“I Am Only Earning $300 A Week”: Here’s What People Are Making For Essential Work

“The take-home pay is completely ludicrous for what we do.”

Venessa Wong BuzzFeed News Reporter

Posted on May 22, 2020

Charlie Riedel / AP

They’re keeping your grocery shelves stocked, preparing your takeout, and packaging your sex toys for delivery, putting their lives at risk in the process. And in return, they’re often taking home less money than they would collect in unemployment benefits — sometimes a lot less.

WHEN THE RIGHT WING SAYS WORKERS ARE GETTING PAID TO STAY HOME THEN ITS TIME TO TELL THE BOSSES TO PAY MORE NOT REDUCE UI

The coronavirus pandemic has served as another reminder that many of the workers who are most essential to our everyday lives are also paid the least. BuzzFeed News spoke with essential workers around the country about how much they are bringing home each week during the emergency, and what it’s like to make so little when your work is so important.

Many of them already earned close to minimum wage before the pandemic; now they’re also dealing with slashed hours as businesses wrestle with lockdowns. The federal government’s $600-per-week unemployment benefit being offered through July as part of the economic relief package — the equivalent of $15 per hour for a 40-hour workweek — exceeds the hourly wages of an estimated 17 million US workers. It’s also more than any of the people we spoke to were earning in take-home pay.

According to a new paper by the Becker Friedman Institute for Economics at the University of Chicago, the relief package “pays bonuses to some workers who are laid off [...] but provides no additional pay for otherwise similar ‘front-line’ workers.” For instance, “Janitors who worked at businesses which are closed can get UI [unemployment insurance] benefits equal to 158% of their prior earnings, while janitors who continue to work at increased health risk in businesses deemed ‘essential’ have no guarantees of any hazard pay or increased earnings.” The researchers found 68% of workers who are eligible for unemployment benefits will receive more than their lost earnings.

Adam Lau / AP

All signs point to there being little pressure for higher pay in the foreseeable future. The unemployment rate is expected to remain above 10% through 2021, and companies that have been offering enhanced pay to employees working through the coronavirus crisis are now phasing it out. Kroger, Starbucks, Amazon, and Rite Aid have recently ended, or plan to end, their hazard pay, which generally had been an extra $2 to $3 per hour.The House of Representatives last week passed a $3 trillion relief package that would include a fund for hazard pay that gives workers an additional $13 per hour on top of their regular wages, and an extension of the expanded unemployment benefits until January. Republicans have said the bill has no chance of passing the senate; Senate Majority Leader Mitch McConnell said yesterday that any future stimulus bill will not include an extension of the $600 per week unemployment benefit.

Here's how six essential workers described their current situation to BuzzFeed News in interviews conducted in recent weeks. All have been edited for clarity and length; we gave companies mentioned the chance to respond and have included their replies.

Alex

Checkers, Tampa, Florida

$9.50 per hour | Net pay: about $200 per week

Courtesy Alex

At Checkers, I’m making $9.50 per hour. I used to work 38 to 40 hours a week, now I’m down to 22 to 25 hours. I’m also landscaping about 32 hours a week.

I moved a few months ago so it would be a little more convenient; Checkers is down the street so I can walk now. I’d think I would have more money in my pocket because I’m not paying for transportation, but I don’t because I’m now getting fewer hours. Everything was going decent, but once this happened, it’s been a little shaky.

I’m appreciative to be able to make money. But none of our customers respect social distancing. They just put blue tape down, but most people don’t know why the blue tape is there. We try to tell them, but it’s a hassle and people get aggravated. The workplace isn’t that safe. Our masks are just pieces of cloth cut out to resemble a mask and no one is getting tested. I don’t have any health insurance. The health insurance that they offer pays for nothing. Most places don’t accept that insurance or it doesn’t cover anything. So it’s better for me to just pay out of pocket.

Checkers is an essential business because it’s food. And I’m thankful for the opportunity. But I believe the level of risk does not match for the type of work I’m doing. Part of me is like, They should allow us to stay home, but the other part of me is like, I still need money.

