Astronomers find new clues on the origin of gold

MINING.COM Staff Writer | December 2, 2021 |

Gold. (Reference image by James St. John, Wikimedia Commons).

Using computer simulations, an international research team was able to demonstrate that the synthesis of heavy elements like gold and uranium is typical for certain black holes with orbiting matter accumulations known as accretion disks.

In a paper published in the journal Monthly Notices of the Royal Astronomical Society, the scientists explain that such black hole systems are formed both after the merger of two massive neutron stars and during a so-called collapsar, the collapse and subsequent explosion of a rotating star.

The internal composition of the accretion disks has so far not been well understood, particularly with respect to the conditions under which an excess of neutrons forms. A high number of neutrons is a basic requirement for the synthesis of heavy elements, as it enables the rapid neutron-capture process, or r-process. Nearly massless neutrinos play a key role in this process, as they enable the conversion between protons and neutrons.

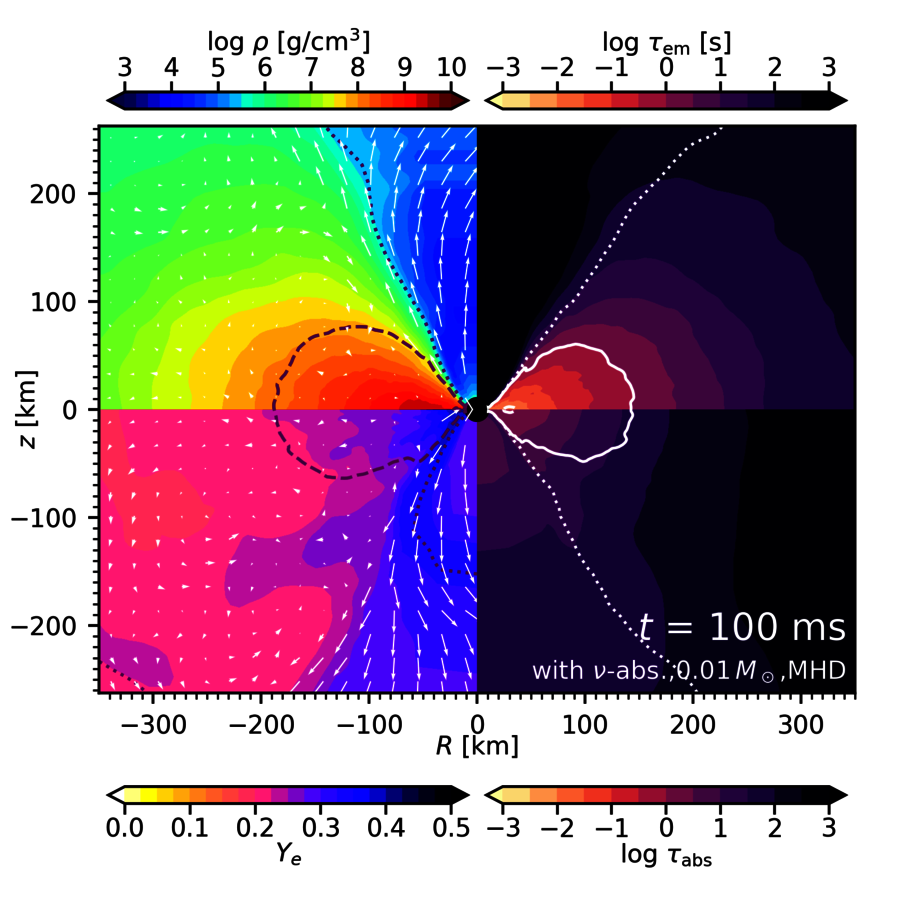

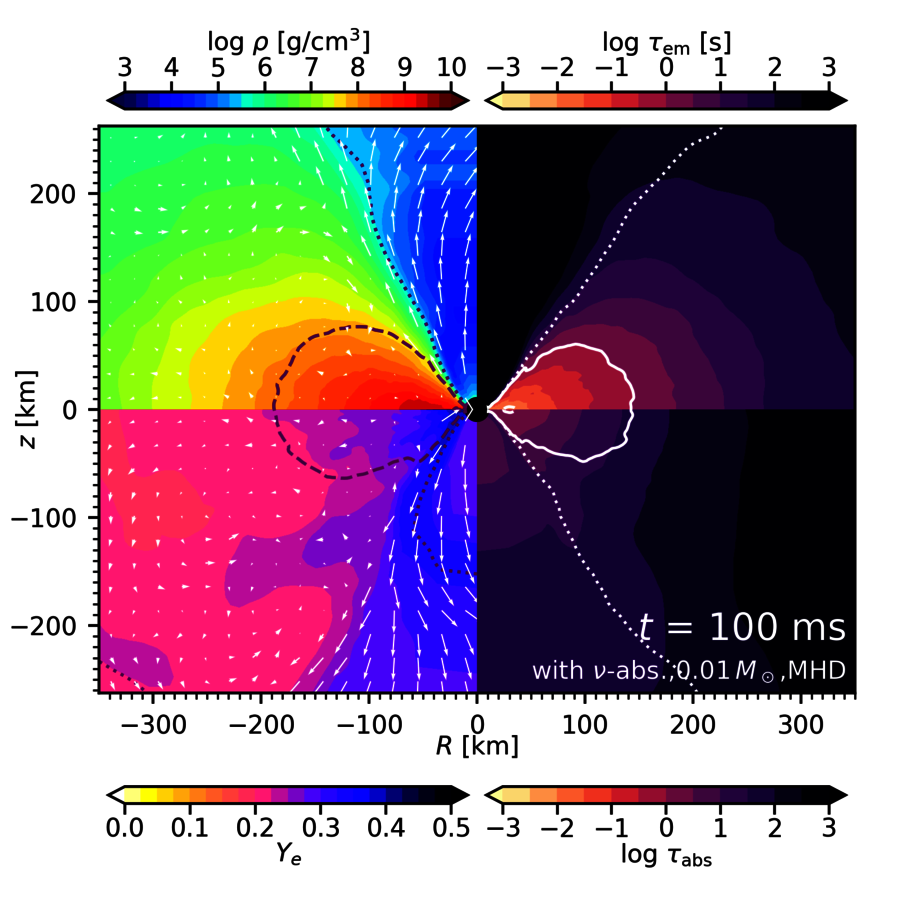

Sectional view through the simulation of an accretion disk from the study by Oliver Just and his colleagues.

(Graph courtesy of the GSI Helmholtzzentrum für Schwerionenforschung)

“In our study, we systematically investigated for the first time the conversion rates of neutrons and protons for a large number of disk configurations by means of elaborate computer simulations, and we found that the disks are very rich in neutrons as long as certain conditions are met,” Oliver Just, lead author is the study and a researcher at GSI Helmholtzzentrum für Schwerionenforschung, said in a media statement.

“The decisive factor is the total mass of the disk. The more massive the disk, the more often neutrons are formed from protons through the capture of electrons under emission of neutrinos and are available for the synthesis of heavy elements by means of the r-process.

