in some cases from corporations’ 2018 financial disclosures.

20. Textron

• Country: United States

• Arms sales: $4.1 billion

• Total sales: $14.2 billion

• Profit: $1.2 billion

• Employees: 35,000

Textron, based in Providence, Rhode Island, is one of 11 American companies to rank among the world's largest defense contractors. The company ranks 20th among companies profiting the most from war in 2017 with $4 billion in arms sales through its subsidiaries, which include Bell Helicopter and Textron Systems.Though the majority of Textron's revenue comes from deals in the United States and Canada, the company also does business in the Middle East, Asia, and Europe. Textron defense products include armored vehicles, unmanned aircraft, and attack helicopters.

While it is one of the largest defense companies in the world, over 70 percent of Textron's revenue comes from commercial deals. The company's non-military subsidiary aircraft brands include Cessna and Beechcraft.

19. Naval Group• Country: France

• Arms sales: $4.1 billion

• Total sales: $4.2 billion

• Profit: $36.5 million

• Employees: 13,429

French industrial conglomerate Naval Group sold $4.1 billion worth of arms in 2017, among the most of any company worldwide. One of the oldest companies on this list, Naval Group's business activities date back to the early 17th century, when the group built the French Navy's Mediterranean and Atlantic fleets. Today, Naval Group is the leading provider of naval defense systems in Europe.

Some of the major innovations throughout the company's history include the launch of La Gloire, the first ironclad steam frigate, in 1858, and the launch of Le Redoutable, the first ballistic nuclear submarine, in 1967. In recent years, some of the company's most lucrative contract work has included the delivery of the FREMM Tahya Misr frigate to the Egyptian Navy, completed in 2015, and a commitment to build 12 submarines for the Royal Australian Navy, awarded in 2016.

18. Leidos• Country: United States

• Arms sales: $4.4 billion

• Total sales: $10.2 billion

• Profit: $242.0 million

• Employees: 31,000

Nearly half of the $10.2 billion in revenue of Virginia-based technology company Leidos in 2017 came from its defense and intelligence division. The company's services include IT infrastructure, data analytics, cyber security, logistics, surveillance vehicle and equipment development and maintenance, and consulting. Its defense clients include the U.S. Air Force, Army, Navy, and NATO.

Though the majority of the company's revenue comes from contracts outside of the defense industry, the company's history with the federal government goes back almost to its founding in 1969. The following year, Leidos won a contract with the Defense Nuclear Agency, now known as the Defense Threat Reduction Agency.

17. Rolls-Royce

• Country: United Kingdom

• Arms sales: $4.4 billion

• Total sales: $19.3 billion

• Profit: $5.3 billion

• Employees: 50,000

Rolls-Royce Holdings is separate from Rolls-Royce Motor Cars, the luxury automobile manufacturer, having sold the Rolls-Royce brand name and logo to German group BMW in 1998. While Rolls-Royce Holdings sold $4.4 billion worth of military products and services in 2017 – making it the 17th largest defense contractor in the world – weapons manufacturing accounts for a relatively small share of the company's total revenue. Today, the largest share Rolls-Royce Holdings' revenue comes from civil aerospace, followed by power systems, defense aerospace, marine, and nuclear technology.

Some of Rolls-Royce's major defense contracts in 2017 included renewals with the U.S. Department of Defense for supporting approximately 3,000 engines on aircraft such as the C-130 Hercules and T-45 Goshawk, and engine orders from the Japanese Self-Defense Force for its new V-22 Osprey fleet.

16. Honeywell International

• Country: United States

• Arms sales: $4.5 billion

• Total sales: $40.5 billion

• Profit: $1.7 billion

• Employees: 114,000

New Jersey-based Honeywell International sells its software and consulting services in a range of industries, including health care, oil and gas, manufacturing, and industrials. In addition, defense contracts accounted for about 11 percent of the company's 2017 revenue. For decades, Honeywell has had a contract with the U.S. Army to develop longer range weapons systems, operating systems for unmanned aerial vehicles, and missile navigation systems. The company has also manufactured over 6,000 T55 engines, which the Army uses in its iconic heavy-lift Chinook helicopter. The company has an ongoing partnership with the Army for maintaining and overhauling the engines.

Honeywell has defense contracts with foreign governments as well, inking a deal with the U.K. in 2016 to install navigation systems in the British Army's AJAX armored fighting vehicles.