I wish they gave us paid sick leave at this horrible moment. We’re working, but we’re not offered hazard pay, paid sick leave, or affordable healthcare. They’re not being good to us as individuals. We just really wish people would take more consideration of us.

I might make more money on unemployment, but I’ve never been the type of person that likes to sit in the house all day. I’m a very active person and try to go out and make as much money as possible. I think I’d go crazy sitting in the house all day. And I’d be worried, in my job, that by the time I come back there would be loopholes that I have to jump through. I just don’t trust the process — not with my job and the managers they have there.

My last paycheck was like $410 for two weeks. I make less than $1,000 from Checkers every month and my rent is $1,200, not counting lights or water or anything. The landscaping job, if I wasn’t blessed with that, I would either be homeless or waiting for them to start the eviction process when coronavirus is over.

Checkers told BuzzFeed News its company-owned restaurants offer paid sick leave and closure pay, and that it offers health insurance to full-time workers after 60 days of employment. The company is now offering employees extra pay through July 13 (it declined to share how much the temporary raise is) and said there is an employee relief fund. “Many of our restaurants were forced to close early due to curfews, limiting the number of late-night hours ... Now, as curfews are being lifted, those hours have returned, and we are actually struggling to staff our restaurants currently because unemployment pay is so high,” a spokesperson said.

Angelica

McDonald’s, Los Angeles

$15.30 per hour | Net pay: about $240 per week

Courtesy Angelica

Angelica's paystub for a recent two-week period at McDonald's

RIGHT CLICK TO ENLARGE

I’ve worked for McDonald’s for 15 years and at this particular store for eight years. I do a little bit of everything. I’m the prep person, so I prep salad, bread, anything that needs to be prepped, and I wash dishes, everything like that. I don’t have much contact with customers.

I make $15.30 per hour. I used to get 30 to 32 hours a week but since COVID-19, they were only giving me 20 hours a week.

I started feeling nervous when the news was reporting that this was something really dangerous. I was coming to work, and knowing we don’t have the right protection — masks, gloves, hand sanitizer — I started to feel really scared. On my way to work, my husband could provide me with transportation, but on my way back home I had to take two buses, and you don’t know who is on the bus. But I was also scared not to have money for my family.

I went on strike. My last day of work was April 8 — that day the manager had to go out and buy some masks because a coworker of mine had tested positive and was in the hospital. And it was hard to maintain 6 feet of distance between each other and work. McDonald’s should have closed the store and disinfected it...and put all the workers on quarantine to clean the restaurant.

After I found out my coworker was positive, my three kids went to live with their grandma, about a 30-minute drive away.

McDonald’s told BuzzFeed News it is now offering bonuses equal to 10% of an employee’s pay earned in May to those working at company-owned restaurants, and that it has implemented a variety of safety measures.

Angelica spoke to BuzzFeed News through a Spanish-English translator; she has filed a complaint to California’s Division of Occupational Safety and Health.

