Another day, another really old house selling for huge money as the Burnaby real estate market stays hot.

More people are putting their old houses up for sale because they are getting good value for these homes. It's a really good time to sell your house, it seems. Someone has put a 55-year-old house up for sale on Government Road for just under $4 million - far more than many modern marble palaces are being priced at.

The latest example as far as sales go is a 90-year-old house on 12th Avenue that has a charming entrance and just sold for $2,168,000 – which is an eye-popping $568,000 over the asking price.

The house sold after just a week on the market. The house is deceptively large at more than 3,100 square feet and with six bedroom. The lot size is a little over 7,150 square feet.

The place has been lovingly cared for an updated in several areas of the home.

The Real Estate Board of Greater Vancouver's monthly report for March shows that two out of three Burnaby areas surpassed the $2-million mark for a benchmark price last month.

Burnaby South currently sits at a benchmark price of $2,067,100 (+4.2% in one month) while Burnaby North was at $2,021,400 (+4.9% in one month).

Burnaby East stayed under $2 million at $1,776,300 (+2.7% in one month).

Meanwhile, a forecast published by the Canada Mortgage and Housing Corporation noted that, despite the expected moderation in prices and the number of sales throughout Canada, costs growth will continue to outpace income growth in several major cities – placing “greater pressure on the affordability of home ownership.”

“Improving levels of employment and immigration are expected to be key factors, as the impact of pandemic restrictions continues to recede,” said CMHC chief economist Bob Dugan in a statement about sales, prices and housing starts remaining elevated in 2022. “In 2023 and 2024, the growth in prices will trend closer to long-run averages, with sales and starts activity expected to remain above 5- and 10-year averages.”

The report paints the same picture for Metro Vancouver, Canada’s most expensive real estate market. According to the CMHC outlook, price growth of homes should slow down this year from the blistering pace seen in 2020 and 2021 – but immigration-driven demand and rising debt servicing costs will lead to a worsening of affordability.

CMHC projects the growth rate of home prices in the Greater Vancouver region will not continue on its double-digit rate beyond Q1 2022, and the rate of growth in prices will actually fall to below 5% year-over-year by 2023.

With files from Jess Balzer and the Canadian Press

Follow Chris Campbell on Twitter @shinebox44.

Canadians find other ways to grow wealth as housing escapes them

Iva Poshnjari, BNN Bloomberg

Published Wednesday, February 2, 2022

Across the country, housing markets continue to soar beyond the reach of many. For most Canadians, the price of buying a home is completely unaffordable. For others, the large debt incurred from a mortgage is no longer justifiable.

Some potential buyers are walking away from the housing market and finding new investment strategies to grow what would have been a down payment. They are choosing to focus on stocks, art and alternative investments to appreciate their wealth.

Trevor Scott, president at the hedge fund Tidefall Capital, is well aware of the uncertainties that the stock market can bring, but still chooses to invest in it instead of purchasing a home in Canada.

A real estate sold sign is shown in Oakville, Ont., on Sunday, Dec.20, 2020. A topsy-turvy real estate market has opened up new opportunities for first-time home buyers this year — but those seeking to take advantage still face major hurdles.

“The advantage of Canadian stocks today is their high free cash flow yields relative to interest rates. This is the opposite of real estate which has record low rental yields, making renting attractive,” Scott said.

Scott pointed to investment opportunities that can be found in index funds that track the TSX, which is comprised mainly of financials and natural resources — both of which are positioned to do well during inflationary times, he noted.

While price spikes might boost many stocks found within the TSX, it should be noted that deflation and recession also go hand-in-hand, along with a drop in equities.

Sky-high prices for living in Canada gave Scott another reason to favour stocks over real estate. And then there's the risk of rising interest rates, he said.

While the Bank of Canada did hold interest rates steady at January’s meeting, Governor Tiff Macklem made it clear that interest rates are coming.

“If rates increase, a lot of these mortgages on million-dollar homes would be difficult to carry,” Scott added.

He's not the only one who feels this way.

Colby Mintram, a partner at Volt Strategic Partners, also jumped into the stock market after he decided it would be more advantageous than buying a home.

“I’m not paying $1 million to own a one-bedroom apartment,” he said.

Mintram justifies renting versus owning a home in this market through the healthy returns he receives from a mixture of U.S. equities, dividend stocks, alongside put and call options.