15. United Shipbuilding Corp.

• Country: Russia

• Arms sales: $5.0 billion

• Total sales: $5.6 billion

• Profit: $101.0 million

• Employees: 80,000

The United Shipbuilding Corporation was established in March 2007 in accordance with a decree from Russian President Vladimir Putin. The state-owned defense contractor sold $5.0 billion worth of arms in 2017, the third most of any Russian company and among the most of any worldwide. Arms sales accounted for 89 percent of USC's total revenue for the year.

In July 2014, USC was added to a list of companies banned from doing business in the United States by the U.S. Department of the Treasury. The sanctions were imposed in response to Russia's continued support for separatists in eastern Ukraine.

14. United Aircraft Corp.

• Country: Russia

• Arms sales: $6.4 billion

• Total sales: $7.7 billion

• Profit: $325.3 million

• Employees: 98,000

Since the breakup of the Soviet Union in 1991, Russia has been transitioning to a privatized economy. The defense industry, however, remains almost entirely state-owned. The United Aircraft Corporation was established by decree of Russian President Vladimir Putin in early 2006. While the company manufactures civil and special purpose aircraft, over 80 percent of its $7.7 billion in revenue in 2017 came from arms sales. UAC's military aircraft include MiG, Sukhoi, and Yak fighter jets. Though based in Russia, UAC has partners in India and Italy.

13. Huntington Ingalls Industries

• Country: United States

• Arms sales: $6.5 billion

• Total sales: $7.4 billion

• Profit: $479.0 million

• Employees: 38,000

Shipbuilder Huntington Ingalls Industries of Newport News, Virginia, is the sole manufacturer of nuclear-powered aircraft carriers in the United States and is responsible for 70 percent of the U.S. Navy's current marine fleet. According to SIPRI, HII brought in $6.5 billion in defense revenue in 2017, the eighth most of any U.S. company and 13th most worldwide. Some of the major contracts awarded to HII in 2017 included upgrades the Arleigh Burke-class guided missile destroyer Jack H. Lucas, development on the U.S. Navy's new Columbia-class submarines, and providing nuclear waste cleanup services at the Los Alamos National Laboratory in New Mexico.

In addition to manufacturing nuclear-powered aircraft carriers and submarines, surface combatants, amphibious assault and transport vehicles, and Coast Guard Cutters, HII offers technical solutions services in such fields as information technology and oil and gas engineering. Non-defense related activities accounted for 13 percent of HII revenue in 2017.

12. L-3 Technologies

• Country: United States

• Arms sales: $7.8 billion

• Total sales: $9.8 billion

• Profit: $693.0 million

• Employees: 31,000

L-3 Communications changed its name to L-3 Technologies on Dec. 31, 2016. The $7.8 billion in arms sales the company made in 2017, according to SIPRI estimates, was effectively unchanged from the previous year. The company's operations include intelligence, surveillance, and reconnaissance products and services in the United States, Canada, Europe, and Australia. The company's communication technology is integrated to the Predator and Global Hawk drones and is used in U.S. Army communication infrastructure. L-3 also designs power distribution systems and communication technology used by the U.S. Navy's Virginia-class submarine.

in 2017, contracts with foreign governments totaled $1.4 billion in sales, a fraction of the $6.3 billion in contracts L-3 had with the Department of Defense.

11. United Technologies Corp.

• Country: United States

• Arms sales: $7.8 billion

• Total sales: $59.8 billion

• Profit: $4.9 billion

• Employees: 240,000

Largely through its subsidiary brands Collins Aerospace and Pratt & Whitney, United Technologies is one of the largest defense contractors in the world. Collins Aerospace designs and sells advanced systems for military helicopters, including rescue hoists, autopilot systems, and laser guided weapon warning systems. Pratt & Whitney designs and manufactures engines currently in use by 34 militaries worldwide. In the U.S. military, the F-22 Raptor, F-16, and F-15 fighter jets, as well as the C-17 Globemaster III, are just a few of examples of military aircraft powered by Pratt & Whitney engines.

In late 2018, United Technologies announced plans to split into three independent companies. The company's defense division will remain under the United Technologies name, while the Otis Elevator Company and Carrier HVAC company will break off as independent entities.