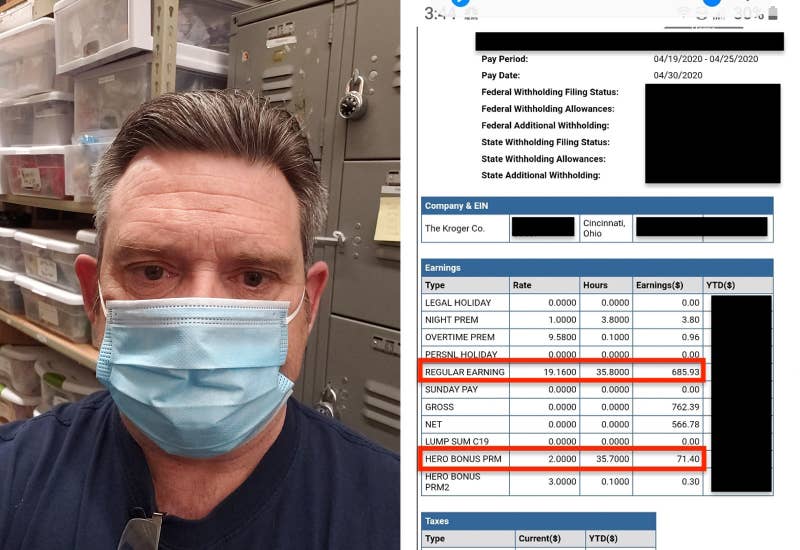

Steve

King Soopers, Littleton, Colorado

$19.16 per hour | Net pay: about $570 per week

Courtesy Steve

Steve and his pay stub from King Sooper

RIGHT CLICK TO EXPAND

I work for King Soopers — which is under the Kroger umbrella — in Littleton, Colorado. I do produce, maintenance, utility work. Monday and Tuesday I come in at 4 a.m. and try to get the floors cleaned and help out in other departments. Wednesday through Friday, it’s 7 to 3:30. I have a good gig, I get weekends off because I’ve been there for a while. My pay is $19.16 per hour. And then there was hazard pay of $2 per hour.

The first four weeks were completely hectic, with people lined out the door. We’d open up and they would just come rushing through the door. It was a panic attack. Everyone was nervous. Everyone was scared. People would run for the toilet paper because it was the new world money. So we let people into the paper goods aisle 10 at a time — you had to start regulating people and telling them how to act. And a couple of weeks ago, some meatpacking plants shut down, ground beef was the new world money. The first five or six weeks it was very scary, but it’s just the new normal.

There was a free COVID testing program for employees at our main office warehouse. I spent 45 minutes in my car to go get tested. It was a great thing, but the company wouldn’t share with us when someone tested positive. With our night crew, I know that we had at least four confirmed cases. So there were a bunch of us who were close to it and some went out on self-quarantine because they have heart and lung conditions and some COPD (chronic obstructive pulmonary disease) and were nervous.

In the stores, I love that they’re making us wear masks and providing gloves, but I don’t understand why the customers don’t have to wear masks. I don’t want to get political, but there are patriots who are just going to get up in there.

The store is taking our temperature when you come in for your shift, but there’s no way in hell those things are calibrated correctly. It’s a handheld thermometer that they put on your head and squeeze. In the last two weeks, I’ve only had one temperature over 95 degrees. They say I’m 91, 92 degrees, and I’m like, I am 2 degrees away from a cadaver. Really, OK? I don’t think it matters to them. They’re just doing the routine.

Kroger is offering bonuses now but cutting hazard pay, and there’s really no reason. The take-home pay is completely ludicrous for what we do. It costs about $1,000 to rent a studio apartment in this part of Colorado. And you have to work for Kroger a whole year to get health benefits. If there’s a government solution for hazard pay, give it to the farmers and smaller businesses. Kroger’s huge, they’re making the money, and the stock is doing quite well now.

Kroger did not reply to a request for comment.

Monica

Amazon warehouse, Concord, North Carolina

$15 per hour plus hazard pay | Net pay: about $500 per week

Courtesy Monica

Monica and her pay stub from Amazon

RIGHT CLICK TO ENLARGE

I work on everything: nonessential and some essential. I grab a case full of items that people have ordered, I scan it, put it into a box, and send it down the line. My regular days are Thursday through Sunday and every day is a 10 hour day, so I’m at 40 hours. If I pick up overtime, I can be near 60 hours. They offered us double overtime, but it ends in May, and the extra $2 per hour is going to be gone. I’ve been here since October. So I’ve been through peak season. This is just another peak for me.

People are ordering everything but the right thing. I don’t know how many boxes of hair dye I have packed, toys — and by toys I mean sex toys — just everything besides what Amazon said they were going to do, sending out essential items. I understand you’re home, you’re bored, but you gotta dye your hair? If people were only ordering essential items, I would feel differently, because it would mean y’all are taking it seriously. And if people aren’t ordering nonessential items, they would have the chance to clean the facility and I could be at home, self-quarantining. Amazon had 30 cases at another facility. They should clean all facilities to prevent it from happening.

I don’t know how long this pandemic is going to last. I’m really tired of coming to work, busting my behind to pack hair dye. That’s where I draw the line. Don’t get me wrong. I like my job, but this ain’t it. I really used to like Amazon, but after this, I’m over it.