“I’m able to make more money investing in stocks than I would have if I sunk all that cash into a mortgage,” he explained.

Market intel is a lot more accessible now than it was 30 years ago, which informs Mintram on how to make money, he said.

If trading stocks is the traditional way to make money in the markets, investors have now found new vehicles like non-fungible tokens (NFTs) and cryptocurrencies to further their returns.

This is the avenue that Amir Parsa Yazdi decided to take.

Yazdi, a 27-year-old who works in data analytics, took his hobby of trading physical sports cards and expanded it into digital collectibles.

“I doubled down on alternative rare collectables and digital formats of cards and art instead of using my money to buy a home,” he said.

Yazdi said he grew his portfolio of digital and collectable assets — including NFTs like NBA Top Shot cards and Beeple art pieces — to roughly $50,000 from less than $10,000 over the course of the last 24 months.

The boom in digital art has also helped usher in young investors to the physical art world, said Brian Liss, the founder of Liss Gallery in Toronto, which saw a 20 per cent increase in sales last year driven by younger clients.

“Millennials are spending anywhere between US$500 to US$30,000 on some of our art pieces," Liss said.

Art as an alternative investment is one trend that even real estate firms see as a good opportunity.

While remaining committed to buying and selling real estate just outside Canadian city cores, Shaminder Gogna, the founder of Condoville, has placed under 25 per cent of his firm’s funds in physical art to hold until the housing market looks more attractive.

Condoville is also eyeing foreign real estate for clients where the pricing makes more sense.

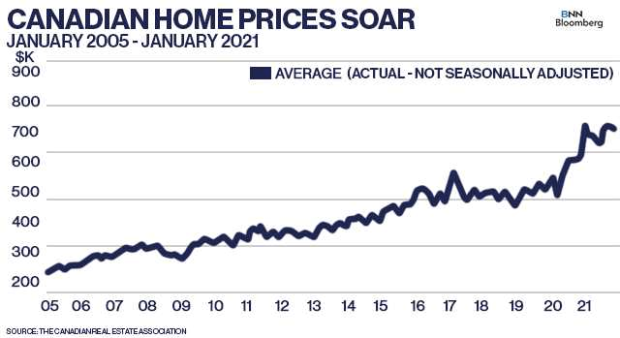

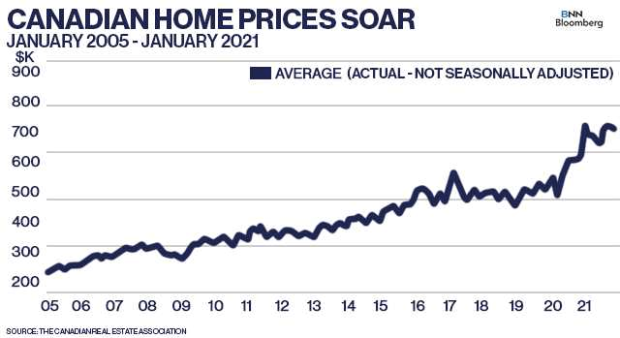

The average cost of a home in Canada remained historically high in the month of December, at $713,500. That’s up 17.7 per cent from the same time in 2020, according to the Canadian Real Estate Association.

In the country’s more populated areas, the costs have risen even further.

As of December 2021, the average home price in the GTA was $1,157,849, according to the Toronto Regional Real Estate Board.

Vancouver home prices went for $1,910,200 on average for the month of December 2021, according to The Real Estate Board of Greater Vancouver.

Younger clients who waited for a pullback to happen two years ago have found that the market has now completely run away from them, said Mark Salerno, owner of Salerno Realty.

“Every house under $2 million is in a bidding war, and it’s simply because there is no inventory,” Sonata said.

One way for buyers to get their hands on real estate without actually buying a home is through a real estate investment trust (REIT).

Avenue Living Asset Management, a firm that oversees $3.2 billion in real estate assets, has noticed eligible investors flocking to several of its alternative fund offerings. That includes multi-family, residential, agricultural, and storage real estate, explained Jason Jogia, the firm’s chief investment officer.

This is one option, outside of direct ownership of real estate, that provides renters the chance to hedge against inflation, he added.

“Young people need to have a shot at real estate exposure in some capacity, so that generational wealth doesn’t escape them,” Jogia said.