Police announce arrest of fourth suspect in B.C. Sikh activist Nijjar's death

The Canadian Press

Sat, May 11, 2024

SURREY, B.C. — A fourth Indian national living in Canada has been charged in last year's killing of Sikh activist Hardeep Singh Nijjar outside of a temple in British Columbia.

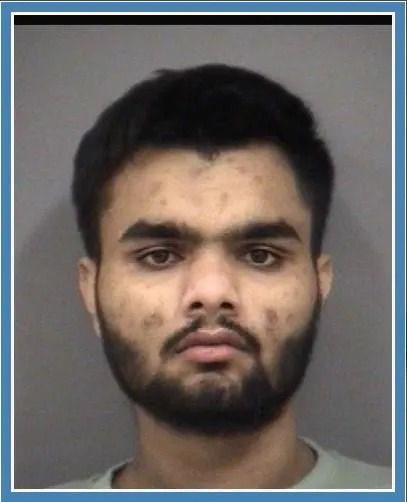

The province's Integrated Homicide Investigation Team said in a release Saturday that 22-year-old Amandeep Singh was already in the custody of Peel Regional Police in Ontario for unrelated firearms charges.

"IHIT pursued the evidence and gained sufficient information for the BC Prosecution Service to charge Amandeep Singh with first degree murder and conspiracy to commit murder," the police statement said.

Police also confirmed that Singh is an Indian national splitting his time in Canada in Brampton, Ont., Surrey, B.C., and Abbotsford, B.C.

Investigators say no further details of the arrest can be released due to ongoing investigations and court processes.

Earlier this month, police arrested three Indian nationals — Karan Brar, Kamalpreet Singh and Karanpreet Singh — in Edmonton and charged them with first-degree murder and conspiracy to commit murder in the death of Nijjar, who was gunned down in the parking lot of the Surrey, B.C., Sikh temple where he was president.

A spokesman for the Guru Nanak Sikh Gurdwara did not immediately respond to a request for comment.

Protesters from the temple rallied outside the provincial courthouse in Surrey last Tuesday when the three men charged in the case appeared via video link.

Nijjar's death has sparked tensions between Canada and India, with Prime Minister Justin Trudeau saying credible intelligence linked the killing to India's government, while Indian officials denied involvement.

The arrests have also heightened scrutiny on Canada's permitting process for international students after revelations that a video posted online in 2019 by an India-based immigration consultancy showed Brar saying his "study visa has arrived" while a photo showed him holding up what appeared to be a study permit.

Immigration, Refugees and Citizenship Canada had said it cannot comment on active investigations or individual cases when asked about the suspects' immigration status.

This report by The Canadian Press was first published May 11, 2024.

The Canadian Press