I wear a mask when I go to work. I’m getting scanned for my temperature. It’s weird. It’s stressful. People are yelling at you to stay 6 feet away. People telling you if you’re caught not staying 6 feet away from each other, that’s an automatic write-up. Do you know how many people you have working in here? How? It’s impossible. There are people who I know come to work, and just turn around. Because they can’t handle it. I try to stay calm, think about something else, stay positive.

I’m bringing home $1,000 every two weeks. It’s not worth it. The hazard pay is, like, $2? I know my worth, and I’m not worth $2. And they’re taking it back anyway. I want to be able to go see my family, but I don’t want to go home infected. I’ve thought about taking unemployment, but I can’t. I’d be bored. And everything outside is closed now — I’d get the [unemployment] check and then what? So I go to work to pay my bills.

An Amazon spokesperson said: “We’ve paid our team and partners nearly $800 million extra since COVID-19 started while continuing to offer full benefits from day one of employment. With demand stabilized, next month we’ll return to our industry-leading starting wage of $15 an hour. We’re proud that our minimum wage is more than what most others offer even after their temporary increases in recent months.” Regarding cleaning, she added, “We’ve implemented a series of preventative measures to help keep our employees, partners, and customers safe ... Each site goes through enhanced cleaning and sanitization multiple times a day.”

Sarah

La Puente, California

$11.50 per hour

I’m a drive-thru worker. I serve burgers and fries and chicken teriyaki and stuff at my uncle’s burger place; we had to cut a lot of hours for other employees so it’s mostly family working there now. I earn $11.50 an hour, but I’m not as concerned about the wages — it all goes back to the family anyway — but whether we’re really essential. Why are we open still? How is social distancing going to work if we keep fast-food places open? You tell us to stay home, but we’re still open — it doesn't make sense.

Grocery stores should be open. But fast-food places shouldn’t be open now. And that’s why the pandemic is not slowing down and this lockdown is getting longer. Is it against liberty to force people to cook? I see mostly couples, teenagers, regulars. I see a lot of single dads who can’t cook. Or nurses who don’t have time to cook. But it’s mostly people who just want to get out of the house.

I want to stay home too. But it’s about serving our regulars and maintaining continuity, my uncle says, because it’ll be open and close, open and close with this virus. My uncle is thankful that we can still open, and I think that it’s wrong that we’re still open. It’s not that I don’t want to make money with him. I'm just concerned for his health too. It’s a personal opinion, and that’s why we have the law to set everything objectively.

We’re deep cleaning everything now — we took all the chairs out and we’re bleaching everything, and taking cushions off the booths. I’m guessing we’re not going to reopen the dining room for a long time. Rebuilding a cool place to hang out is tough. We just have to hope that people will still like the energy we give off.