10. Almaz-Antey

• Country: Russia

• Arms sales: $8.6 billion

• Total sales: $9.1 billion

• Profit: $422.6 million

• Employees: 129,000

Established in 2002 under the direction of Russian President Vladimir Putin, Almaz-Antey is the largest known state-owned defense contractor, as measured by revenue, in the world. Almaz-Antey primarily manufactures surface-to-air missile systems for use by the Russian military. Due to increasing domestic and foreign demand, Almaz-Antey's arm sales rose 17 percent from 2016 to 2017, one of the largest increases of any defense company. The Moscow-based contractor had $8.6 billion in arms sales in 2017, according to SIPRI. This was the most of any Russian company and the 10th most worldwide – the highest position occupied by a Russian company since SIPRI began tracking international arms sales.

In July 2014, Almaz-Antey was added to a list of companies banned from doing business with the United States by the U.S. Department of the Treasury. The sanctions were imposed against the company for its involvement in Russia's continued support for separatists in eastern Ukraine and occupation of Crimea.

9. Leonardo

• Country: Italy

• Arms sales: $8.9 billion

• Total sales: $13.0 billion

• Profit: $310.3 million

• Employees: 45,134

Named after the Tuscany-born Renaissance man, Leonardo is the only Italian company to rank among the world's largest defense contractors. The company has products and services in multiple branches of defense, including land and naval electronics, information systems, helicopters, jet aircraft, and unmanned aerial vehicles. Leonardo also manufactures weapons systems, torpedoes, and ammunition for naval and land artillery. Leonardo products and services are used in 150 countries. After Italy, the company's largest customers are the U.K., U.S., and Poland.

8. Thales

• Country: France

• Arms sales: $9.0 billion

• Total sales: $17.8 billion

• Profit: $931.1 million

• Employees: 65,000

This Paris-based contractor, which offers products and services in land, air, sea, and cyber defense, went from the world's ninth largest defense contractor in 2016 to eighth largest in 2017 after its total arms sales jumped 7 percent from $8.4 billion to $9.0 billion. Late last year, the company announced a deal with the French Navy to install seven new radar systems on frigates for missile fire control. When released, 2018's figures may show even more growth for the company. As of the first quarter of 2018, the value of all orders increased 34 percent from the first quarter of 2017.

7. Airbus Group

• Country: Trans-European

• Arms sales: $11.3 billion

• Total sales: $75.2 billion

• Profit: $3.3 billion

• Employees: 133,671

Though the company's primary business is in commercial and private aircraft, Airbus is the second largest defense contractor in Europe. Airbus has taken orders for over 600 of its Eurofighter Typhoon jet from a number of countries, including Austria, Saudi Arabia, Kuwait, and Qatar. The company has also taken hundreds of orders for its A400M and C295 transport aircraft. Airbus makes secure communication devices for a client list that includes NATO and the French Navy. Like many other companies on this list, Airbus is involved in cybersecurity and has worked with defense departments of countries across Europe to protect vulnerable systems from cyber threats.

6. General Dynamics Corp.

• Country: United States

• Arms sales: $19.5 billion

• Total sales: $31.0 billion

• Profit: $2.9 billion

• Employees: 105,600

Incorporated in 1952, General Dynamics has sold a wide range of armaments, including missiles, warships, submarines, and rockets to all branches of the U.S. military since its beginning. In 2017, the Falls Church, Virginia, contractor sold $19.5 billion worth of arms, the fifth most of any U.S. company and the sixth most of any company worldwide. In 2017, the company received a $5.1 billion contract to design and develop a prototype of the Columbia-class submarine and delivered the latest iteration of the Abrams tank to the U.S. Army. GD is also the company behind the new Arleigh Burke-class Destroyer and Zumwalt-class guided-missile destroyer, developed and built at its plant in Bath, Maine. Like a number of other companies on this list, GD also provides communications, IT, and cyber security products and services.

5. Northrop Grumman Corp.

• Country: United States

• Arms sales: $22.4 billion

• Total sales: $25.8 billion

• Profit: $2.0 billion

• Employees: 85,000

The company now known as Northrop Grumman was founded in Hawthorne, California, in 1939. The company built its first aircraft, the N-3PB patrol bomber, for the Norwegian Air Force in 1940, and it has since expanded into four primary business sectors: aerospace systems, innovation systems, mission systems, and technology services. Northrop Grumman pioneered the Flying Wing concept – an aircraft with no tail or definitive fuselage in which most of the crew, payload, and equipment is situated in the main wing structure – and incorporated the technology in its B-2 stealth bomber line.

