Reuters | June 4, 2024 |

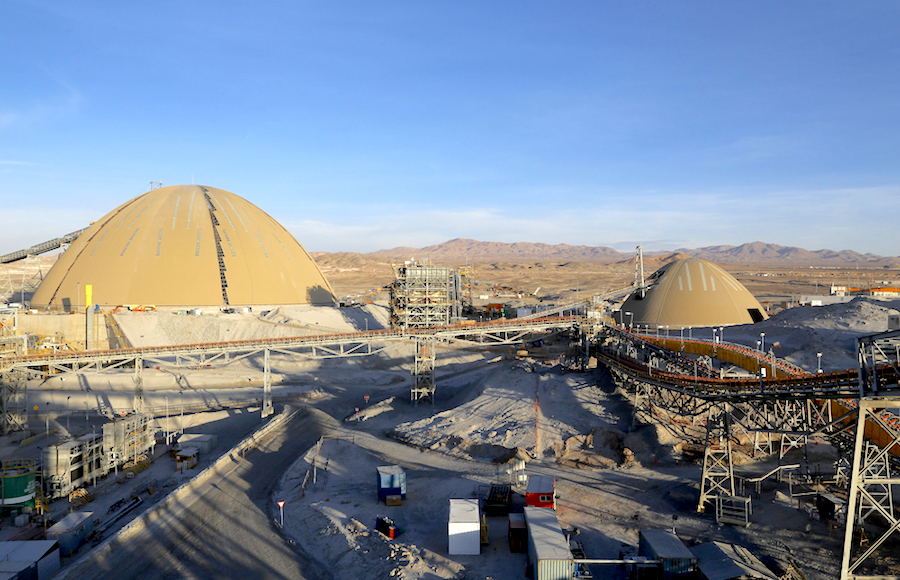

DeGrussa copper mine also owned by Sandfire. Credit: Sandfire Resources

Sandfire Resources said on Wednesday an external probe had found the miner damaged Aboriginal cultural heritage at a copper mine in Western Australia due to “ignorance and process failings”.

Damage to artefact scatters at the Monty copper mine, northeast of Perth, occurred in 2017 and 2018 due to a series of process failures during the construction of a satellite mine. However, it came to the company’s attention only in September 2023.

“Sandfire’s failure to protect the artefact scatters and to quickly escalate the issue once identified is unacceptable,” Sandfire chair John Richards said in a statement.

A group of traditional owners, the Yugunga-Nya, said in a statement the report showed Sandfire’s then management, “just didn’t care about Aboriginal heritage”, while disputing the report’s conclusion that the damage was unintentional.

It also said it looked forward to collaborating with Sandfire’s new management team, led by Brendan Harris, to address heritage matters.

Shares of the company slipped as much as 5.6% to A$8.86 by 0029 GMT, amid a broader weakness in mining stocks.

The damage, which was first flagged by the Australian miner in November last year, had led the Yugunga-Nya to demand the executive team to step down after failures to address the situation.

Aboriginal heritage protection has come into the spotlight since Rio Tinto destroyed rock shelters in Western Australia’s Juukan Gorge in 2020 that showed evidence of human habitation stretching back into the last Ice Age.

The findings of the probe confirmed that Sandfire’s then executive management failed to define line accountability for heritage or ensure measures were in place to manage heritage better within the organization.

“Sandfire recognises the magnitude of these findings and has committed to an extensive program of work designed to ensure the protection of cultural heritage across all of its operations,” Richards said.

A draft of the investigation has been shared with the Yugunga-Nya, the company said.

(By Prerna Bedi and Melanie Burton; Editing by Subhranshu Sahu and Rashmi Aich)

Activists at the Borkum project site (Axel Heimken / Greenpeace)

Activists at the Borkum project site (Axel Heimken / Greenpeace)