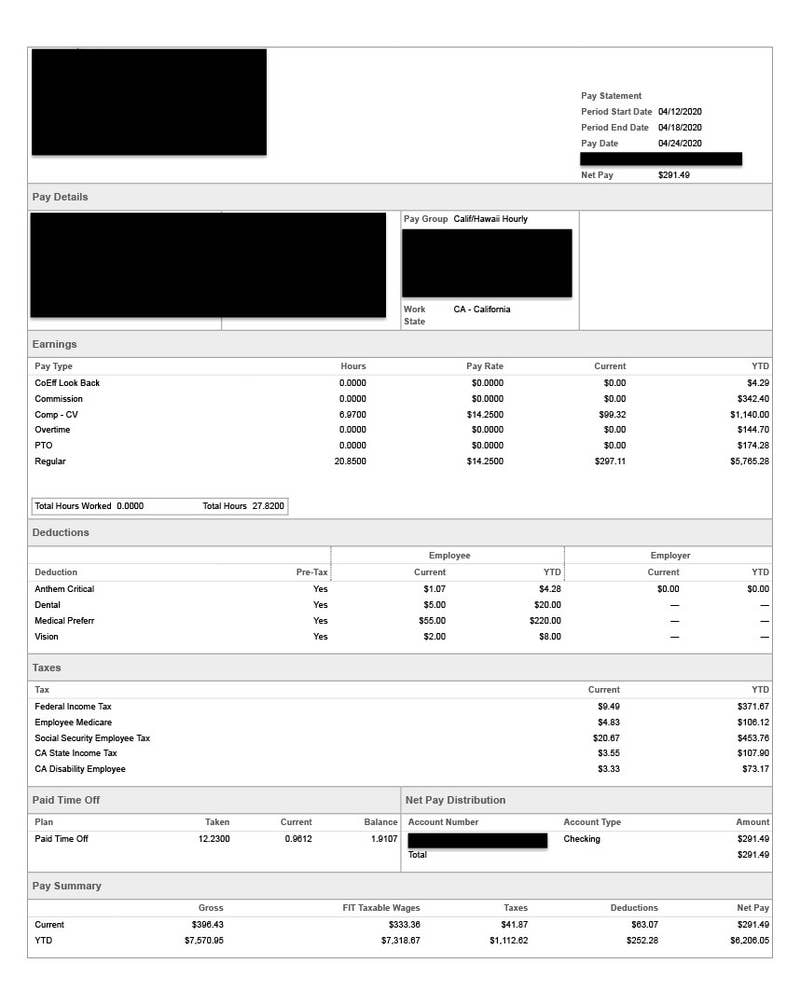

Anonymous

A wireless retailer, California

$14.25 per hour | Net pay: about $300 per week

Courtesy Anonymous

The anonymous worker's pay stub

RIGHT CLICK TO ENLARGE

I work for an authorized retailer for Verizon with stores around the country. Since everything happened, malls shut down, so we had to be relocated to stores 30-plus miles away from their home. I’m driving an additional 15 miles to work each day. Some friends are driving 60-plus miles in a day. And they cut us down to about 24 hours because now we’re overcrowding stores that normally have three or four employees but now have eight to 10 employees. I have friends who have been reduced to 8 or 12 hours. Our pay is hourly and commission-based, but since the stores are overcrowded [with employees], the commission has been almost nonexistent for a month and a half now. So we’re all working part-time hours at close to minimum wage.

I earn $14.25 per hour. After taxes and deductions, I am only earning $300 a week. Honestly I am not making enough to pay my bills. Yes, landlords are being more lenient and allowing us to be late, but that’s only the surface of my bills. I’ve really been struggling the last six weeks. My landlord is just telling us to pay what we can when we can, but it’s been difficult. All of my paycheck is going to rent. My car payment has been deferred. I take what I can each week for rent, and I receive SNAP cash for food.

A lot of us are comparing the situation here to corporate locations owned by the wireless carriers, and those employees are being taken care of. They got paid leave, got pay increases of $1 or $2. So when we compare our situation to theirs, it’s pretty unfortunate.

Almost every day someone brings up whether or not you really do want to go on unemployment right now. I’ve applied just to see if I can get back some of the lost wages from being cut back, and I have yet to receive an answer. My coworkers have done the same. I started in January so I don’t have seniority, so when they talk about layoffs, I figure I come to mind, being someone who is fairly new to the company. There are people who volunteered to leave, but we really don’t know if people are going to have a job to come back to.

I’m trying to be on the front line and do what I can. I want to keep working, establish myself at the company, and make sure my position is secured. In the first two weeks, it was a lot slower, but now there’s more traffic. Everyone is on edge, and it’s gotten more difficult and competitive with more employees per store. It causes a lot of tension at work and no one knows what the future is. I’m waiting to hear if I'm going to be laid off or if my hours will be reduced further.

Even If You're Trying To Avoid Grubhub By Calling Your Favorite Restaurant Directly, Grubhub Could Still Be Charging It A Fee

Venessa Wong · May 15, 2020

Venessa Wong · May 11, 2020

Venessa Wong · May 8, 2020

Venessa Wong is a technology and business reporter for BuzzFeed News and is based in New York.

Venessa Wong is a technology and business reporter for BuzzFeed News and is based in New York.