According to SIPRI, Northrop Grumman made $22.4 billion in arms sales in 2017, the fourth most of any company in the United States and the fifth most of any company worldwide. Some of the major contracts won by Northrop Grumman in 2017 include a $750 million deal to provide maintenance services for the U.S. Army's Special Electronic Mission Aircraft fleet and a $265 million deal to provide maintenance and logistics support for the U.S. Air Force's Battlefield Airborne Communications Node system.

4. BAE Systems

• Country: United Kingdom

• Arms sales: $22.9 billion

• Total sales: $23.5 billion

• Profit: $1.1 billion

• Employees: 83,200

BAE Systems is the largest defense contractor based in the United Kingdom, and the fourth largest in the world. The company builds ground combat vehicles – including the Challenger 2, the main battle tank for both the British Army and Royal Army of Oman – for different situations and clients. The company is also in the early years of a decade-long contract with the U.K.'s Royal Air Force to support its fleet of Typhoon fighter jets, and it is assisting in the continued development of the F-35 fighter jet in a partnership with U.S. companies Northrop Grumman and Lockheed Martin.

While many other companies on this list also have a lucrative deals with private and commercial clients, 98 percent of BAE Systems' 2017 revenue came from arms deals.

3. Raytheon

• Country: United States

• Arms sales: $23.9 billion

• Total sales: $25.3 billion

• Profit: $2.0 billion

• Employees: 67,000

The third largest defense contractor in the world, Raytheon is a missile defense and long-range precision weapons maker headquartered in Waltham, Massachusetts. Through customers in over 80 countries, the company reported $25.3 billion in revenue in 2017, 94 percent of which came from arms sales and defense contracts. The United States and many of its allies rely on the company's radars and ballistic missile interceptors as part of their defense strategy. Raytheon also makes a wide range of air-to-surface, surface-to-air, air-to-air, and surface-to-surface precision guided missiles, in addition to bombs, torpedoes, and tactical small-arms sights.

2. Boeing

• Country: United States

• Arms sales: $26.9 billion

• Total sales: $93.4 billion

• Profit: $8.2 billion

• Employees: 153,000

Boeing made $26.9 billion in arms sales in 2017, according to SIPRI, the second most of any company worldwide. Defense contracts accounted for 29 percent of Boeing's revenue, a far smaller share than most companies among world's 10 largest military contractors. A bulk of Boeing's revenue comes from commercial aircraft such as the 737, 747, 767, 777, and 787 families. In 2017, Boeing completed 763 commercial aircraft deliveries – an industry record – and won over 900 orders to grow its order backlog to a total of 5,864 airplanes.

Boeing won in 2017 the first international order, from Japan, of a KC-46 aerial refueling aircraft, whose design is based on the commercial 767 airplane. Other major defense contracts and continuations of previous contracts won by Boeing in 2017 include the manufacturing of 27 P-8 Poseidon aircraft, 36 advanced F-15 fighters, and 268 Apache helicopters.

1. Lockheed Martin Corp.

• Country: United States

• Arms sales: $44.9 billion

• Total sales: $51.0 billion

• Profit: $2.0 billion

• Employees: 105,000

Lockheed Martin is by far the largest defense contractor in the world. In 2017, the Bethesda, Maryland, company made $44.9 billion in arms and defense contracts, nearly twice the amount of arms sales at Boeing, the second largest defense contractor. The company makes a wide range of military aircraft, including the F-16, F-22, and F-35 fighter jets, as well as sonar technologies, ships, missile defense systems, and missiles used by the Navy. More than $35 billion of Lockheed Martin's arm sales in 2017 came from the U.S. government, more than the entire budget of the Internal Revenue Service and Environmental Protection Agency combined.

Net sales are expected to have climbed even higher in fiscal 2018. In late 2018, the company was awarded a $22.7 billion contract for 106 F-35 fighter jets for the U.S. military and another 89 for ally nations.

24/7 Wall Street is a USA TODAY content partner offering financial news and commentary. Its content is produced independently of USA TODAY.

NOT 2023 BUT CURRENT 2020 MILITARY SPENDING