However, if the mass of the disk is too high, the inverse reaction plays an increased role so that more neutrinos are recaptured by neutrons before they leave the disk. These neutrons are then converted back to protons, which hinders the r-process.”

The study shows that the optimal disk mass for prolific production of heavy elements is about 0.01 to 0.1 solar masses. The result provides strong evidence that neutron star mergers producing accretion disks with these exact masses could be the point of origin for a large fraction of the heavy elements. However, whether and how frequently such accretion disks occur in collapsar systems remains unclear.

Regardless of the current uncertainties, the scientists believe that their findings provide insight into which heavy elements need to be studied in future laboratories to unravel the origin of heavy elements.

The inspiration

The German, Belgian and Japanese researchers behind this study started from the premise that all heavy elements on Earth today were formed under extreme conditions in astrophysical environments: inside stars, in stellar explosions, and during the collision of neutron stars.

Like many other colleagues, they were intrigued by the question in which of these astrophysical events the appropriate conditions for the formation of the heaviest elements, such as gold or uranium, exist.

The spectacular first observation of gravitational waves and electromagnetic radiation originating from a neutron star merger in 2017 suggested that many heavy elements can be produced and released in these cosmic collisions.

However, the question remains open as to when and why the material is ejected and whether there may be other scenarios in which heavy elements can be produced.

But in the group’s view, black holes orbited by accretion disks of dense and hot matter are promising candidates for heavy element production.