(Bloomberg) — The main drivers behind the remarkably resilient American consumer are losing steam at the same time, suggesting a recent pullback in household demand may be more than just a one-off.

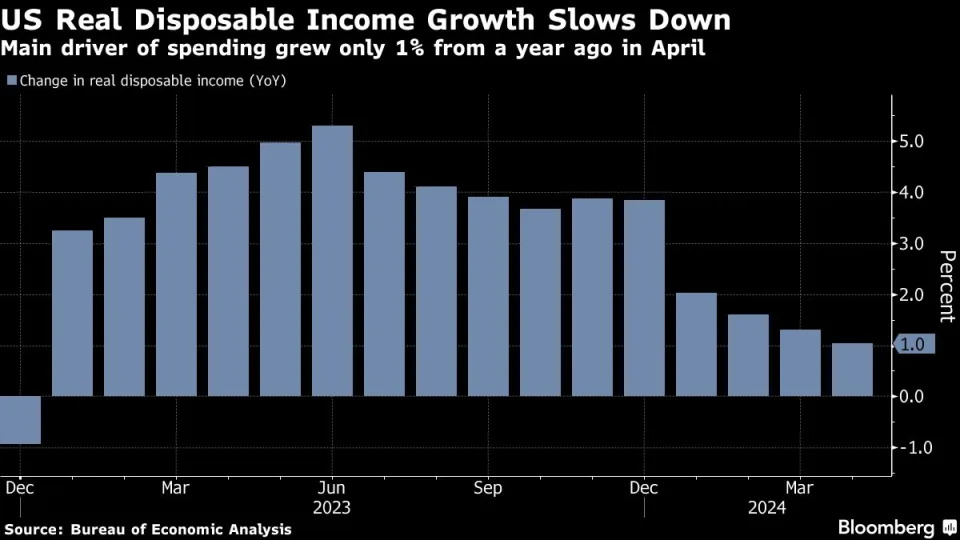

Real disposable incomes have risen only modestly over the past year. The saving rate now stands at a 16-month low as households have mostly exhausted the extra pile of cash they squirreled away during the pandemic. In turn, many Americans are increasingly relying on credit cards and other sources of financing to support their spending.

These factors help explain why real spending — which excludes the impact from inflation — fell in April, with consumers shelling out less on cars, restaurants and recreational activities. With the job market also cooling, companies like Best Buy Co. have noticed a change in recent months as shoppers switch to cheaper brands.

“Slower labor market momentum will continue to limit income growth and push more families to exercise spending restraint amid reduced savings buffers and higher debt burdens,” Gregory Daco, EY chief economist, said in a note Friday. “Factoring increased price sensitivity, household spending momentum will gradually cool.”

The dip in April consumer spending reported Friday and the recent downward revision to the government’s estimate for gross domestic product in the first quarter provide fairly convincing evidence the US economy is coming off the surprisingly strong pace it set in 2023.

The latest data are also likely to reassure officials at the Federal Reserve, where a debate has emerged in recent weeks over whether their policy rate — sitting at its highest level in more than 20 years — was restraining the economy as much as they had expected it would.

The debate sprang from the strength exhibited by the US consumer over the past couple years. While that helped the US economy repeatedly defied recession calls, it puzzled Wall Street economists and Fed officials alike. Robust labor demand, pandemic-era savings and sizable pay gains all contributed to that.

But as inflation proves sticky, forcing the Fed to keep borrowing costs high, the US economy is finally starting to slow. Demand for workers has come down from its pandemic peaks, meaning employers aren’t hiking pay as quickly anymore. Wages and salaries advanced 0.2% in April, the smallest gain in five months, the personal consumption expenditures report showed.

Recent company earnings indicated that consumers have increasingly been prioritizing staples over large discretionary items. And higher-income consumers are trading down or hunting for deals, which helped boost sales at Walmart Inc. and discount retailer Dollar General Inc.

Jobs report

Consumers are making “tough choices with their budgets,” Best Buy Chief Executive Officer Corie Barry said on the first-quarter earnings call. The executive pointed to changes in the macro-economic environment since the electronic retailer’s last quarterly report.

“Three months ago, there were several indicators showing some favorability, including decreasing inflation, continued low unemployment, encouraging trends in consumer confidence and the beginnings of a housing market rebound,” Barry said. “Since then, inflation is still high, mortgage rates are high and consumer confidence scores are trending lower.”

A fresh government jobs report, due Friday, will offer more insights into the direction of the labor market. Fed policymakers will pay close attention to those numbers as they continue their quest to tame inflation without breaking the economy.

From that perspective, April’s decline in consumer spending likely contributed to the welcomed pullback in inflation. Yet it also may raise the question of how long the economy can hold up.

“Fed officials will view today’s report as showing some cooling in consumer spending which points to less inflationary pressure,” Citigroup Inc. economists Andrew Hollenhorst and Veronica Clark wrote after the PCE report Friday. “Our view of the US economy is not as optimistic.”

—With assistance from Jaewon Kang and Leslie Patton.